Country Stock Markets See Downside Mean Reversion

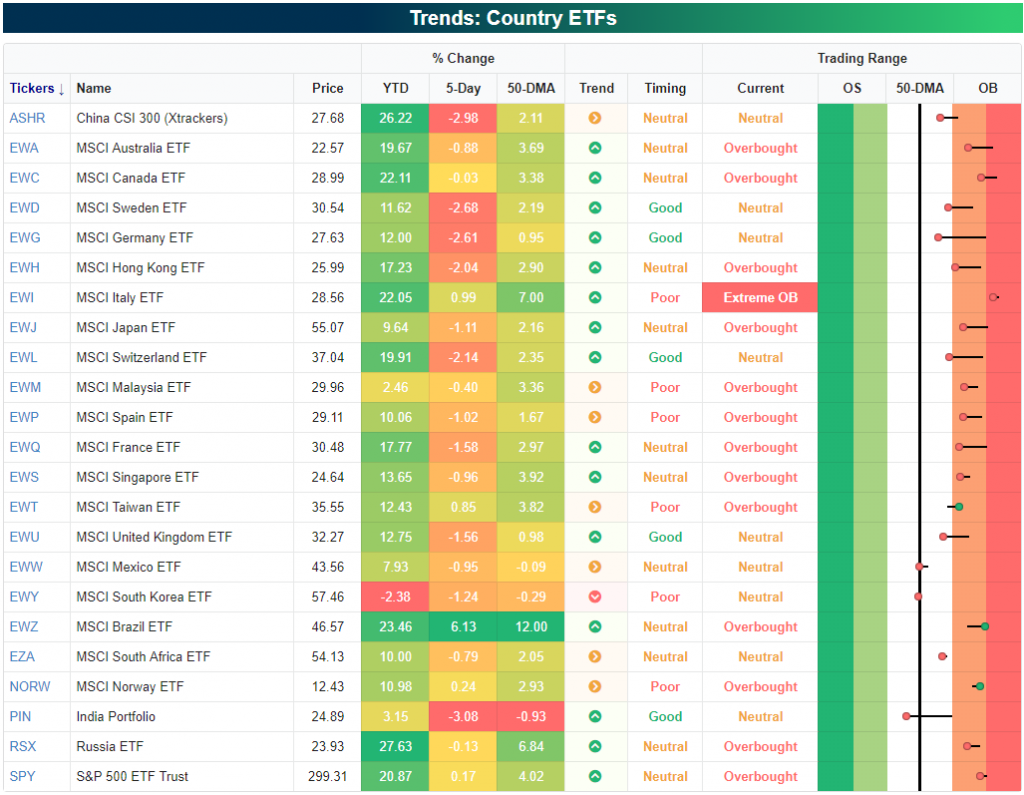

Yesterday we highlighted the year-to-date performance of stock markets for 75 countries around the world. Below is a snapshot of how 23 of the largest countries have been performing more recently relative to their normal trading ranges. While Brazil (EWZ) is up 6% and the US (SPY) is up slightly over the last 5 trading days, most countries are actually in the red. Given how extended a lot of countries were last week at this time, the action we’ve seen since then can be categorized as simple downside mean reversion.

While nearly all of these country ETFs are above their 50-day moving averages, there are three countries that have moved below — South Korea (EWY), Mexico (EWW), and India (PIN). India has shown the most weakness over the last week with a decline of more than 3%, leaving it 1% below its 50-DMA.

As mentioned earlier, Brazil (EWZ) has seen a huge move higher gaining 6% over the last week. The ETF is now 12% above its 50-day moving average, but remarkably, it’s still not even two standard deviations above its 50-DMA because of the big volatility the ETF typically experiences.

(Click on image to enlarge)

Start a two-week free trial to one of Bespoke’s three premium subscription services for in-depth market analysis ...

more