Charts I’m Watching - Friday, January 25

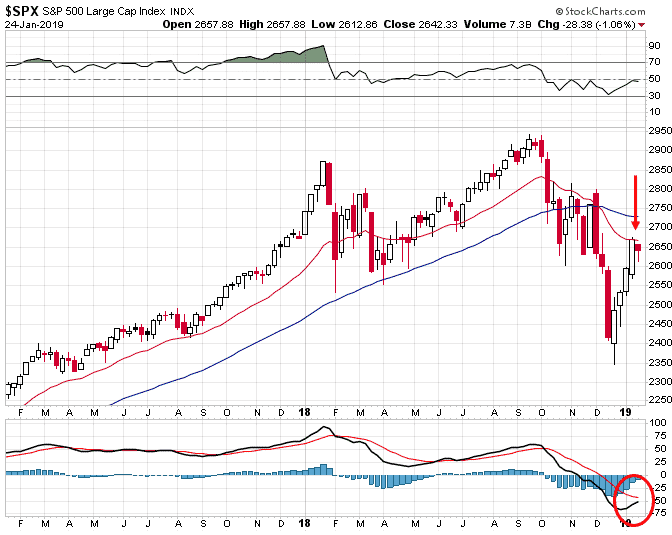

$SPX stalling at the 20 week EMA. RSI 50 also proving difficult to break above. On the plus side, it’s close to a MACD cross.

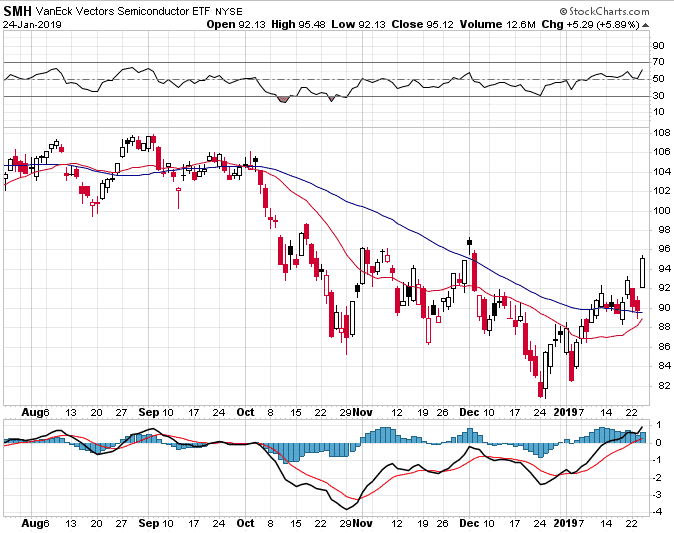

SMH tend to be a great leading indicator and it had a huge day today with some positive earnings. That’s a good sign for the market when aggressive sectors are doing well. SMH is putting in a nice series of higher highs and higher lows and is one of the first sectors where the 20 day moving average is going to cross above the 50.

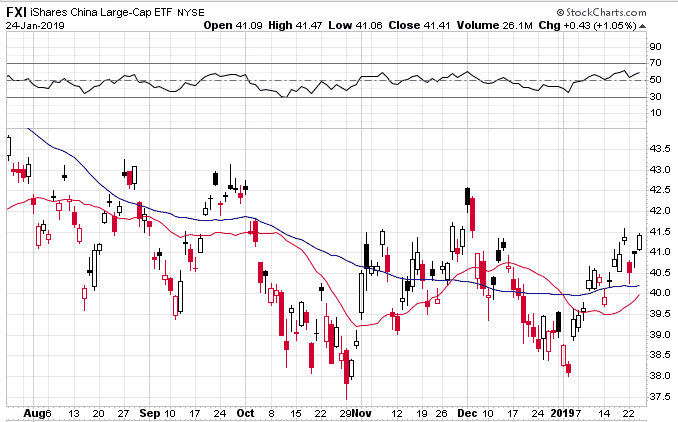

FXI continues to act well holding above the 50 and 20 day moving averages and is close to a golden cross.

