Selling Frenzy By Hedge Funds Hits Record, Offset By Surge In Buybacks

Two weeks ago, Bank of America warned that it had observed a sharp reversal to "increasingly euphoric sentiment" among its institutional, hedge fund, and HNW clients, all of whom sold in the previous week even as stocks continued their grind higher. This happened around the time that Goldman's Prime Brokerage had observed a startling streak as hedge funds sold stocks for 7 days out of 8, which prompted us to warn that a short squeeze was coming... we were right because just a few days later the S&P was back at all-time highs on - you guessed it - another whopping short squeeze.

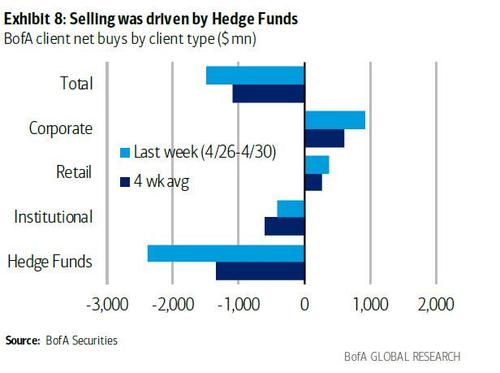

Then, last week, when looking at its latest client flow data, BofA found that bearish sentiment accelerated and for the second week in a row the bank's clients were net sellers (-$2.0B) of US equities with net sales in both single stocks and ETFs (only the third time this year clients sold ETFs), while retail clients were the "least dumb money", and according to BofA were once again the only client group to buy stocks, albeit at the weakest level since mid-Feb.

So after two consecutive weeks of sheer "smart money" revulsion did buyers finally emerge?

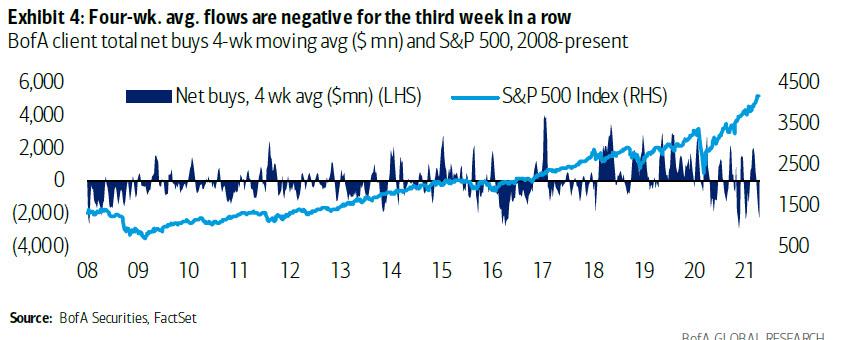

Well, according to the latest BofA Client Flow Trends report published overnight, not only did buyers not return - as the bank's clients were net sellers (-$2.2B) of US equities for the third week in a row...

(Click on image to enlarge)

