Market Briefing For Wednesday, March 25

|

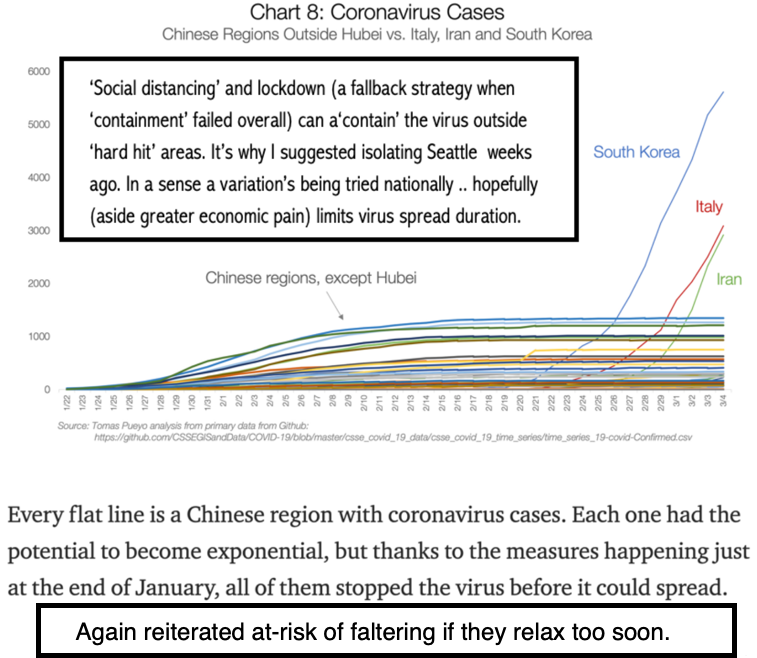

A decision to 'reboot' the economy - fairly rapidly, is being frowned on (often by the same people that opposed shutting things down), while it is clearly being cheered-on by the poorest and most libel to be financially in a pickle if these heavy restrictions prevail for much longer (which certainly emphasizes the weak liquidity positions of a majority of people). Also it's not just that the President believes in the Easter Bunny, but he knows it's not feasible to subsidize people and the economy for very long. Notably that's the segment of the population the President addressed last night when he 'trumped' the network news times with his 2-hour 'Covid-19 marathon news conference', and which most media thought opposed to doing so. Hardly, they get it, but it's also imperative that they 'not get it', in referring to the spread of the disease. Meanwhile, I believe it's important to distinguish 'discounting' from 'real-time' anguish.

So of course there's skepticism about the 'Funding' ability the U.S. really has, and there is the 'mortgage' or hedge issue and generally I disdain these immense algo-generated rallies as much as the 'Newton's Law' (equal and opposite reaction) alternating swings. However, while it's not normal, it is more than a giant 'short-squeeze, as much as that is part of it. I thought yesterday some more nibbling could in a few sectors be done, along with the same a week ago just before the S&P 500 (SPY) had 'that' rally. Of course we'll back-off and frankly I think optimism here is a bit excessive, though we certainly did call for a big rally today that Trump was trying to trigger with his remarks last night, and sure did.

Do I think the Dow's biggest rally (over 11%) and biggest point gain since 1933 means we're out of the woods? No. And of course we don't know at all what the metrics of earnings or long-term estimates will be, but that's not a concern for the moment. More visibly will be the nature of reaction to the terrible economic and unemployment numbers coming next week, because those will indicate how much the horrible news was 'discounted' by the WuFlu crash that already occurred. That will indicate not new highs necessarily (a bit pollyanish to say the least), because you are not going back to artificial tools like buybacks, but no company is designed for zero-revenue for any period of time, hence it is essential to get back to work. And that again is the balance I spoke to.

