Best Long-Term Performance Real Estate ETFs

-

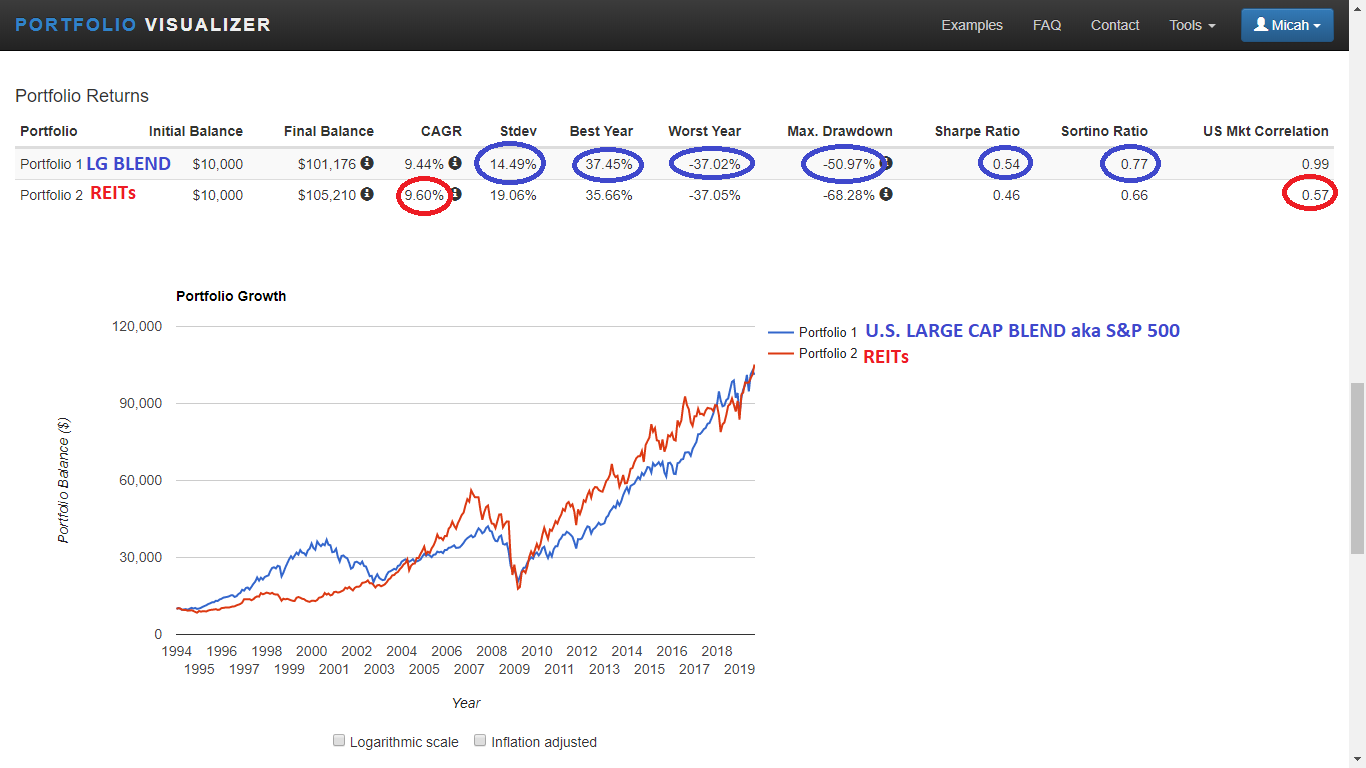

The REIT asset class has had returns comparable to an S&P 500 index fund since 1994 while maintaining a low U.S. Market correlation of 0.57

