The 50 Cent “In Da Club” Stock Market (And Sentiment Results)

This week we chose rapper 50 Cent’s classic, “In Da Club” as our song to embody current stock market sentiment. The lyrics are relevant as it relates to the GameStop (GME) short squeeze playing out on the message board (r/wallstreetbets) on Reddit.

This message board – comprised of ~3M individual traders – has focused on buying heavily shorted stocks (in some cases that started out “undervalued”) and creating a “short squeeze” of epic proportions.

In the case of GameStop, 140% of the shares outstanding were sold short. What these clever individual traders figured out was that if they had enough collective buying power (which they don’t) they could force a short squeeze.

So then why are these stocks continuing to power higher?

The majority of the retail purchases are short-dated “out of the money” call options. For every buyer of “calls”, there is a seller, and that sophisticated seller/dealer (who is happy to sell option premium at >900% IV – Implied Volatility) then BUYS the underlying stock to hedge. This is called “Delta Hedging” and here’s an example of how it works (Bloomberg):

- Bob has a Robinhood account. He bought a single $3,250-strike weekly call option contract on Amazon stock on Aug. 14 for $1,500. That option happens thanks to a market-maker — call her Jenn — sitting at a large dealer-bank. But Jenn isn’t taking the other side of Bob’s trade, instead, she is aiming to be a neutral facilitator. Her job is to make markets, not bet on them, so she wants to hedge her position. She does this by buying Amazon shares, making a calculation based on what’s called the delta of her position. The delta is how much the option will change in value based on the price of the underlying stock. In this case, she judges that she needs to buy $66,100 worth of Amazon stock to get to neutral. If shares of Amazon go up, she might have to pay out on Bob’s option, but at least that will be offset by the gain on her Amazon stock.

- A few days later Amazon stock does indeed rise, going up 5%, so Jenn needs to rebalance her books in order to keep her position neutral. This time, because the delta of her position has moved higher, she needs to buy even more stock. In fact, she needs to buy $230,000 worth of Amazon shares. Bob’s puny $1,500 outlay has been transformed into $230,000 worth of share-buying.

- By targeting dealers’ exposure in a concerted way, some retail traders are in effect trying to take advantage of a phenomenon known as a “gamma squeeze” — betting that as the value of Amazon stock gets closer to an option’s strike price, dealers will have to buy more and more of the underlying stock.

According to Wikipedia:

A Gamma squeeze is a transient increase in the price of a stock based on an investor buying many options to drive up the prices of select stocks due to option sellers needing to hedge their trades on the underlying stocks.

So as more calls are bought by retail traders, more stock is bought as a hedge by dealers (which pushes the stock up) and then creates demand from short sellers (who are collectively short 140% of the float) to buy the same stock all at once (in order to cover their shorts as they get margin calls).

So those retail traders “In Da Club” (r/wallstreetbets) message board could crank up 50 Cent’s lyrics – as they inflicted severe pain on the “sophisticated” hedge fund investors who did not think to see if there would be any stock available to buy when they all rushed for the same narrow exit at the same time.

Go, shorty

It’s your birthday

We gon’ party like it’s your birthday

We gon’ sip Bacardi like it’s your birthday

And you know we don’t give a f**k it’s not your birthday

Play 50 Cent "In Da Club" on YouTube

The retail traders had a huge short term win and mopped the floor with the dealers and the short-sellers, but as the old saying goes, “bulls make money, bears make money, pigs get slaughtered.”

The good news is you will see a number of successes on the Reddit board. Some traders cashed out and paid off student loans, medical bills for families, mortgages, etc.