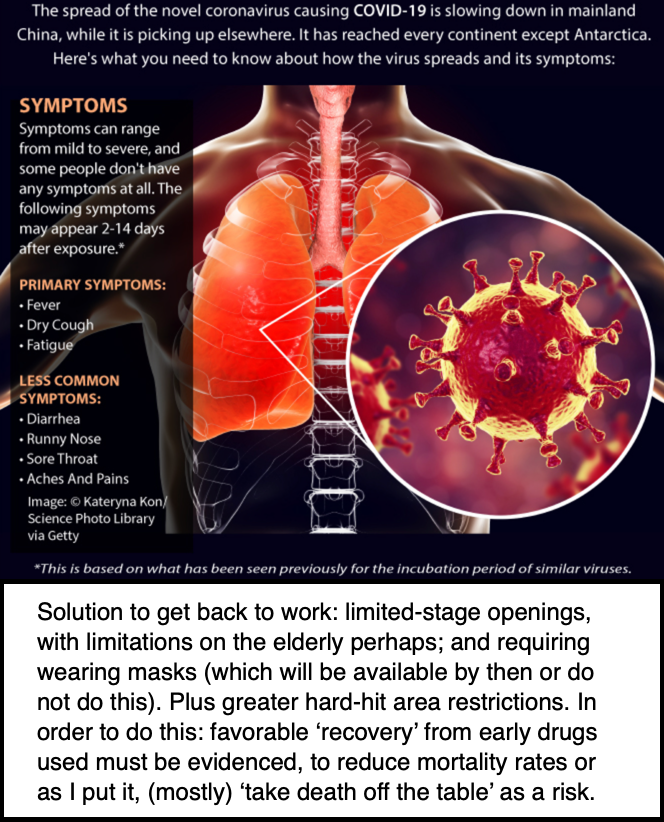

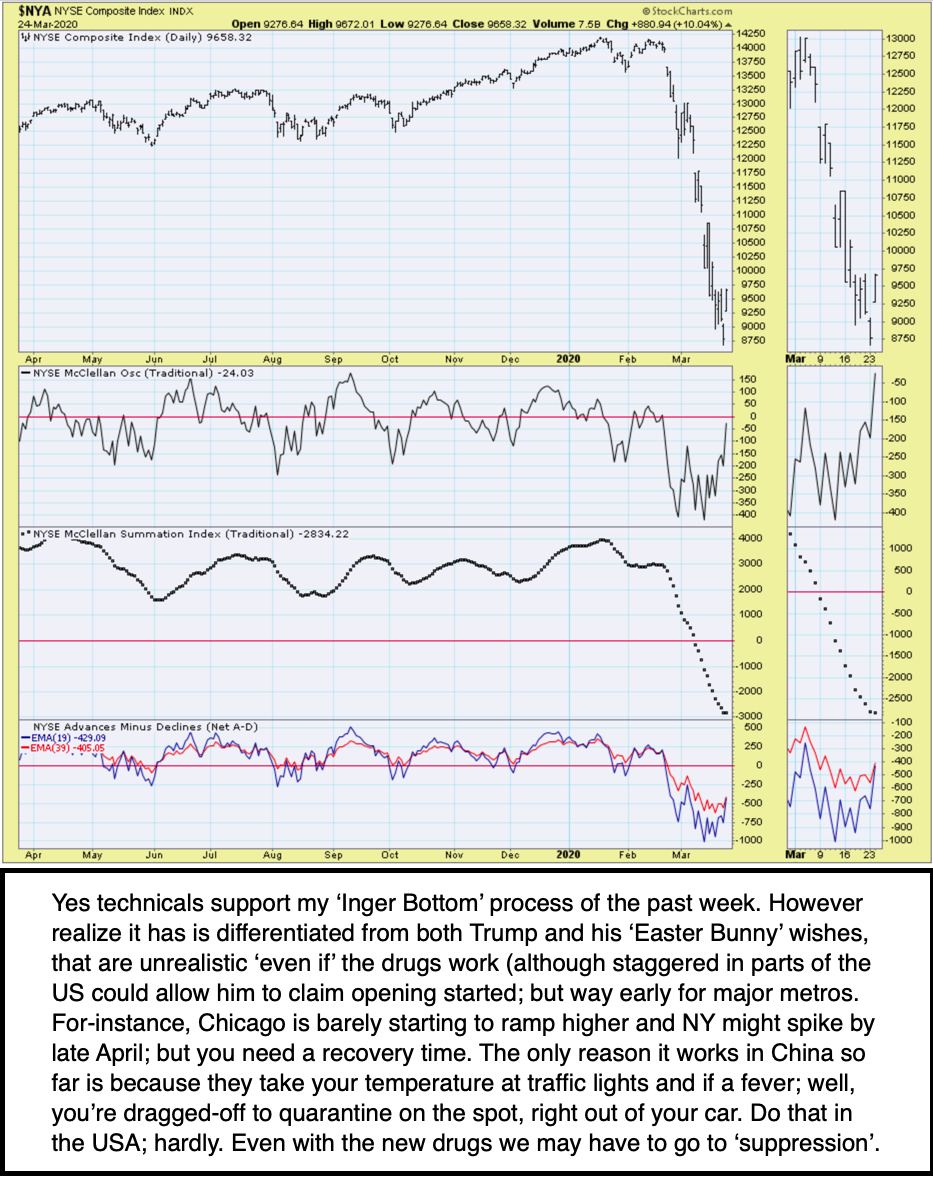

So regardless of agenda-focused politicians and media, the reality was it was extremely oversold, despair prevailed (still does in real life outside of markets, but experienced investors know what a discounting mechanism the market is, and the rub was that this was and still is not at all a typical presentation of extreme oversold) and we had to allow for the 'process'. I suspect the President (including his morning meeting with Wall Street's hedge guys and others) timed it accordingly, because there's no doubt the medical data to reinforce confidence in the efficacy of drugs we've talked about, especially hydroxy-chloroquine with Z-pack, is still premature. That drug was 'officially' distributed starting today (unofficially it was used extensively last week), and needs 6 days for recovery, at least 2-3 days to see response, and then another 6 days for another 'test'. (BTW, India has just barred most shipments of that drug made there.)