-

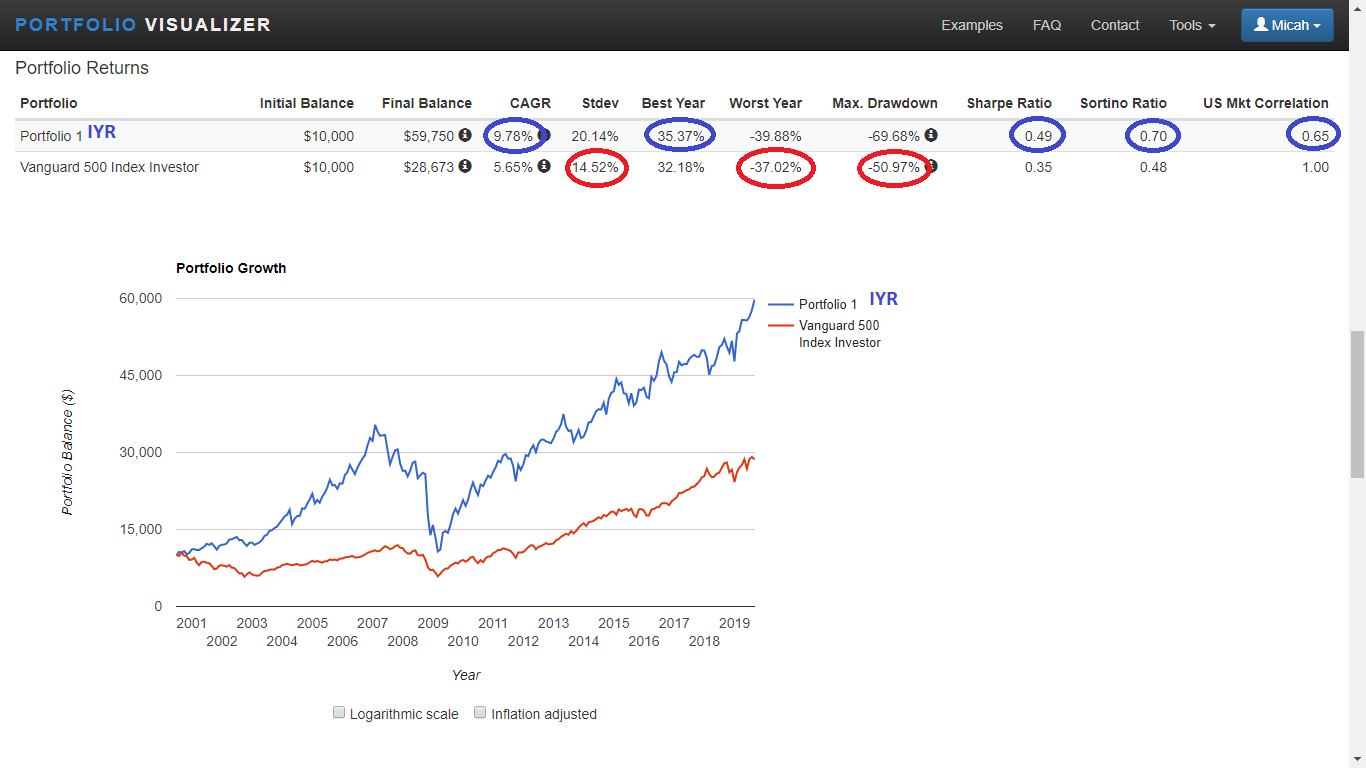

The oldest available Real Estate ETF has outperformed an S&P 500 index fund by 4.13% CAGR over the last 19 years

