Four High-Yield ETFs Returning Value And Dividends To Investors

The stock market crash at the start of the so-called “coronacrisis,” was especially devastating to share prices in high yield sectors. I attribute the extra steep declines to what I have labeled a “liquidity event,” in which leveraged funds using the high yield investments were forced to sell, sell, sell, to avoid becoming leveraged into oblivion.

I have documented the dozens of funds that could not survive and were shut down. In April and May, the income stock sectors came up nicely off the lows of March. By early June, it looked like income investments were on their way to a full recovery.

However, this is a time in history where swings in life, the economy, and investments are all frequent and unexpected. Since early June, the investing public’s focus has been on the tech sector and Tesla (the popularity of my recent TSLA article attests to this). Income stock sectors have pulled back. The news hasn’t changed, so I view this as another opportunity to play like its 2009 and buy quality income investments on the cheap.

Let’s look at the four major types of income stocks. I am using representative exchange-traded funds (ETFs) to show what has happened to values in the sector. With some digging, you can find individual stocks and companies with prospects much greater than the ETF average.

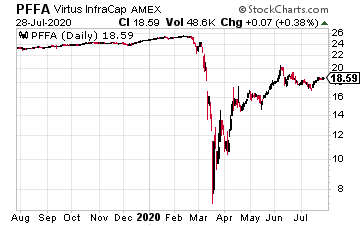

For preferred stocks, let’s look at the Virtus InfraCap U.S. Preferred Stock ETF (PFFA). Prior to the COVID crash, the PFFA share price held steadily between $26 and $27. In normal times, preferred stock prices have very low volatility. Yet, at the bottom of the crash, the PFFA low was $7.50 per share.

If you know anything about preferreds, you know that was an almost unfathomable decline.

On June 8, the ETF closed the day at $20.35. The share price had almost tripled in less than three months.

Currently, PFFA trades for about $18.50, and yields 9.5%.

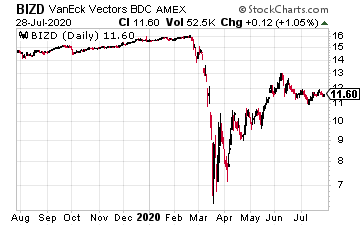

The VanEck Vectors BDC Income ETF (BIZD) illustrates the price swings in the business development company (BDC) sector.

Before the crash, BIZD was at $17.00 per share.

At the bottom, it touched $6.80 per share. After the crash, BIZD recovered to peak at $13.44 on June 8.

The ETF’s share price has drifted back down to $11.61 and currently yields 12.4%.

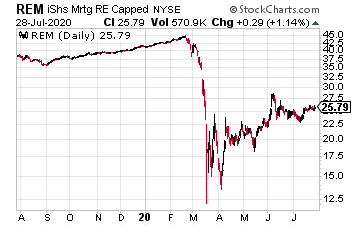

In the real estate investment trust (REIT) world, investors look to the mortgage or finance REITs for high-yield. For this review, the iShares Mortgage Real Estate ETF (REM) represents the sector.

Before the pandemic-stoked stock market crash, the REM share price peaked at over $48.00. At the bottom of the crash, it traded for $13.03 per share.

That’s an unthinkable fall in less than five weeks. The post-crash peak for REM occurred on June 8, when the stock closed at $29.12 per share. Now REM is back down to $25.25.

The current yield is 12.7%.

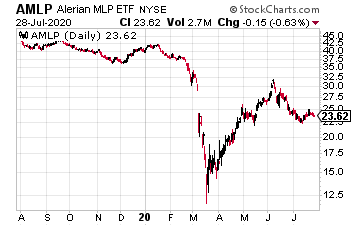

The energy midstream sector, specifically master limited partnerships (MLPs) in that sector have struggled since the 2015 energy sector crash to get back on track. In December 2019, the sector had its best month in years, gaining 10%.

It looked like MLP fortunes had changed. Then COVID-19 hit the world. The ALPS Alerian MLP ETF (AMLP) was at $44.35 in January.

By the market bottom in March, AMLP shares touched bottom at $12.05.

The recovery had AMLP back up to $31.70 on June 8. The share price has fallen back down to $24. This fund has slashed its dividends, but the MLP sector currently yields around 12%.

You can find high-quality large-cap MLPs with double-digit yields and stable dividends.

Disclosure: PFFA is one of my largest investment positions, and most of my more