Stock Exchange: Caught Leaning Into A China Trade? Now What?

Review: Is This The Calm Before The Storm?

Our previous Stock Exchange asked the question: Is this the Calm Before the Storm? We noted that when the market is slow and conditions are not attractive, patiently NOT trading can be an attractive strategy. However, forcing trades when conditions are not attractive by taking on more risk can be a big mistake, especially when slow markets are interrupted with a new batch of volatility. It’s important to know your style, what works for you considering risk tolerance and goals, but that doesn’t mean sticking your head in the sand and never learning anything new.

This Week: Caught Leaning Into A Trade? Now What?

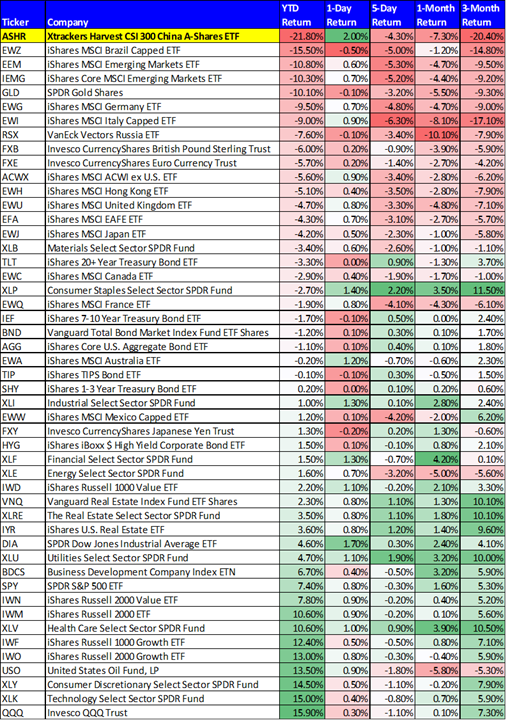

Here is a look at a sector and asset class ETF chart from Blue Harbinger, and it seems many market participants have been leaning heavily against the China “trade war” trade this year (see (ASHR)).

The data is through the end of day yesterday, and as we can see, China had been performing absolutely terribly this year, but showed signs of life yesterday. What happened? The market seems to have been favoring the US strongly as the two countries exchanged tariffs and more tariff threats. But just yesterday we received news that the two sides had made plans to talk, and that was enough to sharply reverse the direction of China stocks in a relatively strong one day move. Further still, it shows a lot of people may have been “caught leaning” into the China trade. So now what?

There is a lot of negative sentiment built into the current market. We have opined that any solid and credible news about improvements on trade would be worth 4%, and 10% if a real trade war is avoided. Yesterday’s rally is a big reaction to a hint of news (China and the US made only tentative plans to talk). It suggests that much of the fast money is “leaning the wrong way.”

So what do you do when you get caught leaning – or even offsides? It is especially challenging because your initial lean reflects an opinion. Alternatively, it can be very useful to discover situations where most others are leaning. Investopedia’s Alan Farely covers the latter in his…

One of the salient points from Farley’s article is that if you’re too in love with a trade, “you give way to flawed decision-making. It’s your job to capitalize on inefficiency, making money while everyone else is leaning the wrong way.”

“RevShark” takes on the former. We don’t necessarily endorse any of the bear trap, rigged market rhetoric, but nonetheless it is an interesting read about leaning the wrong way.

The point is that the market can often lean too far in the wrong direction on a trade, and as a trader you can either lean too far (i.e. get caught “offsides”) or you can look for the opportunity to exploit the market inefficiency. Obviously easier said than done, but staying alert and disciplined in your trades can help.

Model Performance:

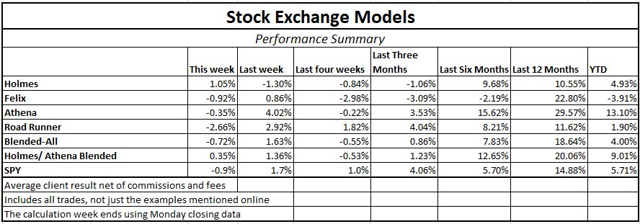

Per reader feedback, we’re continuing to share the performance of our own trading models, as shown in the following table:

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger; (Blue Harbinger is a source for independent investment ideas).

