Pipeline Rally Exposes Lagging MLP Sector

Last week the Alerian MLP and Infrastructure Total Return Index (AMZIX) finally recouped its COVID losses. MLPs have returned to where they were at the end of 2019, when few knew what a coronavirus or N95 mask was. MLP investors have had a miserable decade. The Shale revolution turned out to be an investment bust through overinvestment; the energy transition cast a growing shadow over terminal values; finally, COVID hit demand. As if this wasn’t bad enough, MLP closed end funds endured what leverage and a big market drop inflict (see MLP Closed End Funds – Masters Of Value Destruction).

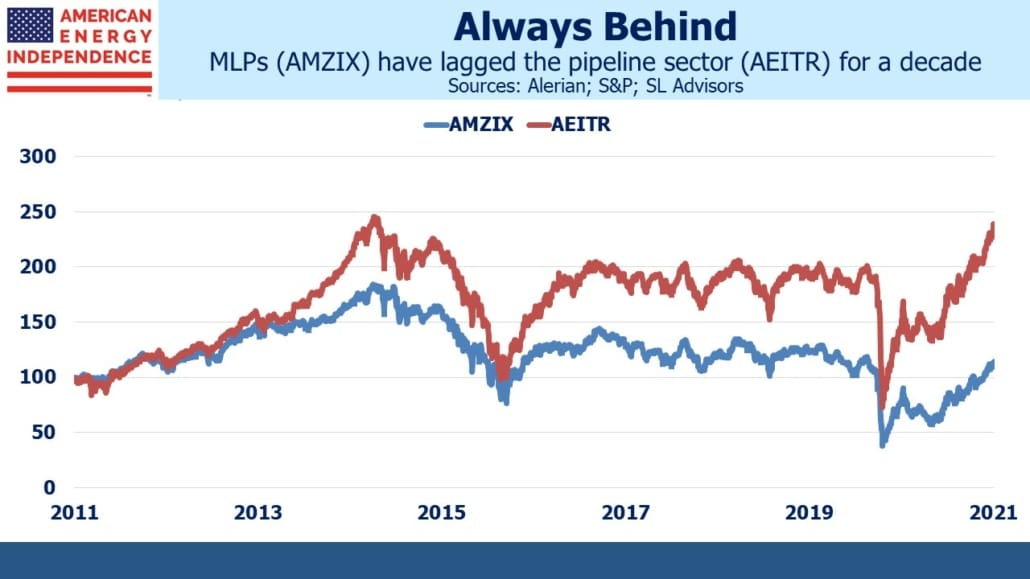

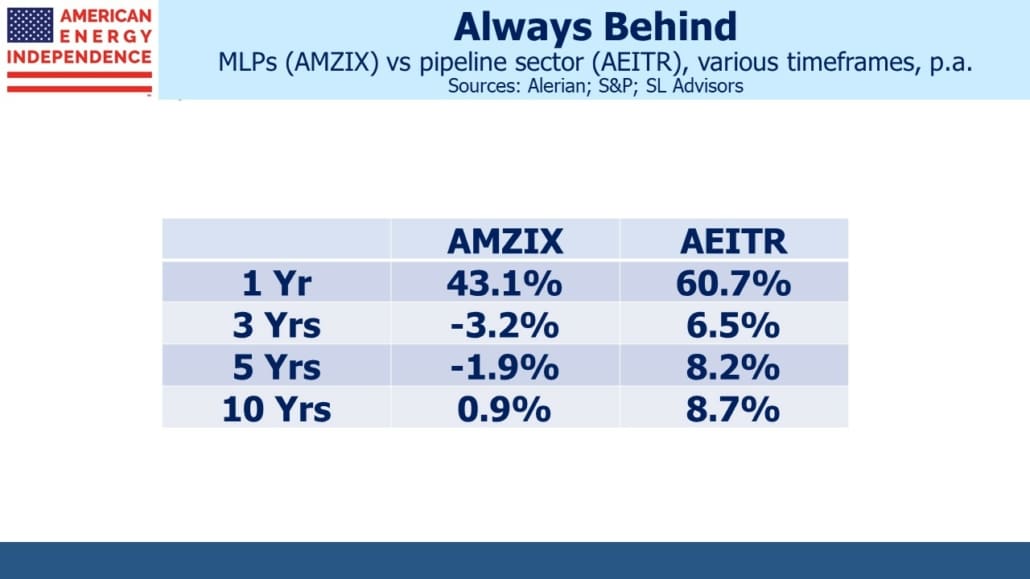

Although MLP investors can celebrate finally recouping their COVID losses, North American pipelines (which are mostly corporations, not MLPs) reached this threshold three months earlier. Energy is experiencing one of the least celebrated rallies of any sector in recent memory. Few investors will forget the breathtaking drop of March 2020, which at one point registered down almost 60% for the year. Although no pipeline company ever looked remotely close to bankruptcy, it seemed as if a recovery would take years.

The rebound has turned out to be more rapid than many expected. It’s taken a year, but fund flows have now turned positive. These are still not meme stocks so caution prevails. But the growing free cash flow story is drawing more interest. The energy transition is driving oil and gas prices higher as well as limiting growth capex. Several firms are exploring opportunities in Carbon Capture and Sequestration (CCS). Gathering the CO2 where it’s produced by power plants or the manufacture of steel and cement may offer new opportunities. The tax code will soon pay $50 per ton for CO2 permanently buried underground. Pipeline operators possess many of the required skills and some useful infrastructure.

Moreover, green policies are helping (see Profiting From The Efforts Of Climate Extremists). While Exxon Mobil (XOM), Chevron (CVX and Royal Dutch Shell (RDS-A) all received clear direction to further curb emissions, Tellurian (TELL) showed that global demand for U.S. Liquified Natural Gas (LNG) is vibrant, and probably stronger with the biggest oil and gas companies set to invest less in future supply. TELL has recently signed 10-year agreements to provide LNG to Gunvor and Vitol, two commodities firms that see a benefit in securing supplies now for customers in Asia and elsewhere.

Investors are slowly warming to the positive fundamentals. MLPs long ago stopped being the dominant corporate form in the pipeline sector. Beyond the three big ones, Enterprise Products Partners, Energy Transfer and Magellan Midstream, MLPs offer a selection of mostly non-investment companies. The AMZIX has to limit the biggest names because there are too few to create a diverse portfolio.

MLPs are now around a third of the North American midstream infrastructure business , and performance has lagged over numerous timeframes. MLP distributions on the Alerian MLP ETF (AMLP), which invests in AMZIX, have been cut by more than half over the past five years. The K-1 tolerant high net worth U.S. taxable investor has for the most part abandoned MLPs, although some remain because of the tax-deferred nature of the distributions. Corporations have handily outperformed MLPs because of the broader investor base.

For years, AMLP’s status as a tax-paying corporation caused it to lag its index. At times this creates asymmetry – when it has unrealized gains its upside is held back by taxes, but when it has unrealized losses it falls with the market. Shorting AMLP around this inflection point can be an interesting trade, one your blogger has done in the past (see Uncle Sam Helps You Short AMLP).

In recent years MLPs have performed so poorly that AMLP has been a long way from having to carry a deferred tax liability. But if the sector’s current trend continues, it will once again become a taxpayer and fail to track its index. And if Democrat proposals to raise the corporate tax rate are enacted, the tax drag will be even more expensive.

We’ve started to see investors once again switch out of AMLP and into more tax-efficient, RIC-compliant vehicles. They recognize that the pipeline sector is attractive, but they’re in the wrong product.

Disclosure: We are invested in all the components of the American Energy Independence Index via the ETF that ...

more