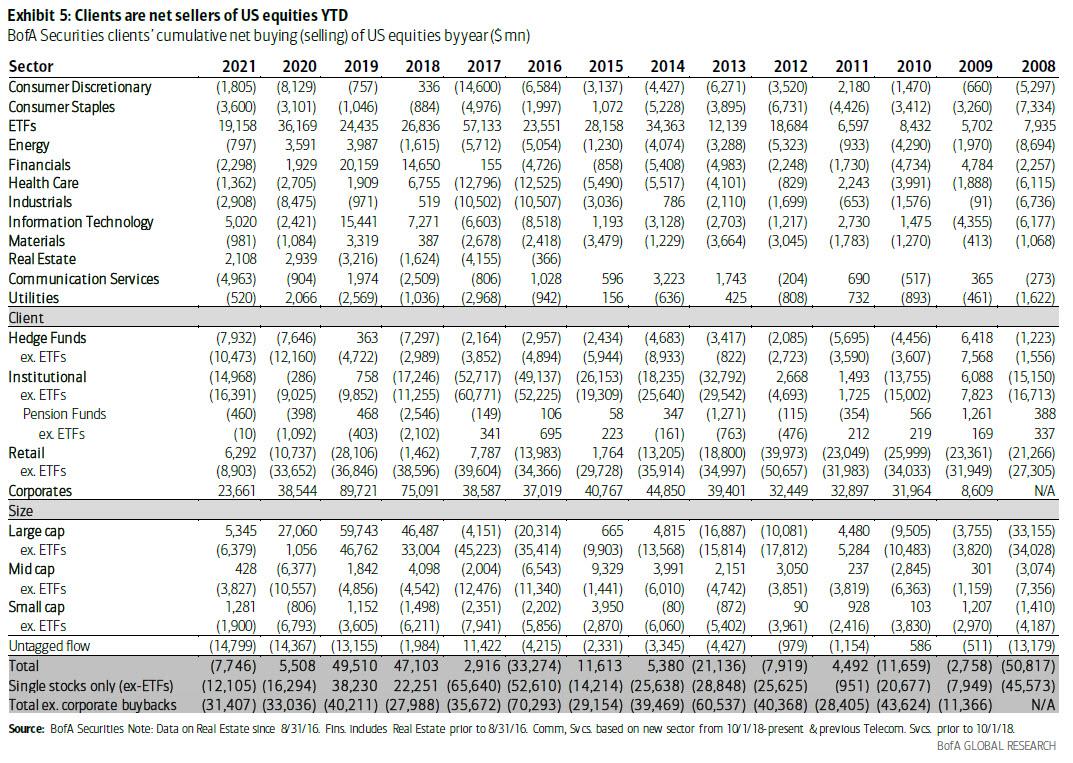

... and are now net sellers on a YTD basis...

(Click on image to enlarge)

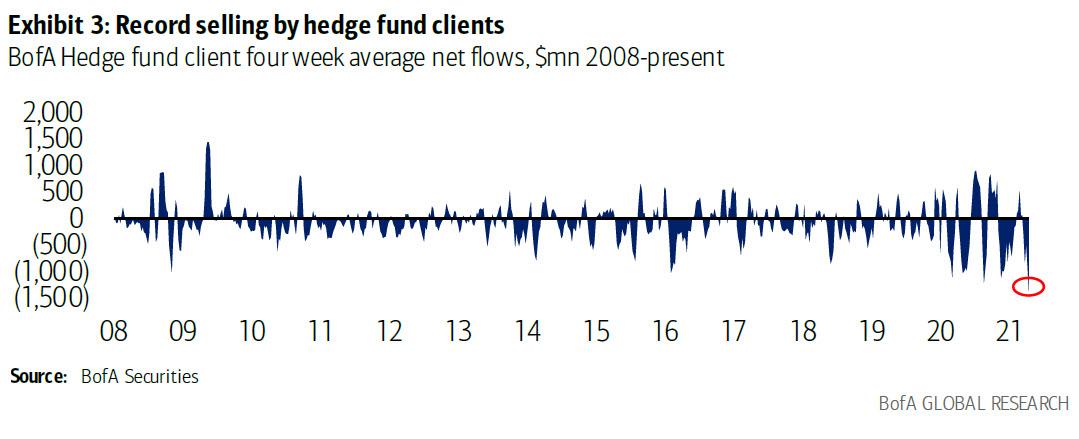

... as the market reached another record high and equity sentiment as measured by BofA's proprietary indexes marched further toward euphoria - but the rolling 4-week avg. flows for hedge funds hit a record low in our data history (since 2008) and were three standard deviations below the average.

(Click on image to enlarge)

This matters, because the only other time flows were this extreme was at the end of last August after which the S&P 500 declined by 2.5% and 2.3% in the subsequent one and four weeks, respectively (although that was driven more by the collapse of the SoftBank gamma squeeze than anything organic).

