Alpha Update: Passive Beats Active

Harvesting alpha’s never been easy. Nor should it be, at least according to the Capital Asset Pricing Model (CAPM). CAPM’s thesis is simple: To get better-than-market returns, you must assume outsized risk.

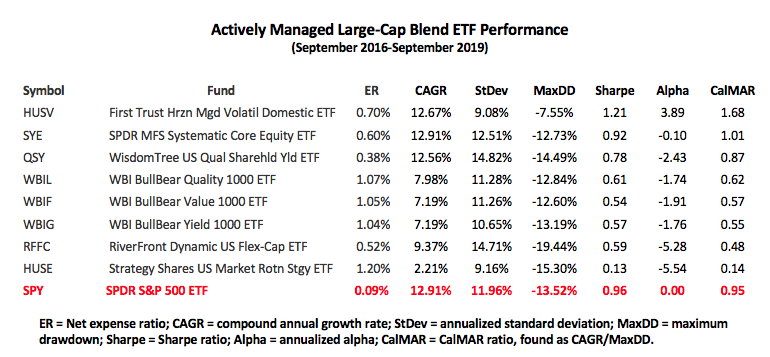

Looked through this lens, you’d expect very few actively managed ETFs to be market beaters. And very few are. In fact, among seasoned portfolios in Morningstar’s large-cap blend category, only one cranks out positive alpha when benchmarked against the SPDR S&P 500 ETF (NYSE Arca: SPY).

(Click on image to enlarge)

(Click on image to enlarge)

The fund runners at the First Trust Horizon Managed Volatility Domestic ETF (NYSE Arca: HUSV) use volatility forecasting to target U.S. large-cap stocks. After a proprietary model spits out predictions for its universe of individual stocks, portfolio managers select and weight 50 to 70 issues with the lowest expected volatilities. Rebalancing the portfolio is at the managers’ discretion.

At first glance, it seems the HUSV upholds the CAPM dictum. HUSV’s annual growth rate is a tad lower than SPY’s, but so too is the active portfolio’s standard deviation: less risk, less return. HUSV’s risk is low enough, in fact, to earn the fund an impressive alpha coefficient, together with benchmark-drubbing Sharpe and CalMAR ratios.

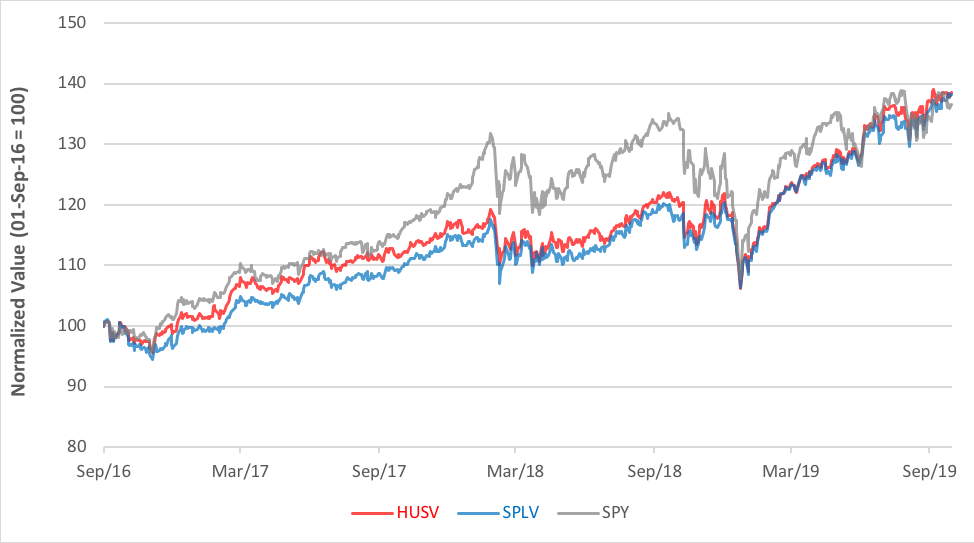

Still, there’s a better, and cheaper, low volatility strategy available in a passive portfolio. For a holding cost of only 25 basis points, the Invesco S&P 500 Low Volatility ETF (NYSE Arca: SPLV) earned an average annual return of 13.38% over the past three years with a standard deviation of just 8.90%.

SPLV’s index methodology selects 100 of the S&P 500’s least volatile stocks, as measured by daily standard deviation over the preceding year, at each quarterly rebalancing.

With an alpha coefficient of 5.16, SPLV is the poster child for factor investing. Here, CAPM is stood on its head: less risk leads to greater reward.

(Click on image to enlarge)

How do we explain the disparate results? We can look to economist Robert Engle for some insight.“Optimal behavior,” he opines, “takes risks that are worthwhile … we must take risks to achieve rewards, but not all risks are equally rewarded.”

Disclosure: None.