The 13.5% Yield MLP You Can Put In Your IRA

One of the biggest problems facing yield-seeking investors has finally been solved. Now, the best quality MLPs can be owned in your retirement account through this ETF solving investors desires for yields and tax efficiency.

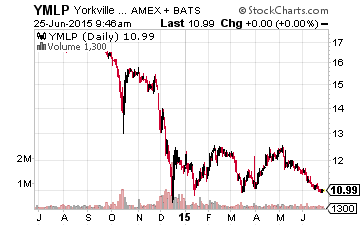

Up until late last year, high-yield investors had been counting on the upstream MLPs to generate high-yield, predictable cash flow streams. The energy commodity price crash resulted in deep distribution cuts from the majority of upstream MLPs. The upstream MLP sector has remained volatile, with both the energy markets and stock markets making it difficult to forecast future distributions and return potential. For investors who like to hold some high-yield MLP exposure, the Yorkville High Income MLP ETF (NYSE:YMLP) diversifies away from the pure-play upstream MLPs, yet still carries a low teens dividend yield.

Fund Strategy

YMLP tracks the Solactive High Income MLP Index, a rules-based index designed to generate a list of stable, high-yield MLPs. To select components, the “high-income” MLP universe is ranked using the criteria of (1) yield, (2) distribution coverage, and (3) distribution growth. According to the index rules high income includes:

“All MLPs operating with one of the following as a substantial business segment:

- Exploration and production of oil and/or natural gas

- Sale, distribution and retail marketing of propane and/or other natural gas liquids

- Marine transportation of one or more of the following: crude oil, dry bulk, refined products, LNGs, and other commodities

- Direct mining, production and marketing of natural resources, including timber, fertilizers, coal and other minerals.”

The top 25 ranked MLPs become fund components with weighting based on average daily trading volume. Sixteen MLPs are equally weighted at 4.75% with the remaining nine split into two weightings of 3.43% and 2.06%. Eligible MLPs for the index are ranked once a year and the top 25 are weighted using the percentages described. The index is rebalanced using these rules once a year on the third Friday in March.

An Interest Mix of Holdings

Distribution reductions at the start of 2015 eliminated some of the larger upstream MLPs from inclusion in the YMLP holdings. The most obvious non-holding is Linn Energy LLC (Nasdaq:LINE). The holdings list includes some MLPs that I am quite interested in owning and others that I would probably stay away from. In today’s energy price environment it is expected that some of the higher yielding options would have a higher associated fear of distribution cut reaction.

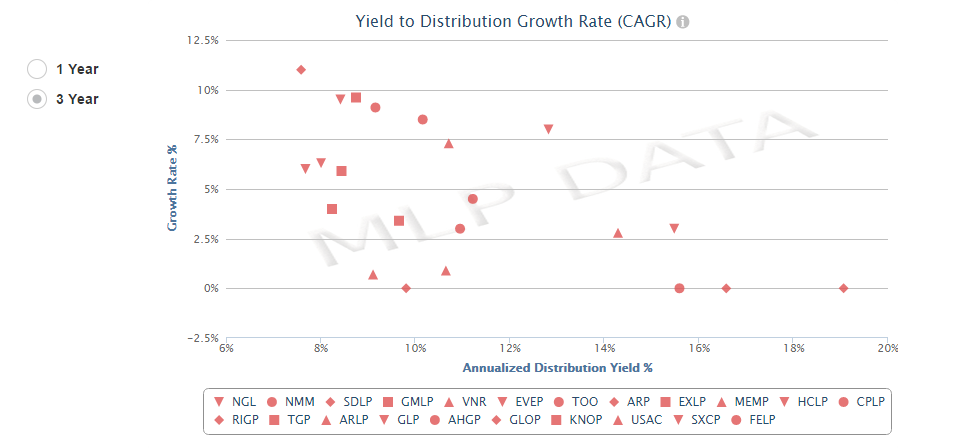

I like seeing NGL Energy Partners LP (NYSE:NGL), Golar LNG Partners LP (Nasdaq:GMLP), GasLog Partners LP (NYSE:GLOP) and Vanguard Natural Resources LLC (Nasdaq:VNR) in the list of YMLP holdings. Some fund components that would cause worry as individual investments include Navios Maritime Partners LP (NYSE:NMM) and Atlas Resource Partners LP (NYSE:ARP). Overall, there is enough diversity in the holdings and forecast distribution growth to provide an interesting option for cash flow focused investors. This chart from MLPdata.com shows the 3-year average distribution growth projection (CAGR).

MLP Fund Tax Issues

Using a fund to get MLP exposure in your portfolio is one way to avoid the pesky Schedule K-1 tax reporting requirements you experience with direct ownership in a partnership. When I am questioned on the topic, I recommend to my subscribers and attendees of speaking engagements that they not own MLP units in an IRA type account. However, an ETF like YMLP is one way to get exposure to the MLP sector in a retirement account.

Any fund, mutual, CEF or ETF, that has more than 25% of assets in MLPs must be organized as a corporation and pay corporate income taxes on realized taxable gains. An MLP focused fund will accrue a tax liability in the share price and show that liability as additional expenses. Corporate income taxes reduce the total return from an MLP ETF by the corporate tax rate compared to the index it tracks. That is why YMLP reports a management fee of 0.82% and total expenses of 4.65%. Those expenses were accrued last year. With MLP values falling, the fund now has an income tax asset or credit of $32.1 million. As a result of the tax asset, the YMLP share price can rise by about $1.50 or 13% from the current value before taxes start to reduce the total return.

Return Potential Going Forward

The YMLP share price is down 40% year-to-date and the most recent dividend was 8% lower than the rate paid for the previous four quarters. The types of MLPs held by the fund are among the most volatile in the MLP space, and in spite of the index rules, there is potential for additional distribution cuts.

On the positive side, the current yield is 13.5%, and the MLP group would recover strongly on higher energy prices. I think YMLP could be an interesting holding to stick in one corner of your IRA, collect the cash payments and understand that in the medium term there could be a lot of volatility. However, longer term the result could be an average annual total return that significantly exceeds the current yield.

High yield / high dividend growth MLPs comprise a significant portion of the core portfolio of The Dividend Hunter and are used as part of the Monthly ...

more