Refining Our Security Selection Process

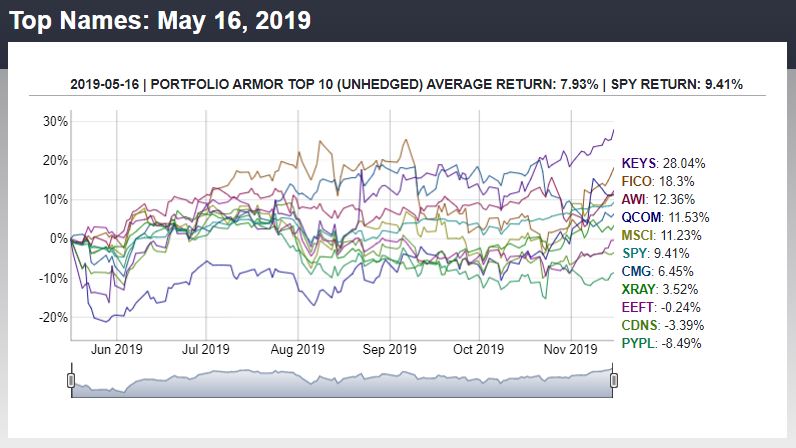

Portfolio Armor's top 10 names (unhedged) from May 16th under-performed SPY over the next 6 months,

but, on average, they have outperformed SPY by 2.72% annualized over 102 6-month cohorts so far.

Refining Our Security Selection Method

In a previous post ("A Security Selection Method That (Still) Beats The Market"), I noted that after 96 weekly cohorts, our top-ranked names were still beating the market on average. That's still true as of now, after 102 weekly cohorts, though the most recent one under-performed SPY, as you can see above. We've recently refined our security selection method in a way that should improve performance going forward. I'll sketch out what we did here, in the event you want to incorporate this into your own investing.

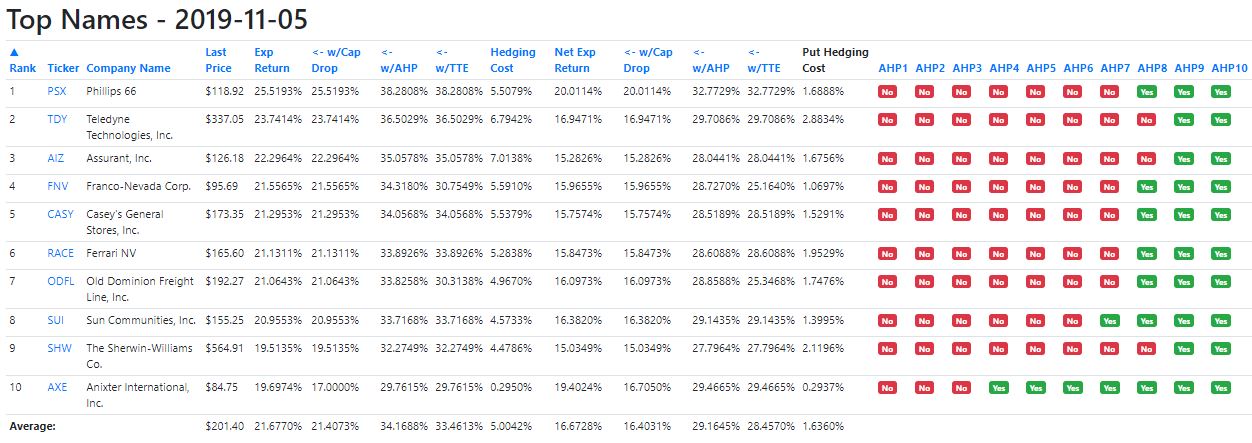

We had already determined that, among our top-ranked names, securities that can be hedged against >9% declines over the next 6 months with optimal puts tend to significantly outperform those that can't be hedged that way. We'd been calling those "AHP" ("Also Hedgeable with Puts") for short. What we've done recently is drill down a bit further, looking at which securities were also hedgeable against even smaller declines with puts, as you can see in the screen capture of a recent top names cohort below.

Portfolio Armor's top 10 names as of 11/5/2019.

We've been saving this data from our live tests since 2017, so we were able to go back and analyze this. What we've found so far is that top names that are hedgeable against >7% declines have a significant performance advantage, and ones hedgeable against >6% have an even stronger performance advantage, and we're going to adjust our security selection process to take this into account ( top names that can be hedged against even smaller declines with puts are rarer still. AXE in the cohort above is an exception explained by the announcement last month that a private equity firm will be taking it private).

How You Can Use This In Your Own Investing

If you're trying to decide between two stocks in similar industries, you can scan for optimal puts against >7% declines on both and see which one is hedgeable that way. I demonstrate doing that for PSX and VLO with a few taps of the Portfolio Armor iPhone app in the (silent) 30-second video in this tweet.

All else equal, we’ve seen securities that are hedgeable against >7% declines over the next several months outperform those that aren’t.

— Portfolio Armor (@PortfolioArmor) November 19, 2019

Currently, $VLO isn’t, but $PSX is. pic.twitter.com/zSHuKqaPUX

A Request For Your Feedback

The security selection method I referred to above is part of our hedged portfolio approach, which I described in more