2019: A Good Year For 'Stealth' Long-Short Funds

The only way a long-short ETF can keep its volume and liquidity high or a traditional mutual fund can keep its assets high enough to pay research and operational expenses is to be on the right side of the market most of the time.

That may sound eminently logical and eminently obtainable but it is not. “A rising tide lifts all boats,” so a fund which, by its charter, must seek short positions even during a booming market (their logic being that there will always be laggards which they can identify) means that most of the time they under-perform in good markets.

By the same token, buying such funds in declining markets when they are still seeking the few good longs to offset their shorts will often leave you disappointed; when investors panic on high volatility down days or weeks or months, they sell into the tsunami no matter how highly they regarded their purchase just a few short months ago.

If you understand this, during and especially near the end of a fine multi-year bull market, you will often be the recipient of a tirade from someone who began investing, say, 7 or 8 years ago after reading some article or listening to a Wall Street analyst on television who advised them to simply buy an index fund and hold it forever since, “stocks always come back in the long run.”

That is true. But as John Maynard Keynes, economist and investor of yore responded to that sort of logic, “But this long run is a misleading guide to current affairs. In the long run we are all dead.” (By the way, recognizing the foibles of many of those in his own profession, the rest of that quote is, “Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again.”)

In my last article on long-short funds (“Is There A Long/Short Fund Worth Buying?”), I concluded that the by-charter seeking and buying of securities contra to the market would have left those funds bereft of the returns they sought, so they basically became long funds during the bull market. Take a look at almost any long-short ETF or traditional long-short fund over the past year and you will see that they rose almost in concert with the market – and dove just as hard in the 4th quarter decline.

That’s why I am following up now with these “stealth” alternatives to long-short funds. My alternatives, balanced funds and tactical allocation funds, have similar issues as the long-short funds but to a far lesser degree. The difference is that they don’t need to take the same level of risk. A balanced fund (ETF or traditional open-end), by definition, owns both stocks as well as fixed income assets. While they allow themselves the flexibility to change the mix, most start out with a 60% stocks, 40% bonds balance. If they are to truly hew to their charter and their promise to investors, as stocks become cheaper, the 60/40 discipline forces the fund to buy more shares when they are down and sell more shares as their ratio gets out of whack.

There is no magic here; just a discipline that makes the fund buy more of what is cheap and sell what is expensive. Some funds, which we think of as conservative-allocation funds, might plan to hold only 20-50% of their assets in stocks, while moderate-allocation funds might strive to hold 45-70% of their assets in stocks. Aggressive balanced funds might go even higher. I personally prefer the moderate allocation funds. I like owning some equities and I like even more a fund that buys more if they dip below certain holding levels.

To confuse matters, some funds calling themselves XYZ *Balanced* Fund or PDQ *Equity Income* Fund are really more like tactical allocation funds. And to return the favor, many funds calling themselves ABC Tactical Allocation Fund might invest more like a balanced fund. The real distinction is that true balanced funds try to stay fully invested, no matter the market environment, in some mix of stocks and fixed income holdings. Their logic is that no one knows when good markets for stocks will begin or end so they will just let the one that is cheapest at any point in time force them to buy low and sell higher.

Tactical allocators, on the other hand, might decide the time is right to be 75% in stocks at Point A in the market cycle but drop that to 30% at Point B depending upon their read of the current and future outlook for securities. They, too, might buy bonds but they are just as likely to go into cash-equivalents (short-term instruments that pay minimal income) or to buy commodities or tighten up their sector and industry choices.

My Favored Examples

Finding true balanced funds that really do stay close to their stated parameters of buying a ratio of equities and fixed income is like seeking a needle in a haystack or, worse, the shortest straw in a haystack. Too many equity-income funds today (and virtually all ETFs) have slid down the slippery slope of considering the “income” portion of their portfolio to include high dividend-paying stocks. The problem with this is that, in a tsunami decline, *all* stocks fall. The size of their annual dividend doesn’t matter. A steady 6% yearly dividend from a blue chip company pales by comparison when that blue chip fell 3% on Friday and 3% again today!

All of the funds I mention in this article get kudos for avoiding style drift – they have kept to their stated goals of being balanced funds – and of course none of them have done as well as their 100%-long peers. But for those investors who prefer shooting ducks at the carnival to riding the roller coaster, slow and steady beats fast ups and terrifying downs.

One other thing about balanced funds that own bonds. Doesn’t everyone know that rates are rising? Doesn’t everyone know that when rates rise, the prices of existing bonds fall? Well, one out of two isn’t bad. The latter is true; the former requires a functioning crystal ball. What “everyone knows” is simply not always true.

Did you know, for instance, that even as the Fed was raising short-term rates in December, mortgage rates continued their quarterly march *down” and long bonds *rose* in price? If you are 100% certain that long interest rates will rise, then you might want to avoid real balanced funds. Personally, I see growing deflationary trends that may well make these selections more valuable, not less, in 2019.

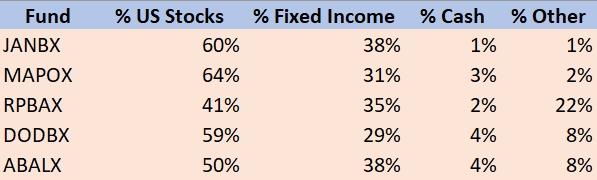

Among my favorites are the Janus Henderson Balanced Fund (MUTF:JANBX), Mairs & Power Balanced (MUTF:MAPOX), T. Rowe Price Balanced (MUTF:RPBAX), Dodge & Cox Balanced (MUTF:DODBX), and American Funds American Balanced (MUTF:ABALX).

