Big Oil November Outlook

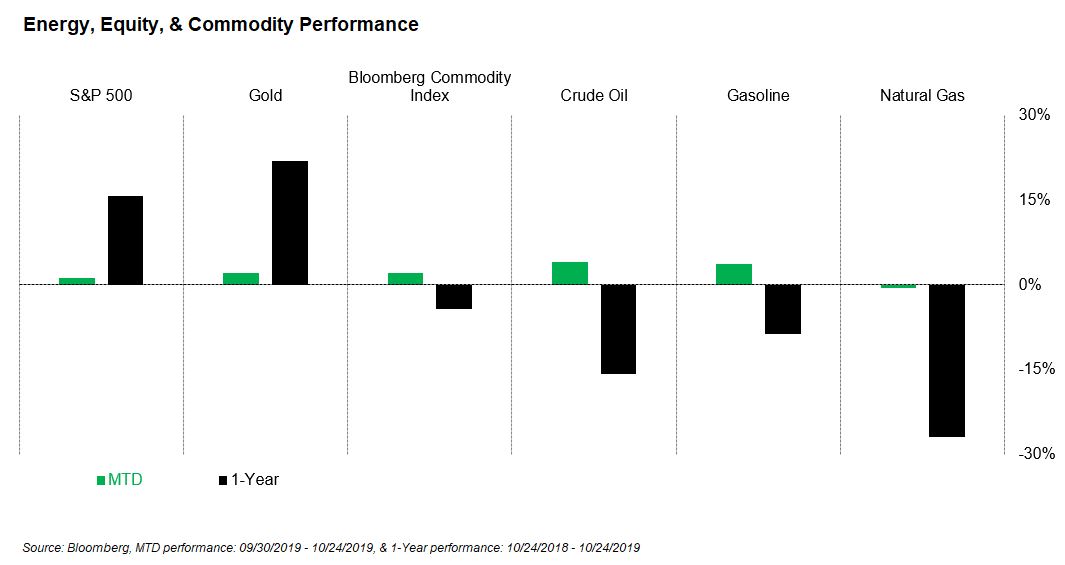

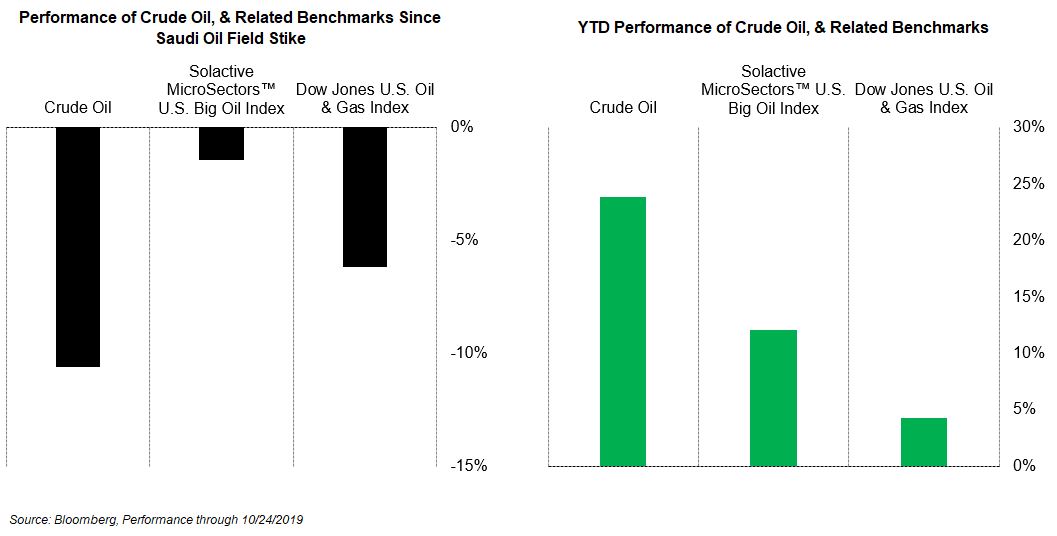

- Crude oil looks to snap its 2-month losing streak, rallying +4.0% in October (through the 24th). The Solactive U.S. Big Oil, & Dow Jones U.S. Oil & Gas indices have lagged crude over the same period – +3.6% & -0.4% respectively.

- Despite the October rally, crude has not retested recent highs set following the attacks on Saudi facilities. Falling -10.6% from September 16th.

- U.S. & global crude supplies have led recent headlines; U.S. reported surprise stockpile draw, & OPEC considers deeper production cuts.

- Macro to watch; Fallout from U.S. withdrawal of Syria, U.S. stock market at all-time highs, Fragile global economy, & U.S./China trade talks.

- Micro to watch; Will U.S. supply continue to fall? Will OPEC follow through on cuts to production forecasts? How will rising transportation costs effect U.S. exports? Will Venezuelan turmoil impact production? Pentagon planning to send tanks, armored vehicles to Syrian oil fields.

