Banks Serving Up Big Gains

Volleyball’s a great collegiate sport, despite my alma mater’s abysmal record. One of the things that keeps the game interesting is player rotation. Each time a team wins a side out or gets possession of the serve, the new serving team rotates its players clockwise. Service, thus, isn’t dominated by a single team member.

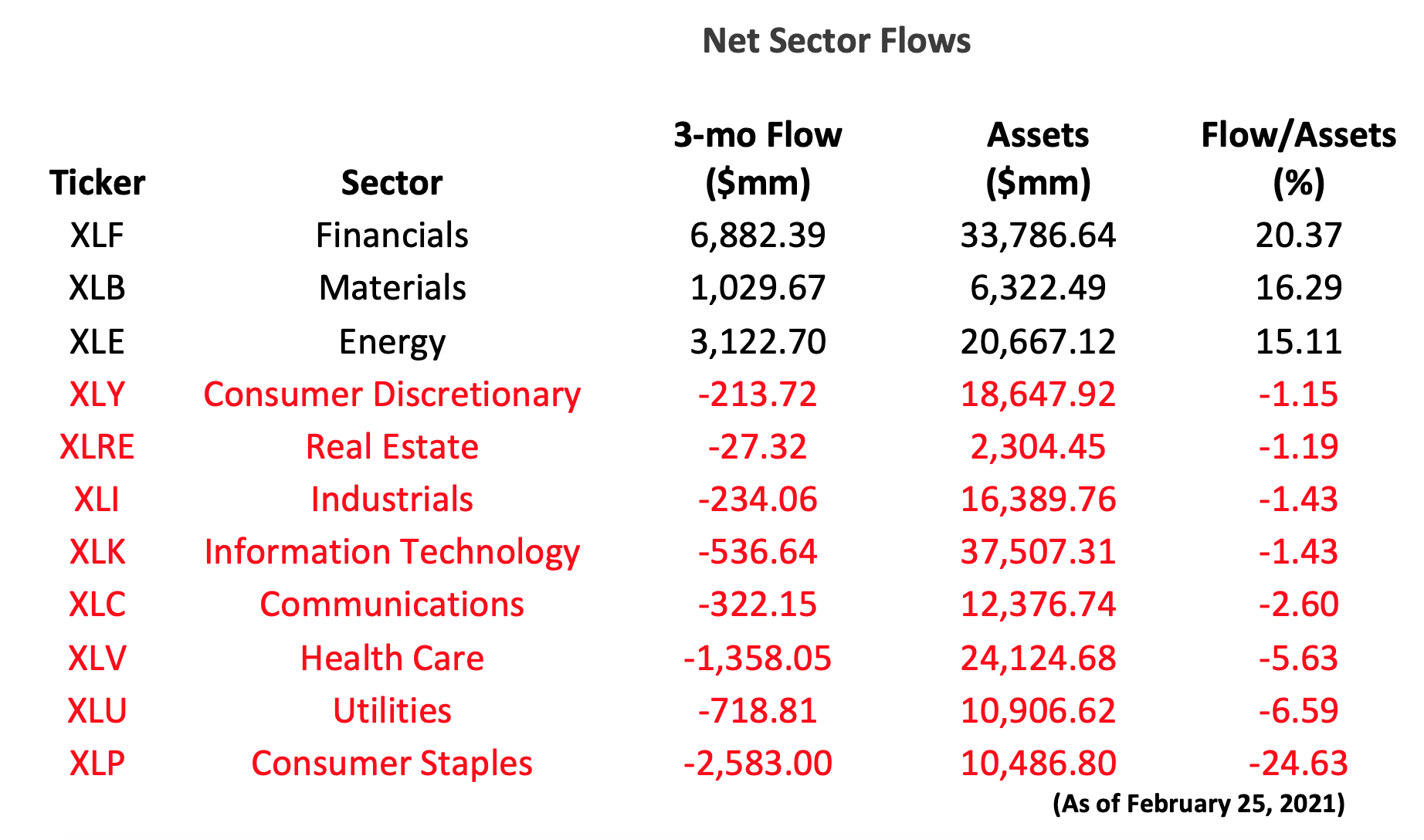

The same thing happens in the stock market, albeit with less regimentation. Certain industry sectors inevitably attain prominence as the economy cycles between boom and bust. Over the last quarter, for example, we’ve seen capital pour out of defensive issues such as Proctor & Gamble Co. and Coca-Cola Co. and into financial stocks including JPMorgan Chase & Co. and Bank of America Corp. Below, you can see the recent sector rotation, depicted in the asset flows within the Select Sector SPDR universe of exchange-traded funds.

