Short Squeeze Mania - Stocks Swoon

It's officially "stonk season" in the markets. The IPO market continues to baffle, and SPACs continue to pop-up like weeds in your front yard.

Plus if you’ve seen GameStop (GME), AMC Entertainment (AMC), and Blackberry (BB) lately, you know the Robinhooders are at it again.

These speculative gambles are ridiculously frothy right now as hedge funds and institutions continue to try and cover their shorts. The moves these stocks are making are more detached from reality than the guy in a buffalo headdress at the Capitol 3 weeks ago.

Complacency is the most significant near-term risk to stocks by far, and I have been warning about this for weeks. It also reminds me of the Q4 2018 pullback (read my story here).

It’s also earnings season (for those who care, like analysts), and it’s time for some big swings and volatility.

Well, not entirely. Monday (Jan. 25) saw a sudden mid-day plummet and subsequent recovery and Tuesday (Jan. 26) traded slightly down. Wednesday (Jan. 27) looks set to open lower - we will see how that ends up.

Earnings have so far impressed, though, and there were some big moves from individual stocks.

General Electric (GE) popped over 9% thanks to a healthy outlook for 2021 and better than expected industrial free cash flow.

Johnson & Johnson (JNJ) also saw a nice 3% gain after beating earnings. Investors are also eagerly anticipating results from its vaccine’s trial. Johnson & Johnson’s vaccine is one dose and does not require any crazy storage protocols like Pfizer (PFE) and Moderna’s (MRNA). Strong results and FDA approval could genuinely change the tide of the pandemic and vaccine rollout.

Earnings from Microsoft (MSFT) and Advanced Micro Devices (AMD) also came in after the closing bell and impressed as well. Microsoft posted record quarterly sales, and AMD exceeded $3 billion in revenue.

Does this mean we're all clear now and can party like it's 1999?

Not exactly. Plus, if you're a stock nerd like I am, you don't want to party like it's 1999. Because that means 2000 will come—the end of one of the biggest parties, investors have ever seen. I'm talking about the dot-com bust.

Fair warning: the S&P 500 is still at or near its most-expensive level in recent history on most measures, and the Russell 2000 has never traded this high above its 200-day moving average.

The more GameStop pops, the more of a circus I think this market is. GameStop a $15+ billion company? Really? A correction at some point in the short-term would not be shocking in the least.

John Studzinski, vice chairman of Pimco, believes that market valuations are sound and reflect expectations of this eventual reopening and economic recovery by the second half of the year.

I agree on some level about the second half of the year. Outside of complacency, though, I have other short-term concerns.

For one, trillions in imminent stimulus could be useful for stocks but bring back inflation by mid-year. The worst part about it? The Fed will likely let it run hot. With debt rising and consumer spending expected to increase as vaccines are rolled out to the masses, the Fed is undoubtedly more likely to let inflation rise than letting interest rates rise.

All of this tells me that the market remains a pay-per-view fight between good news and bad news.

We may trade sideways this quarter- that would not shock me in the least. But I think we are long overdue for a correction since we haven't seen one since last March.

Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

In a report released last Tuesday (Jan. 19), Goldman Sachs shared the same sentiments.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth. Hopefully, you find my insights enlightening, and I welcome your thoughts and questions.

We have a critical week ahead with the Fed set to have its first monetary policy meeting of 2021 and more earnings announcements. I wish you the best of luck. We'll check back in with you at the end of the week.

Small-caps are Too Hot to Handle

(Click on image to enlarge)

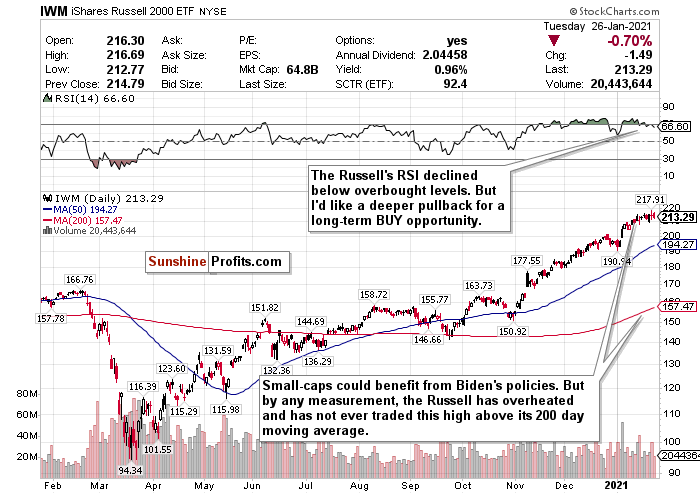

Figure 1- iShares Russell 2000 ETF (IWM)

As tracked by the iShares Russell 2000 ETF (IWM), small-cap stocks underperformed the larger indices on Tuesday (January 26). The RSI is no longer technically overbought, but I still think that the Russell has overheated in the short-term. Stocks don’t just go up in a straight line without experiencing a sharp pullback. That’s just the nature of the beast.

Barron’s also claims that the Russell 2000/S&P 500 ratio has entered a powerful 15-year resistance area.

Nobody knows what will happen during this critical week of earnings, but I called a decline after the IWM began the week over a 70 RSI. Indeed the IWM is having a down week to this point, but it’s not sharply down enough for me to switch my call. Not even close.

