The Short-Term Trend Is Unclear, Yet Continues

The short-term uptrend continues. Although, based on the recent behavior of the PMO index, the trend is a bit unclear because the index is so choppy.

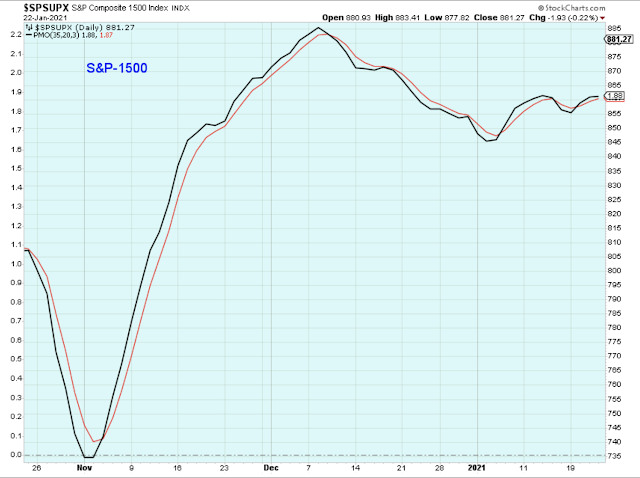

Here is a look at the PMO for the S&P 1500, and it confirms the choppiness of the index shown above. So far this month, the PMO has been moving sideways, but with a slight upward bias. It has a negative look, although I am thinking it is demonstrating that many stocks have paused in their uptrends while the economy works past the shock of the recent wave of COVID-19 infections.

The stochastic of the SPX equal-weight is easier to interpret at the moment than the PMO. This is a clearer, more expected pattern and it gives me a simple indication that the market is getting close to the point where I'll need to be just a little less aggressive in my accounts.

This means that I will get more cautious about buying into any new stock breakouts. Instead, I'll give my current holdings some time to work their way higher and I'll trim from the laggards.

There is much discussion about the current state of the market. Some people are very concerned about excessive valuations, speculative IPOs, small-caps, and frothy bullishness. Even at Investor's Business Daily, they are worried about the indexes being too far above their 50-day averages.

These are all good points and I don't have the answers, so I to stick to what I know and just try to time the short-term trends based on the charts that I post here. Basically, I get aggressive near the bottom of the short-term trend, and then get less aggressive near the top of the short-term trend.

Just because I try to stick to what I know doesn't mean I can't venture a guess about what is happening in this market. My thinking is that as investors ran up stock prices in smaller-cap cyclicals in advance of the stronger economy expected later this year, they turned away from the safety of the large-caps such as Microsoft (MSFT).

My guess is that soon investors will start to rotate out of cyclicals because they are fully priced, and move back into these safety-stocks that are building very nice bases.

This isn't an easy time to trade or invest because there are so many cross-currents. Some areas of the market have run-up to the point where people are ready to lock in profits, while others are giddy and are throwing caution to the wind. I feel that I have to be in the market aggressively because these are the very profitable moments that we wait for.

The bottom line is that it is a strong bull market, so it is time for me to press the advantage and make money with my very best risk management skills.

The Longer-Term Outlook

M2 money supply growth had a nice pop last week, which keeps the trend pointing upwards. Healthy money supply growth points to economic growth and works in favor of stock prices.

The ECRI index continues to point higher, as well. This chart indicates economic growth four to six months out, and also favors higher stock prices.

Here is a look at the same index, but over the course of 30 years. When this index starts to level out, I will listen carefully to what the ECRI has to say about the economy and how the data is interpreted.

Most of the ETF charts are through the roof, but this one looks like a nice, longer-term breakout could occur.

I also have my eye on this group as it moves into new highs.

Outlook Summary

- The short-term trend is up for stock prices as of Jan. 6.

- Contrarian sentiment is unfavorable for stock prices as of Nov.14.

- The economy is in expansion as of Sept. 19.

- The medium-term trend for treasury bonds is down as of Oct. 10 (prices lower, yields higher).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more