Is Twitter The Blueprint For Success During Challenging Market Conditions?

Our previous Stock Exchange noted that the market remains volatile, and we may still retest the 2018 lows. And the market has continued to sell-off since that report. However, despite the volatility (and perhaps because of the volatility) attractive trading opportunities continue to exist.

Is Twitter The Blueprint for Success?

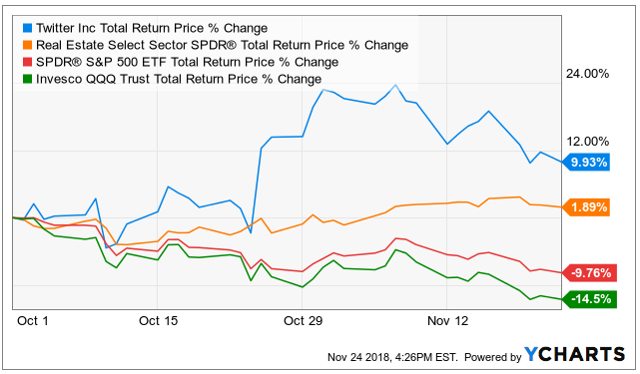

All correlations move towards one during a market crisis. That was the lesson learned by many during the financial crisis of 2008-2009. The current market sell-off that began in October has caused some pain, but so far there have been both winners (e.g. REITs) and losers (e.g. growth, technology and momentum). Basically, thus far, there has been benefit to owning differentiated types of stocks. And more specifically, Twitter (TWTR) may be a good blueprint for success through differentiation during challenging market conditions.

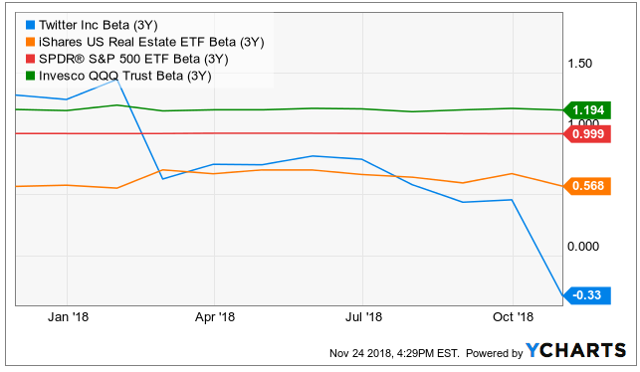

If you don’t know, according to FactSet, “Twitter is a global platform for public self-expression and conversation in real time. It provides a network that connects users to people, information, ideas, opinions, and news.” Twitter also has a low historical beta (-0.33), a bit of a contrarian strategy (they’re intentionally taking a step backwards, in hopes of setting themselves up to take multiple healthy steps forward in the future), and the share price has performed very well while the market has been selling off.

Regarding Twitter being a “blueprint” for success in a challenging market, we are essentially referring to differentiated strategies. As we saw earlier, low beta dividend-paying REITs have performed well during this recent sell-off. But so too have long-short funds, certain trading strategies (we’ll detail our recent Twitter trade later in this report), investment grade bond ladders, and cash (at least on a relative basis compared to the Nasdaq (QQQ) which is down 14.5%).

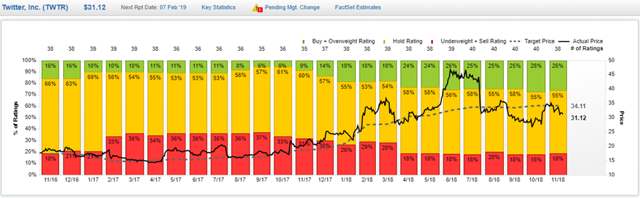

Regarding Twitter’s differentiated strategy, the company is currently foregoing user and content in growth, in favor of purging suspicious users and questionable growth. These actions are “nails on a chalk board” to short-term-focused Wall Street analysts (they have very mixed feelings on the company, as seen in the following graphic.

But Twitters “one step back, two steps forward” strategy could be exactly what the company needs to increase going forward. The company recently beat earnings expectations, and that’s what caused the shares to jump higher in October, but this could have been a much bigger jump if the company had not been focused on purging questionable users. It could also be a sign of much bigger growth in the future once the company gets itself on the right track (i.e. the right kind of content and user growth).

Stone Fox Capital had an interesting bullish write-up on Twitter recently (see: Twitter Is Finally Getting Healthy). His takeaway includes the following:

“Twitter remains a relative bargain… with an exceptionally large market to attack… As the market starts pricing in higher growth rates, one should expect the stock to continue this rally…”

Differentiated market strategies can help drive success during challenging market conditions.