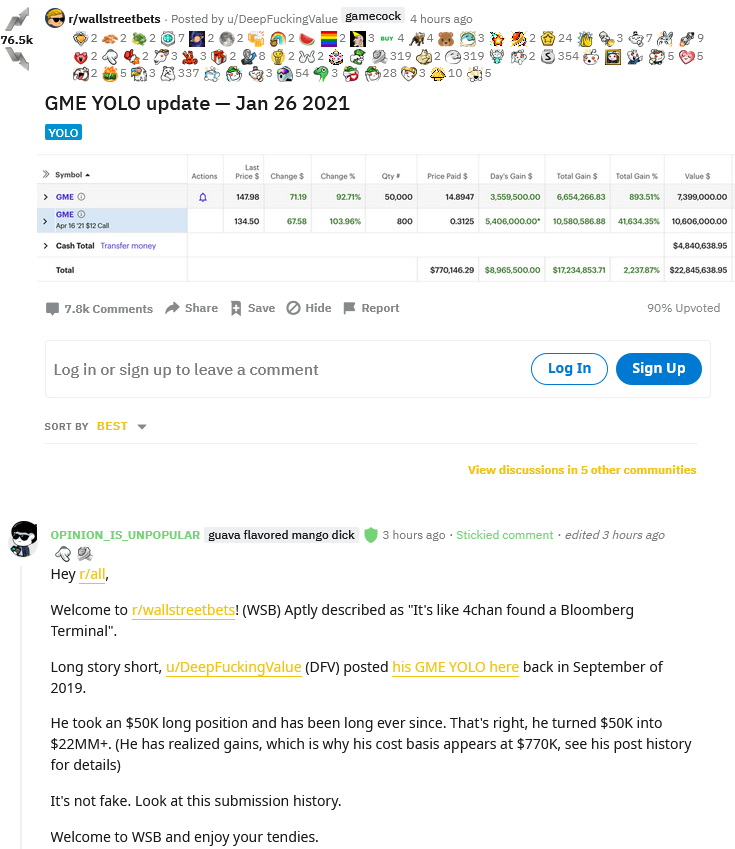

The head poster allegedly turned $50K into $22M, (and is still hodling) per his post below:

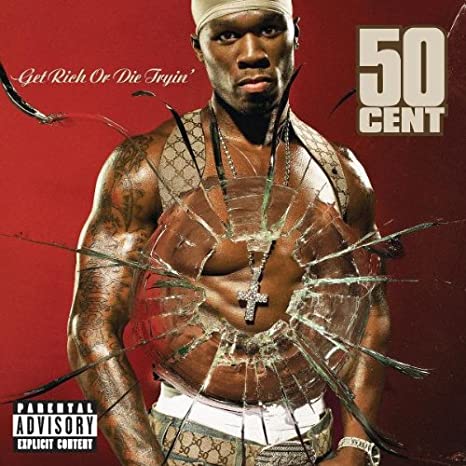

The name of the 50 Cent album that holds the song “In Da Club” is “Get Rich or Die Trying.” While we are currently seeing some members of the club “gettin’ rich” on paper, in coming weeks and months we may see some of the hodlers “die tryin.'” The lesson is to make sure they don’t take you out on a stretcher and that you live to play another day (with greater wisdom and experience).

The key – when you get into these special situations – is to make a moment-by-moment and day-by-day decision to – Sell Some, Sell All, or Do Nothing. With parabolic moves (on options), it’s often best to scale out a little at a time (20% off when you’re up 5x, then another 20% over the next few increments, and finally you can let 10 or 20% run – in perpetuity – until a clear reversal – because you’ve already made so much on the other 80% that it doesn’t matter).

In the case of the retail traders “In Da Club” I think many of them are purist hodlers who may hold too long. An important point to keep in mind is, “just as there was no stock to buy for shorts to cover on the way up, WHO WILL BE THE NATURAL BUYERS ON THE WAY DOWN?”

