AT&T Covered Calls? We Prefer These 5 Big Dividends Instead

As artificially low interest rates have pushed many income-hungry investors out of traditional fixed income categories and into high-dividend low-volatility stocks such as AT&T (T), those too are starting to look pricey. Some investors are now reaching into covered call strategies to eke out some extra income, but in our view they may be executing this strategy in all the wrong places. For example, AT&T is an income-investor favorite, but its valuation is expensive and selling AT&T calls for additional income is significantly less attractive to us than other high-dividend buy-and-hold options such as the five we’ve highlighted in this article.

AT&T is a Cash Generation Machine, But It’s NOT Cheap:

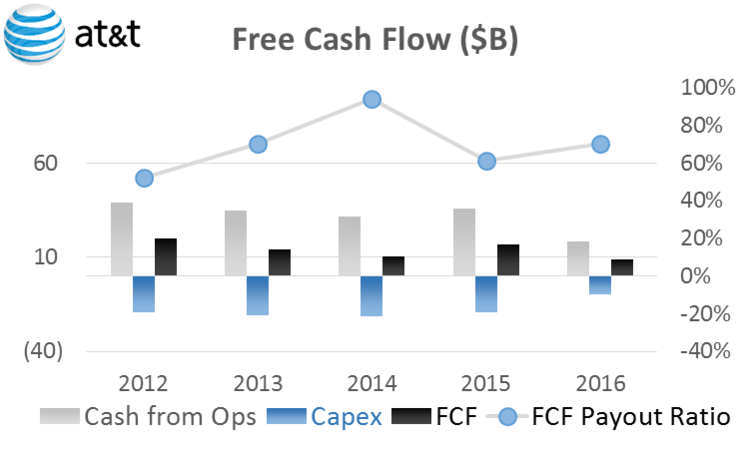

AT&T has generated $8.5 billion in Free Cash Flow so far this year, but it’s also paid out about $6 billion in dividends (and a small amount for share repurchases too). This roughly 70% payout ratio is better than it was prior to the DirecTV acquisition last summer, but it’s going in the wrong direction as shown in the following chart (i.e. a business is not sustainable over the long-term if it pays out more than 100% of the cash it generates).

Additionally, a basic discounted free cash flow model suggests the market is expecting AT&T to shrink by about 0.7% per year into the future. Specifically, we discount YTD FCF of $8.505 billion by a 3.7% CAPM-derived WACC and adjust for outstanding debt to back into the negative 0.7% annual growth rate. And like the climbing payout ratio, the DCF valuation also suggests AT&T will eventually lack the cash flow to pay the dividend (unless they’re able to kick the can down the road again by acquiring another DirecTV or something similar).

The story behind the DCF valuation and rising payout ratio has been the same for years. Specifically, AT&T’s growth businesses (e.g. wireless and now DirecTV) are not expected to grow fast enough to offset its declining businesses (e.g. shrinking wireline as it becomes somewhat obsolete and innovative competition intensifies).

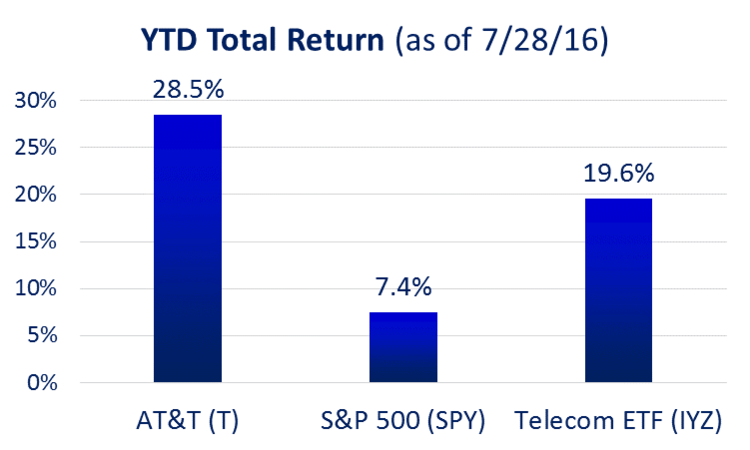

Somewhat ironically, at the same time AT&T’s business faces these challenges, its stock price has appreciated rapidly as the following chart shows.

We believe the stock has increased for two main reasons. First, the DirecTV acquisition provided enough additional free cash flow to successfully patch the dam with regards to the growing free cash flow payout ratio (remember, a company cannot sustainably payout more cash than it brings in). And two, income-investors frustrated with artificially low interest rates continue to bid up the price of low-volatility big-dividend payers such as AT&T.

