GDX: The Bullish Case For The Gold Miners ETF

VanEck Vectors Gold Miners ETF (GDX) has been on fire lately. The gold mining ETF has gained nearly 16% year to date and is currently trading at new highs for the year. Importantly, from a long-term perspective, gold miners still have plenty of room to run, and historically low-interest rates could be a powerful driver for the sector.

Gold Is Leading Higher

When analyzing a position in VanEck Vectors Gold Miners ETF, the price of gold is a major consideration to keep in mind. After all, it doesn't make much sense to consider investing in gold miners unless you think that the price of gold is going to remain strong and ideally keep rising in the middle term.

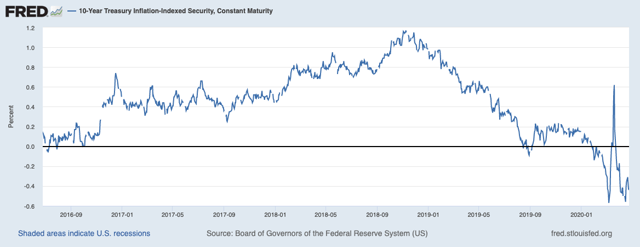

Looking at the macro fundamentals, historically low-interest rates in times of pandemic and global recession are a major tailwind for the price of gold nowadays.

Gold and real interest rates have a negative correlation. Since gold doesn't pay any interest, declining real rates reduce the opportunity cost of holding gold in comparison to other assets.

Even more important, when real interest rates are negative, this means that interest rates are not providing enough compensation for inflation. If the price of gold is expected to adjust for inflation in the long term, then the metal becomes a particularly attractive proposition in this context.

(Click on image to enlarge)

Source: Board of Governors of the Federal Reserve System

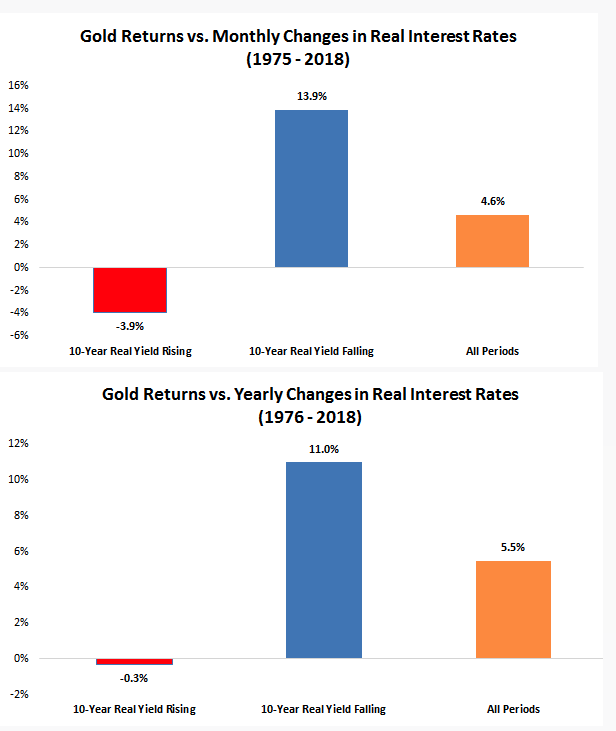

The chart below shows the monthly and yearly relationship between gold prices and real interest rates from 1975 to 2018, and the data shows that declining interest rates can be a major driver for higher gold prices.

(Click on image to enlarge)

Source: Pension Partners

We can assess the timing conditions in gold with the Asset Class Rotation Strategy. This is a quantitative strategy that rotates between nine ETFs representing major asset classes:

- SPDR Gold Trust for gold (GLD)

- Vanguard Real Estate (VNQ) for real estate.

- SPDR S&P 500 (SPY) for big stocks in the U.S.

- iShares Russell 2000 Index Fund (IWM) for small U.S. stocks.

- iShares MSCI EAFE (EFA) for international stocks in developed markets.

- iShares MSCI Emerging Markets (NYSEARCA: EEM) for international stocks in emerging markets.

- Invesco DB Commodity Index Tracking (DBC) for a basket of commodities.

- iShares 20+ Year Treasury Bond (TLT) for long-term Treasury bonds.

- iShares 1-3 Year Treasury Bond (SHY) for short-term Treasury bonds.

In order to be considered for inclusion in the portfolio, an ETF has to be in an uptrend, meaning that the current market price is above the 10-month moving average. Among the ETFs that are in an uptrend, the system buys the top three with the highest relative strength over the past three and six months.

