The “Roaring Kitty” Stock Market

By now, everyone knows about Keith Gill (aka Roaring Kitty aka Deep F**king Value). He’s the guy who put out a relatively solid fundamental thesis on GameStop and got it more “right” than anyone could have anticipated.

But as always, they sacrifice the virgin. He’s getting sued and has to go testify in front of Congress. The brokers that killed the trade (intentionally or unintentionally) get off scot-free. Did he do anything wrong? Unlikely, but we’ll find out in the coming weeks as more details emerge.

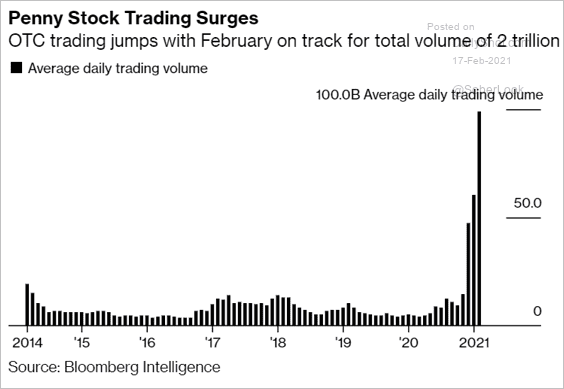

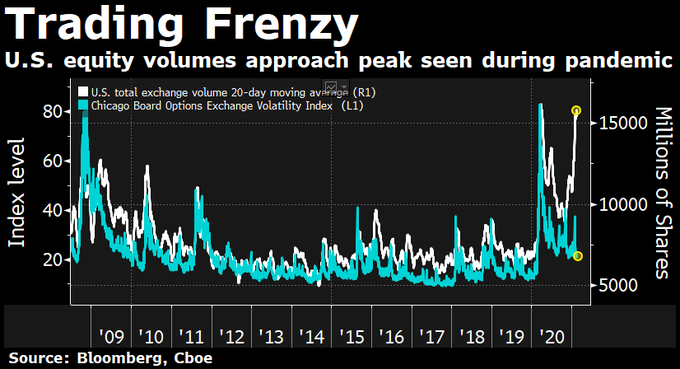

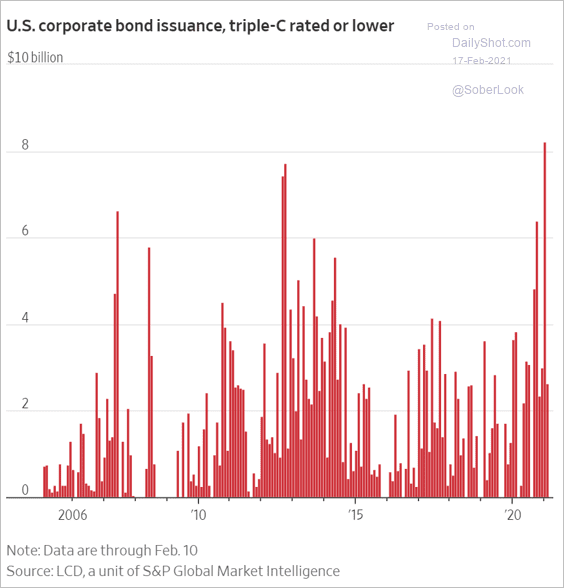

The point of bringing up “Roaring Kitty” is the behavior it represents in the market at present. Penny Stock buying is at record highs. Call Option buying is at record highs. Low-Quality stocks are outperforming High-Quality Stocks. The demand for lowest quality credit “junk” has never been higher (all sources listed directly on image):

