Best Long-Term Performance Consumer Staples Sector ETFs

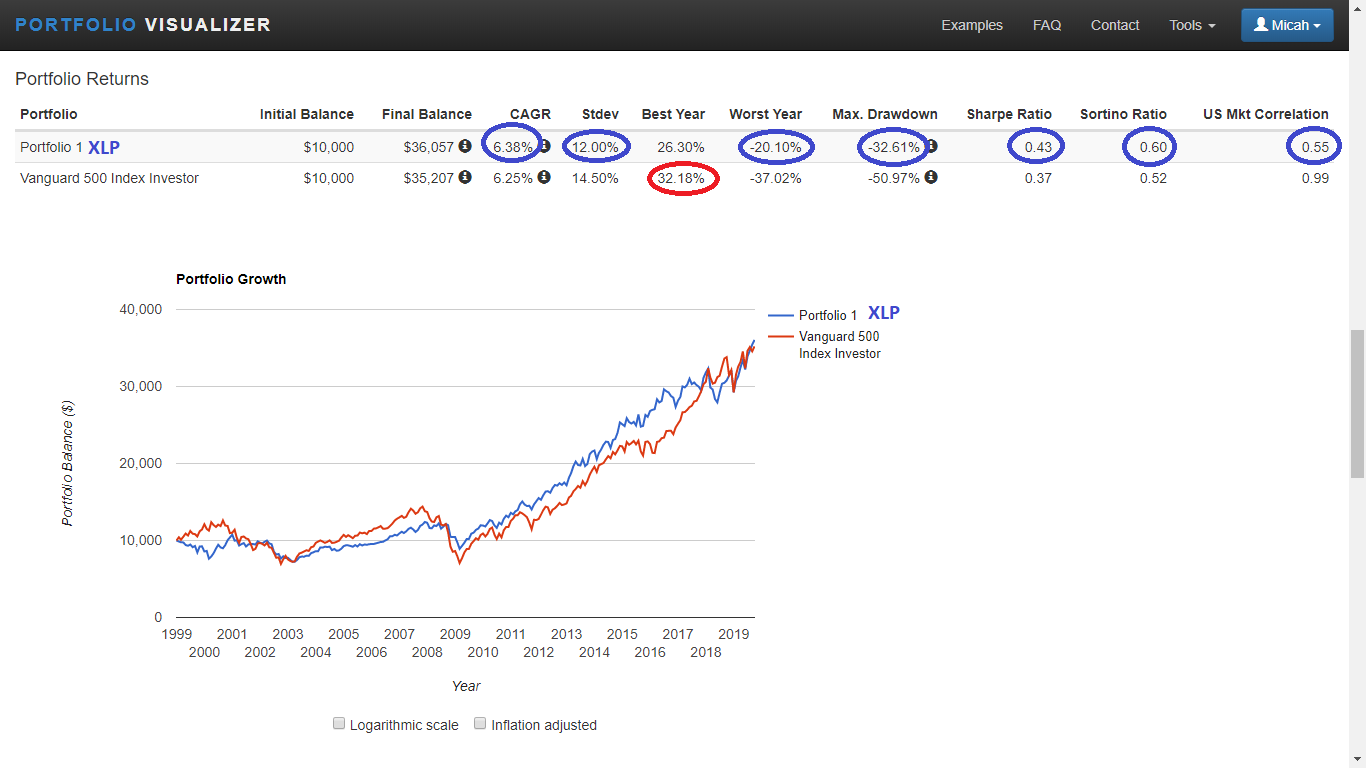

- The oldest Consumer Staples Sector ETF has outperformed an S&P 500 index fund by 0.13% CAGR while being less volatile and having a low correlation to the US equity markets

- There are 16 ETFs to pick from in the Consumer Staples category

- 8 of these Consumer Staples Sector ETFs have been available for 10 years or longer