Macro Backdrop:

Micro Backdrop:

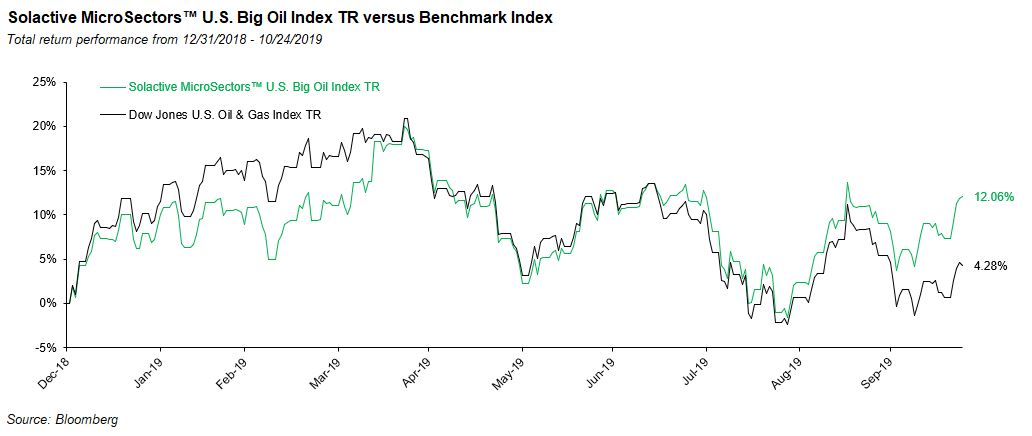

The Dow Jones U.S. Oil & Gas Index benchmark has lagged the Solactive U.S. Big Oil Index in 2019.

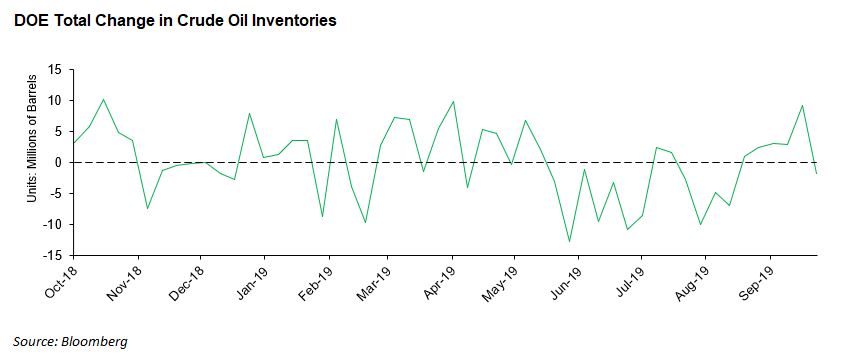

Crude futures rose sharply following reported draws in crude & refined products inventories for the week ending October 18th. U.S. crude inventories fell by -1.7 million barrels WoW, considerably lower than the median analyst estimate of +3.0-million-barrel build.

Big Oil Stock Spotlight & Earnings Expectations

- There are troubling headlines surrounding Exxon (XOM) as we head further into earnings season. Exxon warned investors in an SEC filing that falling crude prices would hurt Q3 earning. The company stated that quarterly profits could drop 50% YoY to roughly $3.1 billion. Additionally, Exxon was accused by the New York attorney general of misleading investors over the financial risk of climate change. The implications of this suit extend beyond Exxon, reverberating throughout the energy sector. Exxon is continuing divestment efforts as they sold Norwegian assets last month (for $4.5 billion), and are considering the sale of Australian, and Malaysian assets. Despite these efforts, the company looks to reallocate to its newfound interest in budding economies like India and Mozambique. The company recently entered a partnership with Oil and Natural Gas Corp – the largest state-run explorer in India. Exxon will share tech and expertise to identify deposits in deep water areas. It also plans on investing upwards of $500 million in Mozambique production efforts.

- Marathon Petroleum (MPC) has had a tremendous run up in recent weeks following a massive sell off in August. Elliott Management, weary of the oil giant’s underperformance, sent a letter to the board of MPC, laying out a plan to create $22 billion in shareholder value. In the letter, they suggest breaking Marathon into three separate entities: Speedway convenience stores, refining, and pipeline assets. MLPX (MPLX) would convert to a corporation and no longer be a partnership.

- After spending big on Anadarko, Occidental Petroleum (OXY) has remained steadfast in pursuing its $10-15 million deleveraging plan. The oil company sold Anadarko’s African assets to Total (TOT) for $8.8 billion with $3.9 billion already completed. They also sold a stake in Plains All American (PAA) and Plains GP Holding (PAGP) for $650 million, and announced a $750 million cash/$750 million carried capital joint venture with Ecopetrol (EC). Seemingly poised to deliver, OXY’s goal of doubling exports to 600 thousand bpd in 2020 might be out of reach. Surging freight costs could significantly hinder profits and cause the company to reconsider exporting on a large scale. Earlier this month, OXY spent a record $15.8 million on a supertanker charter carrying crude from the U.S. to Asia.

- Chevron (CVX) recently scored in Latin America. The oil company grew its upstream portfolio after purchasing 40% of 3 deep water blocks in the Mexican gulf from Royal Dutch Shell (RDS.A). Additionally, Chevron won another 90-day reprieve to continue business operations in Venezuela, as the deadline was extended the deadline from Oct. 25 to Jan. 22. Chevron is looking to shrink its exposure to the middle east through the sale of its stake in an Azeri oil field. CVX is currently in talks with Hungarian energy firm MOL (MGYOY) over the stake valued at more than $2 billion.

Disclaimer

Source: Bloomberg L.P. Solactive MicroSectors™ U.S. Big Oil Index was launched on 2/25/2019. The Solactive MicroSectors™ U.S. Big Oil Index data prior to that date is ...

moreComments

Please wait...

Comment posted successfully.

No Thumbs up yet!