Don’t Miss Out On This Rare Chance To Earn A 17% Yield

This stock’s yield will only be this high temporarily, so if you worry about having a dependable income stream to help you during your retirement, jump on this chance to earn a 17% and growing yield forever.

As the stock markets fall, my email box and news feeds are starting to fill up with dire rumors as to why a particular company is in trouble. These warnings generate the fears that dividends will soon be cut, eliminated, or worse. These rumors can generate extra selling pressure on share values that have already fallen significantly.

I find it somewhat amazing that a chat room thread or an uninformed article on a third-tier financial website can have so much power, at least in the short-term, over share prices. As hopefully better-informed income focused investors, these rumor mill share price hits are a good time to buy or add shares and earn tremendously high yields.

In a recent interview, Jay Hatfield, portfolio manager for the InfraCap MLP ETF (NYSE: AMZA) said, “Predicting irrational behavior is a fundamentally flawed exercise.” He also noted that if the market can price a stock to yield 18%, why not 36%? At some point, markets need to return to some level of rational pricing. In the meantime, these price disruptions allow investors to lock in what look like irrational yields, and if these yields are on stable dividend paying companies, you have locked in those yields for the long-term.

This week three stocks that I follow have been hit by either unfounded rumors or just plain old misleading Internet information, resulting in big share price declines and the opportunity to pick up tremendous yields and upside potential. Before I discuss these three, I want to note that the AMZA ETF is currently priced to yield over 30%, which is another way you might want to lock in an extra high yield.

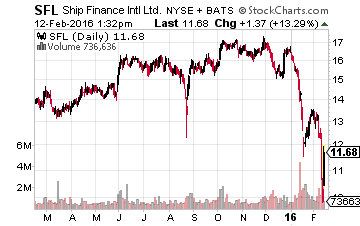

With a share price decline from around $16.50 to a current $10.50, Ship Finance International (NYSE: SFL) is now priced to yield 17%. This week’s drop from above $13 was fueled by a rumor that one of SFL’s bulk carrier leasing customers was on the verge of bankruptcy. The eight ships were just purchased last Fall in a sale/leaseback deal. It seems unlikely that Ship Finance would not have done the deal unless they could verify the stability of the new customer. It seems that this rumor was some chat room claim, probably started by someone who wanted to short the stock.

Even though its share price can be volatile, Ship Finance has a 12-year history including through the financial crisis and last bear market of steady cash flow growth. The company will report fourth quarter earnings before the end of February, and news of business as usual should cause a nice share price recovery.

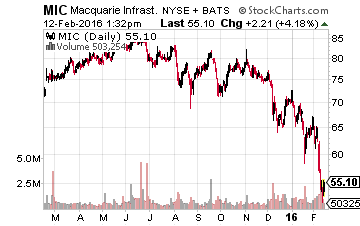

Then, Macquarie Infrastructure Corp (NYSE: MIC) has been the victim of a completely erroneous internet article which incorrectly stated that MIC had declared a dividend of $0.42 per share for the fourth quarter of 2015. The company issued a press release to clarify that it did not issue any Q4 dividend or other information. For reference, MIC paid $1.13 per share for the third quarter. The share price is down 18% over the last week and now yields 8.5%.

The true story is that MIC has been growing its dividend each quarter for the last 10 quarters and should announce another payout increase when earnings are actually announced on February 22. Historically, MIC has been priced to yield between 5% and 6%, which points to a 40% share price increase to get back into that range.

The news on

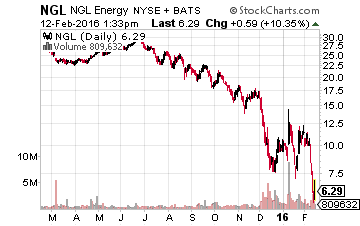

NGL Energy Partners LP (NYSE: NGL) has been very mixed, with both good adjustments by management to sustain the business in the current energy environment and a recent not-so-good quarterly earnings report. The market has focused on the bad news and has driven the NGL value down so far that the current yield is 44%. Yes, 44%!

Management has stated that they can maintain the current distribution rate, but, obviously, the market doesn’t agree. My analysis produces a 60/40 possibility that the dividend rate will not be cut. However, if the rate was reduced by one-third, the company would generate plenty of excess cash flow to cover the new rate, and the yield would still be around 30% based on the current unit value.

Keep in mind that at this point in time this is a speculative trade and not an income investment. However, if NGL does get through the next year or so with all or even most of the distribution rate intact, buying NGL now will be a several hundred percent winner. Against that, there is the small but distinct possibility that there is actually something really wrong with the company.

The stock market can get very irrational both when share prices get too high and also when they get too low. One feature of market corrections is that shares of good companies get really, really cheap. Too cheap. For dividend and income-focused investors, these are once in a decade or so opportunities to lock in high yields. For example, Ship Finance was last at $10 in 2011 when the dividend was $0.30 per quarter. Since then investors have earned $6.00 per share in dividends and the quarterly rate is now $0.45.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

Disclosure: more