Limited-Risk Investing In A Smaller Account

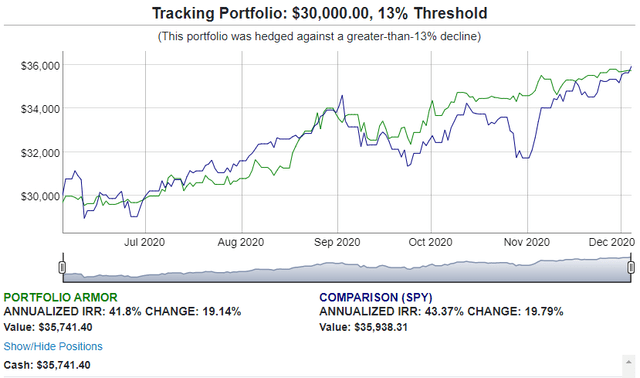

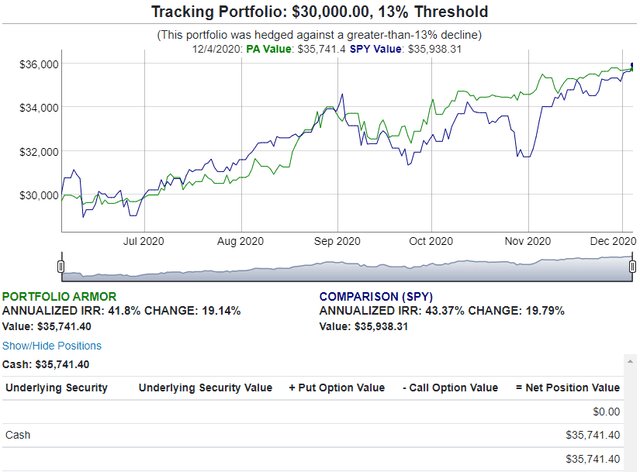

The performance of our $30k portfolio from June 4th, net of hedging and trading costs.

Risk-Limited Investing With A <$50k Account

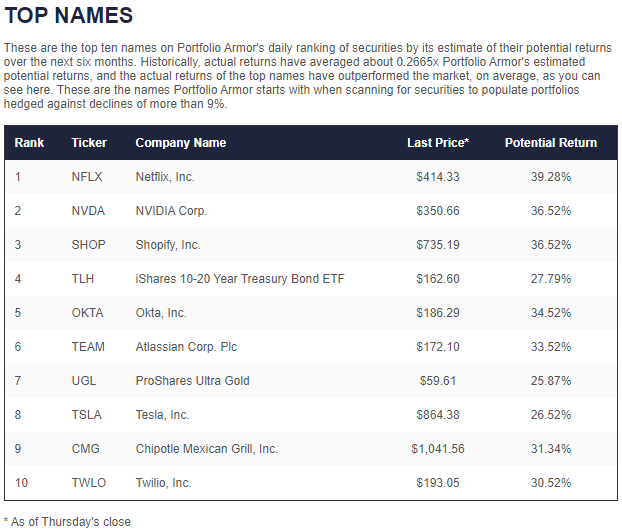

One of our newer subscribers brought up a good point about our top names: their share prices often make it hard for smaller accounts to buy and hedge them. Here we offer a few different approaches for investors with smaller accounts. Let's start by looking at our top names from June 4th (our system estimates returns six months out, so this is the most recent cohort to hit six months).

Our Top Names From June 4th

In a previous article (Why-Yo Silver?), we detailed how we select our top names. These were our top ten names on June 4th of 2020: Netflix (NFLX), Nvidia (NVDA), Shopify (SHOP), the iShares 10-20 Year Treasury Bond ETF (TLH), Okta (OKTA), Atlassian (TEAM), ProShares Ultra Gold (UGL), Tesla (TSLA), Chipotle (CMG), and Twilio (TWLO).

You can see our subscriber's point: the average share price of this cohort was $418. Chipotle had a share price of over a thousand dollars, meaning 100 shares would have cost more than $100,000. Let's consider a few different approaches a small investor could have taken here.

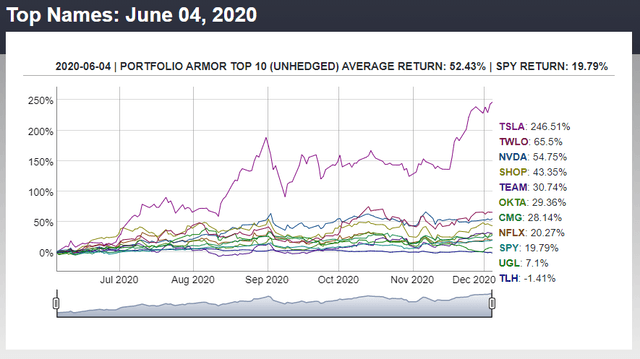

First Approach: Buy Fewer Than 100 Shares

The simplest approach there would have been to divide your $50,000 by ten and invest $5,000 in each of those top ten names. Had you done that in this case, you would have been up 52% over six months.

However, you would have taken on considerable risk.

Second Approach: Same As Above, Plus Optimal Puts

What if you bought equal dollar amounts of each of these shares, and bought optimal, or least-expensive puts on them to limit your downside risk? This wouldn't have worked. The problem is that one put option contract covers 100 shares, so it would have been way too expensive to hedge odd lots (numbers of shares fewer than 100) this way. For example, let's say you had wanted to protect against a greater-than-20% decline on June 4th. The cost of doing so with 100 shares of Chipotle on June 4th was about $4,700. You can see the problem here: the cost of one options contract, $4,700, would have eaten up nearly all of the $5,000 you had to allocate to Chipotle shares.

