Ooops! Your Ratio’s Showing

Have you bought toothpaste recently? Or perhaps recommended the purchase of America’s largest toothpaste manufacturer, The Proctor & Gamble Co. (NYSE: PG)?

If you answered yes to either question, you’ve contributed to the slippage in a significant indicator of consumer – and investor – confidence. You see, PG is the largest component in the Consumer Staples Select Sector SPDR (NYSE Arca: XLP), an exchange-traded fund that also holds shares of Colgate-Palmolive Co. (NYSE: CL), Kimberly-Clark Corp. (NYSE: KMB) and Costco Wholesale Corp. (Nasdaq: COST), and 29 others. These companies make or sell goods that you must buy. That’s why they’re called staples, as opposed to outfits such as McDonald’s Corp. (NYSE: MCD) and General Motors Co. (NYSE: GM) which traffic in things you’d like to buy if you only had some extra cash. MCD and GM, along with five dozen other companies, make up the index tracked by the Consumer Discretionary Select Sector SPDR (NYSE Arca: XLY).

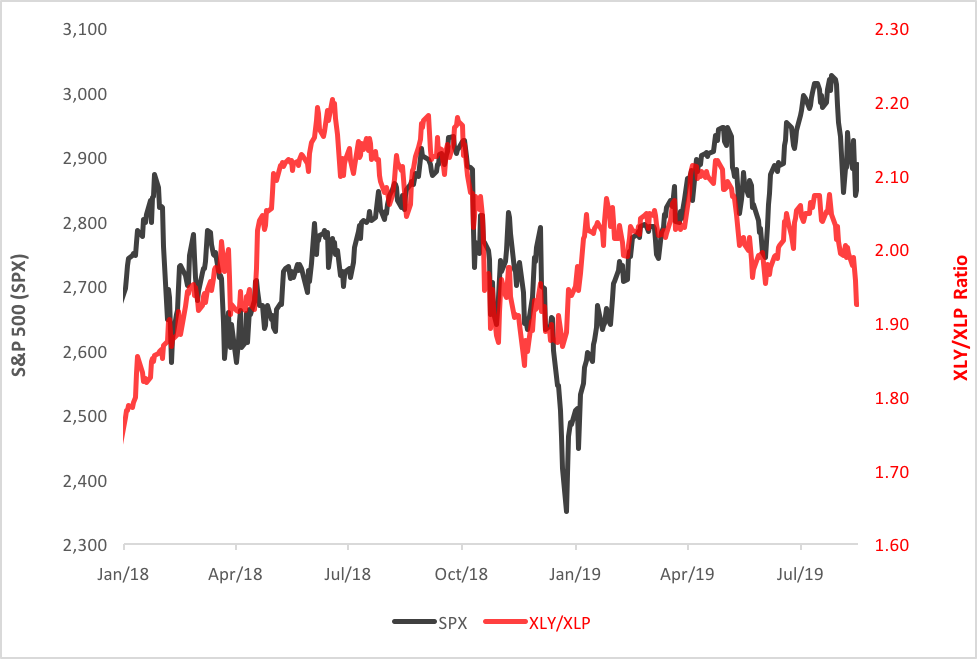

So, what’s the indicator? Simply this: the price ratio of XLY over XLP. When the ratio increases, investors’ appetite for the discretionary sector outstrips that for staples, meaning consumer confidence abounds. On the other hand, a shrinking ratio denotes a defensive attitude toward the economy.

It shouldn’t be surprising that the XLY/XLP ratio’s been on a tear following the Great Recession of 2007-2008. The ratio peaked last summer and has since been consolidating in an ever-narrowing range.

We’ve fretted about the ratio’s rapid ascent in this space before, most recently in a column pointing to a handful of other worrisome signs.

Well, last week the ratio broke down from its wedge pattern and gave us a downside target. Chart 1 shows the technical formation. From its 2.20 peak last June, the ratio now seems e headed to the 1.64 level, an area last visited in the fall of 2017. In other words, two years’ worth of upside is at risk. And that means the broader market’s likely to get dragged down, too.

Chat 1 - XLY/XLP Ratio

(Click on image to enlarge)

Why? The XLY/XLP ratio is a bellwether. It tends to lead the market, topping and bottoming before SPX pivots. As you can see in Chart 2, the ratio’s broken out to the downside while the broader market still dithers.

Chart 2 – XLY/XLP Ratio vs. S&P 500

At this point, many investors and advisors are considering hedges against further beta downdrafts. One of the simplest approaches is simply allocating to the now-ascendant consumer staples sector.

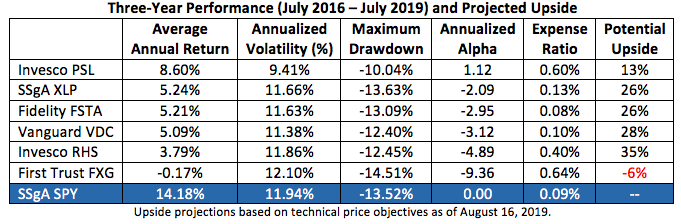

Among the six largest (AUM of $100 million or more) U.S.-focused consumer staples ETFs, five have potential upsides of 13 to 35 percent. Benchmarked against the SPDR S&P 500 ETF (NYSE Arca: SPY) over the past three years, these five portfolios have almost universally cranked out returns with less downside risk than SPY. The cost for that has been lower average returns for the sector funds. One ETF has been a laggard and could lose additional ground from here.

(Click on image to enlarge)

As the tables attest, the performance of vanilla sector index funds is bookended by the results of ETFs with more active tilts.

The Invesco DWA Consumer Staples Momentum ETF (Nasdaq: PSL) tops the table. PSL tracks a Dorsey-Wright relative strength index which measures a security's performance against that of other securities in the same universe. By this methodology, stocks are selected and weighted by their price momentum and rebalanced every quarter. Notably, PSL is the only ETF in the table that produced a positive alpha coefficient over the past three years.

At the bottom of the heap is the First Trust Consumer Staples AlphaDEX Fund (NYSE Arca: FXG), a portfolio that demonstrates how strategic beta can tactically misfire. The fund’s quant model screens out stocks on the basis of their value and growth factors and applies a tiered equal-weighting to the remaining stocks to populate the portfolio.

Chart 3 – Consumer Staples ETFs vs. SPY: The Good, The Bad And The Ugly (July 2 – August 16, 2019)

(Click on image to enlarge)

As you can see in Chart 3, the cumulative return of PSL since July 2018, has pretty much caught up to SPY’s. Before dividends, SPY was ahead by just 33 basis points last Friday.

Conclusion

As of Friday’s close, the XLY/XLP ratio—the consumer sentiment ratio—stood at 1.92. We’re going to monitor the ratio to see when and if it hits our 1.64 target. The technical strength of the indicator then will offer insight into SPX’s fortunes. Just as the ratio can signal an impending market break, it can also be used to discern the prospect of a market recovery.

We’ll await patiently.

Disclosure: None.