The main rationale behind this strategy is actually quite simple. The strategy wants to buy only the asset classes that are in an uptrend. Among the asset classes that are in an uptrend, it looks for the ones with superior risk-adjusted performance in comparison to the other asset classes.

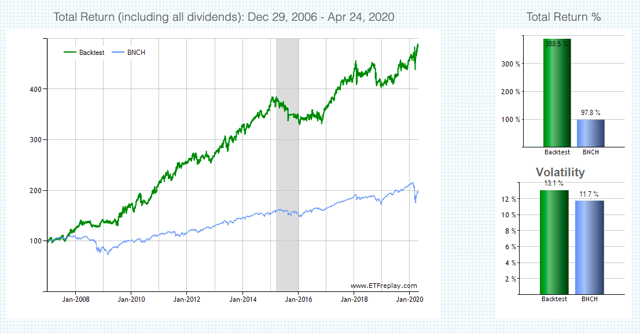

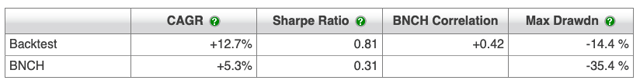

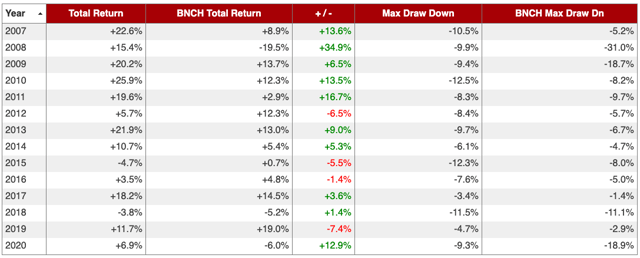

Backtested performance numbers are remarkably strong. Since January of 2007, the strategy gained 388.5% versus 97.8% for the benchmark. The annual return is 12.7% for the strategy vs. 5.3% for the benchmark over that period.

(Click on image to enlarge)

Source: ETFReplay

(Click on image to enlarge)

Source: ETFReplay

The Asset Class Rotation Strategy also is quite effective in terms of reducing downside risk. The maximum drawdown, meaning maximum capital loss from the peak, is 14.4% for the quantitative strategy vs. 35.4% for the benchmark over the backtesting period.

In recent months, the strategy has been positioned in Gold (NYSEARCA: GLD), Cash (Nasdaq: SHY), and Treasuries (Nasdaq: TLT) since January of 2020. Because of this, the strategy has avoided the big drawdowns due to the coronavirus pandemic during March.

The other side of the coin is that the trend-following strategy also missed the big recovery in stocks during the past several weeks, but the risk-reward equation is still quite favorable on a year-to-date basis.

(Click on image to enlarge)

Source: ETFReplay

In the current economic environment of record economic uncertainty and historically low interest rates due to massive liquidity injections from the Fed, it makes sense for gold prices to perform strongly, and the quantitative indicators are pointing toward further upside for the precious metal in the middle term.

Gold Miners Look Cheaper Than Gold

Investing in gold mining stocks is not the same as buying gold. There are plenty of differences to consider, and one of them is that gold mining companies can face some additional risks due to operational hurdles, regulations, and sanitary measures that can affect gold production levels. In this sense, buying gold mining companies can be considered a riskier bet than buying gold.

That said, gold miners also can provide more upside potential if gold remains strong in the long term and production levels remain favorable. The impact of fluctuating gold prices on the underlying value of gold mining companies is mostly a function of the long-term value of gold. In simple terms, if gold makes a quick spike up in the short term and then it comes back down, this is not a major positive for gold miners. But if gold prices start rising and remain elevated, this can have a big impact on gold miners.

Importantly, there's a high degree of operating leverage in the business. The cost of production is relatively fixed in comparison to the price of gold. This means that when gold prices increase, earnings for gold mining stocks can increase in a much stronger way than the price of the metal.

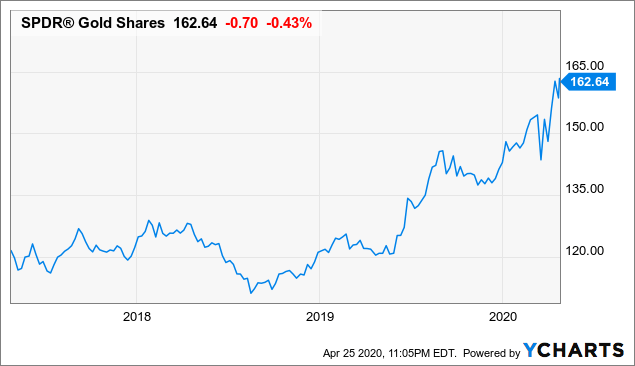

In spite of the typical short term volatility, gold has been in a well-defined uptrend since last year, and the trend is showing no signs of reversal.