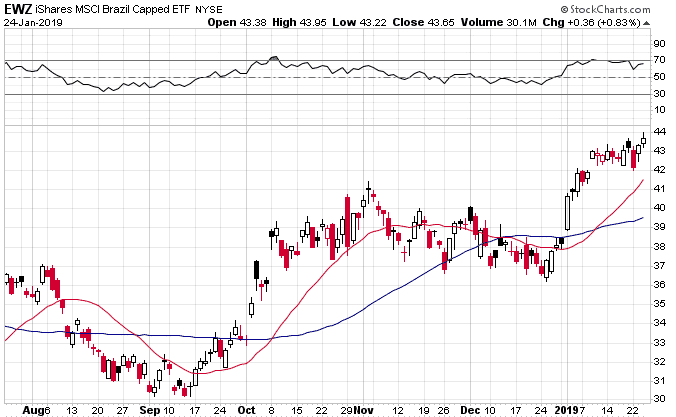

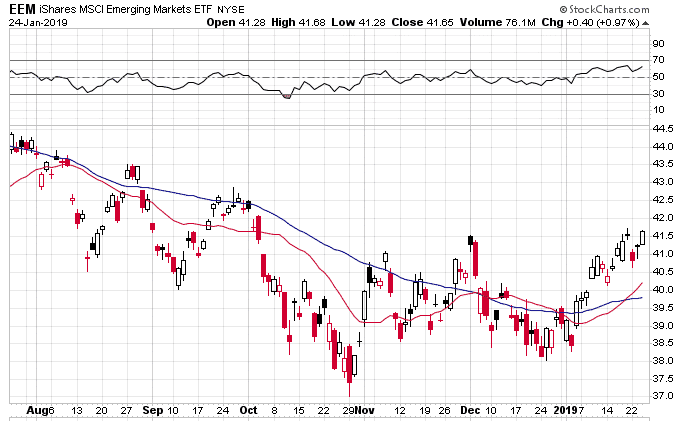

EEM and EWZ also showing excellent relative performance.

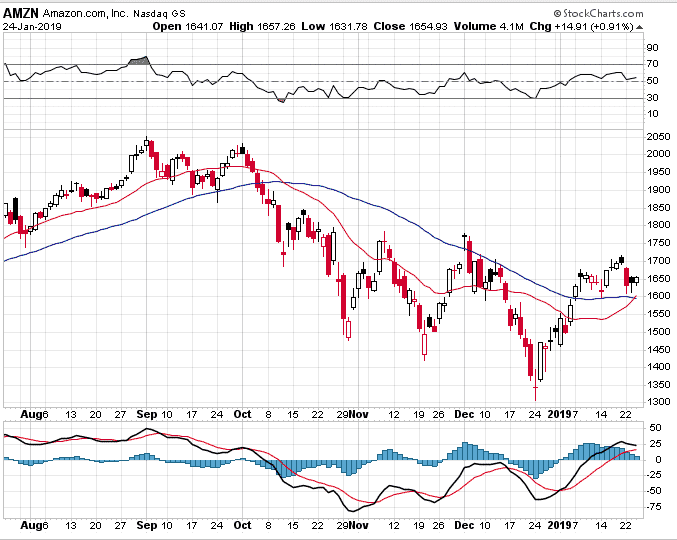

AMZN holding above the moving averages and looking much more positive. Need to watch the potential bearish MACD cross.

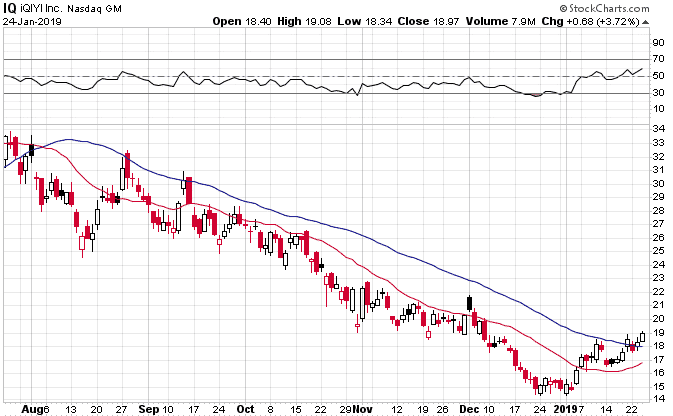

IQ forming a nice base and series of higher highs and higher lows. Needs to hold above the 50 day moving average.

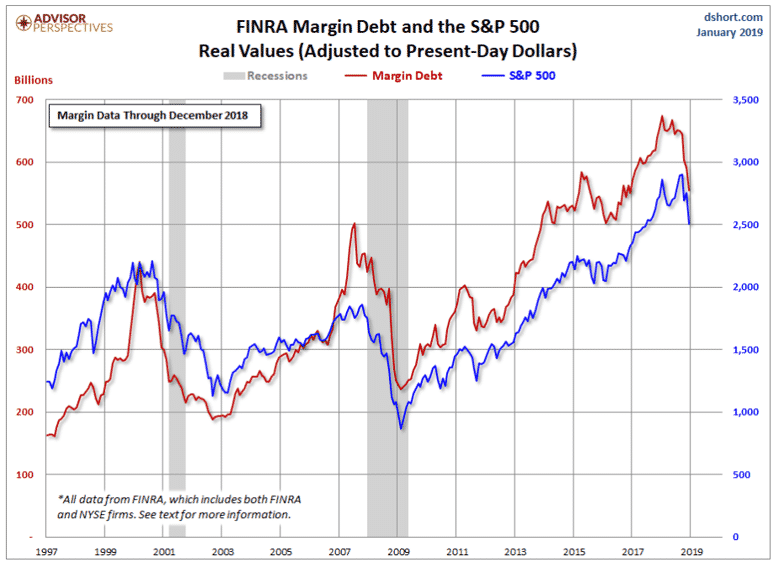

Margin debt is falling off a cliff. Not a great sign for market liquidity.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more