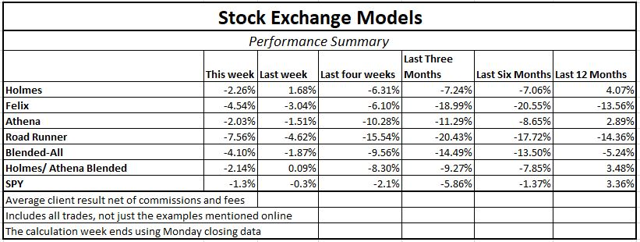

Model Performance:

We are sharing the performance of our proprietary trading models, as our readers have requested, as shown in the following table:

We find that blending a trend-following / momentum model (Athena) with a mean-reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

Note: This week’s Stock Exchange is edited by guest contributor Blue Harbinger, a source for independent investment ideas.

Felix: This week I sold some of my Twitter shares, which I had purchased in October. I sold them at a profit, before you ask.

Blue Harbinger: Turning a profit in these market conditions sounds good to me Felix. Remind us, what is your trading strategy?

Felix: I am a momentum trader, and I usually hold for much longer than the other traders in this report, 66-weeks on average. However, I do monitor macro conditions for risk control purposes, and I elected to take some profits (but I still own some of the shares).

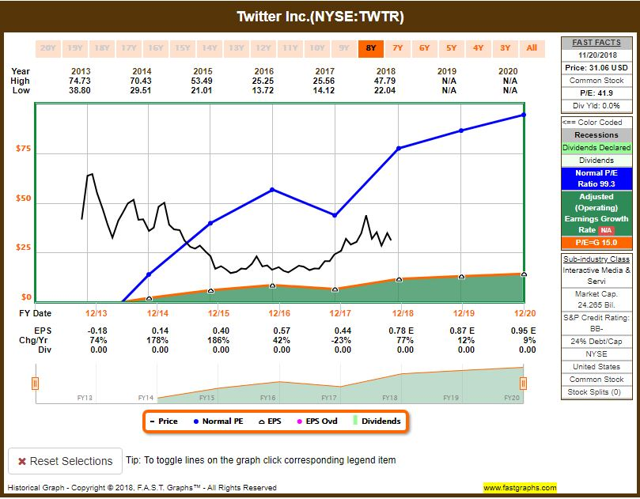

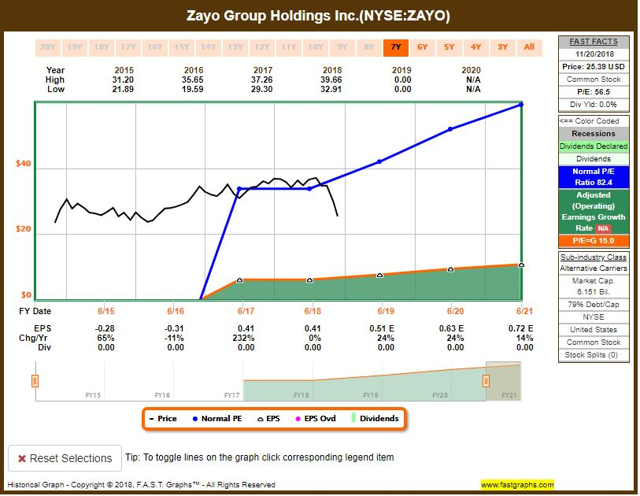

BH: Not bad, although it’s slightly concerning that you’re taking some of your profits early–that’s telling about your view of market conditions. It’s also interesting that you continue to hold some of your Twitter shares too. As we saw earlier in this report, there is reason to believe Twitter’s differentiated strategy may continue to perform well going forward. By the way, for-your-information, here is a look at the Fast Graph for Twitter.

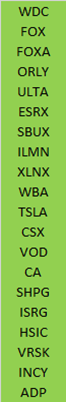

Felix: As you know, I am not a human, I am a computer-based trading model. And if you are curious, I also ran the stocks of the Nasdaq 100 through my model, and my top 20 rankings are included in the list below.

BH: Hey- thanks for sharing. Just eye-balling that list, I see ADP made the list and that is a company I like because it does well when the economy is strong (and despite the recent near-term sell-off, long-term economic conditions remain relatively strong and healthy). However, ADP could be facing some under-the-radar challenges from smaller players that are growing rapidly like Paylocity (PCTY) and Paycom (PAYC), and even Square (SQ). You’ve heard of Square, right Felix? The CEO of Square is also the CEO of Twitter. Apparently, he’s quite a busy guy. Also, I can understand why you might not like the three names I just mentioned–they’ve all just sold-off very sharply, and likely don’t have the momentum you are looking for. They are more of a “buy the dip” opportunity. And speaking of buying-the-dip, let’s see what our resident expert dip-buyer, Holmes, has for us this week. Holmes?

Holmes: I purchased shares of DexCom (DXCM) after its fall this week. And you’re right–I am a dip buyer. Here is a look at the technical chart.

BH: That’s quite a dip Holmes. DexCom makes medical devices for people with diabetes. The company has been on fire over the last year, but I see it’s fallen below its 50-day moving average in the chart above. Here is a look at more data in the following FastGraph.