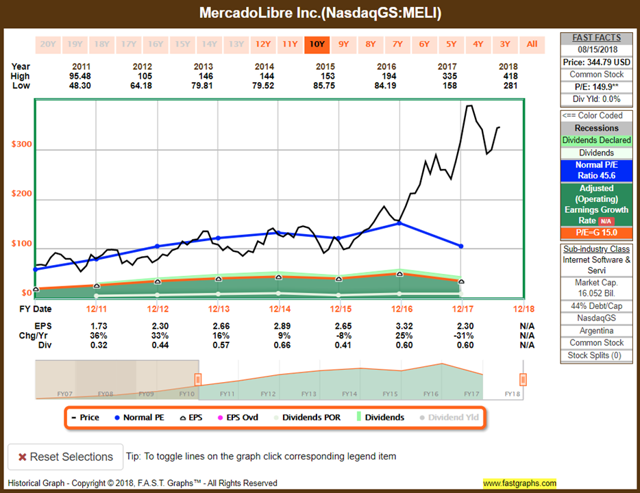

Holmes: This week I bought shares of MercadoLibre (MELI) on 8/16. I am sure you have an opinion on that Blue Harbinger, you always do.

Blue Harbinger: This is an online retailer based out of Argentina, and I have mixed feelings. On one hand, online retailers have been kicking butt in the US as the “death of brick and mortar retail” narrative rages on. However, I’d be a little nervous about investing in a company based out of Argentina because that economy seems very uncertain. Honestly, I think you’re on the right track, but I’d probably prefer a China Internet company. You know, Bidu (BIDU), Alibaba (BABA), YY (YY), they all seems pretty cheap, and we could see a nice springback when the US China trade war ends amicably.

Holmes: My thesis is actually similar. I am a technical trader, and I focus on the metrics surrounding “dip buying” opportunities, and as you can see in the following chart, the dip on MercadoLibre is compelling.

BH: Looks like a “cup and handle” formation to me, and I think emerging (and frontier) markets in general may be due for a rebound. But what about fundamentals, Holmes? Here is a look at the Fast Graph.

Holmes: I am a technical trading model. I care less about long-term fundamentals considering my typical holding period is only about 6-weeks.

BH: Fine, I’ll check back with you then. How about you, Road Runner–any trades this week?

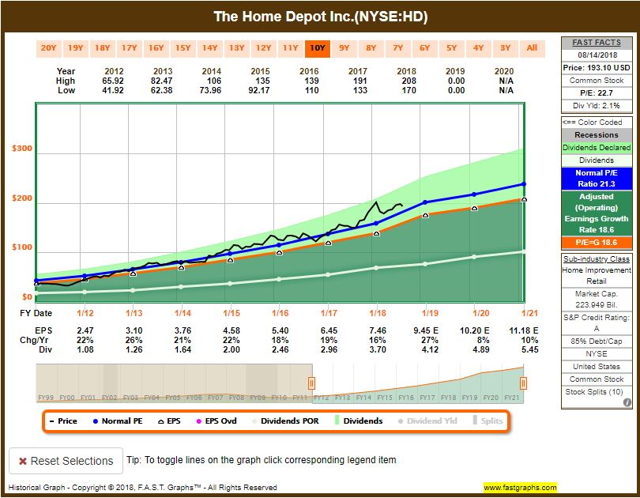

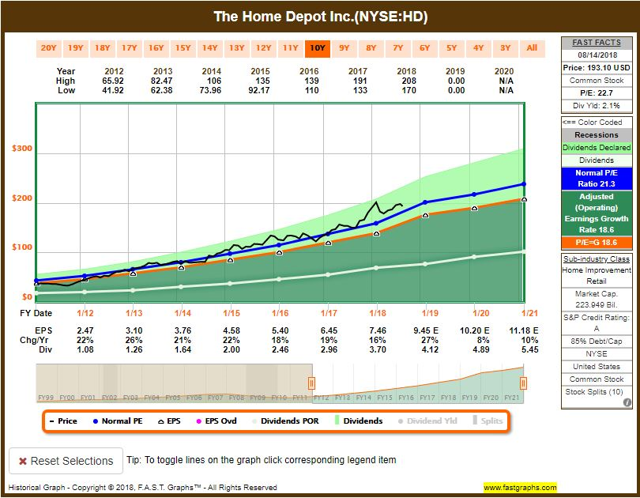

Road Runner: You bet. I bought Home Depot (HD) on 8/13. I too am a technical trader, but I’m not quite the “dip buyer” that Holmes is. Instead, my process is based more heavily on momentum. As a general rule, I try to buy momentum stocks that are in the lower end of a rising channel, and then I hold them for about 4-week. Here is a look at the chart for my Home Depot purchase.

BH: Interesting. I understand your process in theory, Road Runner–but I’m not entirely sure I see the “lower end of a rising channel” in the chart you shared. But how about fundamentals? There’s more good info in the following Fast Graph. And honestly, I can better see the momentum you are talking about in the Fast Graph too.