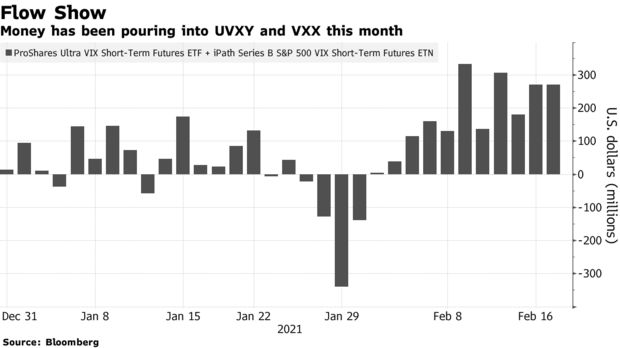

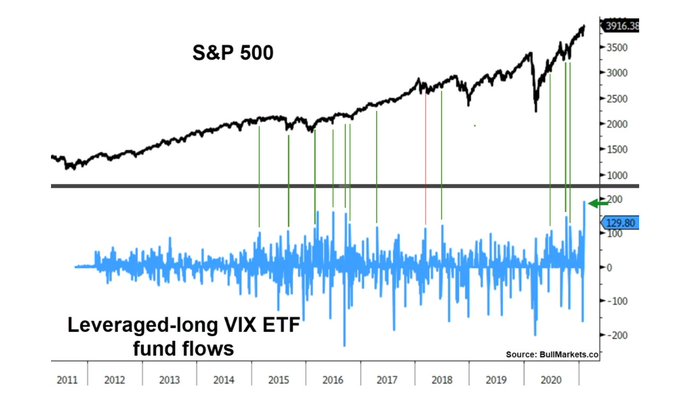

At the same time, we see the conflicting message of record inflows into Volatility ETFs used to hedge:

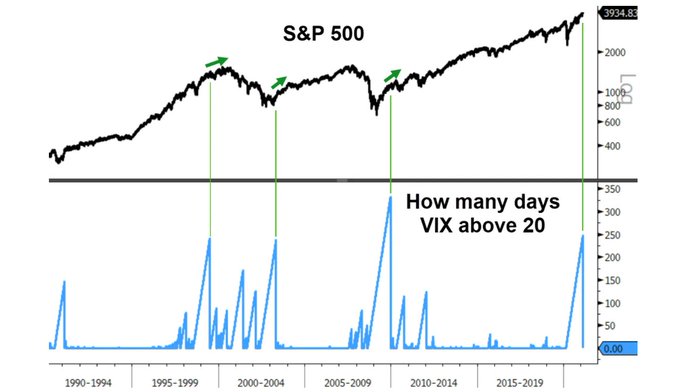

While money flows into long VIX ETFs, history shows that the VIX breaking 20 – after being elevated for almost a year – is generally consistent with the beginning of a cycle versus the end:

Source (above and below image): BullMarkets.co

Furthermore, 13 of 14 x that VIX ETFs showed this level of inflow, the S&P rose versus fell.

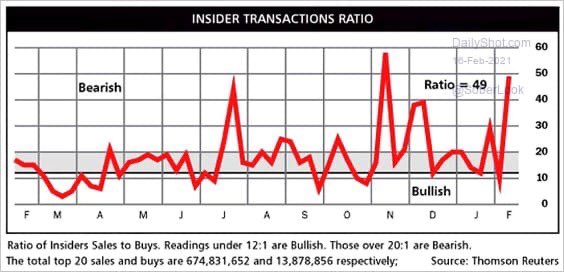

Corporate insiders are selling anything that’s not nailed down:

So what does this tell us?