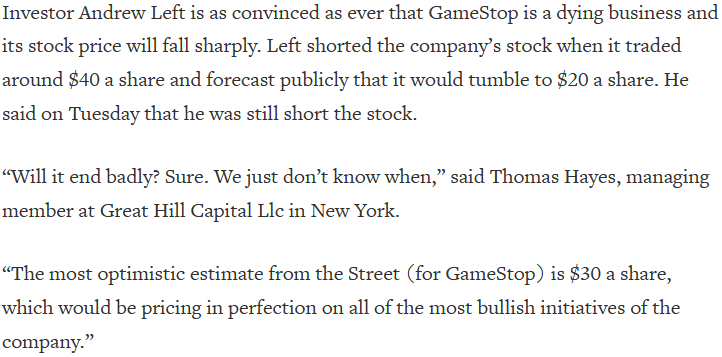

Many of the shorts got blown out, and the ones who are left obviously have staying power and shorted at much lower levels. Nothing has changed fundamentally for them to change the short thesis they had when they shorted at $20 or $30 per share, so why would they cover at $300, or $200, or $100? So if the shorts who are left are not buyers, and there is no fundamental reason to buy at these levels (the most optimistic analysts on the sell-side have ~$30PT on the stock), who will buy on the way down with any size?

Stairs UP, Elevator DOWN.

In this case, it was Rocket UP, No Parachute Free-fall DOWN. I referenced it in a Reuters quote this week when I said,

So at some point, GameStop will transform into GameStopped. “We just don’t know when…”

In the meantime, we’ll sit back with some popcorn and watch the show. In the early innings, the falcon has eaten the falconer, but that dynamic may shift on a dime in coming days and weeks when buying power dries up.

Pro Tip: Always take some chips off on the way up and only press the “house’s” money after you’ve banked your own.

Inflation

In my segment with Liz Claman on Tuesday, I referenced these pockets of froth as well as pointed to the two catalysts that would likely bring on inflation sooner than Chairman Powell is expecting. Thanks to Liz and Jacqueline D’Ambrosi Scales for having me on Fox Business: Watch the Fox Business Segment Here

On Jan 14, we put out our first “cautious note” in 10 months: TikTok Until The Stock Market “Ghosts” Us

It looks like we may now be starting to consolidate gains. Yesterday we closed below Jan 14th, so the anticipated short-term weakness may be starting. The longer the short squeezes last, the more the “winners” FAANGM+ will have to be used as a “source of funds” for any margin calls.

As I stated in my original cautionary note on the 14th, I do not expect this weakness to be material in nature and will use any weakness in coming weeks to add to cyclicals – which will outperform once again after taking their recent rest – as we are at the beginning of a new business cycle.