Road Runner: Thanks for the info, but as a reminder, I’ll be out of this trade in 4-weeks. My strategy has been putting up positive numbers this year, although not as positive as some of the other more pure play momentum traders (i.e. not waiting for the dip in the rising channel).

However, I know that blending my picks with the other models helps us put up strong returns regardless of market conditions, because eventually, pure momentum will fall out of favor, and my “lower end of a rising channel” momentum strategy will be more en vogue again at some point in the future. Team work, Blue Harbinger–plenty of upside with diversified risks, and an aggregate strategy that can perform well across changing market conditions.

BH: Thanks Road Runner. And how about you, Felix–any trades this week?

Felix: I sold my Newell Brands (NWL) shares this week for a loss. I bought them back in February. My holding period is longer than the other traders (on average it’s 66 weeks), but my version of momentum didn’t work out for this particular trade. It happens.

BH: Sorry this one didn’t work out better for you. Home Depot has certainly been returning a lot of cash to shareholders between dividends (the yield is over 2%) and share repurchases. Plus, these types of value stocks have been out of favor lately, as we saw in the ETF performance chart earlier in this report (value has been underperforming growth). Here’s a peek at the Fast Graph:

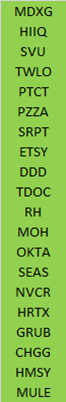

Felix: Thanks for the info. I also ran the Russell 2000 Small cap index through my model, and the top 20 are ranked below.

BH: Thanks Felix. Those small caps have far less non-US business exposure than do their large cap Russell 1000 counterparts. That’s certainly been a factor lately in light of tariff and trade ware talks.

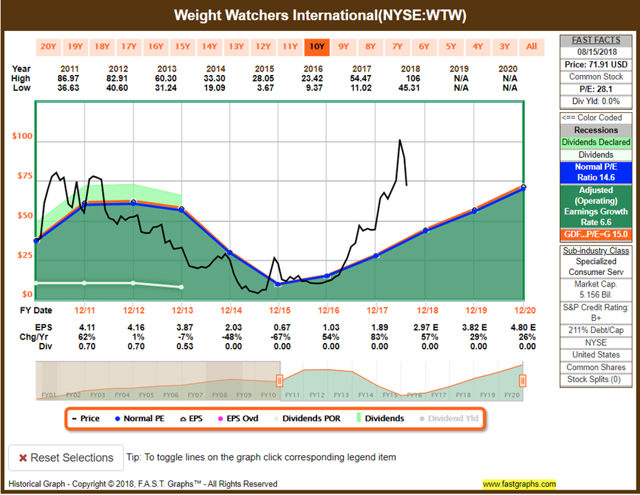

Athena: This week I sold my Weight Watchers (WTW) shares at a loss. I bought them back in July.

BH: That’s somewhat goofy that they sold-off lately considering the company beat earnings expectations and exceeded revenue guidance. However, they did lower future guidance, and the market didn’t seem to appreciate their new share issuance. You’re in and out of these trades so quickly (your typical holding period is about 17-weeks). This seems like more of a long-term play to me (I’ve shared the Fast Graph below), but your strong performance track record (shared earlier in this report) speaks for itself. Thanks, Athena.

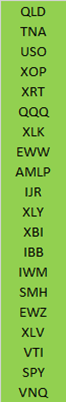

Oscar: This week I ran our High Liquidity ETFs with price-volume multiple over 100 million per day through my technical model, and the top 20 rankings are included below.

BH: Wow–you really are a momentum trader, Oscar. I see you’ve ranked ProShares Ultra QQQ (QLD) at the top of your list. That fund seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the NASDAQ-100 Index. And if you look in our ETF chart near the start of this report, QQQ has been the best performer on this list, year-to-date. Your are quite the momentum bull, Oscar.

Conclusion:

Trading strategies work, until they don’t. And they don’t always stop working when you’d expect them to. You may think of it as bulls versus bears, fear versus greed, or traders leaning too hard in one direction or another. As Benjamin Graham famously said, “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” Investors and traders alike have been “voting” hard against non-US countries in general this year, and heavily against China in particular. And if the market is leaning too far into this trade, did you get caught during yesterday’s snap back? And perhaps more importantly, when the US and China do eventually come to more formal terms (besides yesterday’s simple hint of discussions), the snap back could easily be much more violent. Will you be ready? How are you positioning, and how will you react?

Background On The Stock Exchange:

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

| Character | Universe | Style | Average Holding Period | Exit Method | Risk Control |

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more