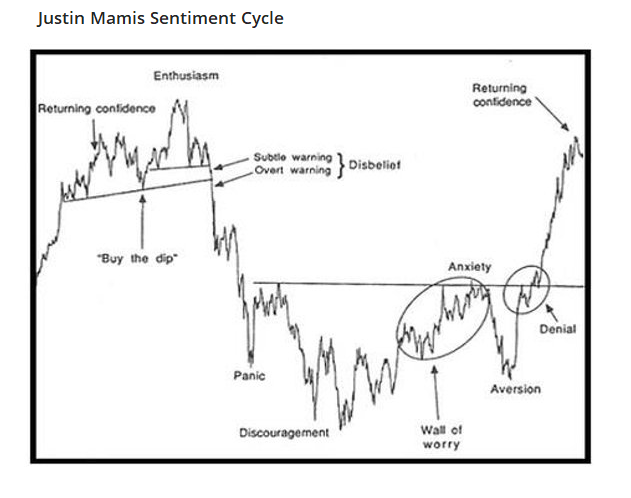

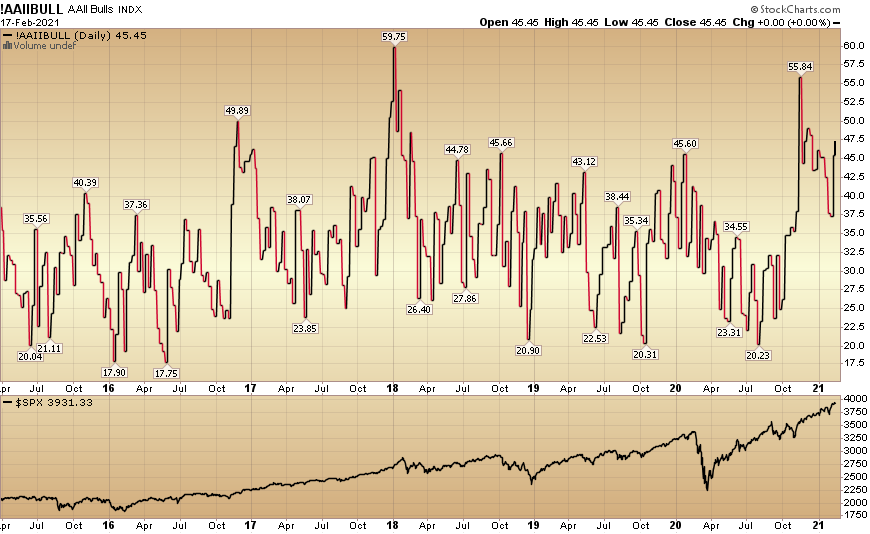

It tells us that there is mania, euphoria, and fear – all at the same time. So long as that fear stays in-tact the market can climb the “Wall of Worry”, but it is unclear (other than the flows above) how pronounced that “fear” is.

For a better look, let’s take a look at the Bank of America “Global Fund Managers Survey” from this week.We posted a comprehensive summary here.

The key takeaways from the ~200 institutional managers (with ~$600B AUM) were:

“After a record flood of money into equity funds, BofA strategists have warned that such exuberance may precede a correction.”

“The only reason to be bearish is … there is no reason to be bearish.”

“Cyclicals: high exposure to commodities, EM, industrials, banks relative to past 10 years, but Jan wobble caused investors to top-up safety of growth exposure via tech health care, US stocks.”

CONTRARIAN TRADES:

-Contrarian trades bubble move and/or big inflation in 2021 best played via FMS laggards (e.g. Energy & UK stocks).

-Conversely longs in EM, commodities, industrials most vulnerable to peak profits narrative.

-Either way consumer staples a smart contrarian accumulator in H1.

Tying it all together

This is a new business cycle and there is reason to be optimistic. A substantial portion of “good news” is priced into the general indices, but not fully priced into selected “lower weighted” laggard sectors.

We continue to pay less attention to the indices as 1) it’s tough to short a dull market, and 2) there are enough spots to still find value that it doesn’t pay to be too pessimistic.

We expect multiple more 3-4% pullbacks this year – like we saw in the last week of January. It will not deter us from using weakness to find value we can hold for the next few years.

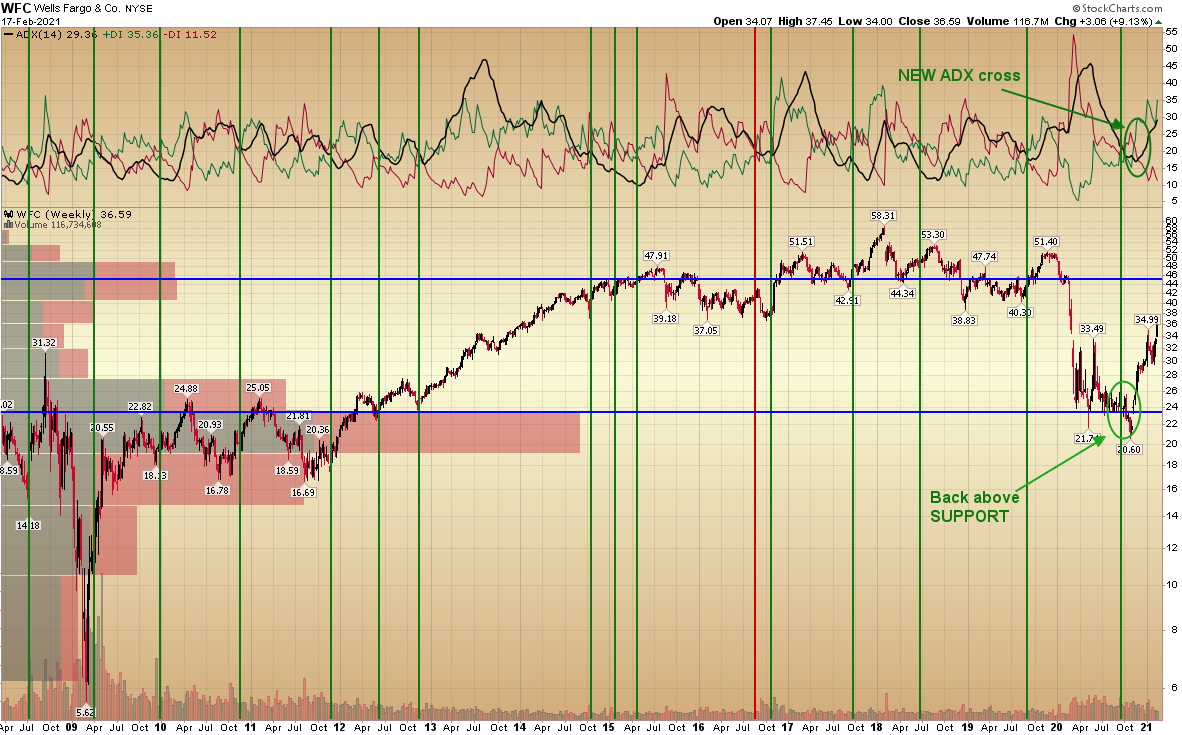

In 2H of 2020, we were aggressive accumulators of Banks, Energy, and Defense & Aerospace Stocks. Banks and Energy have exploded to the upside and have more room to run in coming months and years. Defense & Aerospace has started to bounce but continues to offer great value at these levels. We have added in recent weeks.