Baby Bull

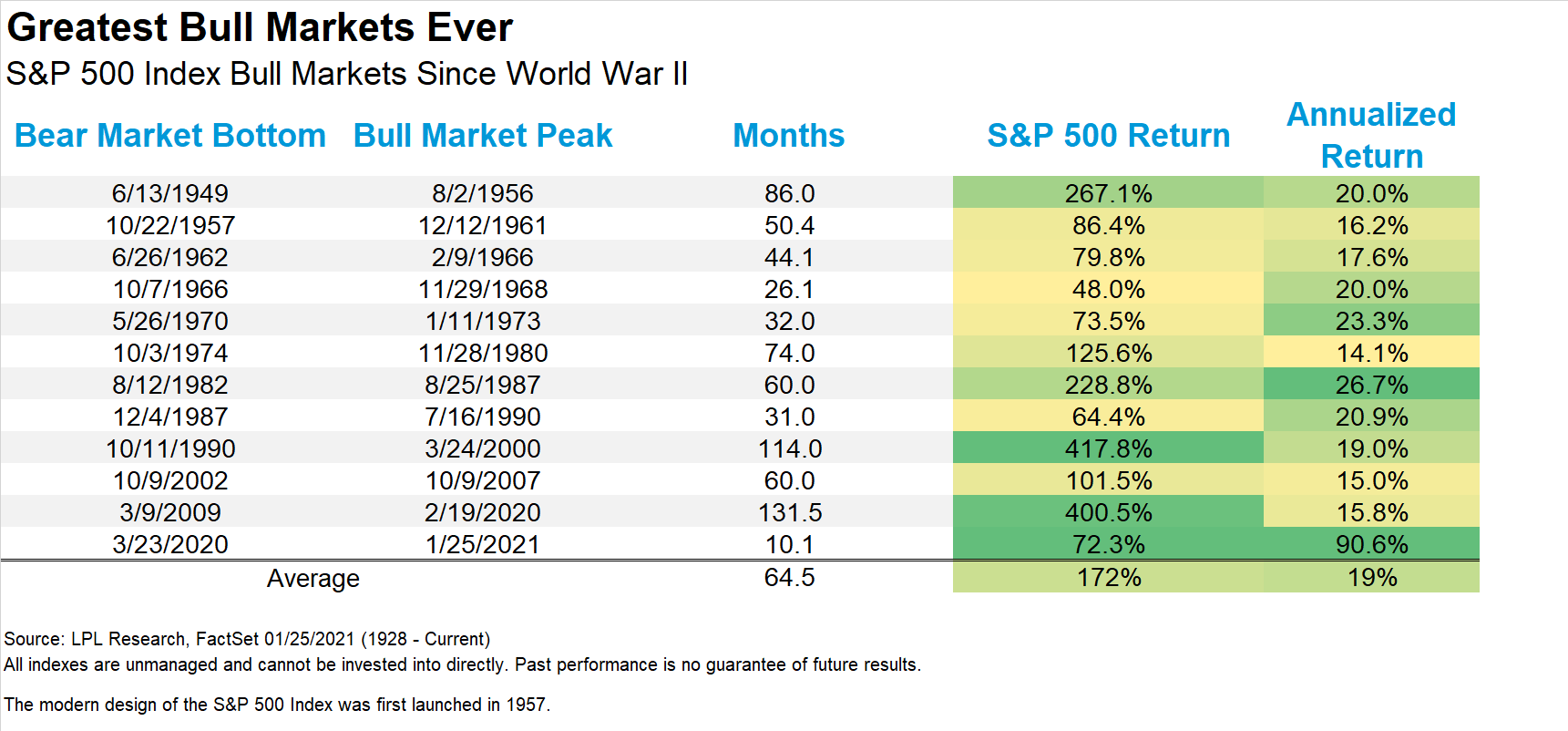

As Ryan Detrick (LPL Financial) put out this week, we are in the early days of the new bull market:

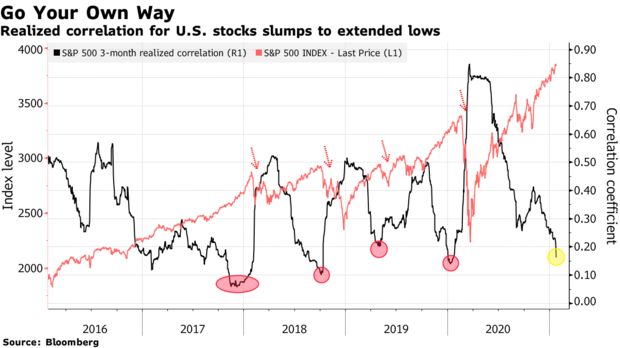

Correlation

This week, Bloomberg put out a note referencing declining stock correlation as an indicator of imminent weakness:

We covered a number of other indicators that led us to the same conclusion in last week’s note: The “Amazing Grace” Stock Market (And Sentiment Results)

They also pointed out, “Still, low correlations are welcomed by fund managers looking to beat indexes through stock picking because if most equities are moving in the same direction, it’s difficult to choose one that stands out from the crowd.”

While breadth has been declining in recent days, we are seeing pockets of stocks performing well (i.e. the most shorted!):

Last week we noted Consumer Staples was a group that should start to get bid:

“In the event, the dollar does show some short term strength, you could see a bounce in recently weak sectors like utilities and consumer staples (as well as bonds and tech – as yields compressed). I want to emphasize, this is a short-term counter-trend, and for most people, the best play is to ride it out and do nothing.”

