Stock Market Outlook: Is Now The Time To Ride The Trend?

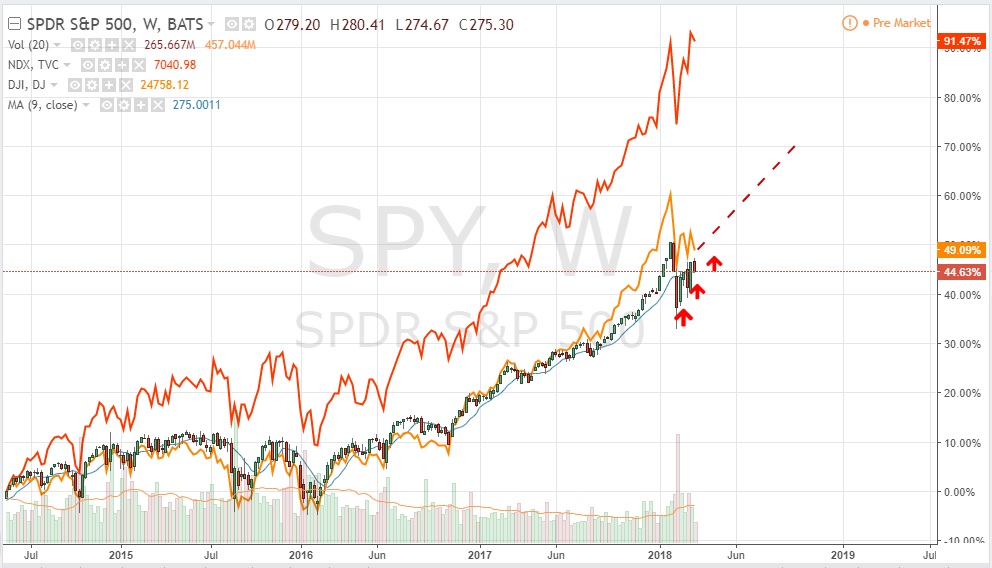

The stock market is currently in a rebound mode after experiencing a major pullback last month. The SPDR S&P 500 ETF (SPY) alongside all the major indices are now looking up. The Nasdaq 100 index has already regained all the points dropped during February and it looks as though it is only a matter of time before the rest of the market indices and their respective ETFs follow.

The SPY appears to be hovering within an upward trending support zone over the last few weeks, which is indicative of an impending resumption of the previous trend. The Nasdaq 100 index has already gone past its previous high after the pullback and now the rest of the indices and their ETFs seem to be headed there as well. This comes after an impressive jobs report early this month.

This rebound could indicate that the current SPY support zone will result in the SPDR S&P 500 ETF raising above the simple moving average line indicated on the chart to go past its previous high, which could trigger another extended period of upward trending movement.

(Click on image to enlarge)

The market also seems to have picked some momentum recently based on the trading volume shown at the bottom of the chart and this could help to propel the SPY ETF further upwards in the coming weeks and months.

When you look at the chart above, it is clear we had a comparable situation in early 2016, and the period that followed is what started the upward trend we have been riding for the last two years. So, the market appears ripe and ready for investors to apply momentum trading techniques if history is to be repeated. That’s the long-term view of things and it looks interesting for momentum investors that subscribe to the notion of the trend being an investor’s friend.

The short-term outlook is slightly different, but it also has some clear indications that the general trend will be maintained going forward. Looking at the 3-month chart below, it is clear that the SPY is currently trending upwards with successive higher-lows rebounds and higher-highs pullbacks, bar the most recent pullback, which occurred at roughly 4% level, same as the previous pullback.

(Click on image to enlarge)

The rebounds, however, have occurred at -5%, -1% and now seem set to take place again at about 3%, which is about 4 percentage points higher, the same points difference between the last two rebounds. So, in general, it is correct to say that the market is clearly looking up, as far as the SPDR S&P 500 ETF is concerned and this supports the case for momentum trading.

Conclusion

In summary, there is no guarantee that the next rebound will occur at the 3% level. The dynamism of the stock market has shown that things can change quickly especially depending on the type of news that comes through over the next few trading sessions.

From a technical perspective, momentum traders might be looking to pounce based on the recent performances of the Nasdaq 100, the S&P 500 Index and the Dow Jones Industrial Index. They all seem set to regain the losses experienced in February and the recent jobs report has given investors the impetus they needed to maintain a bullish outlook on the market.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more