Here is how each of these has allocated their portfolio as of their most recent reporting period:

Chart source: Author

All these balanced funds give themselves a certain flexibility. While most begin with the classic 60:40 equities/income portfolio they will extend it by x amount when they see exceptional opportunity in one or the other. I provide these for your further due diligence. If you want to know why I selected these versus others in the balanced universe you are welcome to ask in a comment or via a private message and I will do my best to respond!

The next category of “stealth” long-short alternatives are the far more numerous tactical allocation funds. Unlike a true balanced fund, these funds might own 0% bonds at one time or 100% at another. They might be very long cash if they think there will be continued weakness or raise the cash purposely if they believe the market is close to hitting bottom and they want to be able to buy in quantity. Finally, their “other” holdings might cover the waterfront.

Among these, my favorites include American Century Equity Income (MUTF:TWEIX) – yes, I know it is “titled” equity income but it is a tactical allocator! - Leuthold Core Investment (MUTF:LCORX), FundX Conservative Upgrader (MUTF:RELAX), Madison Dividend Income (MUTF:BHBFX) and AdvisorOne CLS Shelter (MUTF:CLSHX).

I recently analyzed two additional possibilities in depth but rejected both of them: Quantified STF Fund Investor (MUTF:QSTFX) I declined because of its short history. It is too new to have experienced serious market declines (3 years old last month). Also, it is too volatile for my liking. QSTFX has soared and plunged over the past year but ended up no better, since inception, than any of the tactical allocation indexes. Going forward, because it is still small, the fees are rather high to be 50% in cash.

The other fund I analyzed in depth and rejected deserves a longer explanation. This is the FundX Tactical Upgrader (MUTF:TACTX). Tactical Upgrader is a “fund of funds” – for me, that is one strike against it before I even review it. I trust my own research and analysis to review various funds to see if they fit with my portfolio strategies; in this case I have to trust that the fund of funds manager does the same rigorous review and is aligned with my own approach to the market. Not easy to find.

The second strike is that this fund has been around since mid-2008, a good time to be buying stocks (or selecting funds) with new money. Both TACTX and the S&P bottomed in March 2009 and the S&P soared to new heights from that day forward. TACTX has performed so unevenly since then that it is today lower than even the long-short index.

Strike three is the fact that more than 10 years on, TACTX has not been able to hold on to investor assets. It has just $60 million in AUM. With index and other funds as its primary holdings, TACTX has turned its portfolio over 500% + this year. Tactical is good; this seems more like desperation. (By the way, for those of you who make your mutual fund selections based on Morningstar’s star system, please learn to ignore those stars! TACTX gets four of them…)

As for the five that survived my analysis, I again commend them to you for your own due diligence. I have sifted through hundreds of funds to find even these ten (five balanced/five tactical allocation). I leave it to each reader to determine which, if any, are perfect for your own portfolio. Again, if you want to know why I select these specific funds versus others which you may be contemplating, please compare my choices based upon whatever metrics you are using. If you believe you have found a better choice, by all means leave a comment or send a private message and I will do my best to respond!

Finally, I suggested earlier that you might consider the DIY – do it yourself – approach. There are scores of short-side ETFs you could buy and simply use those short positions to hedge whatever long portfolio you select. I have done that; sometimes it worked well, sometimes not so well.

The problem with using ETFs, which cite as a "benefit" the fact that they can be traded moment to moment, means you will be tempted to protect your short-side profits if, intra-day, the market moves against you. One of the charges leveled against traditional mutual funds is that you can’t trade them until the end of the day. Well, yeah! That is as often more a benefit than it is a disadvantage...

Subscribers and clients know that I have a number of alternative investments in my model portfolio. If 2019 begins to unfold like I believe it will, I might well construct a DIY position myself by selecting a tactical allocation mutual fund and a dedicated short-side mutual fund. One that comes to mind would even allow me to do it within the same fund family. The Leuthold Grizzly Short Fund (MUTF:GRZZX) is a dedicated short bias fund. It only shorts and endeavors to select the weakest firms to short. It has had a dreadful 10 years, of course! But to use it as a hedge in a bad market? This is the time to own a fund like this.

I may decide to pair the Leuthold Core Investment fund – which as of the most recent reporting period was long just 38% in equities, giving some opportunity on the long side but also less risk on the downside. I might then buy shares in the Grizzly Short fund (both are no-load but shorting is expensive so expect to pay bigger fees for this side of the trade). I haven’t decided yet but I might buy $1000 of GRZZX for every $5000 I would buy of LCORX.

I select this example because I have considerable respect for Leuthold’s analysis at the sector, industry and individual stock level. Doing this paired trade myself is the ultimate “stealth long-short.”

Instead of presuming that Fund or ETF XYZ has analysts that are equally brilliant at shorting as they are at buying long, I buy one fund, GRZZX, where the portfolio managers do nothing all year long but look for the most attractive shorts. I also buy a fund, LCORX, where the portfolio managers do nothing all year long but decide the big picture of how much they should be vested/invested on the long side. In this way I might just get the best minds on both sides working in my favor.

However you decide to play it, as they said early on in Game of Thrones, “Winter is coming.” Lighten up a bit, consider a balanced fund, think about a tactical allocation, or wade a little further into the pool and do it yourself with a combination of great funds! The time for index ETFs is when everything is going up and you don’t need to pay an active manager. The time to hire an active portfolio manager, like you do when you own a mutual fund, is coming.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in LCORX, TWEIX, JANBX over the next 72 hours.

Do your due diligence. If I can help, you are welcome ...

more

Well done.

Nice!