Emerging Market Stocks Were Clobbered Last Week… Again

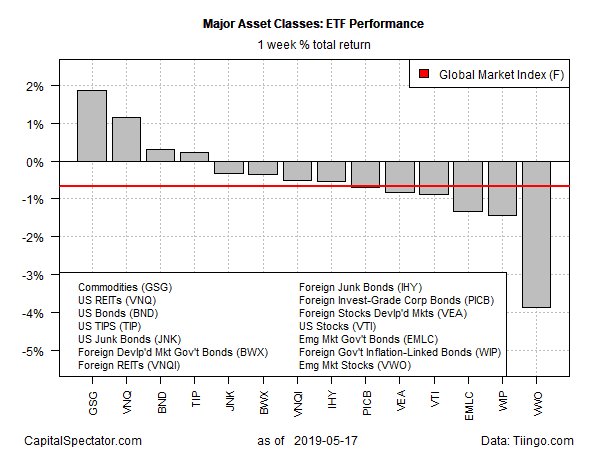

For a second week in a row, equities in emerging markets took a beating, posting the deepest setback for the major asset classes, based on a set of exchange-traded funds for the trading week through Friday, May 17.

Vanguard FTSE Emerging Markets (VWO) fell a hefty 3.9% last week, closing at its lowest price since January. The loss marks a second straight week with a steep decline for the ETF.

A key factor in the recent weakness in emerging market stocks, according to analysts, is this month’s escalating tension between the US and China over trade policies.

“We continue to see the near-term risks for EM as tilted to the downside, and the risk of additional tariffs being implemented is rising,” advise Morgan Stanley strategists in a research note published on Friday. “Comments from China’s state media suggest that the chances of further negotiations with the US over trade issues are unlikely in the near term.”

Last week’s biggest winner for the major asset classes: broadly defined commodities. The iShares S&P GSCI Commodity-Indexed Trust (GSG) jumped 1.9% for the trading week just passed. The gain marks the first weekly increase for GSG since early April.

With most markets falling last week, the Global Markets Index (GMI.F) was under pressure. This investable, unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights fell 0.7%. The decline reflects a second straight week of loss for GMI.F.

For the one-year trend (252 trading days), US real estate investment trusts (REITs) continue to lead on the upside by a wide margin. Vanguard Real Estate (VNQ) posted a strong 21.0% total return for the trailing 12-month period through Friday’s close.

The distant second-place winner for the one-year period: US investment-grade bonds. Vanguard Total Bond Market (BND) is up 6.7% over the past year after factoring in distributions — fractionally ahead of US stocks via Vanguard Total Stock Market (VTI).

The biggest one-year loss at last week’s close: equities in emerging markets. VWO has lost 10.6% over the trailing 12-month window.

GMI.F’s one-year return at the end of last week’s trading: a modest 1.9% rise.

Profiling GMI.F’s component funds via momentum suggests that the bullish tide has peaked for the near term. The upside bias that has prevailed through most of this year to date has, for the first time in 2019, reversed course, based on two sets of moving averages. The first momentum measure compares the 10-day moving average with the 100-day average, a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) offers an intermediate measure of the trend (blue line). The indexes range from 0 (all funds trending down) to 1.0 (all funds trending up). Based on data through last week’s close, the short-term momentum index fell below the intermediate index for the first time this year—a change that suggests we’ll see further weakness for global markets generally.

Disclosure: None.