Here’s what we saw in consumer staples this week:

Ultimately, we’ll get through this short-term consolidation (after a ~75% move off the March lows). The single-shot vaccine from JNJ will roll out en masse, earnings and margins will continue to improve and revert back to trend, and we’ll finish the back half of 2021 measurably higher than we started the year.

We have pounded the table on Banks, Defense Stocks, and Energy for many months. Banks and Energy have had monster rallies and are now resting. The Defense and Aerospace sub-sector still represents great value at these levels – looking out for the next year or so – and we are currently buying weakness.

Now onto the shorter-term view for General Market:

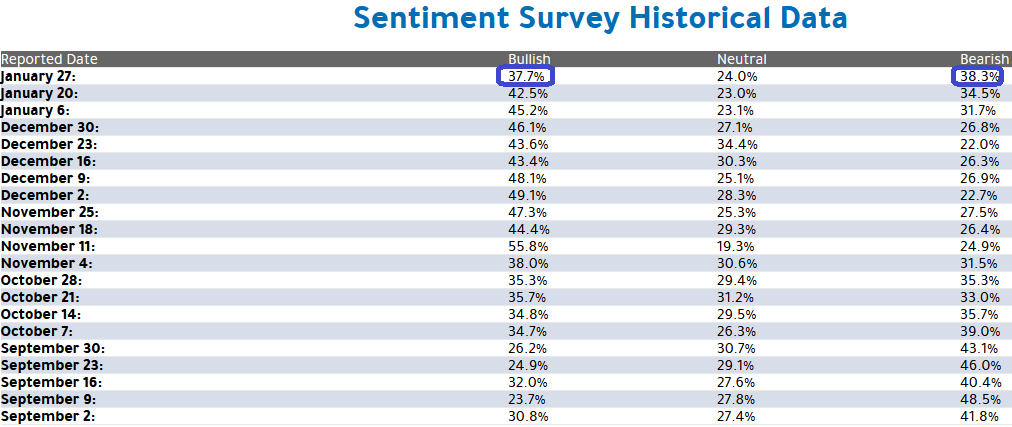

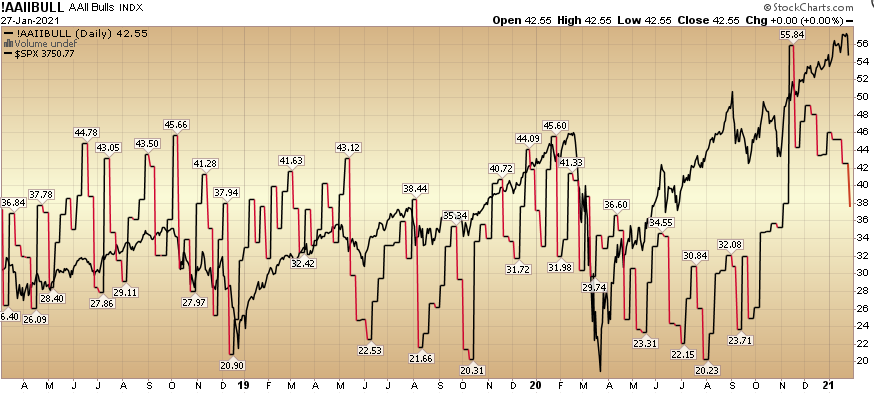

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 37.7% from 42.5% last week. Bearish Percent rose to 38.3% from 34.5% last week. Euphoria is coming off the boil a bit.