The Relative Unattractiveness of AT&T Covered Calls:

As mentioned earlier, some investors have turned their efforts to covered call strategies to eke out some extra income in the face of the Fed’s artificially low interest rates. For reference, a covered call strategy involves collecting extra income by selling a call option on a stock you already own. If the price of the stock climbs above the call price it will be taken off your hands (called) at the predetermined call price (you keep the premium and get the cash from the sale). If the call option expires unexecuted, then you keep the stock as well as the premium you received for selling the call.

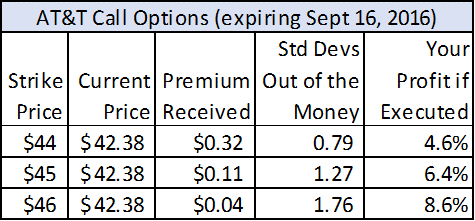

For illustration, the following table shows the recent call premiums you’d receive for selling AT&T covered calls (assuming you already own AT&T stock) that expire on Sept 16, 2016.

The table also shows the number of standard deviations away from AT&T’s current price the call option strike prices are to help you gauge the likelihood that the options will actually get executed. The standard deviations are calculated over the same number of days as there are to the call expiration date. And remember, there’s about a 65% chance the price will be within one standard deviation, and a 95% chance it’ll be within two standard deviations (assuming a normal distribution). And if the calls get executed, your profit will be the price appreciation (strike price minus current price) plus the premium for selling the call in the first place (for this example, we’re ignoring the $0.48 dividend to be paid on 8/1, but you get to keep that too).

The premium you receive for selling AT&T calls is not horrible (but we’ll show you better options later in this report), but the real risk is the opportunity cost. AT&T is expensive, and we believe the stock has relatively less upside (and potentially some risk of a pull-back) for the reasons we’ve described earlier (i.e. growing payout ratio, and unappealing DCF valuation). It’s not at all uncommon for stocks (such as AT&T) and categories of stocks (such as big dividend telecoms) to experience significant underperformance after periods of very strong performance (remember AT&T and telecoms are up much more than the rest of the market so far this year). We’re certainly not saying AT&T can’t go much higher (it can), we’re just saying we believe there are better risk-adjusted opportunities for income-focused investors. Remember, you can pick up a few extra percentage points per year by selling covered calls, but how much good does that do you if the stock you’re holding to write the calls underperforms the rest of the market by 10 to 15%? For your consideration, we highlighted (below) five big dividend options we consider more attractive than an AT&T covered call strategy.

Five Big Dividend Options We Like More Than AT&T

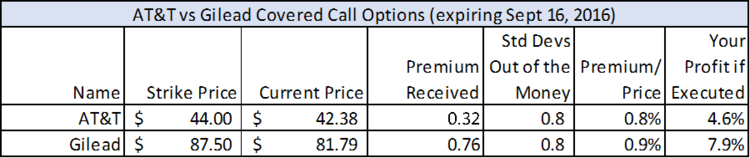

Gilead (GILD): We like Gilead covered calls more than AT&T covered calls for a variety of reasons (Gilead is a large-cap biopharmaceuticals company). For starters, Gilead covered calls offer a more attractive absolute, price-adjusted, and risk-adjusted call premium than AT&T as shown in the following table.

Specifically, you’ll notice that the strike price of both call options is 0.8 standard deviations above the current price (indicating a similar amount of risk, in this sense), but Gilead calls offer a bigger premium for the risk (i.e. you get paid more). Plus, we believe Gilead’s valuation is more attractive than AT&T’s. For example, the following chart shows Gilead’s historical price-to-earnings ratio sits near historical lows.

Gilead is currently very profitable, but the market expects profits to shrink as competition creeps in with regards to Gilead’s blockbuster HIV and Hepatitis drugs. For example, Gilead missed earnings expectations in Q1 of this year, and profits shrank in Q2, especially versus the second quarter of the previous year. However, we believe the narrative has become too negative considering Gilead’s ability defend its big revenues and profit margins, its track record of generating new growth, its strong cash flows, and its discounted price. Plus it offers an attractive dividend yield (2.3%), and the dividend payment was already increased this year. We believe owning Gilead and using it to write covered calls is a more attractive investment opportunity than AT&T for long-term income-focused investors.

Wells Fargo (WFC): We like Wells Fargo covered calls more than AT&T covered calls for a variety of reasons. For starters, the following table shows a variety of Wells Fargo call options as well as AT&T call options.