Holmes: Thanks for that data, but it appears to be mostly fundamental. I am a technical model, and I typically only hold my position for about 6-weeks. It’s good to keep those fundamentals on my radar, but over a 6-week period they usually are far less relevant than they might be over the long-term.

BH: Alighty then. How about you Road Runner?

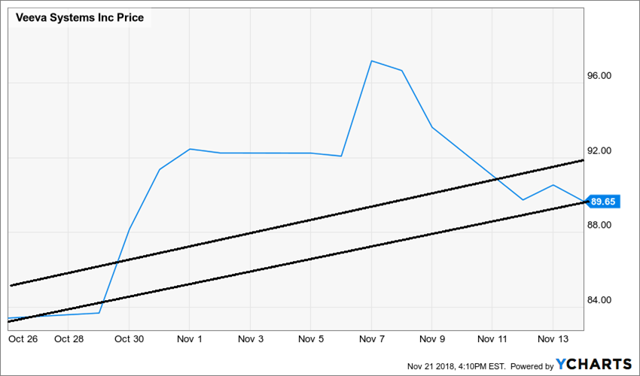

Road Runner: As you know, I am a momentum trader, but I like to buy things in the lower end of a rising channel. This week I purchased Veeva Systems (VEEV). And as you can see in the following chart, it is in the lower end of a rising channel.

BH: Interesting. I think it is a little easier to see what you’re talking about in this next chart. Now I see a longer-term dip in a rising channel.

RR: Great, but I typically only hold for about 4-weeks, even shorter than Holmes.

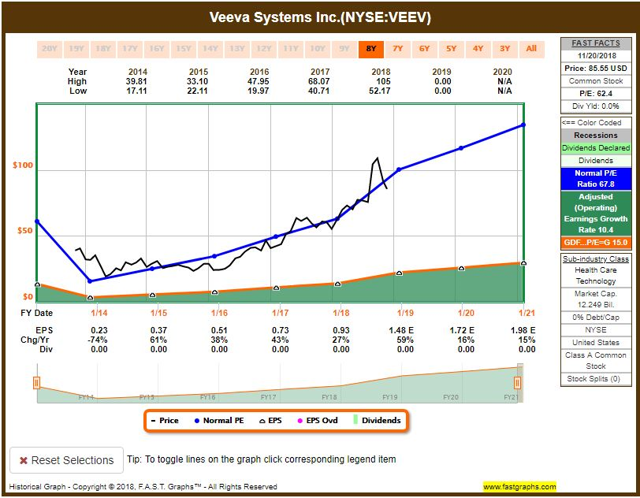

BH: Ok. You are aware that Veeva Systems is a cloud-based software solutions company for the life sciences industry, right? Its solutions enable pharmaceutical and other life sciences companies to realize the benefits of modern cloud-based architectures and mobile applications for their most critical business functions, without compromising industry-specific functionality or regulatory compliance. Here is a look at the Fast Graph if you’d like a fundamental metrics picture.

RR: Thanks, but I am a trading model based on technical factors.

BH: Fine, just trying to help. How about you Athena–anything you care to share this week?

Athena: I purchased shares of European infrastructure services company, ZAYO Group.

BH: Care to tell us why?

Athena: Because it knocked another name out of the portfolio this week. I run a “king of the hill” type strategy, or “queen of the hill” actually. This is a best ideas portfolio.

BH: That’s quite a setup, Athena. Seems like a bold move to me, but I know you have your disciplined and repeatable technical trading process in place. I also know you’re into momentum, you typically hold for about 17-weeks, and you use dynamic stop orders for downside protection. I have included the Fast Graph below, which I know you won’t look at because you’re into technicals, not fundamentals. Thanks for sharing.

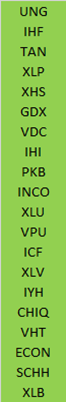

Oscar: As the “sector rotation” model, I also have a ranking to share. I ran our “Comprehensive and Diverse” ETF universe through my model, and the top 20 are ranked below.

BH: I see you have the US Natural Gas ETF (UNG) ranked at the top. I realize you are an ETF momentum trader, and this list is your weekly ranking, and not your actual trades, but you’re bold to put UNG at the top. Look at this chart.

Conclusion:

Differentiated strategies can be one key to success during challenging market conditions. Traditional, long-only, buy-and-hold strategies have fallen hard since early October, and depending on your situation, you may not be comfortable with this type of volatility. High beta tech stocks have sold-off even harder than the market, and lower beta REITs have sold off less. Further differentiated trading strategies can also perform well. For example, Twitter’s unique and differentiated strategy (e.g. low beta, and focus on long-term health instead of short-term user and content growth) has benefited its share price well, and we were able to profit from a recent Twitter trade, despite negative market conditions. When seeking success in the markets, knowing your goals and sticking to your plan is paramount, but being differentiated can help a lot too.

Stock Exchange Character Guide:

| Style | Average Holding Period | Exit Method | Risk Control | ||

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more