Clean Energy Outshining

Looking across the ETF space, there are only a handful with dividend yields above 10%. While most high yielding ETFs are income-focused funds there is currently one outlier: the VanEck Vectors Coal ETF (KOL). This ETF focuses on equities associated with coal mining, equipment, and transportation. As investors have favored more sustainable options over fossil fuels, the deterioration in KOL’s share price over the past couple of years has elevated the yield to more than 11.5%. In other words, that high yield has come at a cost.

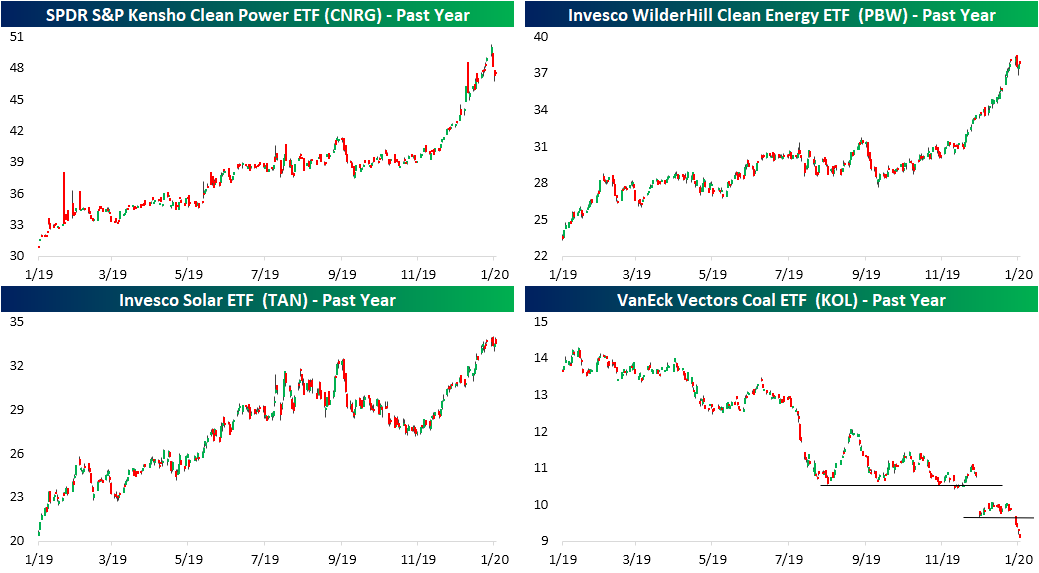

KOL has already fallen over 8% in 2020 and that is in the context of a 21.25% decline in 2019 and more general weakness of the energy sector. While KOL has majorly lagged the S&P 500, its underperformance is even more dramatic when compared to clean-energy focused ETFs which have gained favor as ESG investing has stepped into the spotlight. As shown below, the Solar ETF (TAN) was actually one of the top-performing of these in 2019, notching a 66% gain and now adding another 8.21% YTD. Likewise, the SPDR S&P Kensho Clean Power ETF (CNRG) and Invesco WilderHill Clean Energy ETF (PBW) also rose twice as much as the S&P 500 in 2019. Though CNRG’s year to date outperformance versus the S&P 500 is marginal, the general trend has remained in place so far.

KOL has not only been in a downtrend over the past year but over the past week it has broken down further. That comes after a gap down in late December which broke through support that had been in place since August. While KOL has legged lower, clean energy ETFs have gone parabolic.

Overall, the price changes of these ETFs and their underlying stocks helps to illustrate the general rotation out of fossil fuel focused stocks and into those that are more climate-conscious. Some of this recent strength for CNRG and PBW comes as a result of the strong performance of electric vehicle stocks like Tesla (TSLA) and Nio (NIO) which are some of the largest holdings. Similarly, TAN owes some of its gains in recent weeks to the strong performance of its top holdings. While not as large as TSLA’s 30% gain in 2020, TAN’s top holding of SolarEdge (SEDG) has experienced a similar rally to NIO of around 15% year to date. That is after it rose 167.8% in 2019.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our Bespoke Report, Chart Scanner, custom portfolios, ...

more