The Breakout

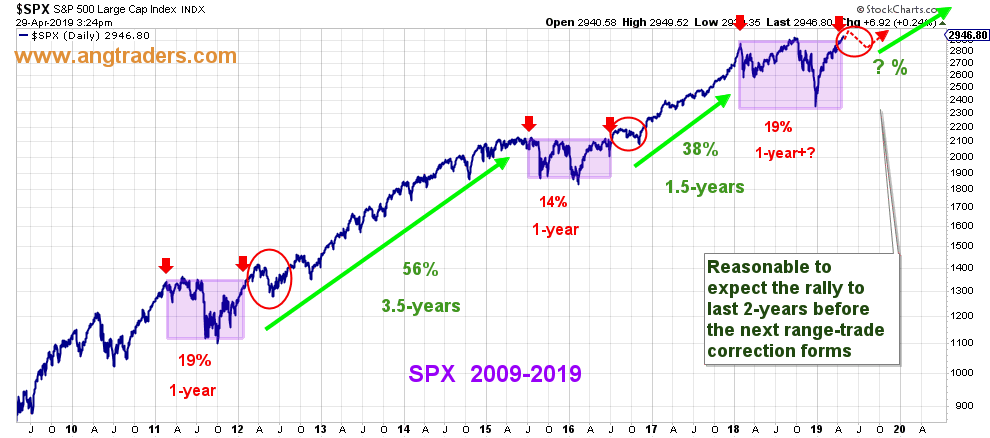

The S&P 500 is in position to break out of the third “step” or trading-range since the bull market began in 2009 (colored rectangles in chart below). (As this goes to print, the S&P 500 and the NASDAQ Composite have broken out to new highs)

(Click on image to enlarge)

The following is from our January 26 Weekly Summary:

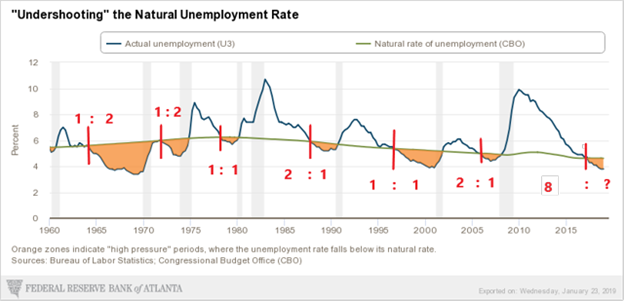

Every expansionary period (the periods between recessions) starts with the unemployment rate above the natural rate, and during each expansionary period there comes a time when the unemployment rate drops below the natural rate (red vertical-lines on the chart below). The ratio of time spent as non-high-pressure, to the time spent as high-pressure has varied in the six expansionary periods occurring since 1960; there were three different ratios found, 1:2, 1:1, and 2:1, with each ratio occurring one-third of the time and, therefore, equally probable (chart below).

(Click on image to enlarge)

The current expansion, turned high-pressure in 2017 (eight-years into the expansion) and continues to this day, but for how much longer? It could last a further two-years if we consider the 2:1 ratio, another six-years if the 1:1 ratio happens, and fourteen-years more if the 1:2 ratio becomes a reality. That gives us a theoretical range of between two and fourteen more years before we see a recession. That sounds crazy, and certainly not what the majority of analysts are saying, but it supports the conclusion that we are not at the start of a bear market.

Based on that analysis, the next up-leg could last two years or more, which most definitely is not what the majority is expecting. Once the SPX breaks out, however, the majority will stop expecting a pullback which, ironically, will increase the probability of a pullback. That is what happened after the breakouts in 2012 and 2016 (red-ovals on chart below), and is likely to happen again this time.

(Click on image to enlarge)

The timing of the 'post-breakout-pullback' could coincide with the delayed effect of the tax season sectoral flows that will remove more than $300 Billion from the economy and which will affect the stock market in the next week or two. The expected pullback will be a 'buy the dip' opportunity ahead of the positive sectoral flows that the end of tax season and new government deficit spending will create, and which should push the market higher during the Spring and Summer. Longer-term, this breakout will be the start of the next major up-leg of the on-going bull market.