Geopolitics Produces Investment Opportunities

A basic premise of the Global Investment Letter is that the current geopolitical environment is more tenuous than it has been in decades. The volatile geopolitical scene will produce both threats and opportunities for investors. We update an opportunity we have identified below.

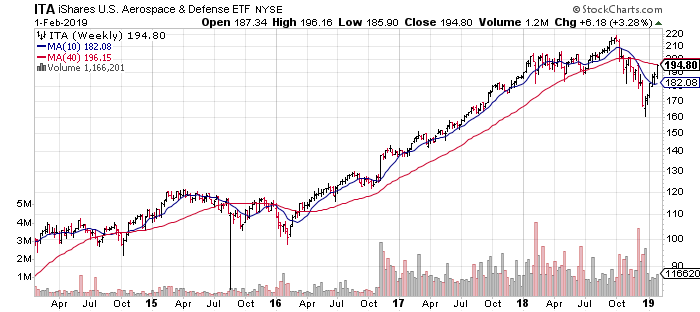

The defense sector, as illustrated by the ITA proxy above, performed strongly in January, moving up to its 40-week moving average. Following a brief trade down to the 160 level, the rebound was very sharp.

Notwithstanding short-term trading machinations, the long-term prospects for the defence sector remain very strong based on our premise that a convergence of geopolitical and technological factors will drive defence spending higher in the years ahead.

Further support was supplied to our thesis with the announcement that the United States is planning to leave the 1987 Intermediate-Range Nuclear Forces Treaty negotiated with Russia because Russia breached the accord. The treaty states that neither side may possess ground-based missiles that can travel between 500 and 5500 kilometers. The United States maintains that Russia's 9M729 missile can fly that far.

The collapse of the treaty can be expected to spur a missile arms race focused on the development of hypersonic missiles, a technology in which Russia is believed to lead. Hypersonic missiles can fly at speeds greater than five times the speed of sound. More importantly, no effective defence to these missiles has yet to be developed. We have commented previously in the Global Investment Letter on the prospects for hypersonic missile spending. The collapse of the treaty will likely accelerate the pace of this spending.

The defence sector has performed very strongly since first being recommended in the February 2017 issue of the Global Investment Letter, more than doubling the performance of the S&P 500. We continue to believe that defence companies engaged in the production of products with the highest technological input should be favoured. Companies mentioned for consideration include Boeing, Lockheed Martin, Raytheon, Airbus, BAE, Thales, General Dynamics, L3 Electronics and Rolls Royce.

A major lesson for investors in the growing geopolitical turbulence is that corporate fortunes, and hence stock prices, will be more strongly influenced by geopolitical influences in the future than has been the case for many decades. The pace of geopolitical change has accelerated in recent years and will likely continue to evolve at a brisk rate for some time until a measure of stability is regained. The fragmenting of long-held alliances will alter spending patterns in areas such as defence, where we have suggested investors be geographically diversified in order to offset the growing isolationism on the part of the U.S. and the potential effects of its fraying relationship with other NATO members. This fragmenting of relations will also present opportunities as existing or new alliances are strengthened in response to changes in the old order. European countries may well increase their defence budgets and purchase their defence needs more within the E.U.

In conclusion, events continue to confirm that investors must stay attentive both to geopolitical developments now and in the years ahead and have a good understanding of their consequences because they will undoubtedly influence investment returns.

The Global Investment Letter is a monthly journal of ideas and opinions about capital markets. Global macro ...

more