Clean Energy Funds Outperforming Traditional Oil And Gas ETFs

It’s a tough time for the energy sector, that’s for sure. Over the past 12 full months, shares of the Energy Select Sector SPDR (NYSE Arca: XLE) slid 36%.

Pulling its components from the S&P 500, XLE offers concentrated exposure to oil and gas giants such as Chevron Corp. and Exxon Mobil Corp. In fact, CVX and XOM themselves make up half of XLE’s market capitalization. As they go, so goes XLE. And they’ve gone down in the past year: a 27% swoon for CVX and a 39% dive for XOM.

It’s not just the big integrated outfits that are hurting. Pretty much every segment of the energy market has suffered over the past year: oil and gas producers off 49%, oil services outfits down 54%, and refiners 21% weaker.

But amid all the gloom, there’s a bright spot. A clean and shiny spot you might say. It’s clean energy. As bad as the oil and gas segment has sunk, clean energy has risen. And then some. Take, for example, the First Trust Nasdaq Clean Edge Green Energy Index Fund (Nasdaq: QCLN), a 42-stock portfolio of manufacturers, developers, distributors and installers in the alternative energy space.

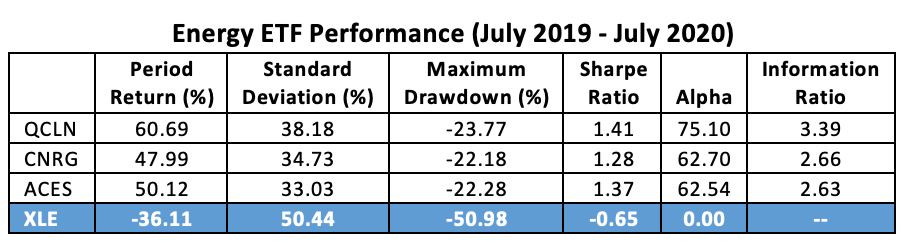

In the past 12 full months, QCLN’s share price has appreciated 61%.

So what’s in the alternative energy space that cranks out such gains? Well, QCLN’s underlying index is broken into four sub-groups:

- Advanced Materials — including companies producing nanotech, membranes, silicon, lithium, carbon capture and utilization as well as other materials and processes that enable clean-energy technologies;

- Energy Intelligence — firms engaged in energy conservation and the manufacture of automated meter reading equipment, energy management systems, smart grid technologies, superconductors and power controls;

- Energy Storage and Conversion — makers of advanced batteries, hybrid drivetrains, hydrogen and fuel cells for stationary, portable and transportation applications, and

- Renewable Electricity Generation and Renewable Fuels — outfits supplying solar photovoltaics, those concentrating solar, wind and geothermal energy, together with manufacturers of ethanol, biodiesel and biofuel-enabling enzymes.

With a 13% allocation, electric auto maker Tesla, Inc. is, no pun intended, the key driver of QCLN’s appreciation over the past year. In that time, TSLA’s share price has rocketed 455% higher. Overall, QCLN’s a pretty top heavy portfolio: Its top ten constituents account for 57% of its total capitalization.

QCLN’s competitors are more ecumenical. The tier-weighted SPDR S&P Kensho Clean Power ETF (NYSE Arca: CNRG) stands out as an example. Each of CNRG’s 39 issues is equally weighted at the outset, subject to an overweighting factor applied to the stocks of companies focusing on renewable energy. CNRG’s weightiest component—at 6%—is Vivant Solar, Inc., a Utah-based provider of residential solar energy systems. Over the past 12 months, VISR shares have appreciated 158%, helping to propel CNRG to a contemporaneous 48% gain.

A middle ground is plowed by the ALPS Clean Energy ETF (Cboe BZX: ACES), a portfolio of 31 North American clean and renewable energy outfits. The fund’s underlying index is market cap-weighted, subject to a 5% cap on individual issues at each rebalancing. Like QCLN, the weightiest constituent is TSLA—now, because of recent appreciation, nearly 9% of ACES’ market weight--subject to being pared back at the next quarterly reconstitution in September. ACES’ share price has climbed 50% higher over the last 12 months.

Besides handily besting the petroleum complex, these three ETFs outdo conventional energy portfolios in another way. QCLN, CNRG and ACES all skew to smaller stocks. And that’s an important consideration for diversification. Overall, small- and mid-cap stocks have lagged large caps over the past year. Clean energy stocks are outliers, though. On average, the clean energy funds give over only 16% of their portfolio to large caps. Compare that against XLE’s 99% allocation to the big guys.

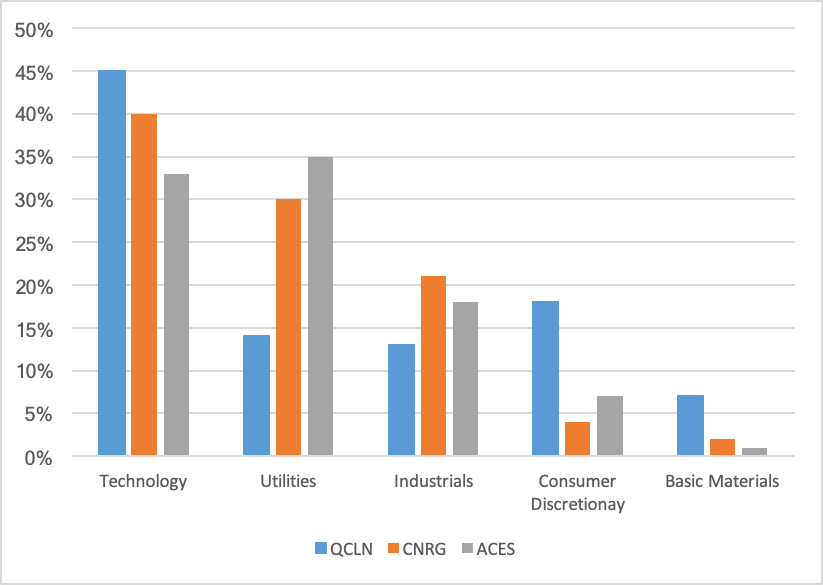

Diversification is made manifest along another spectrum as well. XLE is a singular sector exposure. QCLN, CNRG and ACES allow investors access to multiple market segments. Technology stands out with an average exposure of 39%, followed by utilities at 26% and industrials at 17%.

Sector Exposure of Clean Energy ETFs

You’d think the gains engendered by these clean energy ETFs would come at a volatility premium, but you’d be wrong. At least for the past year. Volatility tends to increase in down moves. And it’s been the conventional energy sector that’s faltering, widening the volatility gap as you can see below:

The clean energy portfolios have provided far more favorable reward-to-risk ratios than the large-cap oil-and-gas ETF. The question advisors and investors now must ponder is the potential persistence of this advantage.

Clearly, clean energy’s riding the crest of a secular wave. To be sure, the segment’s outperformance has been made all the more dramatic by the recession-plagued petroleum complex. Keep in mind that the oil-dominated XLE fund has been losing ground since its 2014 peak. Clean energy funds are in uncharted territory now, but technical signals are still very bullish. So, while there may be wobbles ahead, there’s reason to believe this wave isn’t likely to crash anytime soon.

Disclosure: None.

All forms of energy are in a well balanced portfolio although clean energies are growing as a whole component of the market. That said, any major crimp in oil supply or big jump in demand will still have the potential to cause inflation and roil the markets. This has not happened in clean energy yet.

Interesting and educational