-

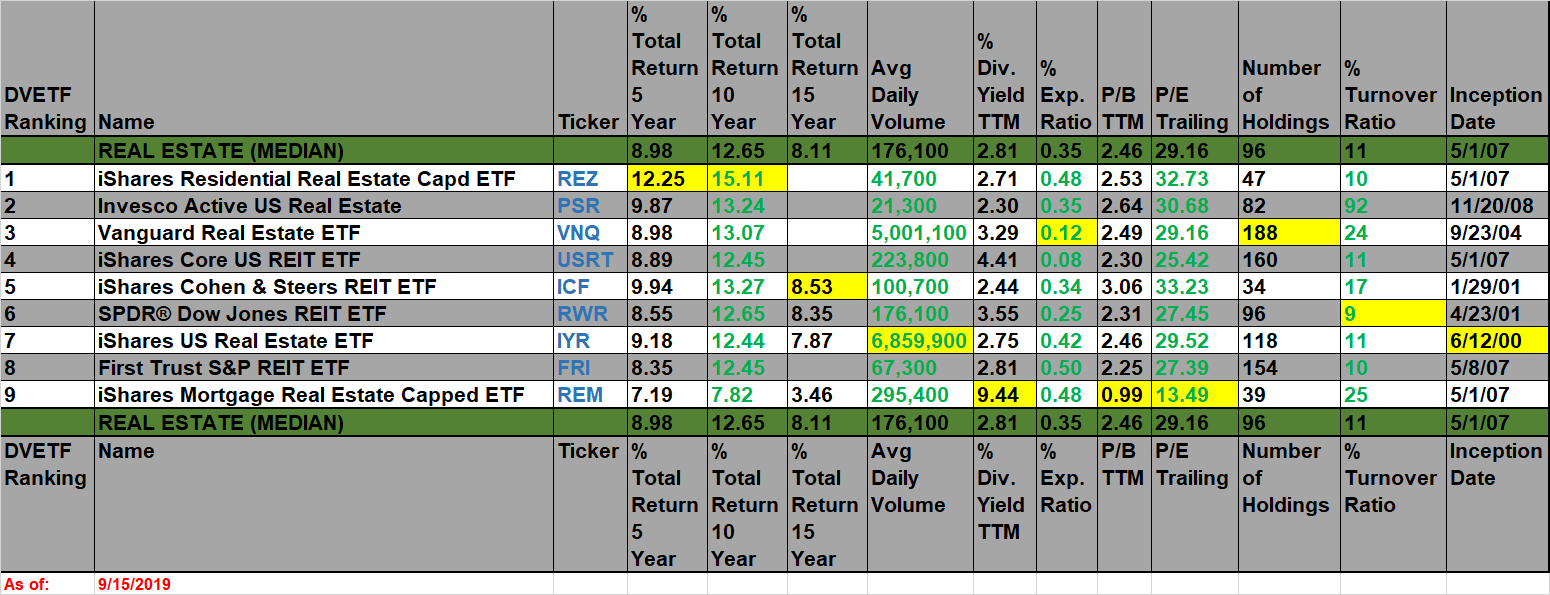

There are currently 28 ETFs available in the Morningstar Real Estate Category. 9 of those ETFs are 10 years old or older

REITs vs US Large-Cap Blend (aka S&P 500): January 1994 - August 2019

Source: https://www.portfoliovisualizer.com/

The oldest Real Estate ETF is the iShares U.S. Real Estate ETF (IYR). Its' inception date was June 12, 2000. Since inception, this ETF has outperformed an S&P 500 index fund by 4.13% CAGR with a relatively low correlation to US Markets of 0.65.

