Mid-Year Appraisal Of Alternative ETFs

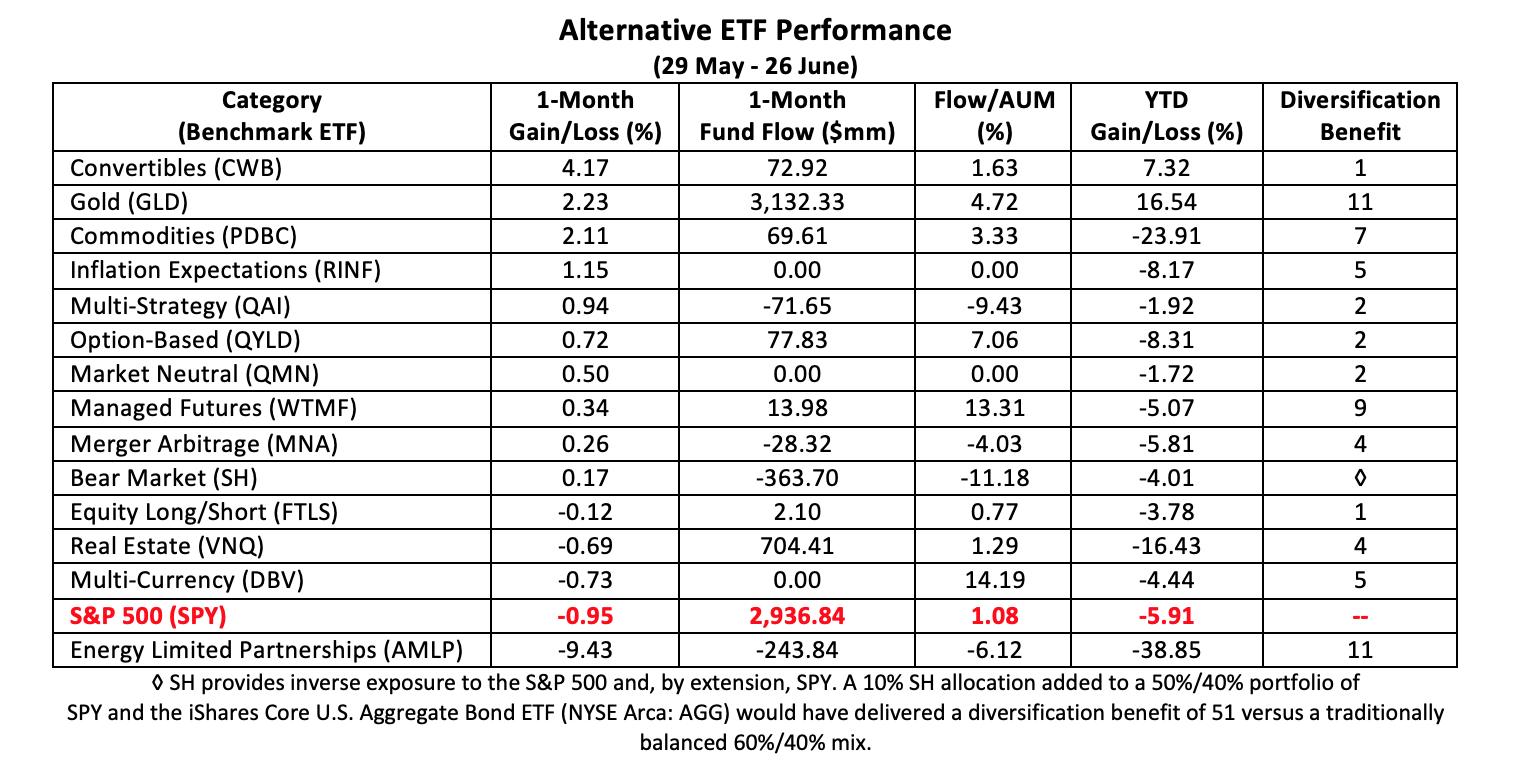

Alternative investment (“alts”) shone over the past four weeks, at least relative to the broad equity market. Only one of our 14 benchmark ETFs fared worse than the SPDR S&P 500 Trust (NYSE Arca: SPY) in June. The blue-chip stock proxy gave up nearly 1 percent of its market value between May 29 and June 26.

Ten alt ETFs earned positive returns, led by:

- the SPDR Bloomberg Barclays Convertible Securities ETF (NYSE Arca: CWB), a portfolio of convertible bonds and preferred stocks;

- the SPDR Gold Shares Trust (NYSE Arca: GLD), backed by London-vaulted bullion, and

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (Nasdaq: PDBC), nominally an actively managed basket of futures optimized to curtail negative roll yields.

