Muni Bond ETFs Still Attractive

Psst! Wanna know a secret? Interest rates are headed higher. What?! You knew?

Well, I bet you also think that bonds are gonna tank. Some will, for sure, But not all. Not every segment of the credit market responds to Fed snugging in the same way. Take a look at the bond ETF universe and you’ll see what I mean.

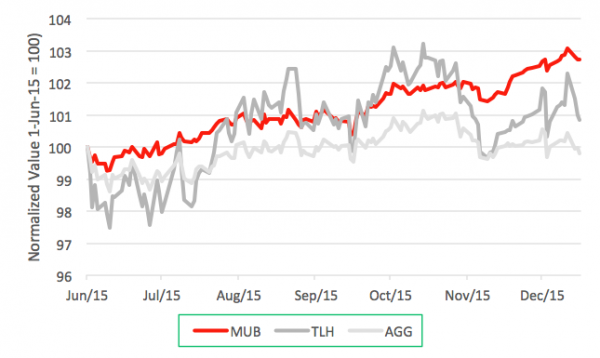

The red line in the chart below represents the total return of the iShares National AMT-Free Muni Bond ETF (NYSE Arca: MUB), The grey lines track the performance of two other bond funds with similar average maturities — the iShares 10-20 Year Treasury Bond ETF (NYSE Arca: TLH) and the iShares Core US Aggregate Bond ETF (NYSE Arca: AGG). The mean maturity for each is around 13 years. But that’s where the similarities end.

MUB tracks a market-weighted index of investment grade state- and local government-issued debt paying interest exempt from U.S. income tax and the Alternative Minimum Tax (AMT). TLH is a portfolio of U.S. government notes and bonds while AGG’s portfolio is loaded with Treasury, agency, mortgage - and asset-backed securities as well as investment grade corporates.

As you can tell from the chart, these three funds behave differently, most particularly over the past couple of months when interest rate and oil price worries heightened. Since the beginning of June, MUB’s risen nearly 3 percent, while the other funds are each on the other side of breakeven. MUB’s done this, in large part, because of its low volatility. But there are other reasons.

And, while rate hikes are a headwind, there’s reason to believe those reasons may continue to help the muni market hold up, relatively speaking, in 2016.

First of all, munis historically hold their value better than Treasurys in rising rate environments.

It’s really yield that gives a fund like MUB an edge, though. The portfolio offers a yield to maturity 50 basis higher than TLH and AGG. And that’s a tax-free premium. Yield premiums, especially for the AA revenue bonds that dominate the MUB portfolio, act as a cushion as rates rise.

Then there’s the supply issue. This year, the muni market was dominated by current and advance refundings ahead of the Fed’s rate hike. That’s pretty much run its course. The issuance calendar in 2016 is likely to be dominated by financings for long-deferred infrastructure projects.

So, here’s the deal: MUB’s now trading at the $110 level. The long-term charts point to a technical objective of $140. With a tax-free current yield of 2.5 percent and a duration of 6.3 years, MUB seems like a pretty good portfolio diversifier, don’t you think?

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option ...

more