Russell Rarely This Oversold

The massive declines in equities this week has sent the major indices reeling in their respective trading ranges as shown in the snapshot below. Every major index ETF is now extremely oversold (2 standard deviations or more below their 50-DMA) with the exception of the Nasdaq 100 (QQQ). That compares to one week ago when just about everything was overbought, some to nearly extreme degrees. One interesting point concerning the Nasdaq is that despite having fallen the most in percentage terms over the past week, it is the only index that entered today up on the year and it remains the least oversold of these index ETFs. While perhaps not to the same degree as QQQ, another dynamic worth mentioning is that small and mid-cap indices are much more oversold than large caps.

(Click on image to enlarge)

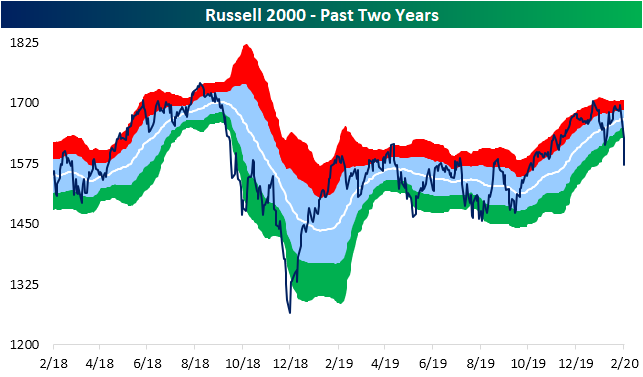

The small-cap Russell 2000 has generally underperformed large-caps for much of the past two years (it still has not gotten back up to its summer 2018 all-time highs), and this recent weakness leaves it much more dramatically oversold than other major indices. As of yesterday’s close, the Russell sat over 4 standard deviations below its 50-DMA. That compares to the prior day when it was just over 2 standard deviations below and the day before when it was within one standard deviation of its 50-DMA.

(Click on image to enlarge)

This is only the sixth day in the index’s history that it had gotten this oversold. The last time this happened was in August 2011. Prior to that there was one occurrence in August 1990 and another cluster of three days during the October 1987 crash. Performance following these prior instances have been very mixed. While the 1987 and 1990 instances were followed by severe declines in the Russell 2000 over the next few months, more recently in 2011 performance was very strong over the next year.

(Click on image to enlarge)

Join Bespoke Premium to access Bespoke’s most actionable stock market research and analysis. Start a two-week ...

more