ACIO And DRSK: And Now, For Those Who May Be A Little Nervous

The glib response from those in "buy! Buy anything that's down!" mode, when disparaging more conservative investors, is to quote the Wall Street maxim "don't fight the Fed." This truism has to do with not resisting the power of the Fed when they decide to lower or raise interest rates in order to stimulate or dampen inflation. It has less to do with the current misconception that when the Fed helicopters money that this is a buy signal.

The Fed has been lowering rates for years now, which has kept the market humming along. But how does the Fed lower further from its 0-0.25% target? Will the US go negative? Would you buy a US Treasury bond if you had to pay the Treasury to do so?

The market does not give a signal that is graven in stone. It must be watched carefully every day if one wishes to use it as a predictor of the economy. Black swans happen. Black buzzards congregate. You never hear the bullet that gets you. Six months ago the market was moving steadily upward. If someone took that signal only as the only way the market ever moves, they would have been completely blindsided by the decline in the first quarter.

We do not want to make the mistake of confusing "liquidity" with "solvency." Just because the federal government is willing to guarantee liquidity for many different instruments does not guarantee the solvency of consumers or businesses.

Does this rally have legs? It certainly has so far and I and our subscribers are delighted to have partaken in the fruits of the rally.

I am an optimist. I have faith in the strength and the work ethic of the American people. I know that markets rise about two-thirds of the time and only decline about one-third of the time.

As an optimist and an opportunistic investor, I am willing to buy any time I see an opportunity I can believe in, even though I grow more skeptical whenever I see an excess building. My buys during the down days back then included Raytheon (RTN), Carrier (NYSE: CARR), Texas Pacific Land (NYSE: TPL), and many others, all now well-ensconced in our model portfolio. By smart investing we have reaped some nice profits while still protecting the bulk of our nest egg.

So how do you invest today if you believe we are approaching nosebleed territory? Mark Cuban's comment today that his 19-year-old niece asked him for advice on what to buy so she can get on the easy money train was not overly encouraging. I place my trust in my trailing stops and continue to add to my positions - but I understand that some investors may see "Mark's niece" a little too redolent of "Joseph Kennedy and the shoeshine man" he regularly frequented in 1929.

When the young man began to give stock tips as he polished Kennedy's shoes, it struck Joe that he needed to leave the market. He reasoned that if everyone was now giving tips to anyone who would listen (and this was in the days before Facebook and Robinhood!) the market might be getting too frothy. He allegedly sold out over the next few weeks, just before the stock market crash.

I do not believe we are in that situation - but if you do, or you just want a little protection from any potential storm, here are two ETFs you might want to consider.

ACIO

The Aptus Collared Income Opportunity ETF (ACIO) seeks current income as well as providing the opportunity for some capital appreciation. It does this by investing in 50 very popular large cap stocks, then generating income by writing covered calls on those stocks.

Aptus takes this covered call writing strategy a step further, however, minimizing the downside by hedging via long put options on broad-based market Indexes. This does not mean no loss of capital in the event of a major slide down, but it does dampen that possibility considerably - while still providing income and potential gains from the long side of the portfolio.

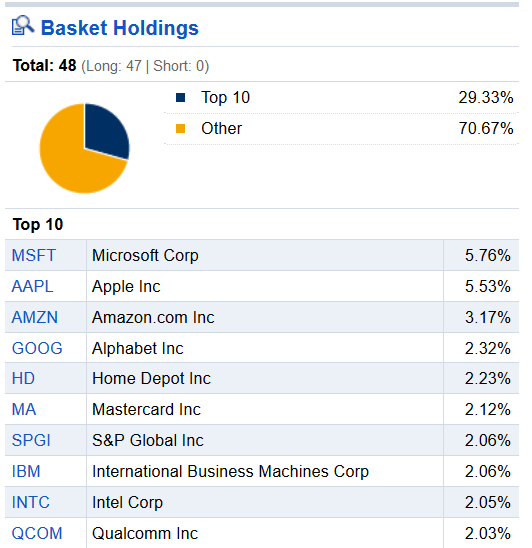

Here are ACIO's largest holdings:

Source: Fidelity

Yep. These are the same darlings that are moving the market forward. The biggest, most liquid, and most popular. Perfect for a call-writing strategy.

The next 10 are no slouches, either:

Source: Fidelity

…and so it goes for all 50.