(Click on image to enlarge)

Two table-toppers—CWB and GLD—are in the black for the year, which is more than can be said for SPY. Gold’s clearly the standout exposure, measured by its gross return and by dint of its diversification power.

Diversification is the raison d’être for alts. An ETF’s effect on a portfolio can be measured by its diversification ratio, a factor describing the reduction in overall volatility achieved by the ETF’s addition.

Over the past three years, a classically balanced portfolio—60 percent stocks and 40 percent bonds—earned a diversification ratio of 1.15 versus stocks alone. Further diversification can be attained, differentially, by adding any of the alts ETFs in the table. The degree of additional diversification is reflected in the rightmost column.

For example, the diversification ratio for a 50%/40%/10% mix of stocks, bonds, and gold is 1.26, 11 points higher than that of the classic 60%/40% portfolio.

GLD also enjoyed a strongly positive inflow in June. GLD’s market price is driven by the value of its underlying bullion, not by secondary market trading volume, so fund flow is a telling indicator of investor interest.

Another ETF exhibiting a combination of investor momentum and relatively high diversification is the Wisdom Tree Managed Futures Strategy Fund (NYSE Arca: WTMF), a quantitatively managed portfolio of commodity, currency and interest rate futures. Its diversification benefit is 9 points higher than a traditionally balanced portfolio, aided by WTMF’s avoidance of stock index futures.

What’s becoming increasingly clear from the foregoing is that investors are attempting to get more diversification from their alts allocations. When they make an alts allocation.From the numbers, it seems gold, by far, is the favored alts allocation. It’s easy to see why.

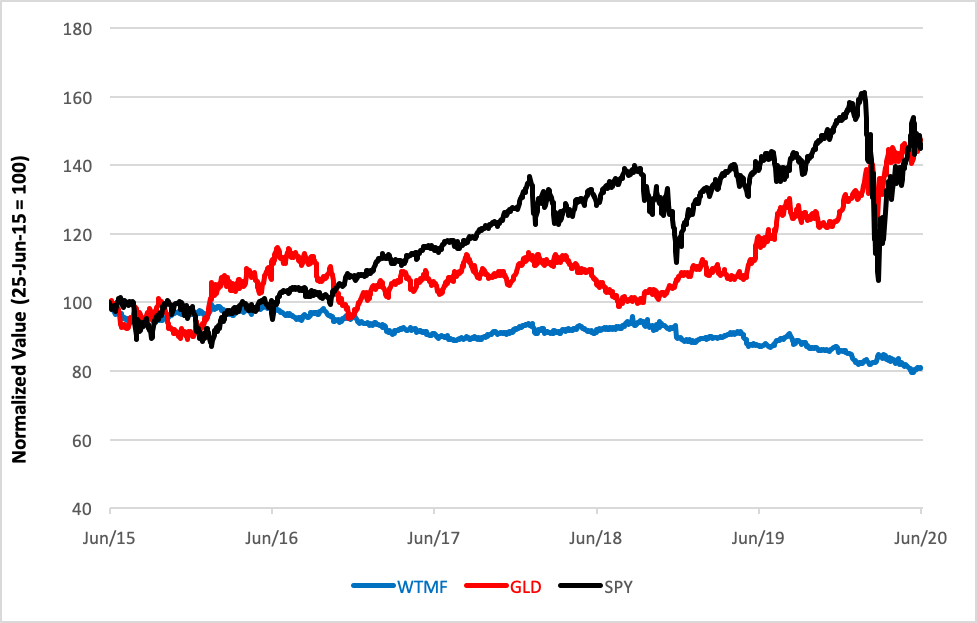

GLD and SPY have basically ended up in the same place after the past five years (see below). The bullion trust grew at a compound annual growth rate of 9.5 percent while the stock fund appreciated at an average rate of 9.3 percent. The two funds, however, attained their current levels with a significantly different degree of difficulty.

Daily ETF Performance

(Click on image to enlarge)

The annualized volatility of GLD’s been 13.4 percent. The standard deviation for SPY’s been 19.1 percent.

And WTMF? It cranked out its 3.8 percent average annual loss with a measly 6.1 percent volatility. If and when futures develop some positive mojo, WTMF’s trend line may turn upward.

In the meantime, investors can content themselves with a gold exposure. It could be worse.

Disclosure: None.