Right now we are beginning to notice that Utilities, Consumer Staples, Healthcare/Pharma are a bit overdone to the downside and may be due for a bounce. Since these are all defensive sectors, the implication is that it could be coupled with a short term compression of yields (and possible choppiness in the indices).

This is consistent with the theme we have been repeating in recent podcasts to look for “rallies under the surface.”Pay less attention to the general indices grinding sideways and up (or even pulling back), and pay more attention to “where the puck is going.”We’ve given you a few clues above.

Wells Fargo Update

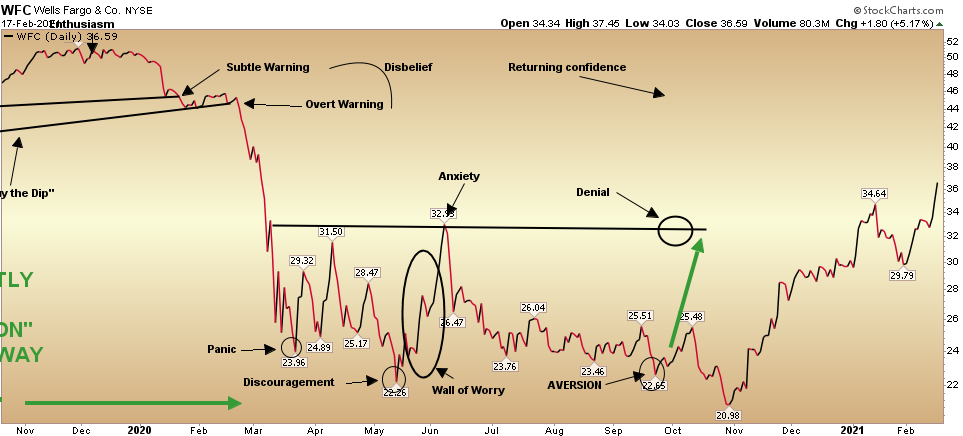

On September 24, I put out the now-famous “Cobra Kai” article on Wells Fargo – presenting the concept of a painful “leg sweep” in WFC that was designed to take out the final weak holders:

Wells Fargo is now up 60.27% from that article. Here’s where we are in the progression. It looks like we are just now coming out of the “Denial” phase:

On Wednesday, we took one more baby step toward full recovery when this headline (which we have been talking about for several months in our podcasts) finally crossed the tape:

“WELLS FARGO WINS FED ACCEPTANCE FOR OVERHAUL PLAN TIED TO CAP”

Now onto the shorter term view for the General Market:

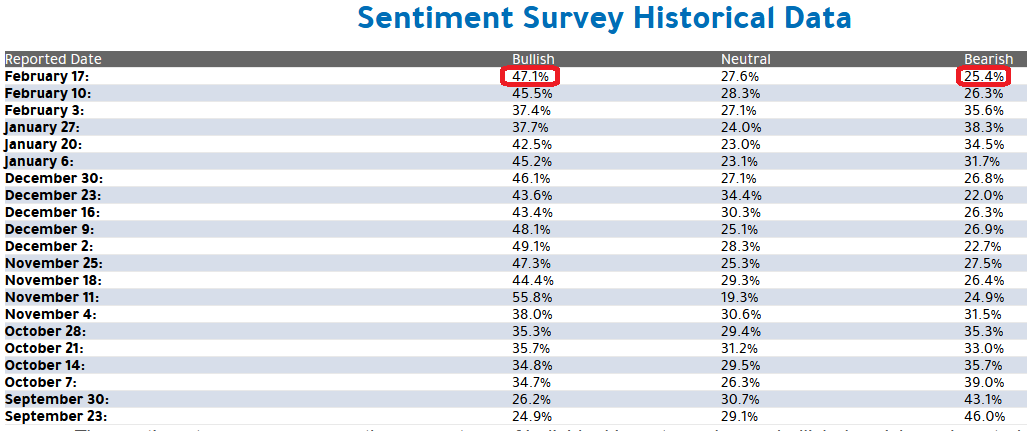

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) climbed to 47.1% from 45.5% last week. Bearish Percent dropped to 25.4% from 26.3% last week. Retail exuberance from last week is persisting.

