Home Builder Index Reaches Milestone But Can It Beat History?

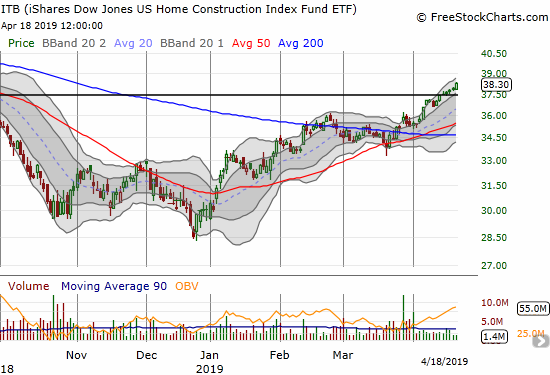

The iShares US Home Construction (ITB) reached an 8-month high last week even as the S&P 500 (SPY) struggled to make headway toward its all-time high.

Source: FreeStockCharts

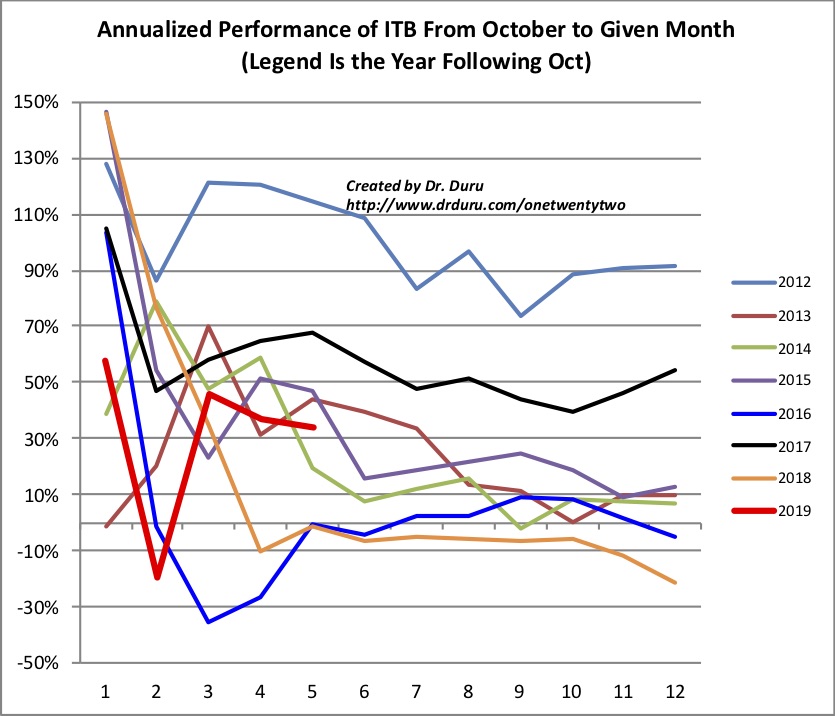

This 8-month high confirmed a major milestone: the index has reversed the entire breakdown from October of last year. Yet, history is leaning against ITB making additional headway for most of the remaining year. Since 2017, ITB's first full year of trading, the index of home builders has shown a definitive seasonal pattern: starting from November to the following October, ITB tends to peak by April both in absolute terms and relative to the S&P 500. Only the years 2009 and 2016 beat the odds. This pattern forms the basis of a seasonal trade on home builders that I have used for several years. The following chart comes from that analysis. I truncated the years before 2012 for clarity.

The seasonal trade in ITB over SPY tends to fade after Spring (indices 5 and 6 are March and April)

The x-axis in the above chart provides an index counting the months in the seasonal trade starting with November as month number 1. The y-axis is the annualized performance of ITB starting from October's last closing price. So the first point in a line is the annualized performance from October to November of a given year. Each colored line represents a different year (or season). For example, the line for 2018 measures from November 2017 to October 2018.

Note the chart only covers full months so ITB's April 2019 milestone does not yet appear. Still, when juxtaposing the 2018/2019 season with the other seasons, the headwind of history is quite clear. Given my short-term bearishness on the stock market and my sober read on the existing housing data, I am doubly doubtful that 2019 will deliver an exception to the strong history of trading in ITB. Yet, if ITB somehow manages to beat the odds, I will have to assume the implications will be quite bullish for the stock market going at least into the summer.

Be careful out there!

Disclosure: no positions

Follow Dr. Duru’s commentary on financial markets via more