(Click on image to enlarge)

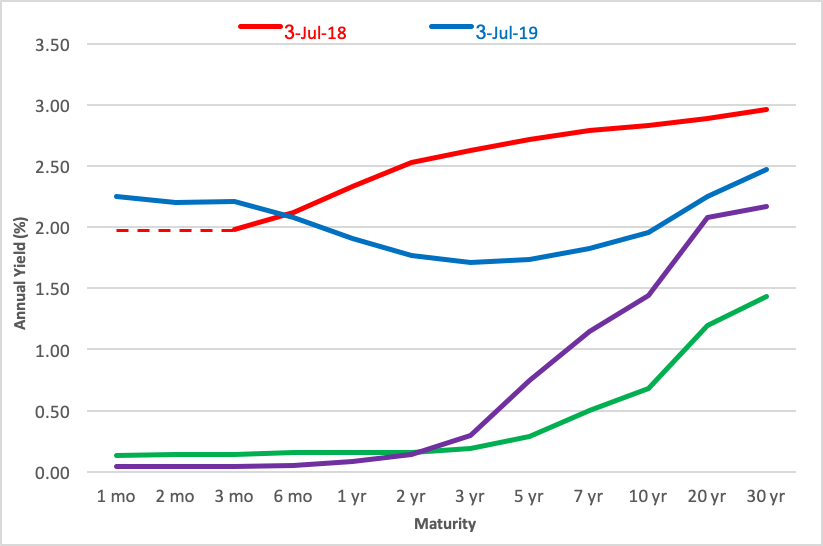

So, what accounts for this repositioning of assets? In large part, the Fed’s accommodative monetary policy, together with rising inflation expectations. Take a gander at the current Treasury yield curve (in purple) and you’ll see how deeply the central bank has pulled down the short end as the curve has steepened.

Treasury Yield Curve

(Click on image to enlarge)

A steep curve allows a bank to borrow cheaply through the deposit window while it lends money out at substantially higher rates. In short, it’s a good lending environment, which is why bank stocks have historically outperformed other industry sectors as rates rise.

Banks, in fact, are driving the asset flow into the financial sector. Eighteen bank stocks populate the 65-issue Financial Select Sector SPDR (XLF) portfolio, each averaging a 24% gain for the year to date. Banking is the heftiest of XLF’s five subsectors, accounting for 39% of the fund’s capitalization.

From a broad perspective, the steepening yield curve has been a good thing. A rising spread between short and long rates indicates an expanding economy and a healthy credit environment. But going forward? Are rates likely to rise further from here?

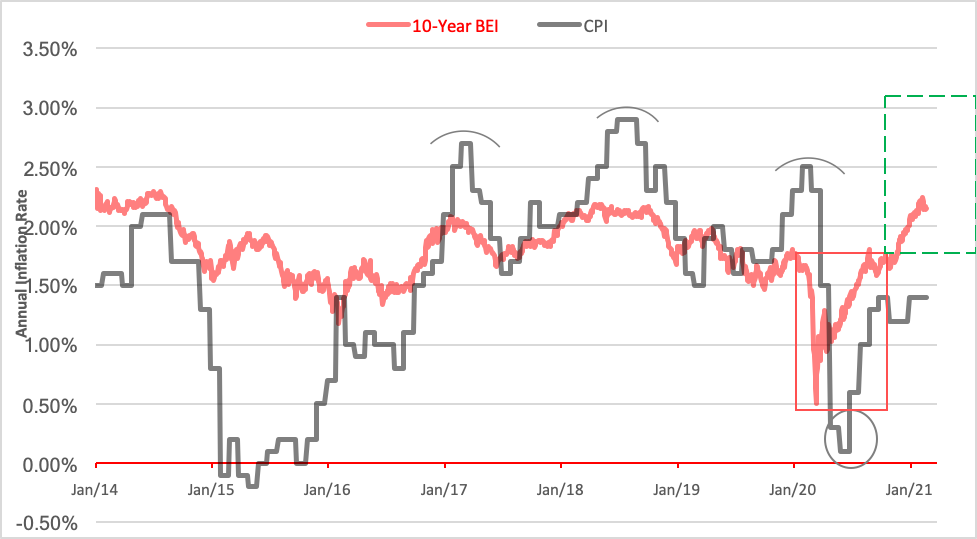

And what about inflation? Rising rates at the long end of the curve bespeak heightened inflationary expectations. Indeed, the 10-year breakeven inflation (BEI) rate has spiked more than 160 basis points over the past year and looks to top 3% before the current cycle ends.

