Finding Stable Investments In An Unstable Market

I find it a bit strange to say this, considering everything that happened last year, but we are in a period of unprecedented uncertainty as far as investing goes.

I regularly read and hear commentary covering both sides of where the stock market will go for the rest of 2021. As I went through my morning news feeds, I noted some interesting commentary that points toward potential (or even ongoing) stock market disruption. Here are some thoughts and quotes.

So far, 2021 has been what I call the “year of the low-information trader.” Individuals who have never invested are now trading on Robinhood-type apps, following stock ideas they get from social media. I think this quote from Jim Cramer is a backdoor comment about these new traders: “If you don’t know if the company makes money, you shouldn’t be owning the stock.”

I don’t pay much attention to the hot tech stocks, especially the high flyers that promise to be profitable eventually, just not someday soon. So I was a bit surprised that according to CNBC, Tech stocks are down 25% to 50%.

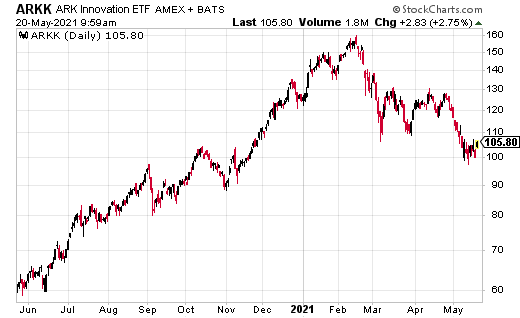

Wow! That’s bear market territory. I have watched with fascination as Kathy Wood’s ARK Innovation ETF (ARKK) gained 150% when the fund had very little in the way of assets… and then after it was discovered and investors piled in, the fund’s share price took a tumble. As I write this, ARKK is off 38% from the fund’s February 2021 peak.

Cryptocurrencies are another hot topic for traders. The theory is that cryptos can, to a certain extent, replace good old U.S. dollars. However, the crypto values remain highly volatile. I took the following quote from a Bloomberg email update following the news that Tesla has suspended its policy of letting customers pay for a new car with Bitcoin, as announced by Elon Musk.

Musk’s online persona seems to have an influence over the value of Bitcoin, and, as Paul Donovan of UBS wrote in a recent client letter, “if one person can dramatically alter spending power, the ‘stable store of value’ criteria of a currency is not met.”

Then we get an April annual inflation rate of 4.2% the largest year-over-year increase since 2008. The Federal Reserve continues to say that this current bout of high inflation will be temporary. As Ben Hunt of Epsilon Theory put it: “Transitory inflation is the new subprime is contained.” Subprime mortgages ended up triggering that Great Financial crisis, which peaked in 2008.

I hope these news bites give you the feeling that I have, which is that for investors, the future is very uncertain. That uncertainty makes the high-yield investments I recommend to my Dividend Hunter subscribers even more appealing here in the middle of 2021. I suggest you give up on guessing which way prices, stocks, and crypto will go next, and instead put your money to work, earning a solid dividend income.

The Dividend Hunter recommendations list has an average yield of around 8%.

And real cash 8% annual returns may be the best game going for the rest of this year and even into ...

more