So, even though we know the French story, a Brooklyn doctor who claims 350 recovered patients (not hospitalized) and an infected patient that I do know in a New York Hospital, who is actually responding while in an ICU, it does contribute to optimism. Yes there can be long-term side effects but alive is alive and it is part of what I wrote about last night, getting 'death off the table' and that alone will empower courage among Americans (at the same time staggered openings, staggered kinds of work and more, as well as 'not allowing' travel or social interaction to increase too, quickly in a sense). How do you do that? You do the South Korean model, everyone must be wearing masks (incredible how slow supplies arrive) and go to work other than where there are known 'clusters' of infection (and again failure to roll out tests here broadly, and rationalizations as to why no masks for all as well as no tests for all, are basically to cover inadequate preparedness). In-sum: President Trump today tweeted 'USA starting to reopen in about two weeks'. By Easter. Correct. Now 'that' is what I had in mind requiring, not the open 'next week' nonsense we heard about last night, that I thought very premature. It gives time to get supplies to hospitals (hopefully!!) and the early results of the 'malaria + Z-pack' treatment, as reduces 'death levels' not to 'tolerable levels', because no level is acceptable, but if you get it to a level more or less comparable to influenza that's one thing (still not so good but they can't keep this locked-down for the months it will be here). If next week's unemployment numbers coincides with a New York / New Jersey case-load explosion that includes many deaths as contrasted to a report of many salvaged with the new drugs, then you have serious fears of premature economic restart, risking negating whatever benefits coming from the new stimulus programs might assist. I can't really divine next week (and neither can Trump), aside from saying as I have for two weeks that I share optimism about the new drugs while sure believing we should know a bit more before relying extensively on that. (NYA)

Bottom-line: Tuesday's historic rally (beyond a turnaround we looked for of course, and probably not sustainable, as a return to algo-driven swings are not at all unlikely) tends to support my view 'at the lows' last week, of a series of moves I half-humorously termed "The Inger Bottom" process, with emphasis on the word 'process' including swings and even lower lows as part of hammering it out. They pounded on the lows and now are thrusting higher in absolutely amazing fashion. By no means do I assume events can't result in more downside later; and at the same time I realize there are a number of component issues that in fact are not doing poorly. Aside Microsoft (MSFT) and others thriving, with a shift to working-from-home and online schooling, or online retailers or big-box stores, like Amazon (AMZN), Target (TGT), Cisco (CSCO), Walmart (WMT) and such (all cap-weighted influences on markets), many are sort of coming-along. Those retailers in fact are not going to be in big trouble when you see huge unemployment numbers next week, 'if' everyone knows we're going back to work in April. Yes those number will rewrite economic record book horror-shows, and despite being stale numbers, they reflect the instant-recession return (a sluggish economy prevails for about two years as I sometime mention as that was my argument from Spring 2018 to that December 2018 low). So the market recession may be winding down, not ending yet, over the next 3 or so months. All of that comes together (and coincident with) doubters and overly-chicken-littles that panicked in the past week 'after the crash', and into and after what I called a possible "Inger Bottom" process start. (COMP)

There are reasons to be concerned about this rally, as everyone is saying it must fail on the first rebound. Not necessarily, go if you want to see it higher before it goes lower, let's see what Congress and the Fed do in a rapid way as they try to avert the biggest calamity in financial history. Also key is OIL, as it firms more (as I suspected) it reflects China turning-around (demand that is irrelevant of whether there's a quid-pro-quo with Saudi Arabia; though I remain suspicious of that possibility). Confidence relates to oil, the Saudi/Russian spat (China quid-pro-quo or not) helped the washout become a selling climax, and my belief that would not hold for very long (in other words, no sub-20 oil nonsense), it contributed to my thinking, which isn't entirely focused 'only' on fighting the epidemic.

Speaking of: Today Apple (APPL) announced they will reopen their U.S. stores in a staggered fashion, starting in April's first half. I see Tim Cook thinking of a new ad: 'Buying an Apple a Day Keeps the Doctor Away'. Conclusion: Fortunately (and ironically) the President modified his 'next week' comment to the next two weeks and we insist on less of a 'dice roll', and better prospects of 'taking death (largely) off the table'. Time will tell how close it all has been to being 'The Inger Bottom', but more importantly it needs to be, for the people, a process financially and medically, that leverages not just money, but knowledge, industry, and science, to salvage this mess. If our optimistic suspicion over almost exactly a week ago has been helpful as a sort of alternative to the prevailing negative narrative out there, fine. But I am not deluding anything, this is going to be very challenging ahead on all fronts. We must all embrace hope, not fear, and go forward. |