S&P 500 Growth ETF - Chart Of The Day

Summary

- 100% technical buy signals.

- 14 new highs and up 4.82% in the last month.

- 29.21% total return in the last year.

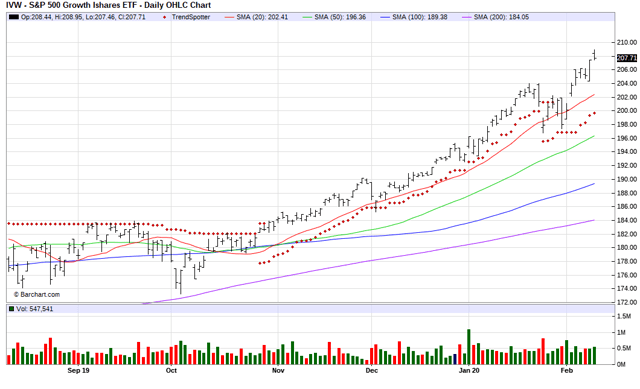

The Barchart Chart of the Day belongs to the S&P 500 Growth ETF (IVW). I found the ETF by sorting Barchart's Top ETFs to Own list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend spotter signaled a buy on 1/30 the ETF gained 3.11%.

The iShares SP 500 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the SP 500 Growth Index (the Underlying Index). The Underlying Index measures the performance of the large-capitalization growth sector of the U.S. equity market. It is a subset of the SP 500 Index and consists of those stocks in the SP 500 Index exhibiting the strongest growth characteristics, as determined by the Index Provider, representing approximately 50% of the market capitalization of the SP 500 Index. The Fund generally invests at least 90% of its assets in securities of the Underlying Index and in depositary receipts representing securities of the Underlying Index.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 26.95+ Weighted Alpha

- 27.69% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 4.82% in the last month

- Relative Strength Index 68.59%

- Technical support level at 205.39

- Recently traded at 207.19 with a 50 day moving average of 196.37

Fundamental factors:

- Assets Under Management in this Fund $26.11 billion

- P/E 28.06

- Dividend yield 1.52%

- Mgt Fee .18%

Disclosure: None.