How Should Your Non-Core Portfolio Look?

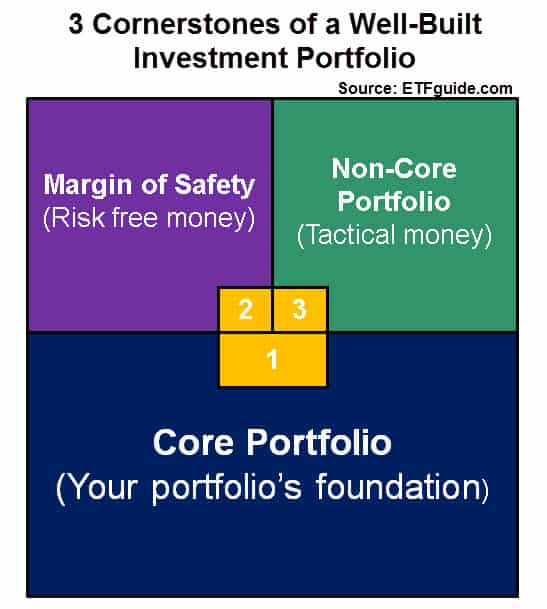

I’ve written extensively about the role of an investor’s non-core portfolio. It’s one of the three cornerstones of a well-built portfolio (see figure below) and it always plays a complementary role to the much larger core portfolio and a person’s margin of safety. If used properly, the non-core portfolio can greatly enhance an investor’s total returns. On the other hand, if used improperly, the non-core portfolio can dramatically change the risk and volatility profile of the portfolio.

(Audio) A Portrait of Shareholders + Non-core Portfolio 101

For the record, an investment portfolio with authentic diversification will always have broad exposure to the five major asset classes: stocks (VT), bonds (AGG), commodities (DBC), real estate (RWO), and cash. Obtaining this broad diversification should be an investor’s priority, meaning it comes before any consideration or thought is given to the non-core portfolio.

The key characteristic of a person’s non-core portfolio is that it owns non-core asset classes. These types of assets are typically tactical, under-diversified, and can include sub-asset groups within core asset classes. (Example: Gold is a sub-asset group within the larger and core commodities asset class.)

Here’s a quick rundown of non-core assets:

–Currencies

–Derivatives

–Individual stocks

–Active mutual funds

–Leveraged Long/Short ETFs

–Sector Funds

–Hedge funds

–Private equity

–Venture capital

–Volatility

When people begin to use non-core asset classes as core building blocks within their portfolio is usually when portfolio problems happen. The whole point is to identify these problems before they negatively impact your financial situation.

In summary, you should not own non-core asset classes inside your core portfolio. Why? Because your non-core portfolio is just an appetizer that complements the rest of your portfolio holdings which encompass the much bigger main meal.

Disclosure: None

Disclaimer: Ron DeLegge has analyzed and graded more than $125 million with his Portfolio ...

more