SPDR Gold Trust Driven By Low Rates And Strong Momentum

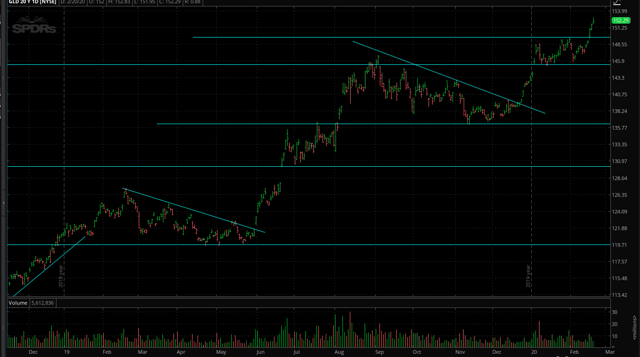

SPDR Gold Trust (GLD) has been firing on all cylinders lately. The gold-tracking ETF broke above resistance levels in the area of $150 per share in recent days, and it is making new highs for the year as of the time of this writing.

(Click on image to enlarge)

After such a strong run, nobody should be surprised to see some kind of consolidation in the short term. However, both the economic fundamentals and the quantitative price trend indicators are looking bullish for SPDR Gold Trust over the coming months.

Gold And Interest Rates

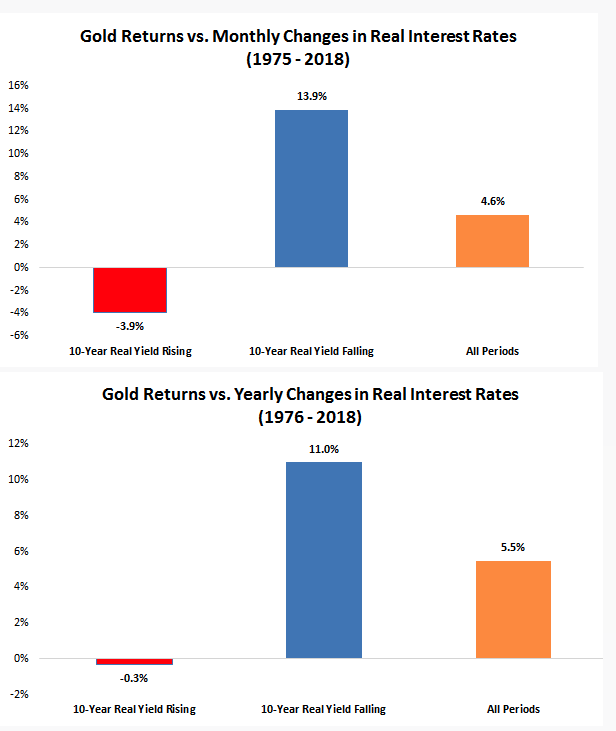

Gold and real interest rates have a negative correlation. Since gold doesn't pay any interest, declining real rates reduce the opportunity cost of holding gold, making SPDR Gold Trust more attractive in comparison to other alternatives in the market when rates are low and declining.

Even more important, when real interest rates are negative, this means that interest rates are not providing enough compensation for inflation. If the price of gold is expected to adjust for inflation in the long term, then SPDR Gold Trust becomes a particularly compelling proposition when real interest rates are below zero.

The chart below shows the monthly and yearly relationship between gold prices and real interest rates from 1975 to 2018. An image is worth a thousand words and declining real rates are clearly a major tailwind for gold prices.

(Click on image to enlarge)

Source: Pension Partners

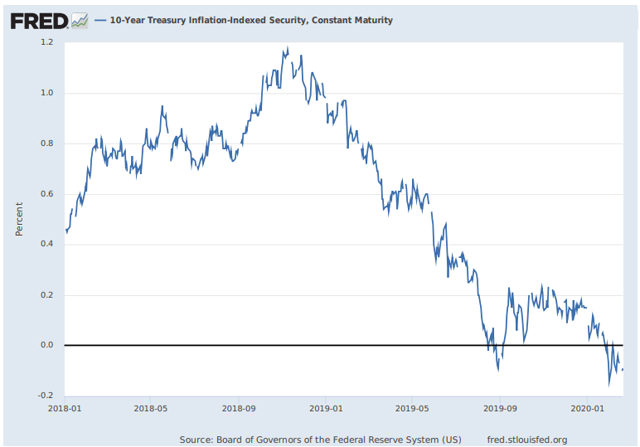

The US economy has been mostly resilient in recent months, yet real interest rates have fallen deeply into negative territory. To a considerable degree, this is due to the fact that financial markets are now deeply integrated on a global scale, and nominal interest rates in many European countries and in Japan are now in negative territory.

(Click on image to enlarge)

We are not just talking about Germany and Switzerland, but even Greece is issuing short-term debt at negative nominal rates. Forget about even starting to account for inflation, investors are willing to take negative rates in nominal terms for the privilege of parking their money with the government.

Ultra-low interest rates in Europe and Japan make US bonds look attractive in comparison, which keeps rates low in the United States too. It is all relative, and as long as interest rates remain at amazingly low levels all over the world, it is hard to imagine interest rates in the U.S. rising too much.

An Uptrend With Vigorous Momentum

It is one thing to say that low real yields can be a key driver for SPDR Gold Trust and a very different thing to see the thesis playing out well in the present time. The ETF has just made new highs for the year, so the price is in an uptrend, no doubt about that.

However, in order to assess the timing in an investment, it can be important to move beyond the more subjective visual analysis and incorporate indicators based on hard quantitative data as opposed to opinions and interpretations.