IYR vs S&P 500 Index fund: July 2000 - August 2019

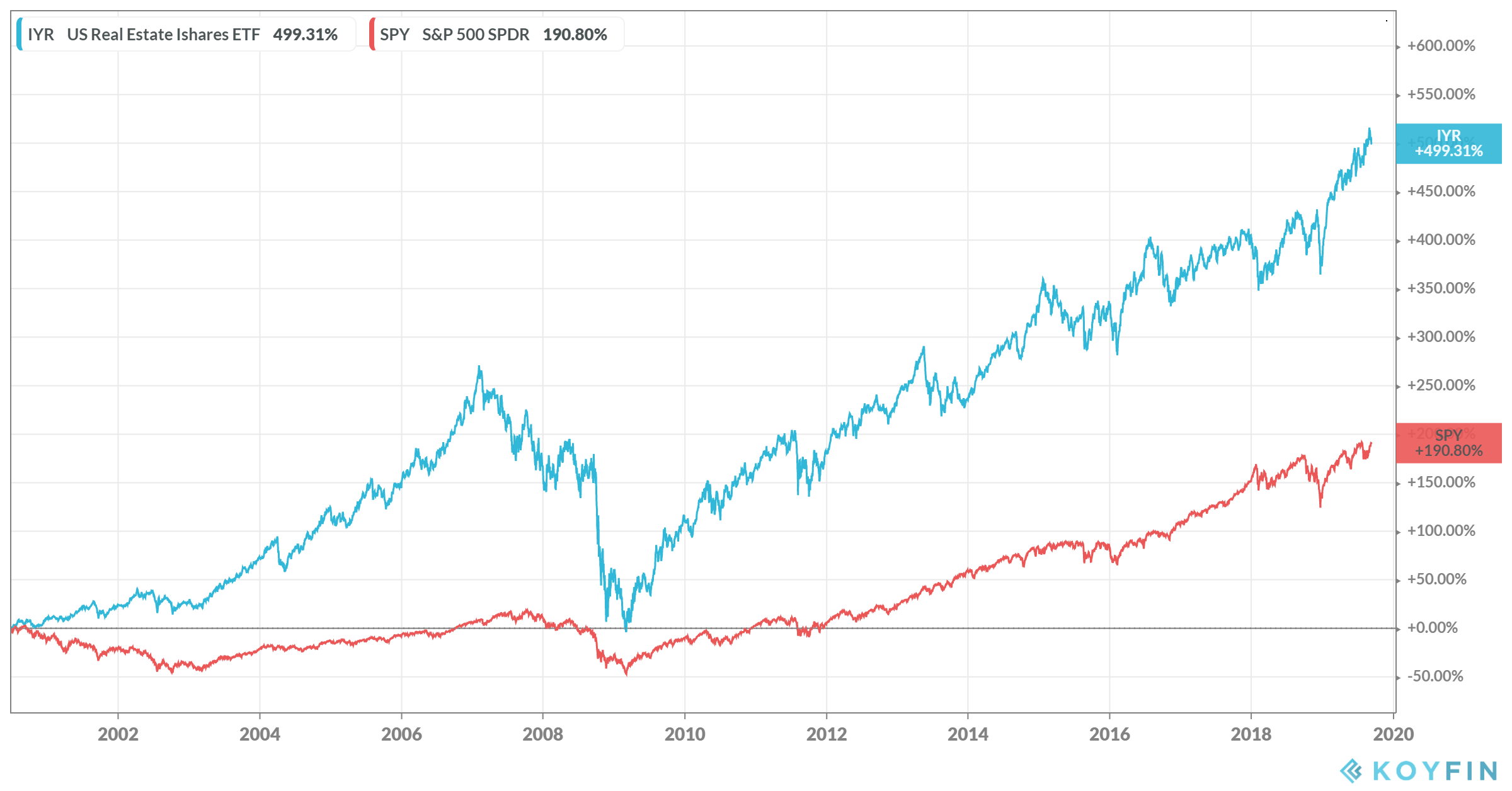

IYR vs SPY: June 19, 2000 - September 13, 2019

Source: https://www.koyfin.com/home

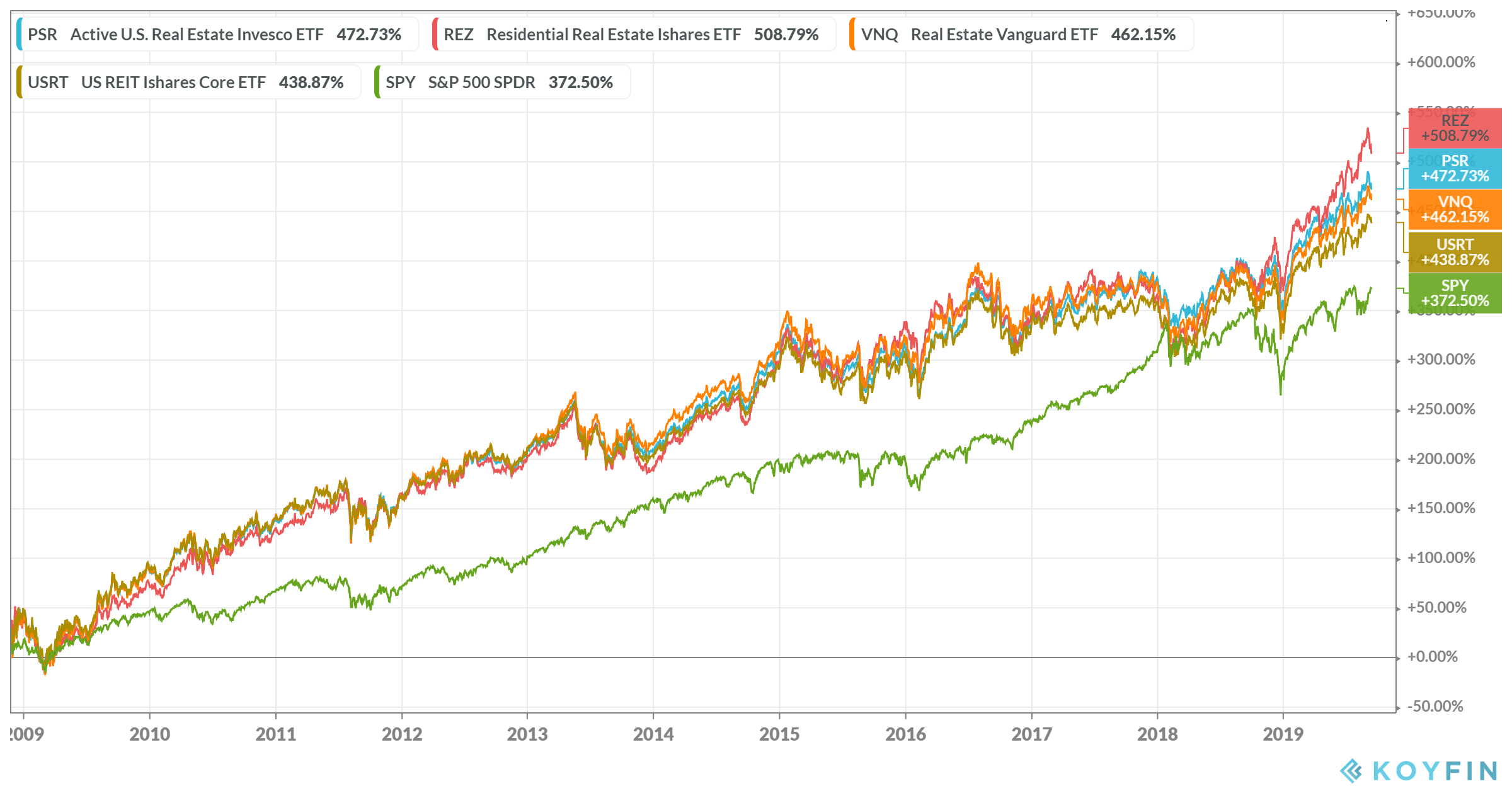

There are currently 28 ETFs available in the Morningstar Real Estate category. 9 of those funds have inception dates before September 15, 2009. The chart below shows how these 9 older funds ranked when comparing their long-term performance head-to-head using back-testing tools at KOYFIN and PortfolioVisualizer.