- This article focuses on the long-term performance of these 8 older ETFs

XLP vs S&P 500 Index Fund: January 1999 - September 2019

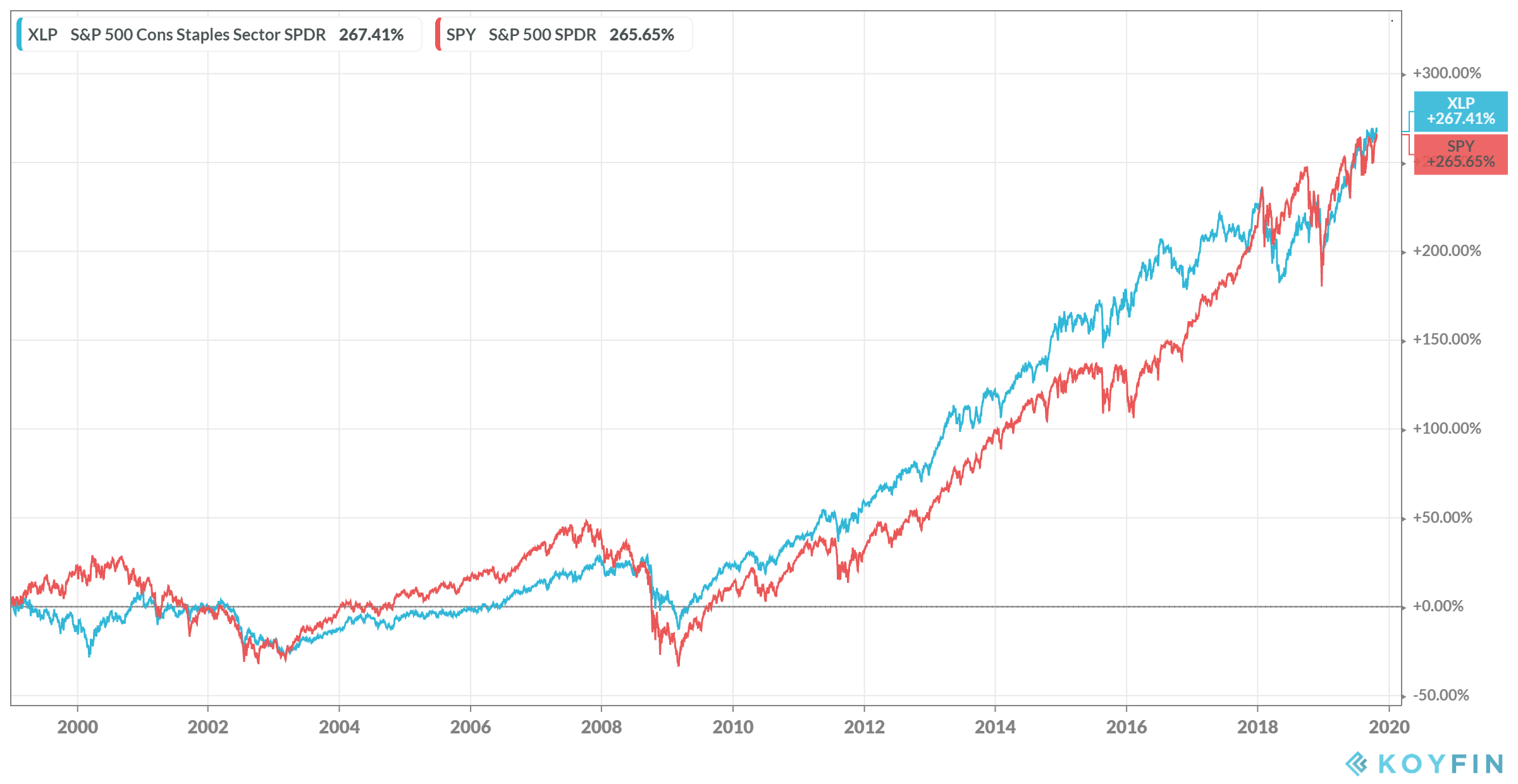

XLP vs SPY: December 22, 1998 - October 25, 2019

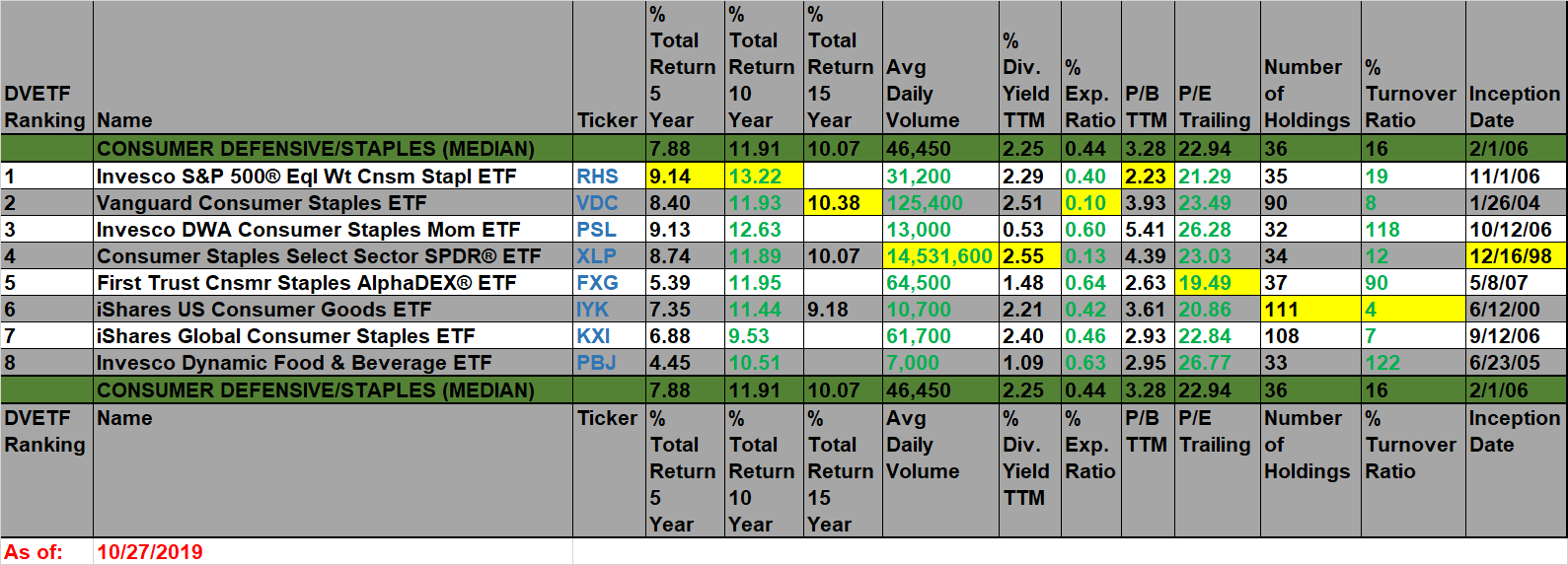

There are currently 16 ETFs available in the Morningstar Consumer Defensive category. 8 of these have inception dates before October 27, 2009. I have compared all 8 of these older ETFs head-to-head using the back-testing tools at Koyfin and Portfolio Visualizer. The chart below shows how they ranked based on long-term performance only.