Similar to AT&T, Wells Fargo offers decent call premiums, however Wells Fargo also offers a much more attractive valuation than AT&T. Specifically, while AT&T’s price and valuation have been climbing sharply this year, Wells Fargo has become more attractive. The driver behind Wells Fargo’s attractive valuation has been the market’s inclination to sell down all big banks (including Wells Fargo) as interest rate have remained low (low interest rates put downward pressure on bank’s net interest margins and their profits). However, nearly 50% of Wells Fargo revenue is fee based (this is higher than many other banks) and it helps Wells Fargo remain profitable regardless of interest rates. Also worth noting, Wells Fargo offers an attractive 3.2% dividend yield, and its volatility is very low (almost as low as AT&T’s). Many investors still give big banks (such as Wells Fargo) a bad rap since the financial crisis, but recent stress tests have proved one again most big banks (including Wells Fargo) are far less risks (and less volatile) than they used to be. And given the divergent valuations, we believe owning Wells Fargo and collecting additional income by writing covered calls is more attractive than doing the same with AT&T.

Energy Sector ETF (XLE): The energy sector exchange traded fund presents another relatively attractive opportunity to write covered calls. Given this ETF’s low idiosyncratic risks (it diversifies away stock specific risks within the energy sector), its big dividend payments (3.6% yield), its recent relative performance, and it call premiums, we believe it is worth considering. For the following table show the recent call premiums available for XLE versus its ETF peers sorted by “standard deviations out of the money.”

And as the table shows, XLE stands out for its high risk-adjusted premiums. Certainly, the energy sector has been volatile and faces unique challenges, but even after adjusting for volatility we believe XLE covered calls are a compelling opportunity to collect attractive income payments. If you are going to have exposure to the energy sector, the diversified XLE ETF (along with covered calls) is a decent way to do it.

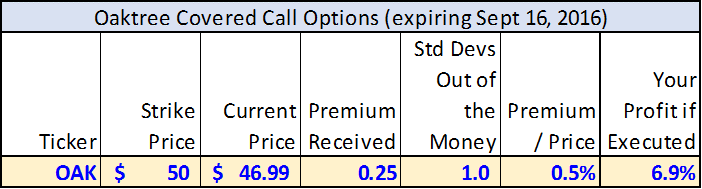

Oaktree Capital (OAK): Oaktree Capital is global investment manager managing assets across corporate debt, convertible securities, distressed debt, control investing, real estate and listed equities. It also offers an attractive valuation, a big dividend (4.7%) and the premiums on its call options are compelling. For example, you can collect a $0.25 premium (0.5% return) on the September 16th $50 calls (this amounts to an additional 3.65% return annualized). And if your shares do get called you end up earning a 6.9% return in under 50 days (plus you receive the upcoming 8/12 dividend payment as long as your shares aren’t called first).

For some added background, Oaktree manages around $100 billion in assets mostly for pension fund and endowment type clients. They have a very strong reputation (the author of this article hired Oaktree for a $500 million emerging market equity mandate in 2014), and they collect healthy fees on the assets they manage.

Main Street Capital (MAIN): We view simply owning Main Street Capital (without writing covered calls) to be a more attractive investment opportunity for income-hungry investors than owning AT&T (or owning AT&T and writing covered calls on it). For starters, Main Street offers a significantly bigger dividend (6.5%) than AT&T, and if you factor in MAIN’s supplemental dividend then the yield rises to nearly 9%. The dividend is so large because it has elected to be treated as a Regulated Investment Company (RIC) and a Business Development Company (BDC). This means Main Street generally pays no federal income tax on any ordinary income (or capital gains) that it pays out as dividends to its shareholders. Main Street’s business is basically to provide financing (mostly debt and some equity) to smaller and mid-sized companies. Main Street also offers low volatility and a more attractive valuation than AT&T, in our view. Main Street is attractive because its Distributable Net Investment Income consistently exceeds its dividend payments, and because its Net Asset Value continues to enable supplemental dividend payments. If you are a long-term income-focused investor, Main Street is worth considering. We prefer it over AT&T (even if you’re writing covered calls on AT&T).

Conclusion:

AT&T’s price has rallied significantly, and its valuation looks expensive. However, that doesn’t mean the price can’t still go much higher (it can). For the many investors that will never sell AT&T, writing covered calls is a decent way to eke out a little extra income. However, we believe there are far more attractive opportunities for income-focused investors and we’ve highlighted five of them in his article. It’s critically important to consider the risks and total return opportunities when engaging in a covered calls strategy, and we’ve provided a wider assessment of these in our recent article titled Covered Calls Roadmap: 5 Big Income Opportunities. In the case of AT&T, investors should focus on their personal investment goals, and not let the small potential income bump from a covered calls strategy distract them from the much bigger total return relative underperformance that may lie ahead.

Disclosure: None.