I love small-cap stocks in the long-term, especially as the world reopens. Small-caps are also the most likely to benefit from Biden’s aggressive stimulus plan.

But the index has overheated. Period.

Before January 4, the RSI for the IWM Russell 2000 ETF was at a scorching hot 74.54. I called a sell-off happening in the short-term due to this RSI, and it happened.

After the RSI hit another overbought level of approximately 77 two Wednesdays ago (January 13), the IWM declined by another 1.5%. I said that Russell stocks would imminently cool down because the RSI was too hot, and precisely that’s what happened.

Consider this too. In its entire history as an index, the Russell has never traded this high above its 200-day moving average.

Small-caps may have priced in vaccine-related gains by now, and some stimulus optimism may have been priced in too.

I hope small-caps decline before jumping back in for long-term buying opportunities. I love where these stocks could end up by the end of the year.

SELL and take profits if you can- but do not fully exit positions. If there is a deeper pullback, this is a STRONG BUY for the long-term recovery.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more

While I agree that a correction to speak of is likely and overdue, I've been laying the case all this week for why I don't see it coming in January or February. The coming month is going to be quite weak, and market breadth isn't really exciting but muddling through remains the most likely scenario for now in S&P 500.

good thing March is included in Q1!

Here we go, retracing the indiscriminate selling. This won't be a bloody correction, no. Feels great to be in service of the people, the truly grateful ones, and absolutely for free. I'll be a frequent contributor to our audiences who have known me for a good year already - daily pushing the button In all markets analyzed. I believe in exchange of professional ideas to the real and proven betterment of the clients and readers, who are the sole inspiration of my efforts. Thank you.

Even the final sentence in bold says that this is not the end of the bull market at all. My call too. The session turned out as sell first, ask questions later - across the board. I am saying that such moves are a gift for those of a not too short-term investment horizon. The IWM resistance will be overcome - it's a matter of time only.

I completely agree. The market needs a healthy correction at this point, though, which is why in the ST I think its best to take some profits and / or be wary, even after the move today. Medium to long term constructive, but a lot will depend on if inflation rears it's ugly head after massive stimulus across the globe - will this time be different?

I had called this bull market, and been predominantly on the long side since April during the long authorship era of Stock Trading Alerts. Great appreciation for readers and subscribers. What I've been writing all this week, is that this "winter correction" will be rather sideways, and not down, making so clear everywhere I talk.

Good comment thread, thanks.

Thank you Carol! I welcome professional interaction within community :)

New reply. And this is where you can help as you're talking. I built up Stock Trading Alerts from scratch, being their author for over 9 months, and I'm thankfully independent now. You've been assigned these for 2 months running. Yet, you do engage me in talking, which is healthy. Great, I appreciate!! I value open and professional talk done respectfully and publicly, and it seems that your company is hiding my replies to its Tweets as none is shown. I ask whether your company is open to professional discussion on Twitter and here, or not. I welcome their public tweets and comments, and expect the same. Mature professional environment. Good part of my tweeted response is pinned to my profile at Twitter. Thank you for letting me know here publicly.

Monica, this sounds like a conversation you should have directly with Sunshine, rather than on a public forum. At least it's not something the rest of us need to hear about.

Susan, it was my opinion that everyone no matter where, benefits from open discussion. Curiously then asked in the flow the person communicating, that's all.

Hi Monica, "calling the rally" can be a dangerous way to turn trading into biases. We all suffer from the same emotional attachments to investing, and must be aware of them. The point of these articles is to help readers manage risk in their overall portfolios, diversify properly, and professionally manage volatile markets. Markets do not always go up, and a correction is likely around the corner - they tend to happen at least once a year. With the analysis above, I think taking risk off is prudent at this time as a correction (10%+) is looking more probable even as we go higher today and this week. Lots to catch up on over the next week, and when everyone thinks the market is going up, history tells us not to go with the herd for too long.

Both traders and analyst are opinionated and clear. I am always judicious in going long, short, or closing a trade, and have written extensively in 2019 on the many pitfalls of trading. Roughly half of my 2020 profits were made on the short side of stocks, exiting at the very Mar 23 bottom etc. My view on real correction timing is differrent from yours, thus fair nailing it in my public 2021 calls just as mostly last year. Neither a permabull nor a permabear, I am confident in going both with the herd, and against - but when, I tend to decide that - the point is to deliver proven dollar value to the people.

I don't think 10% is out of the question at all, even despite today's rally @[Monica Kingsley](user:149790). It could happen extremely fast, akin to the March correction in 2020, but it's definitely within the realm. 20%? probably not.

I called this rally. and people who followed me, profited. March 2020 downswing veracity, now? I doubt that very vocally. While I understand and also did strike myself earlier a cautious tone for the bulls, it's not clear how you translate the conviction about "correction here" into action. Hey, if your call of 10% is right, that's money on the table left. I am a nimble trader ready to profit both on the long and short side, creating value for people who care to listen and belong. New reply follows.

Monica, I'm sure you are a great trader. But you brag too much about it. It's annoying and a major turn off.

AOL: Thank you for being open. I'm expressing own opinions on S&P 500 path ahead, mentioning in 4+4 words what I had done in the meantime. People might not know my trading style and speed. That's all, no ill intent

Depends upon what you define as a correction. 10%? I don't really think so