Inflation vs. Inflation Expectations

(Click on image to enlarge)

Because of the accelerating economy, inflation’s becoming a concern for the markets. Rising housing costs, hikes in meat and grain prices, together with mounting costs for energy and motor vehicles, are now being clocked at double-digit rates, offset to some degree by declines in the pricing of leisure activities (cinemas, theme parks, cruise ships, etc.) beset by COVID-19 fears.

The Fed’s not likely to raise rates until it sees full employment and inflation in excess of 2% per annum. All that’s dependent on consumers’ and businesses’ willingness to spend and invest once they feel they’re getting past the coronavirus threat. Given the currently accelerating data points and factoring in another $1+ trillion stimulus, the first Fed Funds rate hike seems likely in the first half of 2022.

So does this rate trend and by extension, the strength of the financial sector, have legs? In a word, yes. For a year at least.

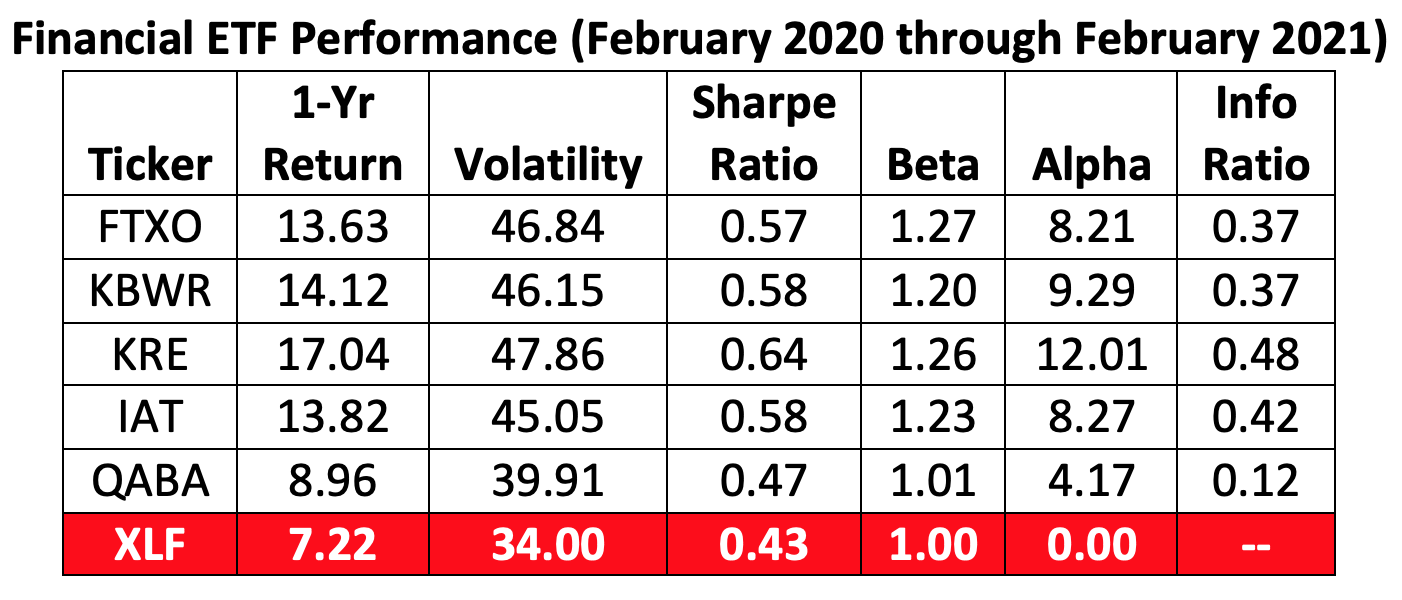

The greatest beneficiaries of the rotation to date have been regional and community banks which investors can easily access through five index ETFs:

(Click on image to enlarge)

The First Trust Nasdaq Bank ETF (FTXO) selects its holdings on the basis of their liquidity and weights them on volatility, value, and growth factors. In 2021, the fund’s gains have topped the table at 26 percent.

Equally weighting its constituent stocks, the Invesco KBW Regional Banking ETF (KBWR) skews toward smaller stocks and has climbed 24% since the top of the year.

The SPDR S&P Regional Banking ETF (KRE) portfolio is also equal-weighted, subject to liquidity constraints, and has matched the year-to-date performance of its KBWR peer.

A Blackrock product, the iShares U.S. Regional Banks ETF (IAT), is a market-cap-weighted composite of small- to medium-sized bank issues. IAT’s risen 20% for the year.

With a year-to-date gain of 19%, the First Trust Nasdaq ABA Community Bank Index ETF (QABA) draws its constituents from the smaller end of Nasdaq listings.

Regional and community bank exposure may be just the way for investors to spike the ball as interest rates cycle higher in the coming year, provided the segment’s inherent volatility can be tolerated.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option ...

more