Source: https://www.morningstar.com/

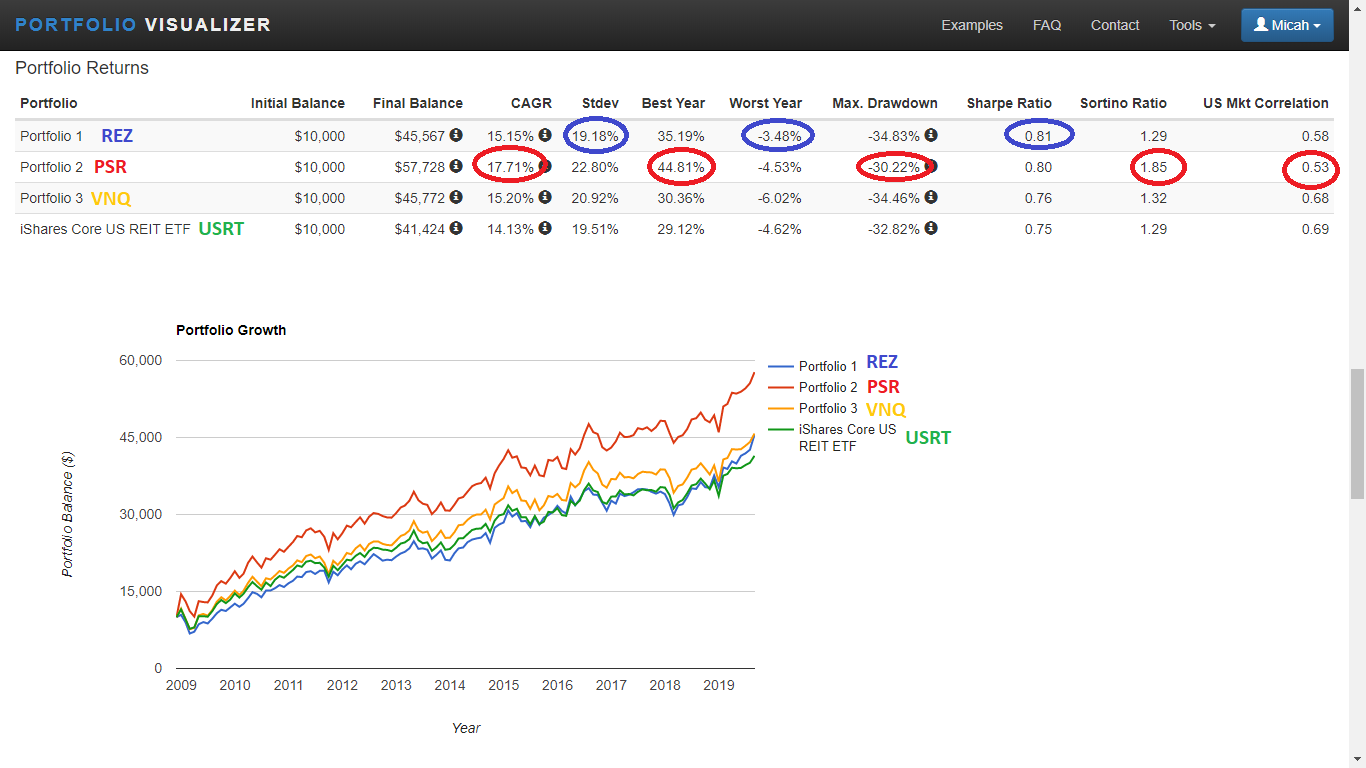

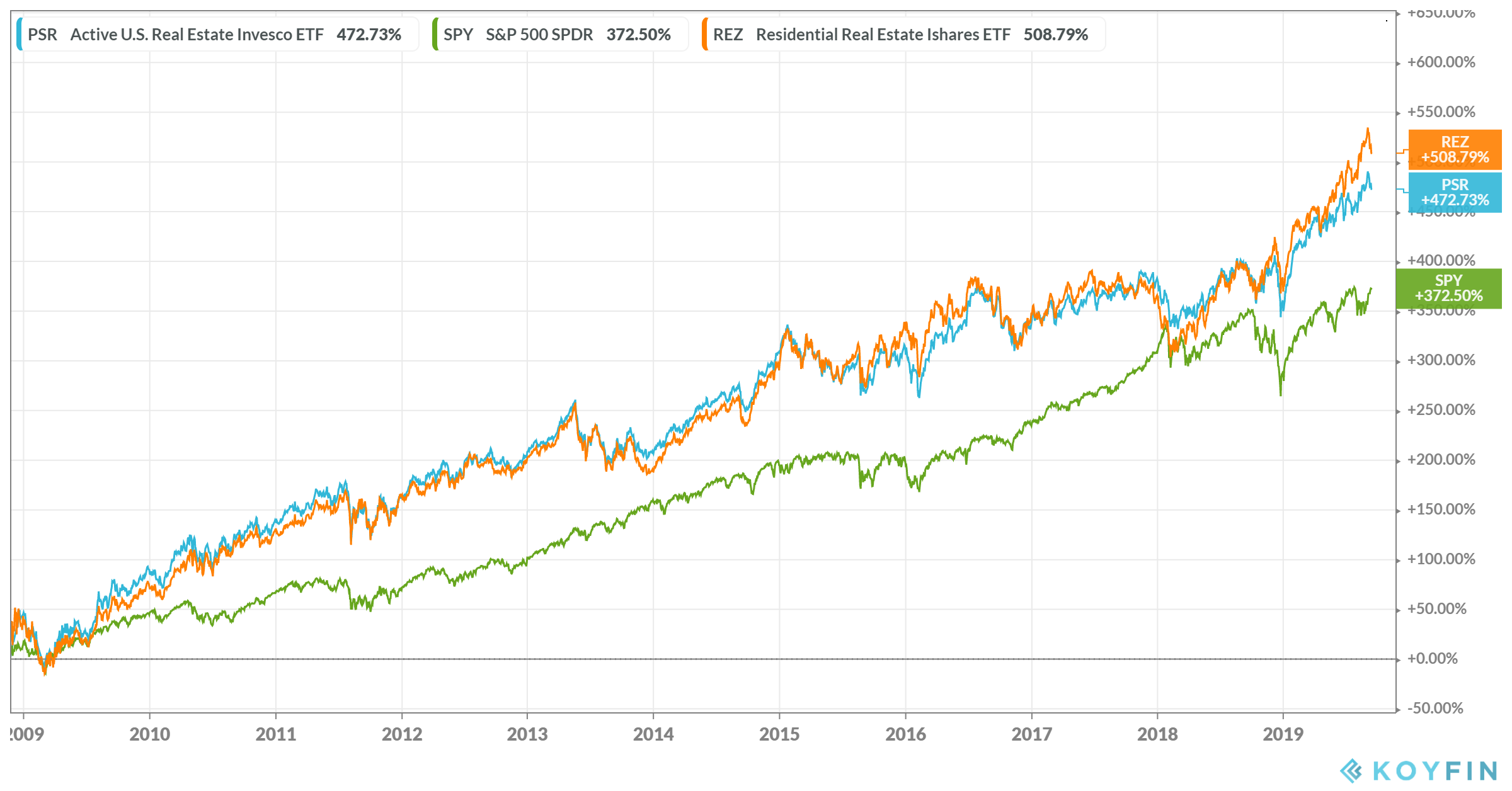

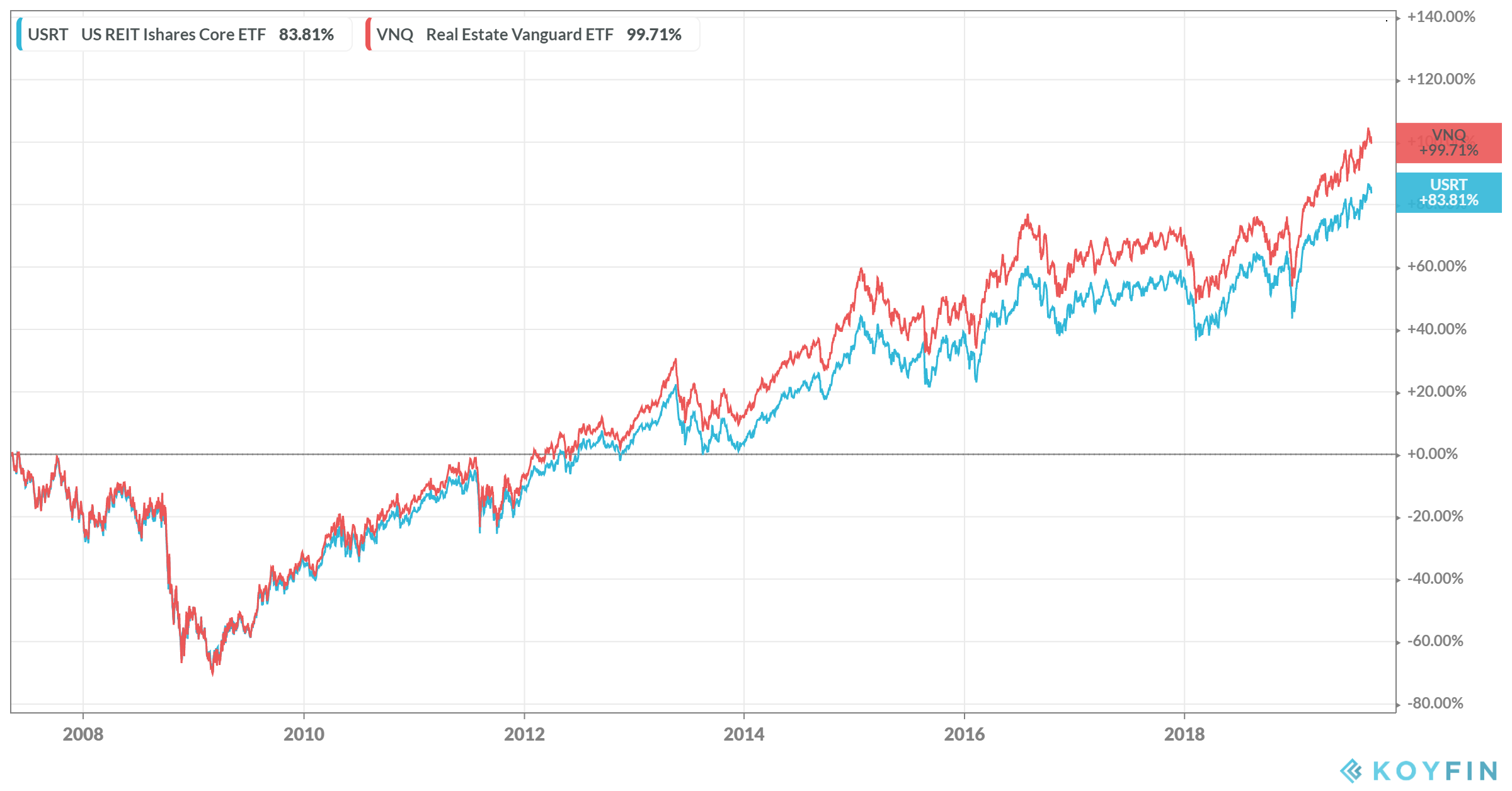

The 4 top-performing Real Estate ETFs were REZ, PSR, VNQ, and USRT. I discovered some conflicting data on the Invesco Active U.S. Real Estate ETF (PSR). This ETF is shown to have phenomenal returns on PortfolioVisualizer, but slightly worse than REZ on KOYFIN and Morningstar. Since PSR is a newer fund and it is actively managed, I went with the KOYFIN & Morningstar data and ranked it as #2. Below are a series of charts showing how these top 4 ETFs compared with each other head-to-head:

REZ vs PSR vs VNQ vs USRT vs SPY: November 21, 2008 - September 15, 2019

REZ vs PSR vs VNQ vs USRT: December 2008 - August 2019

REZ vs PSR: November 21, 2008 - September 13, 2019

PSR vs VNQ: November 21, 2008 - September 13, 2019

VNQ vs USRT: May 4, 2007 - September 13, 2019

These top 4 performing Real Estate ETFs differ considerably in what they are invested in and how the funds are managed. Listed below is each ETF's stated objectives:

REZ - The iShares Residential Real Estate ETF seeks to track the investment results of an index composed of U.S. residential, healthcare and self-storage real estate equities. Exposure to the U.S. residential real estate sector. Targeted access to a subset of domestic real estate stocks and real estate investment trusts (REITs), which invest in real estate directly and trade like stocks. Use to diversify your portfolio and express a view on a specific U.S. real estate sector.

PSR - The Invesco Active U.S. Real Estate ETF (Fund) structures and selects its investments primarily from a universe of securities that are included within the FTSE NAREIT All Equity REITs Index at the time of purchase. The selection methodology uses quantitative and statistical metrics to identify attractively priced securities and manage risk. The Fund will invest principally in equity real estate investment trusts (REITs). Portfolio management generally conducts a security and portfolio evaluation monthly.

VNQ - Vanguard Real Estate ETF Invests in stocks issued by real estate investment trusts (REITs), companies that purchase office buildings, hotels, and other real property. Goal is to closely track the return of the MSCI US Investable Market Real Estate 25/50 Index. Offers high potential for investment income and some growth; share value rises and falls more sharply than that of funds holding bonds. Appropriate for helping diversify the risks of stocks and bonds in a portfolio.

USRT - The iShares Core U.S. REIT ETF seeks to track the investment results of an index composed of U.S. real estate equities. Low-cost access to diversified U.S. REITs (Real Estate Investment Trusts). Seek income and growth with broad exposure to U.S. real estate across property sectors. Use at the core of a portfolio for long term exposure to U.S. real estate.

The Real Estate sector is a great way to diversify an equity portfolio. Investors have 28 ETFs to choose from in this category. It is my hope that readers can use the information provided to help narrow down that list and make their investment decision a bit easier.

Thank you for taking time to read this article. If you found it useful, please share it with a friend.

Disclosure: We currently own shares of REZ and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform you own due diligence or seek the advice of a ...

more