Here’s How To Profit From The Market’s M&A Craze

2015 continues to be the year of the deal.

The value of merger and acquisition deals so far this year has topped $3.2 trillion and is closing in on the record of $3.4 trillion set in 2007. And by all accounts, there are more deals to come in 2016.

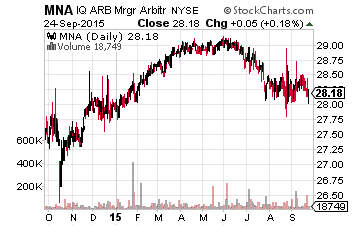

One way to play this strategy is with ETFs. The IQ Merger Arbitrage ETF (NYSE: MNA) has consistently been the best performing ETF in the space. It has outperformed the S&P 500 by nearly six percentage points over the last year.

However, longer-term the M&A ETF has yet to prove itself. Over the last three years it has underperformed the S&P 500 by 20 percentage points. And since its inception in 2009, the M&A ETF has underperformed by 63 percentage points.

Beyond that, there’s the Credit Suisse X-Links Merger Arbitrage ETN and ProShares Merger ETF, both of which are underperformers as well — underperforming the S&P 500 by 71 and 43 percentage points, respectively, since inception.

Just something to keep in mind if you’re looking for an easy way to play M&A (read: there is no easy way). It takes work and diligence. With that in mind, here are the top three places to look for profits from M&A activity:

Best Place to Play M&A No. 1: Oil

The wave of mergers and buyouts that were expected to come from the selloff in oil just haven’t come to fruition.

Rather, the best plays in the industry appear to be in derivative oil industries. It might still be too early for any M&A among oil explorers, but companies that transport oil and make oil-related equipment could be worth considering here.

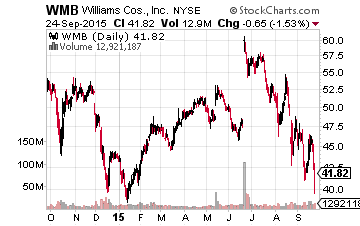

Williams Companies (NYSE: WMB) is perhaps the most interesting name among oil and gas companies right now. This comes as it's flirting with Energy Transfer Equity (NYSE: ETE) as a potential buyer.

Energy Transfer Equity offered an all stock buyout over the summer that valued Williams Companies at roughly $64 a share. Energy Transfer has since sweetened the deal by offering to pay for about 15% of the deal using cash. The two are meeting this week to discuss the details more.

With Williams Companies you also get paid to wait as it offers a 6.03% yield.

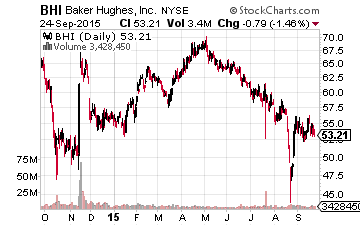

Now, another play in the industry is a merger of the major oil and gas servicers,Halliburton (NYSE: HAL) and Baker Hughes (NYSE: BHI).

Halliburton will have to do some divestitures, but it’s said that it’s committed to getting the deal done. It’s already put up various assets for sale and received bids — final bids are expected by mid-October.

Based on the cash and stock offer, shares of Baker Hughes could trade higher by 12% if the deal gets done — an annualized return of 57% if it closes by year-end.

Best Place to Play M&A No. 2: Media and Telecom

The media and telecom industry has turned into a playground for mergers.

AT&T (NYSE: T) may have started a new trend when it comes to meshing mobile and cable with its purchase of DirecTV (NYSE: DTV). So much so that Dish Network (NASDAQ: DISH) could step up and buy T-Mobile (NYSE: TMUS).

Beyond that, big cable is getting a bit smaller.

The European company, Altice (OTCMKTS: ATCEY), is buying Cablevision (NYSE: CVC) for just under $35 a share. Cablevision shareholders will get a 7% annualized return if the deal closes in the summer of 2016.

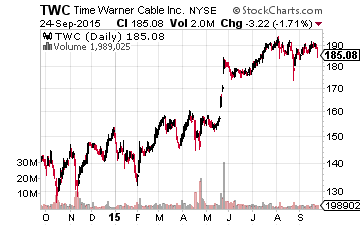

The more interesting play among cable companies is Time Warner Cable (NYSE: TWC). Charter (NASDAQ: CHTR) is buying Time Warner and both sets of shareholders have already approved this deal.

With the current cash and stock buyout offer, there’s 8% upside for Time Warner Cable shareholders — with a 36% annualized return if the deal closes before 2016.

As well, don’t count out the cable cowboy, John Malone, who also has a stake in Charter. This is a bit more speculative, with no official deals announced, but it’s only a matter of time. His Liberty Global (NASDAQ: LBTYA) is trying to work out a deal to buy the British telecom giant Vodafone (NASDAQ: VOD).

As well, he owns stakes in both Starz (NASDAQ: STRZA) and LionsGate (NYSE: LGF). Last year, Malone facilitated a share swap between the two and got a board seat at LionsGate.AMC Networks (NASDAQ: AMCX) has been exploring a potential deal to buy Starz, which could serve to only push LionsGate to buy the company.

Best Place to Play M&A No. 2: Healthcare

Pharma and anything healthcare-related has been a consistent winner when it comes to M&A activity. And, the sector is still presenting interesting opportunities.

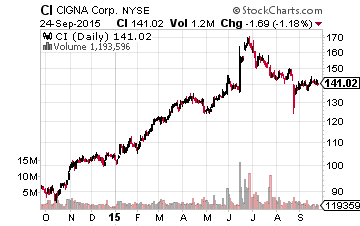

First up is the action we’ve been seeing in the health insurance space. Aetna is looking to snatch up Humana (NYSE: HUM) and Anthem is trying to buy Cigna (NYSE: CI). Based on the current numbers, there’s 19% upside for Humana shareholders and 27% upside for Cigna if the deals get done.

Anthem (NYSE: ANTM) and Aetna (NYSE: AET) have been in Washington D.C. touting the benefits of industry consolidation, speaking in front of a Senate subcommittee. After their testimony, it appears the mergers will face less political push back.

There are still antitrust concerns, however. Aetna and Humana have already received a second request for information from the Department of Justice about their merger. But both buyers are committed to making any required divestitures to get the deals done. Even if the deals take a year to be completed, there’s still plenty of upside for investors.

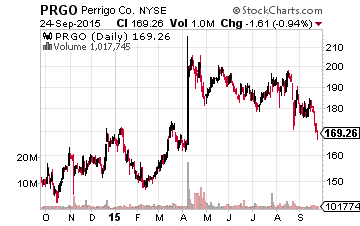

The more immediate play could be Perrigo (NYSE: PRGO), where Mylan (NYSE: MYL) has been trying to buy the company for several months.

Mylan is willing to undergo significant divestitures to the get the deal done, but Perrigo has been against the buyout, as its board rejected the offer. Perrigo cites the value of Mylan’s stock as the big concern, with the deal being cash and stock.

However, Perrigo appears to be coming around to a deal. Perrigo’s CEO has even been buying Mylan shares. As it stands, Mylan is offering $178 a share for Perrigo — that leaves 6% upside and a 26% annualized return if the deal closes by year-end.

In the end, investing in M&A deals isn’t for everyone. But with the myriad of deals getting done, there are a number of interesting opportunities that are going overlooked by the market.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more