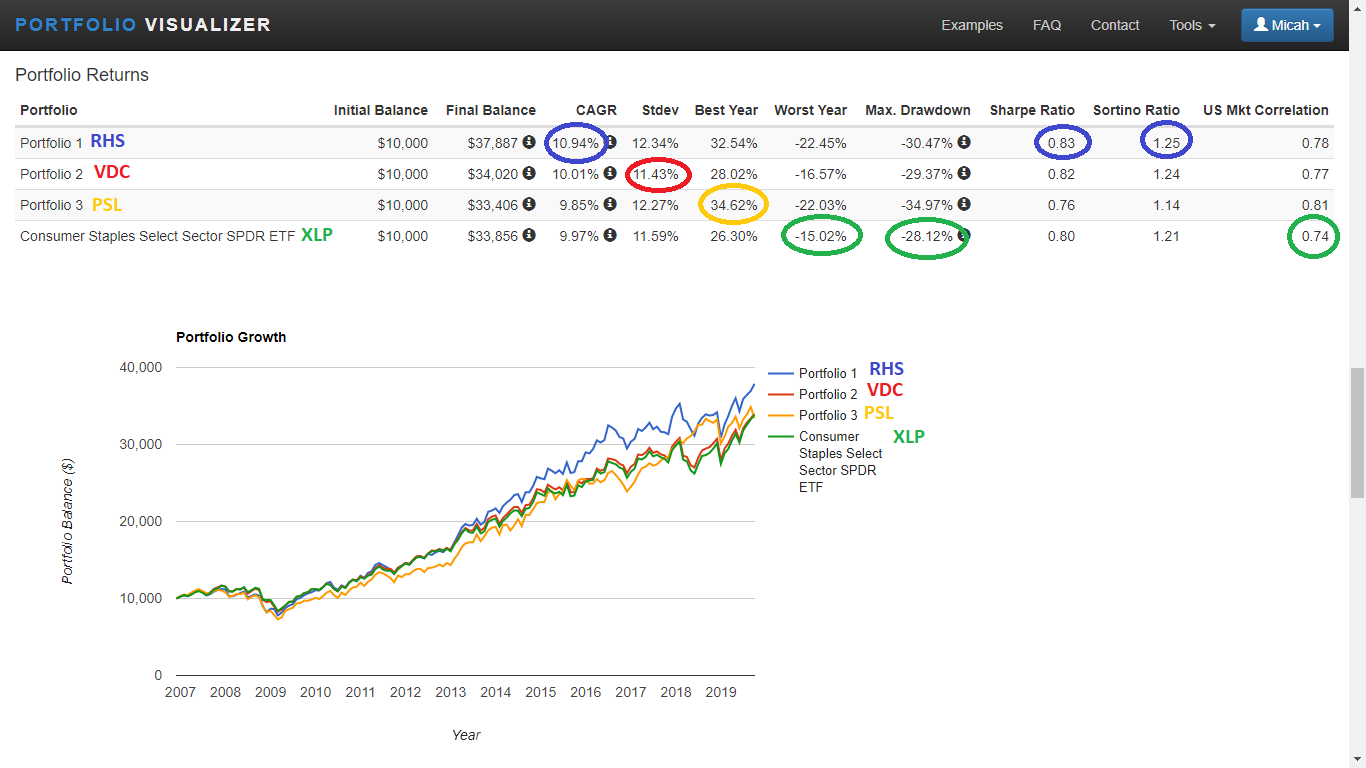

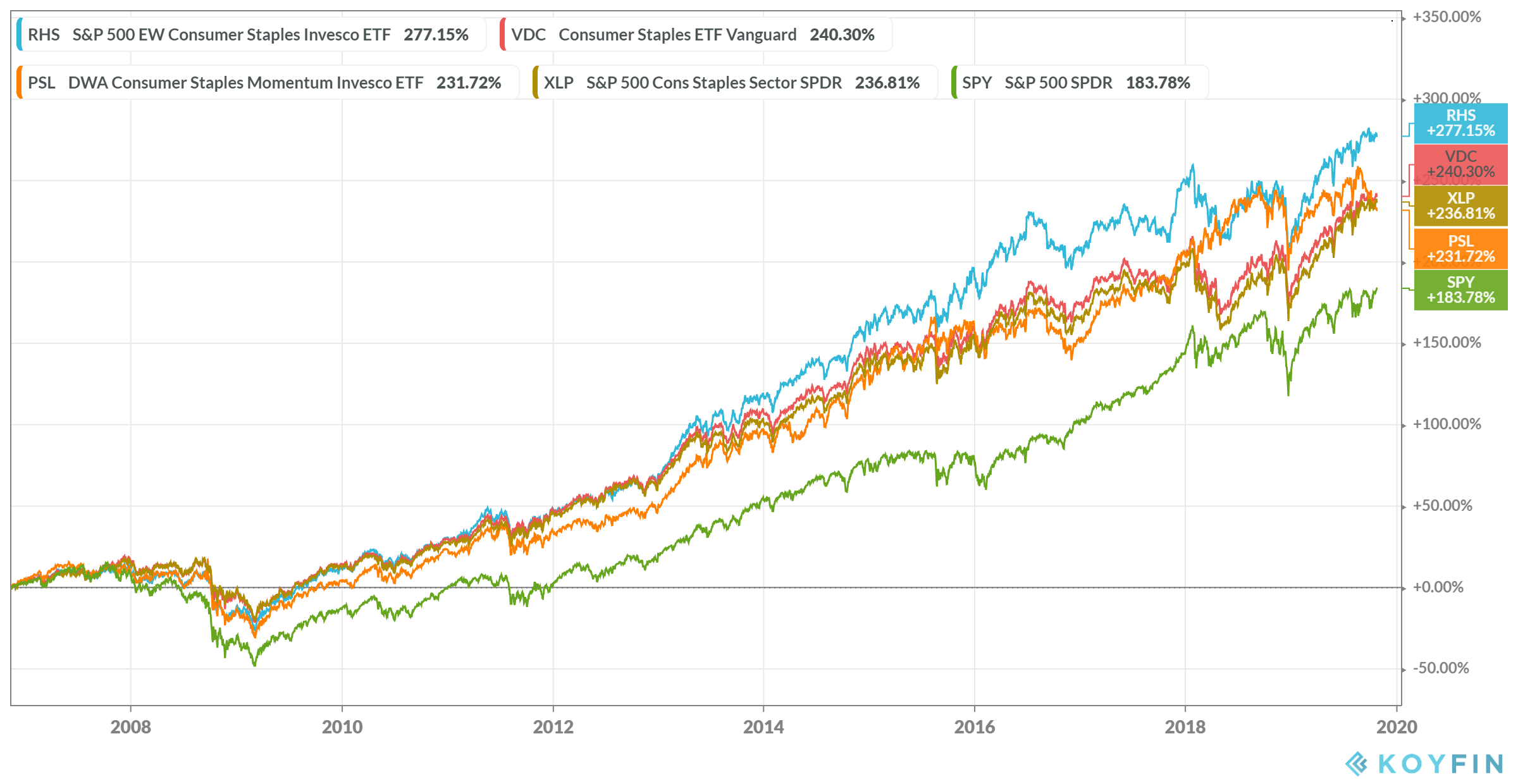

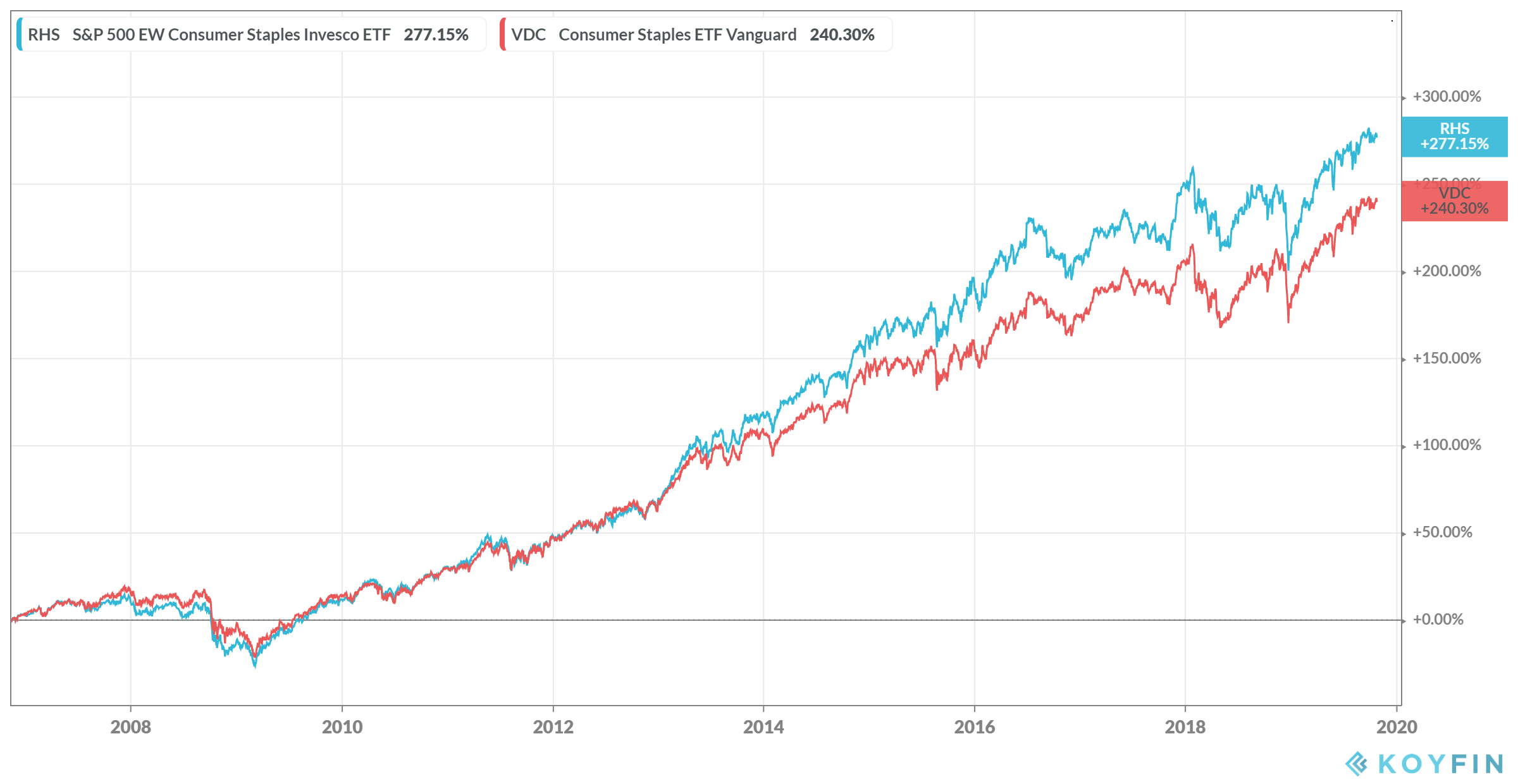

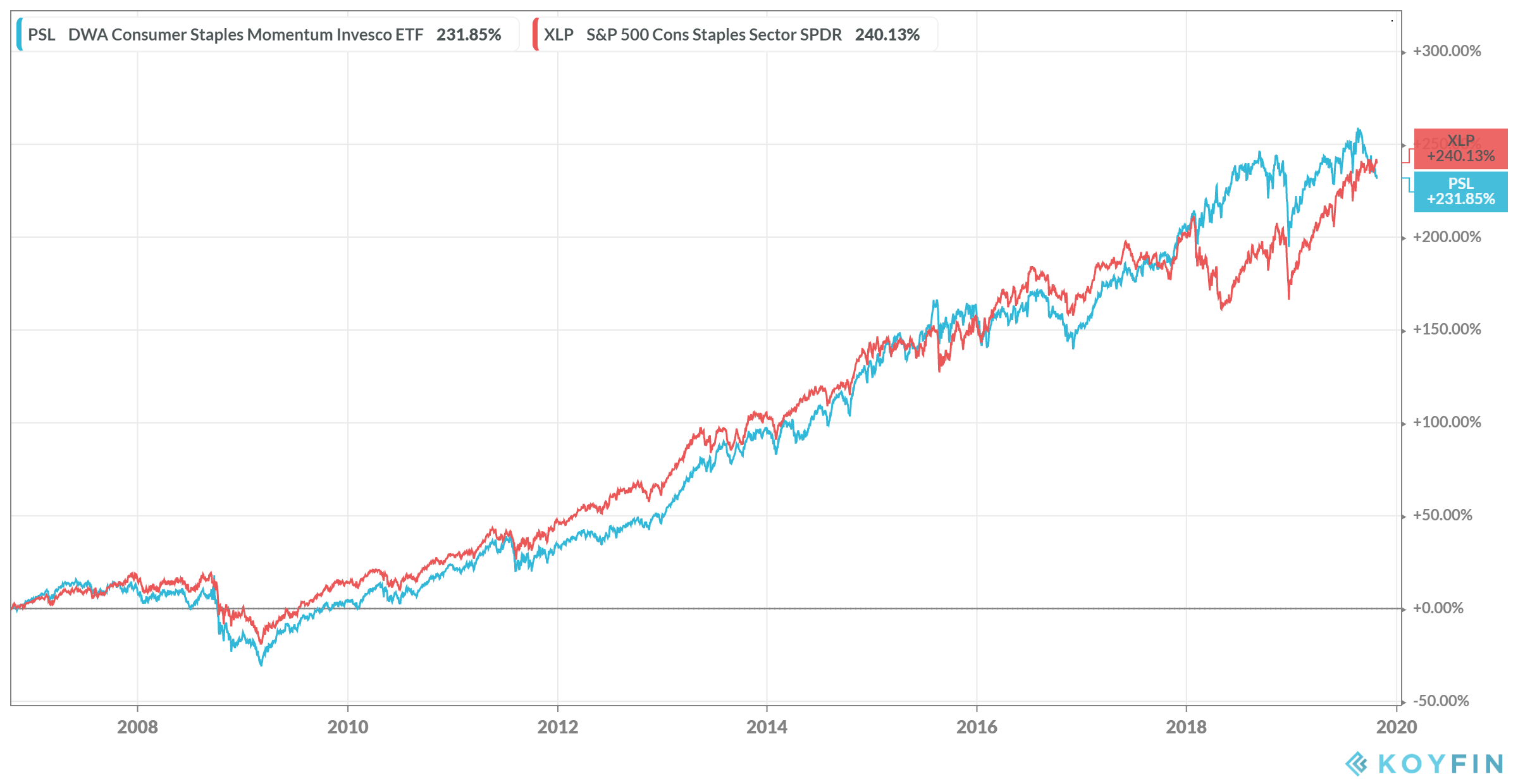

The 4 best performing Consumer Staples Sector ETFs were RHS, VDC, PSL, and XLP. The charts below depict how these ETFs have performed compared to each other in the past.

RHS vs VDC vs PSL vs XLP: December 2006 - September 2019

RHS vs VDC vs PSL vs XLP vs SPY: November 7, 2006 - October 25, 2019

RHS vs VDC: November 7, 2006 - October 25, 2019

VDC vs PSL: October 12, 2006 - October 25, 2019

PSL vs XLP: October 12, 2006 - October 25, 2019

Here are the stated objectives of the top 4 performing Consumer Staples Sector ETFs:

RHS - The Invesco S&P 500® Equal Weight Consumer Staples ETF (Fund) is based on the S&P 500® Equal Weight Consumer Staples Index (Index). The Fund will invest at least 90% of its total assets in common stocks that comprise the Index. The Index equally weights stocks in the consumer staples sector of the S&P 500® Index. The Fund and the Index are rebalanced quarterly.

VDC - Vanguard Consumer Staples ETF. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the consumer staples sector. Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictat RHS e. Includes stocks of companies that provide direct-to-consumer products that, based on consumer spending habits, are considered nondiscretionary.

PSL - The Invesco DWA Consumer Staples Momentum ETF (Fund) is based on the Dorsey Wright® Consumer Staples Technical Leaders Index (Index). The Fund will normally invest at least 90% of its total assets in the securities that comprise the Index. The Index is designed to identify companies that are showing relative strength (momentum) and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security's performance in a given universe over time as compared to the performance of all other securities in that universe. The Fund and the Index are rebalanced and reconstituted quarterly.

XLP - The Consumer Staples Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Consumer Staples Select Sector Index (the "Index"). The Index seeks to provide an effective representation of the consumer staples sector of the S&P 500 Index. Seeks to provide precise exposure to companies from the food and staples retailing, beverage, food product, tobacco, household product, and personal product industries in the U.S. Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing.

The Consumer Staples Sector is a good place to diversify an equity portfolio. One of the best reasonings for investing in this sector is that it has a long-term low correlation to the total U.S. equity market of 0.55. And this low correlation did not come by sacrificing returns. There are 16 ETFs to choose from in this sector. The data above can help investors decide which Consumer Staples Sector ETF is best for them.

Disclosure:

We currently own shares of RHS and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform you own due diligence or seek the ...

more