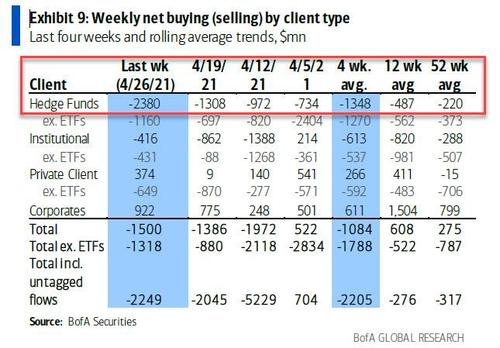

And while institutional clients sold equities for the third week in a row (but at a decelerating pace) while hedge fund (HF) clients sold for the fifth week (largest outflow in over a month)...

... the only buyers were retail clients who have been net buyers for 10 straight weeks, providing once again that as stocks hit all time high, they were the smart money (although it remains to be seen what they do as stocks now appear set for a pullback).

Some more details on the latest client flow trends:

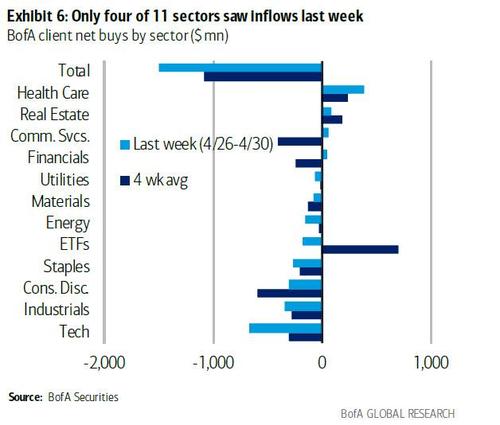

- Clients sold stocks in seven of 11 sectors with the largest outflows from Tech, Industrials, and Cons. Disc.

- Selling was most pronounced in cyclical and growth-oriented sectors: Energy outflows were the largest in nearly two months, Cons. Disc. saw its seventh straight week of outflows, and Tech outflows were the largest since mid-Jan.

- Health Care and Real Estate saw the biggest inflows. Inflows into Health Care neared historic highs for the second week, though cumulative flows for Health Care have generally been negative since last spring.

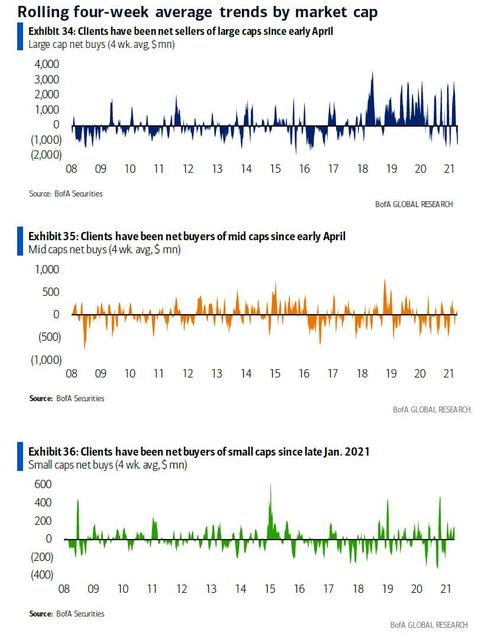

A breakdown by market cap reveals more nuanced picture, and while clients have been puking large-caps since April, they have offset this by buying mid-caps, even as they bought small caps all year.