The Asset Class Rotation Strategy is a quantitative strategy that rotates between 9 ETFs that represent some key asset classes.

- SPDR Gold Trust for gold

- Vanguard Real Estate (VNQ) for real estate.

- SPDR S&P 500 (SPY) for big stocks in the U.S.

- iShares Russell 2000 Index Fund (IWM) for small U.S. stocks.

- iShares MSCI EAFE (EFA) for international stocks in developed markets.

- iShares MSCI Emerging Markets (EEM) for international stocks in emerging markets.

- Invesco DB Commodity Index Tracking (DBC) for a basket of commodities.

- iShares 20+ Year Treasury Bond (TLT) for long-term Treasury bonds.

- iShares 1-3 Year Treasury Bond (SHY) for short-term Treasury bonds.

In order to be eligible, an ETF has to be in an uptrend, meaning that the current market price is above the 10-month moving average. Among the ETFs that are in an uptrend, the system buys the top 3 with the highest relative strength over 3 and 6 months.

The main rationale behind this strategy is actually quite simple, the strategy wants to buy only the asset classes that are in an uptrend. Among the asset classes that are in an uptrend, it looks for the ones with superior risk-adjusted performance in comparison to the other asset classes.

The portfolio is monthly rebalanced, and the benchmark is All-World 60-40 Benchmark (BNCH), which is a portfolio of global stocks and bonds holding 60% in stocks and 40% in bonds.

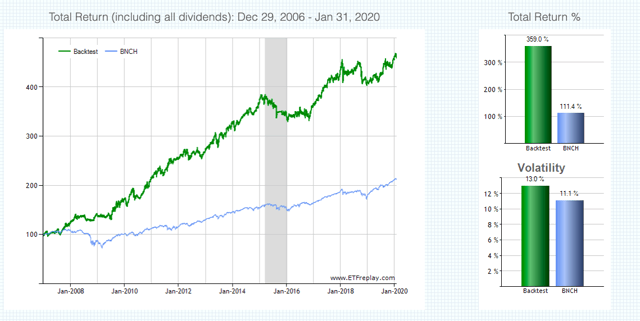

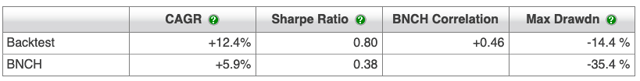

The charts below show the historical performance numbers for the ACR Rotation Strategy since January of 2007.

(Click on image to enlarge)

Source: ETF Replay

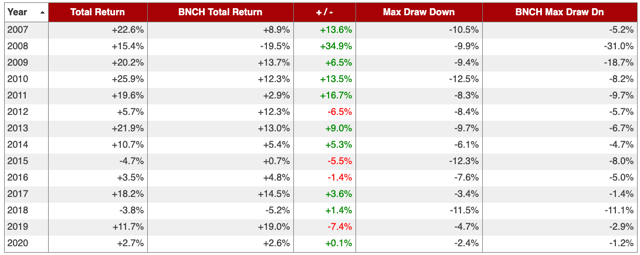

(Click on image to enlarge)

Source: ETF Replay

Since inception, the strategy gained 359% versus 111.4% for the benchmark. More importantly, the maximum drawdown, meaning maximum decline from the peak, was 14.4% for the ACR strategy versus 35.4% for the benchmark.

It is important to understand that no strategy can outperform in each and every year, though, and relative performance will depend on market conditions to a good degree.

In periods when trends are strong and long-lasting, either up or down, we can expect these kinds of strategies to deliver market-beating returns. On the other hand, when prices for different asset classes are moving sideways, the strategy will most probably produce many false signals and, ultimately, disappointing returns.

We can gain a deeper understanding of how the strategy works by looking at the annual return numbers for different periods. Its worst year was 2015, and the annual loss in that year was a very manageable -4.7%.

(Click on image to enlarge)

Source: ETFreplay.

The fact that the strategy tends to produce positive returns most of the time and that losses are relatively small when they happen is the main strength in these kinds of strategies. Offense sells tickets, but defense wins championships.

As a reference, the worst year for the benchmark was 2008, with a return of -19.5%. During that year, the ACR strategy gained a healthy 15.4% by investing in safe-haven assets such as Treasuries and gold.

In a year such as 2017, when risky assets boomed, the strategy gained 18.2% by investing aggressively in equities, also outperforming the benchmark by a considerable margin.

On the other hand, in years such as 2015 and 2018, when the main trends in different asset classes were weak and short-lived, the strategy produced mediocre returns in comparison to the benchmark.

The strategy buys strong assets and sells weak assets. When market trends are strong, either up or down for risky assets, the strategy does a solid job in terms of capturing those trends. Conversely, when trends are weak, the strategy will tend to get hurt by false signals.

Importantly, these kinds of strategies are not only useful for investors who trade ETFs based on quantitative indicators. The strategy can provide actionable information in terms of evaluating the overall market environment and positioning your portfolio in the right sectors at the right time. The signals from the strategy can also be used to make discretionary investing decisions.

During the month of February, the strategy is allocated to SPDR Gold Trust as one of the top 3 ETFs in terms of risk-adjusted relative strength. This means that ETF is not only in an uptrend but also outperforming many other alternatives in the market.

Winning assets tend to keep on winning over time because investors looking to outperform the benchmarks gravitate towards the assets that are not only rising but also outperforming. Strong price behavior attracts more buyers, creating a self-sustaining cycle that has bullish implications for SPDR Gold Trust in the current environment.

When considering both the fundamental tailwind of negative interest rates and the bullish price behavior in recent months, SPDR Gold Trust has what it takes to continue delivering attractive returns going forward.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more