SPDR Biotech ETF: A Quality Long-Term Bet

The SPDR Biotech ETF (XBI) has been on a tear ever since global investors started chasing biotechnology stocks after the COVID-19 disruption slammed into us. The investor interest in this sunshine sector is not just because of the vaccine race, but also because nations will give more prominence to healthcare spends in the post-COVID-19 age.

I am still bullish on XBI for the long-term, and here are the reasons why.

Proven Long-Term Outperformer

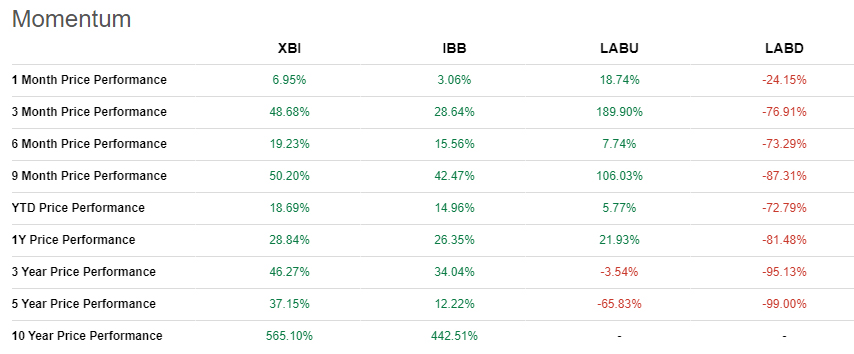

XBI has outperformed its peers such as iShares Nasdaq Biotechnology ETF (IBB) and Direxion Daily S&P Biotech Bull 3x Shares ETF (LABU) by a wide margin from the long-term point of view.

(Click on image to enlarge)

Image Source: Seeking Alpha

Investors who have held on to XBI for 10 years have seen their capital appreciate by 565%, plus dividends. Investors who have bought the stock at any point of time in the pre- or post-COVID-19 period have gained (see the table above).

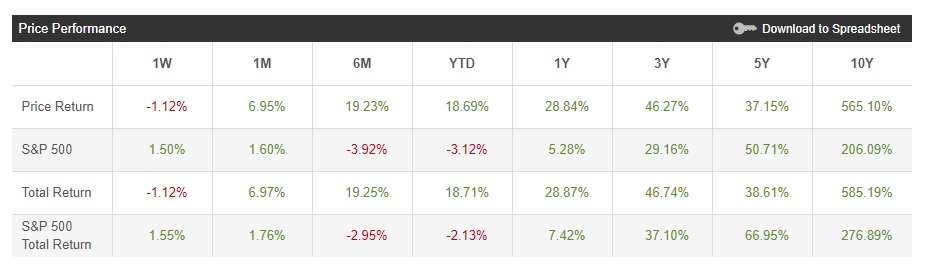

XBI also has largely outperformed the S&P 500 (SP500) over the long term (10 years). Investors who bought XBI 10 years ago or 3 years ago have made more money than they would have made had they invested in the SP500. However, the SP500 outperformed XBI for investors who bought it 5 years ago. That said, XBI caught up quite nicely and raced ahead of SP500 as time progressed (see table below).

(Click on image to enlarge)