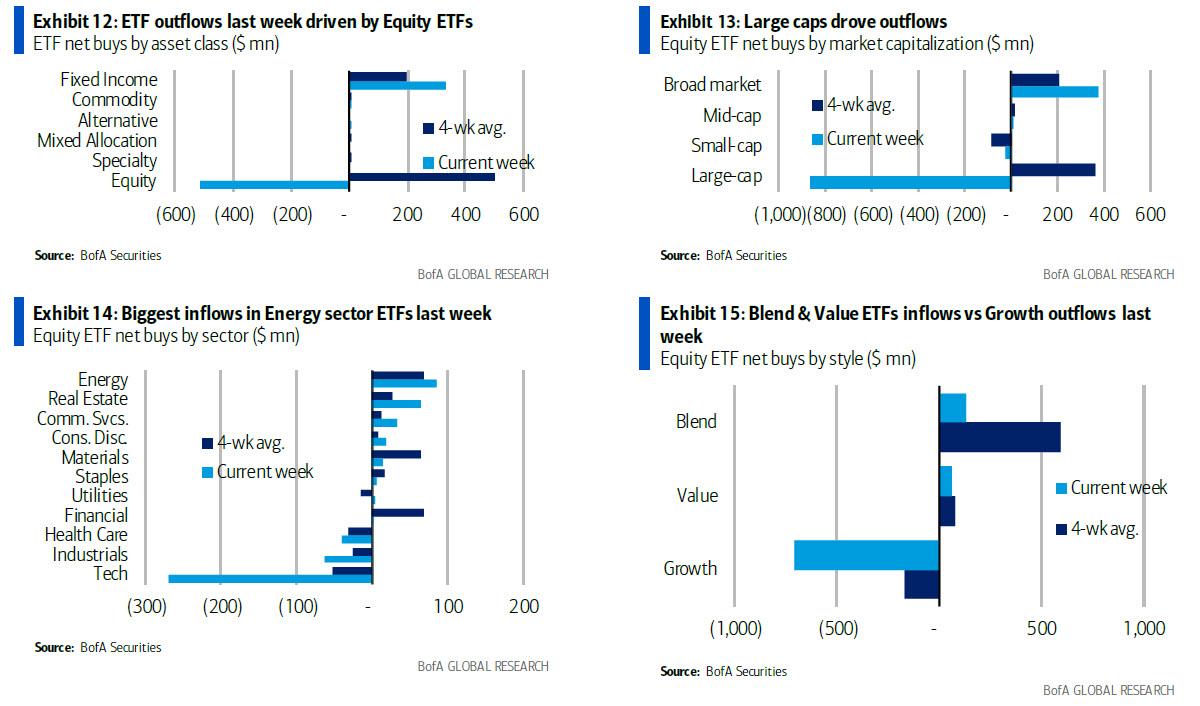

Finally, digging through ETF flows, we find that BofA clients sold ETFs for the second straight week, which is rare and last occurred during the March 2020 selloff. Outflows were driven by Growth ETFs, which saw the largest weekly outflow since mid-Jan, while Value ETFs saw small net inflows.

BofA highlights "that a rotation from Growth to Value could suggest downside to the S&P 500 overall", meanwhile energy ETFs saw the largest inflows among sector ETFs while Tech ETFs saw the largest outflows.

(Click on image to enlarge)

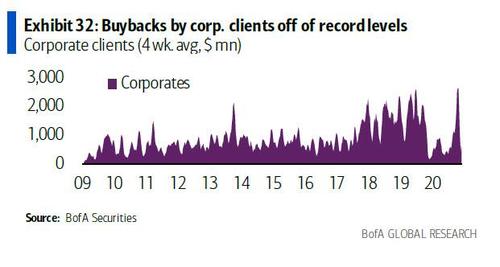

So while institutions and hedge funds were dumping and retail was buying, another entity was waving stocks in with both hands: corporations themselves.

That's right: after they exited the buyback blackout period, companies have unleashed a massive buyback spree, and BofA notes that corp. repurchases (led by Financials), accelerated amid the height of earnings season, and YTD are tracking +19% vs. last year’s levels at this time.

While the surge in buybacks has yet to validate our thesis laid out last week "The Catalyst For The Next Leg Higher: Buyback Blackout Period Just Ended", we are confident that it's only a matter of time before the massive firepower unleashed by tech firms - recall that just AAPL and GOOGL combined will repurchase a record $140BN in stock between the two - reverses the downward flow in stocks and hedge funds and momentum chasers reverse their bearish bias and jump on the retail-driven bandwagon, looking for much higher stock prices.

In short: we are back to the pre-QE market where it wasn't Fed purchases as much as (debt-funded) stock buybacks that provided the relentless dry powder pushing risk assets to all-time highs. There is just one difference - not only do we have record buybacks but we also have $120BN in monthly Fed liquidity injections. We say that just in case someone is naive enough to actually short the manipulated policy tool once upon a time known as "the market".

Translation: it's just a matter of days, if not hours, before hedge funds - whose prime brokers know with complete clarity about their extreme bearish positioning - are squeezed and push the broader market higher.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more