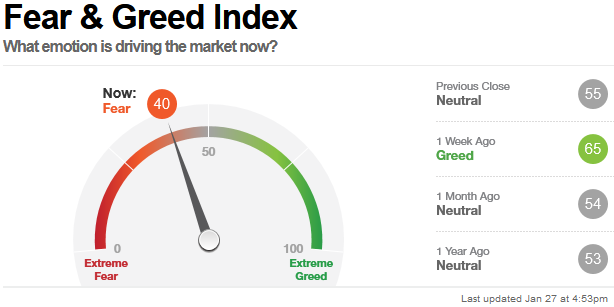

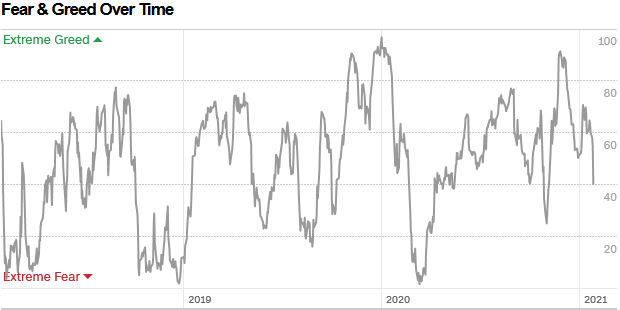

The CNN “Fear and Greed” index dropped from 69 last week to 40 this week. This is a neutral read – but starting to show that fear is returning. You can learn how this indicator is calculated and how it works here: (Video Explanation)

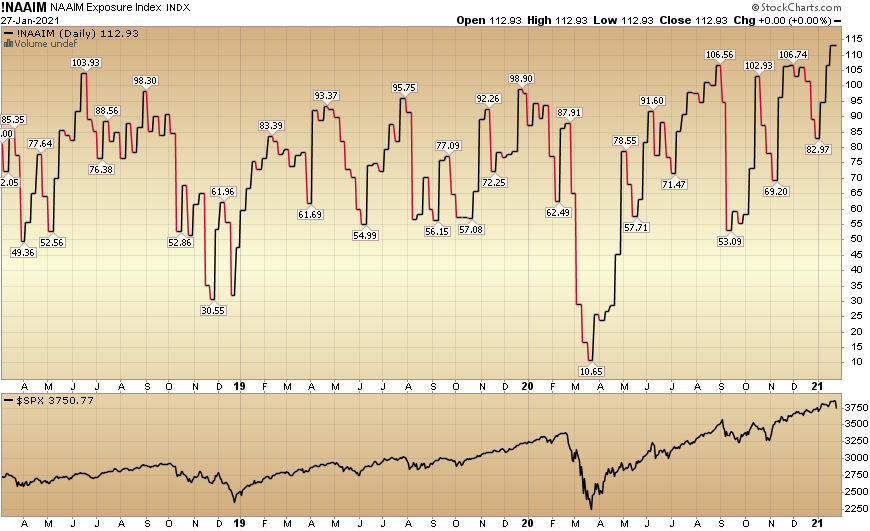

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 112.93% this week from 106.76% equity exposure last week. This is at an extreme.

Our message for this week:

Last week I said:

“The stock market can correct in TIME or PRICE. While I do think we may push a bit higher first, I expect the market will finally begin to consolidate some gains in the coming weeks.

This can be by simply grinding sideways for a month or two to digest the > 75% gains off the March Lows OR more likely get a health pullback. As we have stated in recent weeks, this is the beginning of a new business cycle and it does not pay to get too cute trying to predict the when and how much of a short-term correction we will get.

As we saw after a monster rally off the lows in 2009, it did not pay to play the short term pullbacks in 2010 and 2011 – as you may very well have missed out on a decade long bull market run.

We’ll be using any weakness that potentially comes our way in Q1 to add more value/cyclical names (themes listed above) to hold for the next 3-5 years…”

We will continue to add to Defense and Aerospace (on the 2H Commercial Aviation recovery) and hold (and possibly add to) Banks and Energy in the coming weeks (if they come down enough).

To the Reddit folks “In Da Club”, you crushed some big names in the game. Make sure you walk away with some chips and live to play another day…

You identified the vulnerability that “sophisticated players” missed – and you deserve to harvest the spoils…

Now take some chips off the table while you can and, “go sip Bacardi like it’s your birthday…”

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.