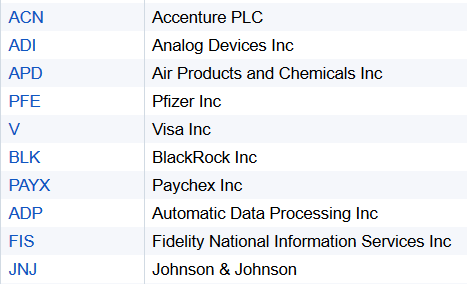

Below I have placed, from the Aptus website, just three examples of how ACIO writes covered calls on their positions:

Cash and Other: 0.71%

("Cash and Other" is where the long puts will reside.)

Source: Seeking Alpha

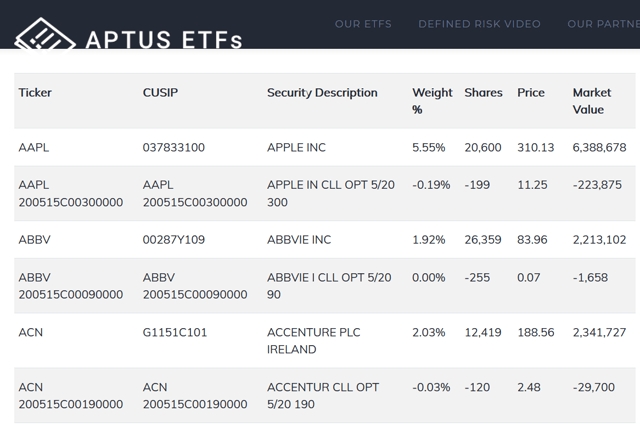

This conservative strategy still created an 18% return since the low of March 23. There are also two possible disadvantages of this ETF.

(1) Because it takes time and attention to execute this strategy, the expense ratio is 0.79%. An index fund without the downside protection might be as low as 0%.

(2) It has relatively low trading volume. Place limit orders and buy slowly.

DRSK

Also from Aptus, the Defined Risk ETF (DRSK) is designed to be a conservative investment by using a more aggressive strategy with a small portion of the portfolio - which is supported by a fixed income base. It's an interesting strategy.

DRSK combines a laddered bond portfolio going out just a few years with asymmetric equity exposure. That asymmetry comes from using the income from the bonds to buy call options on a select group of highly liquid equities.

Income comprises at least 90% of the strategy, with the rest pursuing equity gains using long call options. If the market were to plunge anew, the only equity exposure DRSK has lies in the value of the call options that could expire worthless. There is no further equity risk.

From the Aptus website:

"1) What problem is Aptus Defined Risk trying to solve?

After a glorious three-decade run for 60/40 portfolios, it's really tough to make the math work from here. Chasing yield may boost current income, but brings added risk when business conditions weaken.

2) Why own options instead of the actual stocks? Call options gives us two benefits; defined risk and leverage. To participate meaningfully in a stock market advance requires 30% of the portfolio if not more, exposing one to meaningful downside as well. Options allow us to participate using the least amount of capital at risk.

3) Why own individual stocks and sectors vs. owning the index? Fifty stocks comprise half the value of the U.S. equity market. Owning 10-20 diverse names gives us a chance to spread our optionality across more than just a single cap-weighted index. Capturing the power laws of markets requires only a few winners, and with this "component" approach we also gain useful correlation benefits."

Source: Seeking Alpha

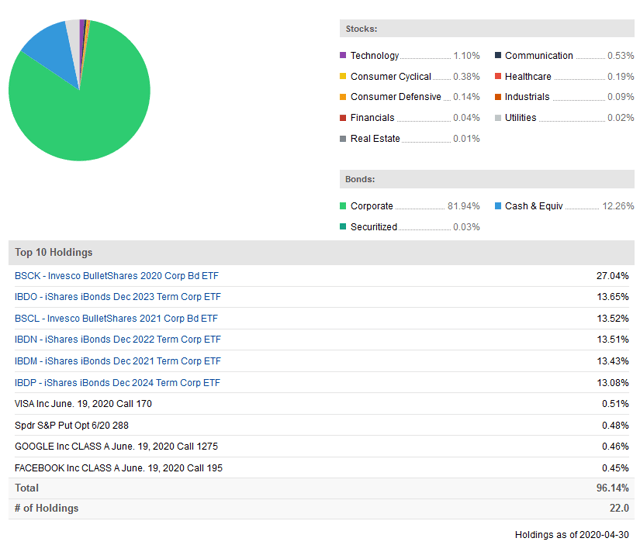

The green in the pie chart below represents the bond positions, the largest of which are shown individually below it. The "stocks" legend to the right refers solely to call options, not actual stocks. Please also note, as an additional hedge, ½ of a percent is given over to a put option on the S&P 500.

Source: Fidelity

I have purchased shares of both DRSK and ACIO as ballast for my own personal portfolio. I offer this short introduction for your own further due diligence.

Disclosure: I am/we are long ACIO, DRSK.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own ...

more