(Click on image to enlarge)

Data by YCharts

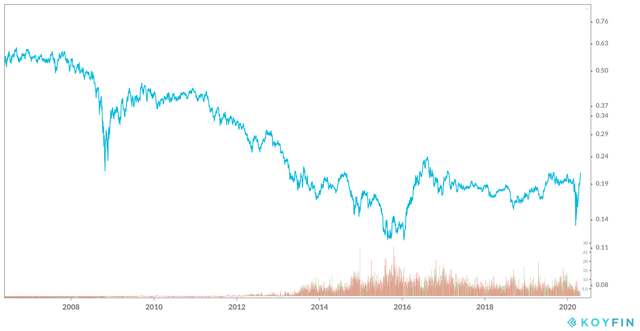

The chart below shows the relative performance of gold miners in comparison to the price of gold. Miners have been underperforming gold over the past decade, but the trend seems to be changing in recent days.

(Click on image to enlarge)

Source: Koyfin

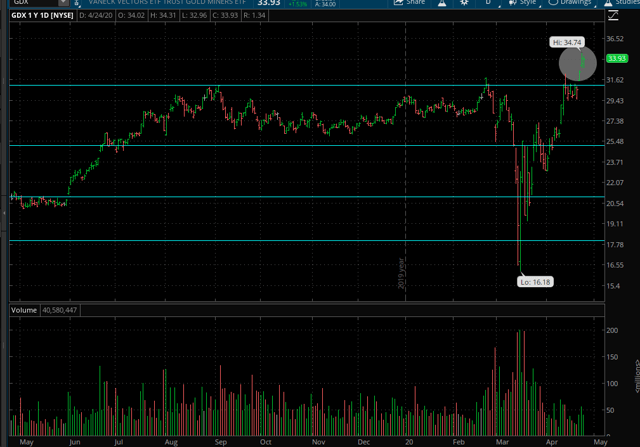

Looking at the VanEck Vectors Gold Miners ETF on a daily chart, the ETF has recently broken above a key resistance level at $31 per share. This clearly is a bullish sign in the short term, but value-oriented investors may feel unenthusiastic about the idea of buying gold miners at new highs for the year.

(Click on image to enlarge)

Source: TOS

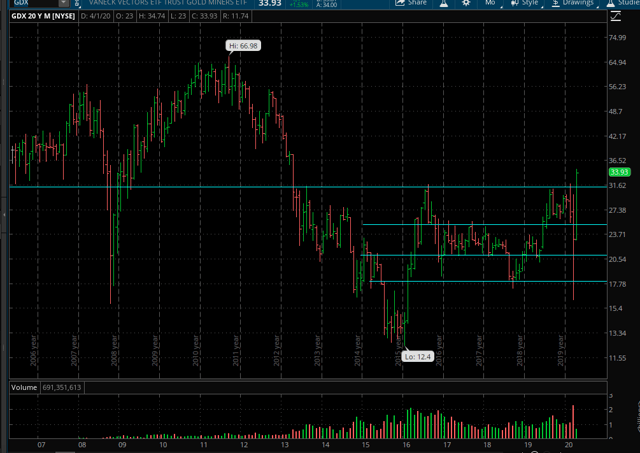

However, the situation looks very different when you take a step back and zoom out to the monthly chart. The ETF is currently trading at levels last seen in April 2013. In fact, the ETF has not made much progress in terms of price appreciation since 2006.

VanEck Vectors Gold Miners ETF has not appreciated by much in the past 15 years, even if the instrument is showing vigorous momentum in the short term. This shows that investing in gold mining stocks can be excruciatingly difficult, and getting the timing right is of utmost importance. However, the chart also is showing that VanEck Vectors Gold Miners ETF still has plenty of room for recovery from a historical perspective.

(Click on image to enlarge)

Source: TOS

The gold mining industry is cyclical and challenging, and stocks in the sector tend to be particularly volatile. Investors analyzing a position in VanEck Vectors Gold Miners ETF need to be willing to tolerate some wild swings in prices, for better or for worse.

That said, historically low real interest rates are a key driver of higher gold prices, and gold mining stocks could outperform gold itself in a favorable environment for the sector. The risks are elevated, but the potential returns could more than compensate for the risks.

Disclosure: I am/we are long GDX.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more