Looking Back, Looking Forward – Sunday, Feb. 7

The S&P 500 ended the week at a new closing high. S&P 500 members are on their way to show year-over-year EPS growth after a gap of three quarters. President Biden and the Democrats moved to fast track the $1.9 trillion relief plan without Republican support. Prospects of this stimulus helped investors to take a subpar January jobs report in stride. Vaccine administration has picked up.

Fears of speculative excesses triggered last week by Reddit group-led squeeze of the most shorted stocks like GameStop (GME) and AMC Entertainment (AMC) vanished quickly as such stocks crashed.

The parade of impressive fourth-quarter earnings reports continued meanwhile. With S&P 500 members beating analysts’ forecasts by 15% on average, the benchmark’s aggregate earnings are on track to grow year-over-year for the first time since the fourth quarter of 2019.

By a 51-to-50 vote, the Senate approved a budget resolution that would allow Democrats to fast track President Biden’s $1.9 trillion coronavirus relief plan without Republican support. The package includes $1,400 stimulus checks, a supplemental jobless benefit, and COVID-19 vaccine & testing funds.

Investors looked past a lackluster January jobs report, believing Federal stimulus will continue to heal the economy. The Labor Department reported the U. S. economy added just 49,000 jobs. The unemployment rate fell to 6.3% from 6.7% as millions, unable to find work, dropped out of the labor force. Nearly 10 million jobs that vanished in the early stages of the pandemic have not returned.

Vaccine administration gained momentum last week. The cumulative number of COVID-19 vaccination doses administered rose by nearly 9 million to 36.8 million. Concurrently, the nationwide total of COVID-19 hospitalizations fell, ending the week at 86,300 from 101,000 the week before.

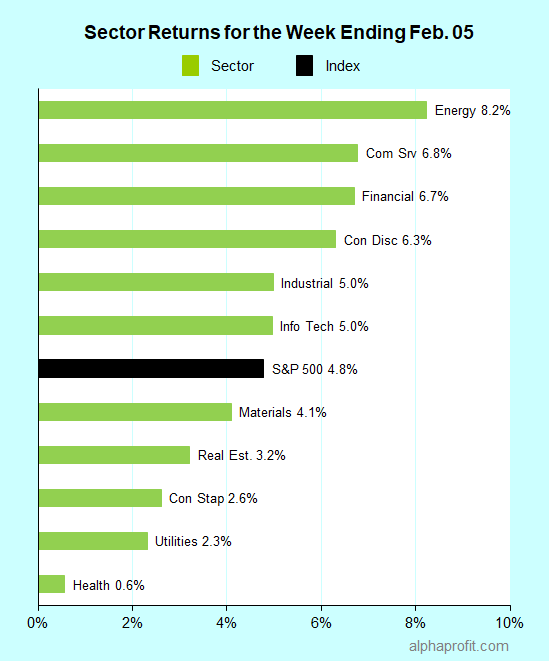

For the week ending February 5, the S&P 500 (SPY) rose 4.8%.

All of the 11 sectors gained.

Leaders and laggards for the week ending February 5. 2021

Energy (XLE), communication services (XLC), and financials (XLF) led the S&P 500.

Health care (XLV), utilities (XLU), and consumer staples (XLP) lagged the benchmark.

Market breadth was strong. The number of advancing stocks in the S&P 500 beat the number of decliners by a 15-to-2 ratio.

Consumer discretionary companies accounted for eight of the S&P 500’s top 10 winners. Health care and materials companies were among the other top 10 winners. Retailers and resorts & casinos in the consumer discretionary sector were well represented.

1A. Consumer Discretionary – Retailers

Shares of L Brands (LB) surged 21% to claim the top spot among the S&P 500’s winners for the week. The retailer raised its mid-point of its fiscal fourth-quarter EPS guidance by 8%. The operator of Bath & Body Works and Victoria’s Secret stores firmed its plan to split-off its Victoria’s Secret line by August.

Tapestry (TPR) shares jumped 19% after the owner of Coach and Kate Spade brands topped analysts’ quarterly sales and EPS forecasts. Tapestry’s e-commerce sales grew triple-digits year-over-year to account for one-third of global sales.

1B. Consumer Discretionary – Resorts & Casinos

As vaccines rolled out, investors gravitated towards resort & casino stocks on optimism over profits and margins surging later this year. Penn National Gaming’s (PENN) strong start of its online gambling operations added to the bullishness. Worse-than-expected quarterly results from Wynn Resorts (WYNN) did not detract. MGM Resorts (MGM), Wynn Resorts, and Las Vegas Sands (LVS) were up 20%, 18%, and 16%, respectively.

2. Health care

Align Technology (ALGN) shares soared 18% after the maker of Invisalign teeth straighteners beat analysts’ fourth-quarter sales and EPS forecasts. Sales surged 28% year-over-year as adults joined teens in getting their teeth straightened.

3. Materials

Shares of copper producer Freeport-McMoRan (FCX) rose 18% after the copper producer reinstated its dividend after a 12-month gap. Freeport plans to pay $0.30 a year in dividends, up from $0.20 it paid before suspending them.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- ETFMG Alternative Harvest ETF (MJ) 23%

- The 3D Printing ETF (PRNT) 15%

- Amplify Transformational Data Sharing ETF (BLOK) 15%

- Global X Uranium ETF (URA) 12%

- Invesco Dynamic Software ETF (PSJ) 12%

Looking ahead to the week of February 8

Stimulus, earnings, inflation data, and President Trump’s impeachment trial will be in focus this week. Small-cap stocks have been overbought for some time. Unforeseen delays in stimulus or reversal in COVID-19 trends can potentially be a catalyst that can trigger a pullback.

- Investors will keenly follow the progress of the $1.9 trillion stimulus package Democrats are fast-tracking to Congress.

- The fourth-quarter earnings reporting season continues. Nearly 80 S&P 500 companies report this week. Cisco Systems (CSCO) from the technology sector, consumer staples heavyweights Coca-Cola (KO) & Pepsi (PEP), and Disney (DIS) from the communication services sector are among those reporting.

- In economic data, the Labor Department reports on consumer price index inflation. Investors will also be attentive to Federal Reserve chairman Powell’s comments to the Economics Club of New York.

- Wall Street will keep an eye on President Trump’s Senate impeachment trial starting on February 9.

Disclosure: Get two special reports Five Smart Ways of Using Fidelity Select Funds and Avoid Three Common Mistakes ETF Investors Make when you more