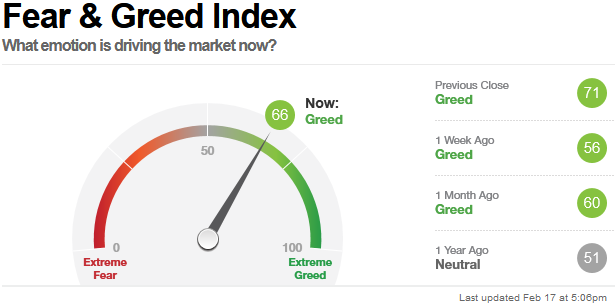

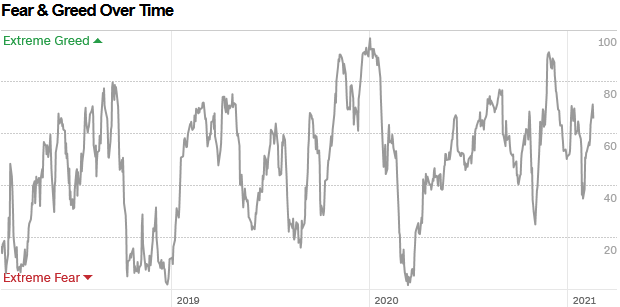

The CNN “Fear and Greed” Index rose from 63 last week to 66 this week.This is a neutral read.You can learn how this indicator is calculated and how it works here: (Video Explanation)

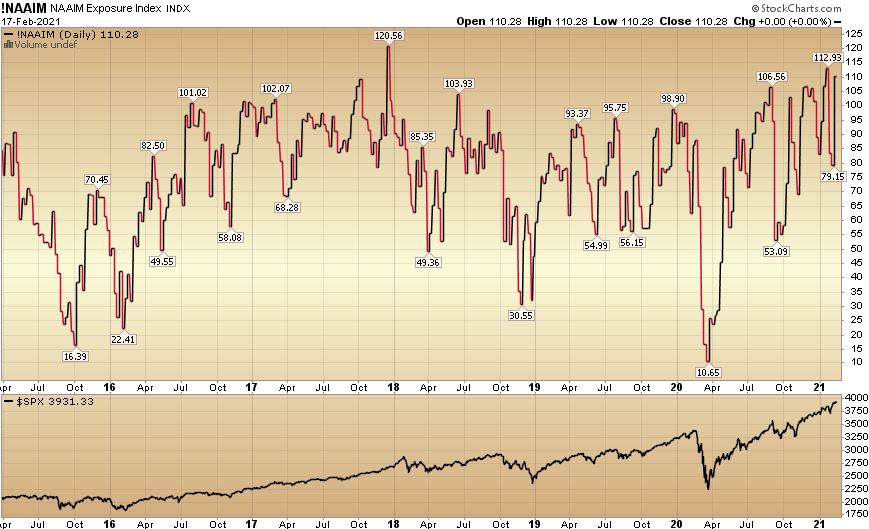

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 110.28% this week from 79.15% equity exposure last week.

Our message for this week:

We will continue add to Defense & Aerospace on any weakness (on the 2H Commercial Aviation recovery thesis), and hold Banks and Energy – as we have a much lower basis in these groups.

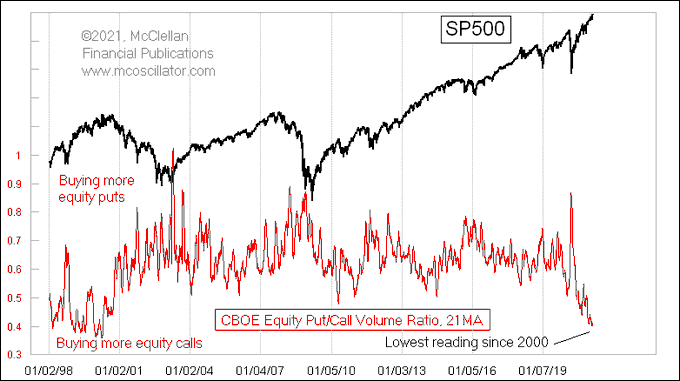

New: We are also now looking at very selective opportunities in Consumer Staples, Healthcare, Utilities and Big Pharma.These groups will start to perk up when this chart from Tom McClellan finally begins to matter again:

It would also imply that we could see a possible short-term bounce in bonds in coming weeks.

Remember: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.

less