ETF Deathwatch For December 2015: AccuShares Join The List

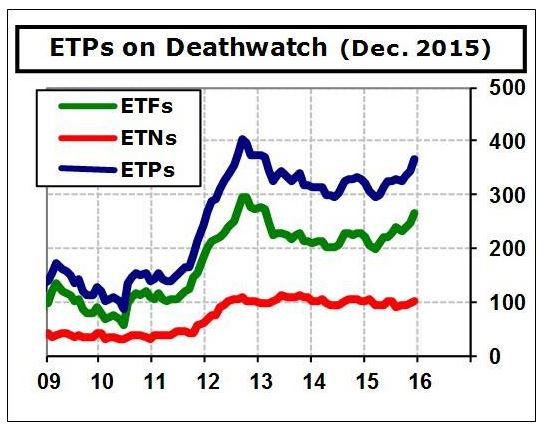

The quantity of ETFs and ETNs on Deathwatch jumped by 23 for December. There were 28 additions and only five removals. Of those coming off, three were the result of improved health, while the other two were closed, delisted, and liquidated. The net increase pushes the membership count to a 35-month high of 366, consisting of 266 ETFs and 100 ETNs.

Heading up the new arrivals are the two AccuShares ETFs, which are now more than six months old, making them eligible for Deathwatch. These two ETFs attempt to track the spot price of the VIX Volatility Index and fail miserably at doing so. They are teeter-totter ETFs, constructed much like the ill-fated MacroShares. As such, they were doomed from the start. But AccuShares added new twists that made them even worse than MacroShares in my opinion.

AccuShares introduced the concept of “Corrective Distributions” that try to keep the demand for “up” shares in balance with the “down” shares. However, these distributions were both numerous and large, quickly depleting their asset bases. To overcome this, the funds made distributions of offsetting shares two months in a row: The owners of AccuShares Spot CBOE VIX Up (VXUP) received a “Corrective Distribution” of one share of AccuShares Spot CBOE VIX Down (VXDN), and owners of VXDN received a share of VXUP. It is almost impossible to bet on the direction of the VIX when offsetting positions are forced into your account.

So far, the VXUP has made per-share distributions of $44.67 plus two shares of VXDN. Owners of VXDN have received $15.12 and two shares of VXUP (it’s a vicious circle). Between all the distributions, reverse splits, and offsetting shares, performance is nearly impossible to determine, and they do not even attempt to do so on the website. These products need to close before anyone else gets hurt.

Once again, the majority of the new names added to ETF Deathwatch this month carry the smart-beta label. This suggests the market is currently saturated with smart-beta products, and investors need time to understand and digest all that are currently available. Three of the new additions are China-oriented funds, indicating this is another group approaching saturation. From a quantity standpoint, Global X had the most products added this month with eight of its ETFs, including all four of its new “scientific beta” line, joining the list.

The average asset level of products on ETF Deathwatch increased from $6.8 million to $6.9 million, and the quantity of products with less than $2 million held steady at 73. The average age increased from 48.0 to 48.2 months, and the number of products more than five years old surged from 114 to 130.

Here is the Complete List of 366 Products on ETF Deathwatch for December 2015 compiled using the objective ETF Deathwatch Criteria.

The 28 ETPs added to ETF Deathwatch for December:

- AccuShares Spot CBOE VIX Down Shares (VXDN)

- AccuShares Spot CBOE VIX Up Shares (VXUP)

- AdvisorShares Madrona Global Bond (FWDB)

- Columbia Large Cap Growth (RPX)

- DB Crude Oil Long ETN (OLO)

- Deutsche X-trackers MSCI All China (CN)

- EGShares India Small Cap (SCIN)

- ELEMENTS Morningstar Wide Moat Focus ETN (WMW)

- Elkhorn S&P 500 Capital Expenditures (CAPX)

- ETRACS S&P 500 Gold Hedged Index ETN (SPGH)

- Global X JPMorgan Efficiente (EFFE)

- Global X MSCI Pakistan ETF (PAK)

- Global X NASDAQ China Technology (QQQC)

- Global X Scientific Beta Asia ex-Japan ETF (SCIX)

- Global X Scientific Beta Europe ETF (SCID)

- Global X Scientific Beta Japan ETF (SCIJ)

- Global X Scientific Beta US ETF (SCIU)

- Global X YieldCo Index ETF (YLCO)

- Guggenheim International Multi-Asset Income (HGI)

- iPath Pure Beta Coffee ETN (CAFE)

- iShares B – Ca Rated Corporate Bond (QLTC)

- iShares FactorSelect MSCI USA (LRGF)

- iShares Treasury Floating Rate Bond ETF (TFLO)

- Market Vectors Gulf States (MES)

- PowerShares China A-Share (CHNA)

- PowerShares KBW Insurance (KBWI)

- WisdomTree China ex-State-Owned Enterprises (CXSE)

- WisdomTree Japan Quality Dividend Growth (JDG)

The 3 ETPs removed from ETF Deathwatch due to improved health:

- CS X-Links Long/Short Equity ETN (CSLS)

- First Trust Morningstar Managed Futures Strategy (FMF)

- ProShares Managed Futures Strategy (FUTS)

The 2 ETPs removed from ETF Deathwatch due to delisting:

Disclosure: None.

more