Third Approach: Buying Calls Instead Of Shares

This approach can work provided you limit your position sizing accordingly. For example, let's say you were willing to risk a 20% decline in your account, but not one larger than that. In that case, if you had $50,000, instead of allocating $5,000 to each of the top ten names, you could have tried to purchase $1,000 worth of calls of each name. That way, if all of your calls expired worthless, you wouldn't have lost more than 20% of your account.

Fourth Approach: Using Smaller Share Price Top Names

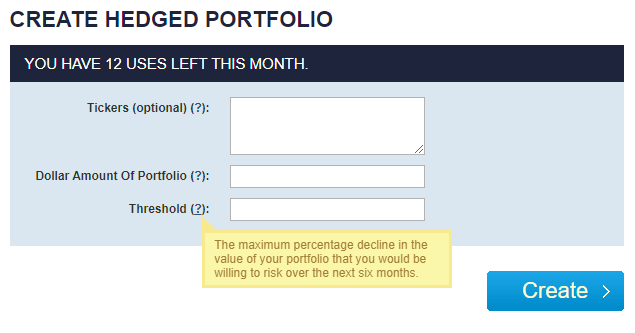

This is what our website does if you ask it to create a hedged portfolio for a smaller dollar amount. It automatically excludes securities that have share prices too high to allow buying and hedging round lots given the dollar amount of your portfolio.

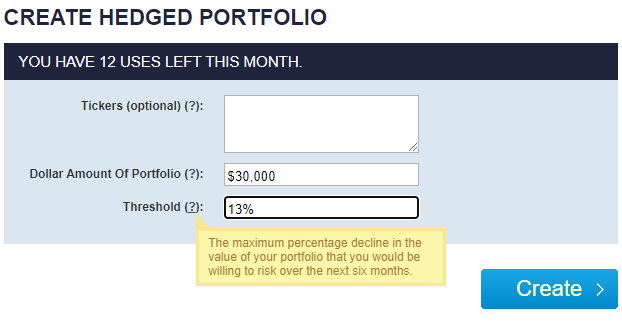

The smallest dollar amount you can enter in the middle field is $30,000. Let's say that on June 4th, you left the first field blank, entered $30,000 for the size of your portfolio, and indicated that you weren't willing to risk a decline of more than 13% over the next six months.

This is the hedged portfolio the site would have presented to you then:

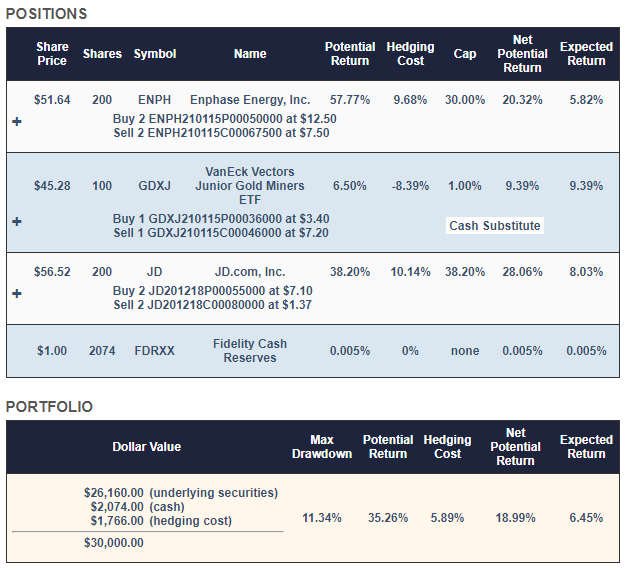

The two primary securities here were Enphase Energy (ENPH) and JD.com (JD). These weren't among our site's top ten names over all, but they were among its top fifty names. They were the top names with share prices below $100 though. Our hedged portfolio construction algorithm started with equal dollar amounts in each, then rounded down to round lots. It then used a tightly hedged position in the VanEck Vectors Junior Gold Miners ETF (GDXJ) to absorb most of the leftover cash from the rounding down process.

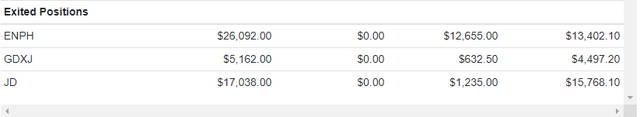

Here's how that portfolio performed over the next six months, net of hedging and trading costs:

This portfolio was up 19.14%, versus the SPDR S&P 500 ETF (SPY), which was up 19.78%.

It's worth remembering that this portfolio was hedged against a >13% decline. A similar portfolio hedged against a larger decline, say, a >20% decline, would have outperformed SPY due to the lower hedging cost.

An Experimental Approach

We'll close with an approach we haven't tested yet, but which might be promising:

- Buy equal dollar amounts of our top ten names, with trailing stops 10% or 15% below the current market price (It's important to remember here that trailing stops will not protect you if a security gaps down below your stop - say if it opens down 30% the day after a bad earnings report).

- Buy optimal puts on an index ETF such as SPY to hedge against market risk. This video shows how to do that:

3. Roll your index put protection before it expires.

4. Each time one of your trailing stops causes you to exit a top name, replace it with a top name from the current list.

Again, we haven't tested this approach yet, but it seems like it might be promising.