High Yields Lead The Way

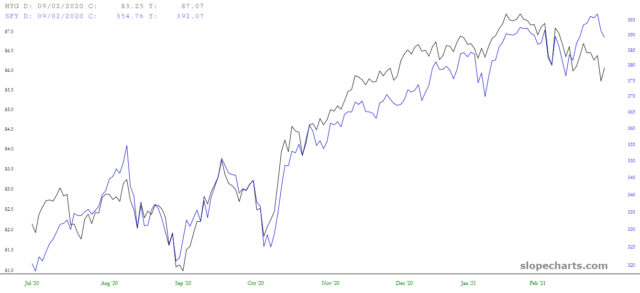

This is a look at two ETFs: the grandfather of them all, SPY (the S&P 500), and the high-yield corporate fund symbol HYG. In normal markets, they pretty much mimic the behavior of the other. As you can see, they have been joined at the hip for many years.

Recently, however, a divergence has taken place which is worth noting. The high yield corporate bonds have weakened, having peaked way back on Feb. 8 while the SPY hit its own lifetime-high a full five weeks later.

Take a closer look. The HYG (black line) has been making a series of lower highs while the SPY has steadfastly been marching higher and higher.

Historically, the HYG provides a heads-up about a shift in the direction of equities. I suspect this will be yet another instance of such a phenomenon.