Reserve Fluctuations And Market Timing

Required reserves are mandated by the central bank to be a specified percentage of the amount of deposit liabilities that commercial banks owe to their customers. These reserves change in order to stay within stress-test limits, and these changes allow us to better time our market movements.

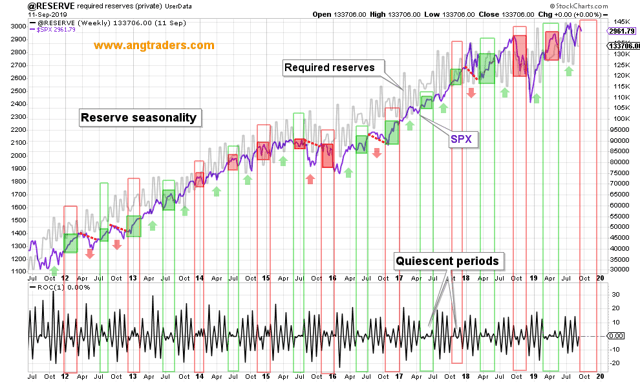

The rate of change of required reserves, shows a repetitive rhythmic pattern where periods of relative quiescence are followed by periods of frequent fluctuation (lower panel of chart below). This repetition also displays a pronounced seasonality, with the quiescent periods occurring in fall/early-winter (red rectangles) and again in spring/early-summer (green rectangles).

Since 2011, 4/8 of the fall/winter and 5/8 of the spring/summer quiescent periods showed positive SPX returns, which is not a very useful result. However, when we look at the periods of fluctuation, the results are more interesting; 12/17 (71%) of the fluctuation periods showed a gain in the SPX (green pointers). If you were to buy the SPX at the start of each fluctuation period and sell near the end of it, you would be successful ~70% of the time. This could be a useful bit of information to add to our tool kit.

Something else we noticed, was that there has been a phase shift to the left (earlier on the calendar) for the start of each period. Before 2015, the fall/early-winter quiescent period occurred between December and February, and the spring/early-summer period occurred between June and August. Since 2016, however, they have been occurring earlier; between October and December, and between March and June, respectively. This means that we are entering a quiescent period for the change in reserves, which is a period where the stock market has a 50% chance of rallying, and starting in November these odds increase to 70%, all else being equal, which of course they are not. Keep in mind that flows coming out of the Treasury can drown out most other factors, but these correlations should be kept in mind as we consider making trades.

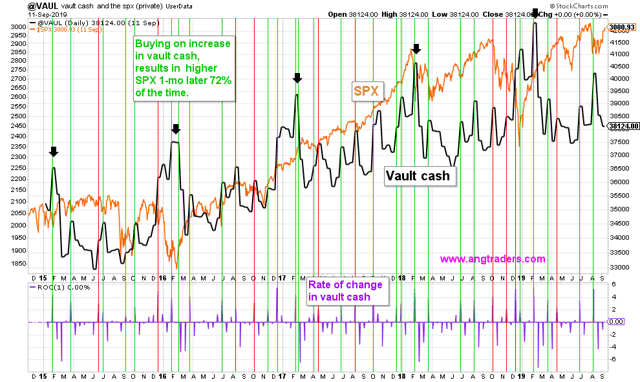

Associated with required reserves, is vault cash held by the banks. Like reserves, vault cash displays a periodic nature. The most pronounced of which, is the spike increase that occurs at the end of January or beginning of February (black pointers below). Since 2015, the SPX has always been higher one month later, at the beginning of March.

Studying the other increases (greater than 1.75%) in vault cash, we found that the SPX was higher, one-month later, 72% of the time. This too could be useful when considering short-term trades (chart below).

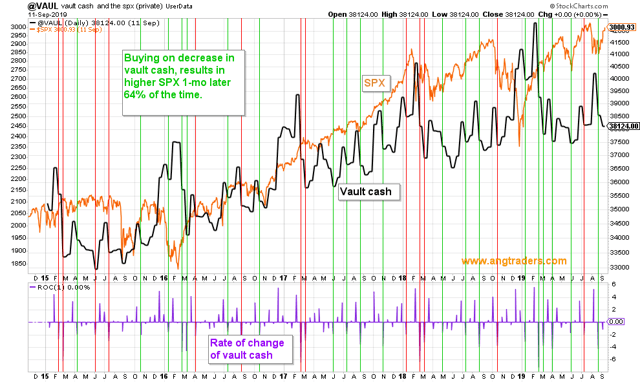

The correlation between decreases in vault cash and the SPX one-month later is not as strong as the increases, but the SPX was higher, one-month after a decrease in vault cash, 64% of the time (chart below).

The fact that required reserves and vault cash cycle seasonally, allows us to better time our movements in the market.