Moving Averages: December 2018 Month-End Update

Valid until the market close on January 31, 2019.

The S&P 500 closed December with a monthly loss of 9.18% after a small gain of 1.79% in November. All three S&P 500 MAs are signaling "cash" and four of five Ivy Portfolio ETFs — Vanguard Total Stock Market ETF (VTI), Vanguard FTSE All-World ETF (VEU), Vanguard REIT Index (VNQ), and PowerShares DB Commodity Index (DBC) — are signaling "cash".

The Ivy Portfolio

The above table shows the current 10-month simple moving average (SMA) signal for each of the five ETFs featured in The Ivy Portfolio. We've also included a table of 12-month SMAs for the same ETFs for this popular alternative strategy.

For a fascinating analysis of the Ivy Portfolio strategy, see this article by Adam Butler, Mike Philbrick, and Rodrigo Gordillo:

Backtesting Moving Averages

Over the past few years, we've used Excel to track the performance of various moving-average timing strategies. But now we use the backtesting tools available on the ETFReplay.com website. Anyone who is interested in market timing with ETFs should have a look at this website. Here are the two tools we most frequently use:

- Backtest an Individual ETF

- Backtest an ETF Portfolio

(requires a paid subscription)

Background on Moving Averages

Buying and selling based on a moving average of monthly closes can be an effective strategy for managing the risk of severe loss from major bear markets. In essence, when the monthly close of the index is above the moving average value, you hold the index. When the index closes below, you move to cash. The disadvantage is that it never gets you out at the top or back in at the bottom. Also, it can produce the occasional whipsaw (short-term buy or sell signal), which we've seen most recently in 2016.

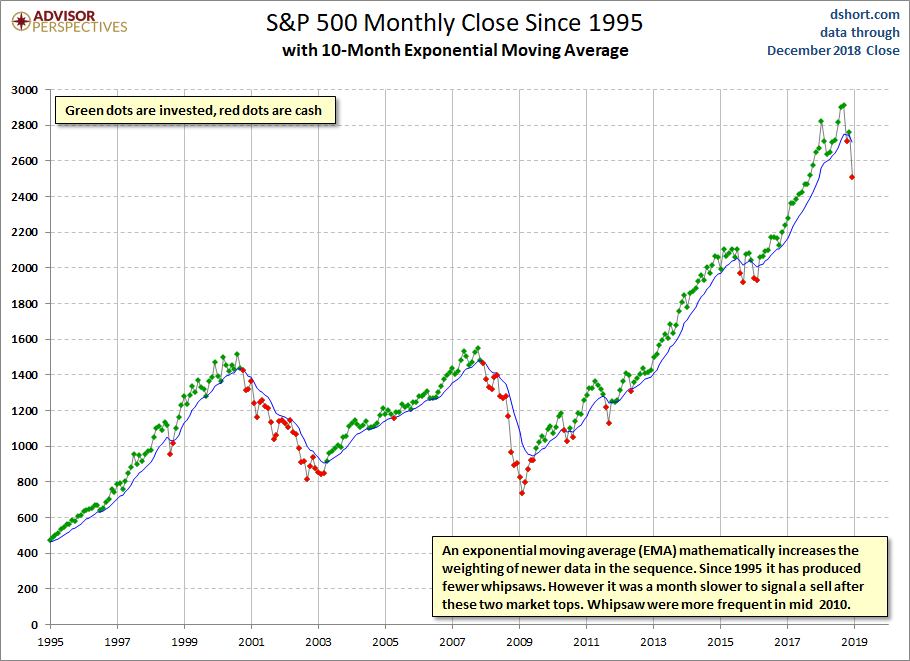

Nevertheless, a chart of the S&P 500 monthly closes since 1995 shows that a 10- or 12-month simple moving average (SMA) strategy would have ensured participation in most of the upside price movement while dramatically reducing losses.

Here is the 12-month variant:

The 10-month exponential moving average (EMA) is a slight variant on the simple moving average. This version mathematically increases the weighting of newer data in the 10-month sequence. Since 1995 it has produced fewer whipsaws than the equivalent simple moving average, although it was a month slower to signal a sell after these two market tops.

A look back at the 10- and 12-month moving averages in the Dow during the Crash of 1929 and Great Depression shows the effectiveness of these strategies during those dangerous times.

The Psychology of Momentum Signals

Timing works because of a basic human trait. People imitate successful behavior. When they hear of others making money in the market, they buy in. Eventually, the trend reverses. It may be merely the normal expansions and contractions of the business cycle. Sometimes the cause is more dramatic — an asset bubble, a major war, a pandemic, or an unexpected financial shock. When the trend reverses, successful investors sell early. The imitation of success gradually turns the previous buying momentum into selling momentum.

Implementing the Strategy

Our illustrations from the S&P 500 are just that — illustrations. We use the S&P because of the extensive historical data that's readily available. However, followers of a moving average strategy should make buy/sell decisions on the signals for each specific investment, not a broad index. Even if you're investing in a fund that tracks the S&P 500 (e.g., Vanguard's VFINX or the SPY ETF) the moving average signals for the funds will occasionally differ from the underlying index because of dividend reinvestment. The S&P 500 numbers in our illustrations exclude dividends.

The strategy is most effective in a tax-advantaged account with a low-cost brokerage service. You want the gains for yourself, not your broker or your Uncle Sam.

Note: For anyone who would like to see the 10- and 12-month simple moving averages in the S&P 500 and the equity-versus-cash positions since 1950, email us for an Excel file (xlsx format) of the data. Our source for the monthly closes (Column B) is Yahoo! Finance. Columns D and F shows the positions signaled by the month-end close for the two SMA strategies.

Recommended Reading

In the past, we've recommended Mebane Faber's thoughtful article A Quantitative Approach to Tactical Asset Allocation. The article has now been updated and expanded as Part Three: Active Management in his book The Ivy Portfolio, coauthored with Eric Richardson. This is a "must read" for anyone contemplating the use of a timing signal for investment decisions.

The book analyzes the application of moving averages the S&P 500 and four additional asset classes: the Morgan Stanley Capital International EAFE Index (MSCI EAFE), Goldman Sachs Commodity Index (GSCI), National Association of Real Estate Investment Trusts Index (NAREIT), and United States government 10-year Treasury bonds.

As a regular feature of this website, we update the signals at the end of each month.

For additional insights from Mebane Faber, please visit his website, Mebane Faber Research.

Footnote on calculating monthly moving averages: If you're making your own calculations of moving averages for dividend-paying stocks or ETFs, you will occasionally get different results if you don't adjust for dividends. For example, in 2012 VNQ remained invested at the end of November based on adjusted monthly closes, but there was a sell signal if you ignored dividend adjustments. Because the data for earlier months will change when dividends are paid, you must update the data for all the months in the calculation if a dividend was paid since the previous monthly close. This will be the case for any dividend-paying stocks or funds.