Image Source: Seeking Alpha

A Diversified Biotech Portfolio

Image Source: Self-Generated

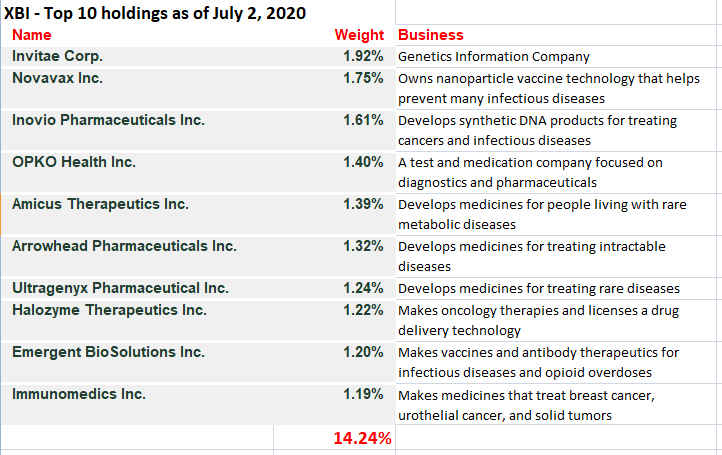

Out of the company’s total funds, 14.24% are invested in a variety of biotechnology companies making products that treat a wide range of conditions, including infectious diseases, cancers, opioid overdoses, intractable diseases, rare diseases, etc. Companies that are into genetic information, diagnostic companies, and those that make drug delivery technologies are included as well.

The diversity in XBI’s top 10 holdings suggests that its research team is top-quality and knows how to hedge risks well. What I specifically liked was that this ETF has not focused only on COVID-19 plays, which could have been a bad decision.

Risk Management

As of July 2, 2020, XBI holds 135 stocks in its portfolio. The highest allocation, which is 1.92%, has gone to Invitae Corp., while the lowest allocations have been made to Prothena Corp. (0.12%) and Achillon Pharmaceuticals (0.009%).

Savvy investors know that investing in biotech growth stocks can be a dicey proposition. For example, clinical trials can fail, regulations can clog up pipelines, commercialization can be delayed, and so on and so forth. These are standard risks faced by many biotech companies that are on a growth trajectory.

Therefore, it makes more sense to invest in XBI instead of parking funds in one or two biotech companies. With its risks spread out over 135 stocks, XBI is well-poised to absorb any price shock in a few portfolio companies.

Dividends

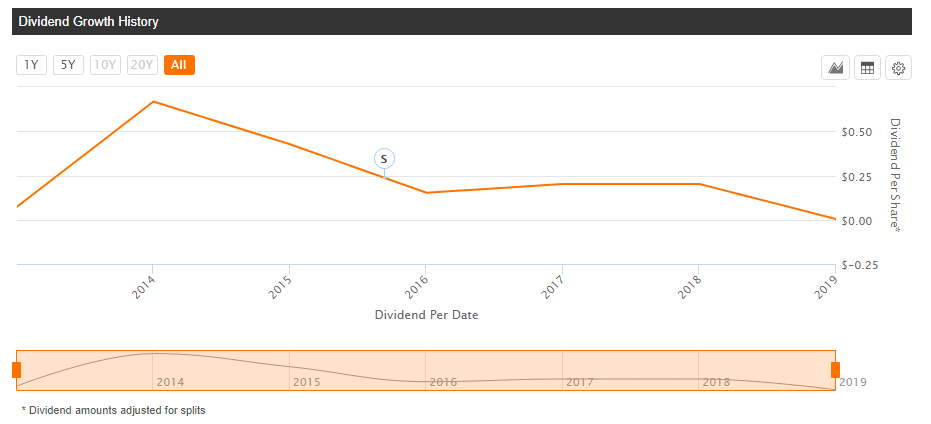

XBI is a growth ETF – if you’re eyeing it for dividends, forget it.

(Click on image to enlarge)

Image Source: Seeking Alpha

XBI paid $0.004 dividend in 2019, which represented a fall of 75.40% over the previous payout. Biotechnology companies typically invest huge sums in R&D to develop drugs or technologies that will provide a sustainable income for decades. XBI has gotten into many such early-stage companies and therefore it is an ETF for growth investors.

Summing Up

XBI is a very simple ETF to decide on. If you’re a biotech growth chaser who is averse to risk, consider buying it; if you’re a dividend chaser, look at other options; if you are a risk-taking biotech stock investor, look at individual stocks.

I’m bullish on XBI because I believe in growth, especially near-term growth. I believe that biotech stocks will be in momentum until the COVID-19 vaccine is discovered, and will then again pick up pace after the virus is contained because at that time nations will begin responding to the pandemic by beefing up healthcare infrastructure, including research and development.

For me, XBI is a buy for the long term.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more