ESCO Technologies - Chart Of The Day

Summary

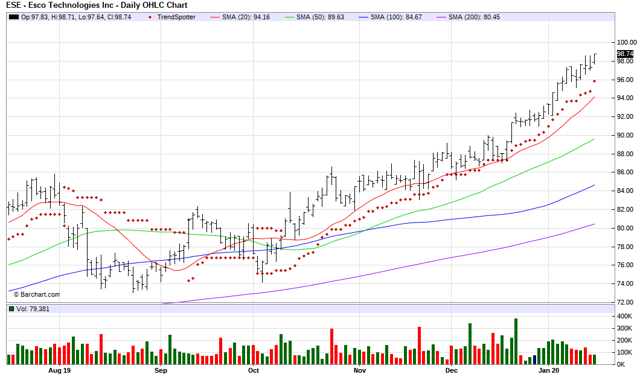

- 100% technical buy signals.

- 16 new highs and up 12.50% in the last month.

- 51.54% gain in the last year.

The Barchart Chart of the Day belongs to the technical instruments company ESCO Technologies (ESE). I found the stock by sorting Barchart's Top Stocks to Own list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 10/10 the stock gained 22.29%.

ESCO Technologies Inc. produces and supplies engineered products and systems for utility, industrial, aerospace, and commercial users worldwide. The company operates in four segments: Filtration/Fluid Flow (Filtration), RF Shielding and Test (OTC: TEST), Utility Solutions Group (USG), and Technical Packaging. The Filtration segment supplies filter elements, manifolds, assemblies, modules, indicators, custom and standard valves, filters, regulators, actuators, and other related components; elastomeric-based signature reduction solutions; and mission-critical bushings, pins, sleeves, and precision-tolerance machined components, as well as processing services. The Test segment designs and manufactures RF test and secure communication facilities, acoustic test enclosures, RF and magnetically shielded rooms, RF measurement systems, and broadcast and recording studios; and RF absorptive materials and filters, active compensation systems, antennas, antenna masts, turntables, electric and magnetic probes, RF test cells, proprietary measurement software, and other test accessories to perform various tests, as well as calibration for antennas and field probes, chamber certification, field surveys, customer training, and various product tests. The USG segment designs manufactures and delivers diagnostic testing solutions for electrical equipment comprising the electric power grid and enterprise management systems. The Technical Packaging segment offers thermoformed products and packaging materials for medical, pharmaceutical, retail, food, and electronic applications. The company distributes its products through a network of distributors, sales representatives, direct sales teams, and in-house sales personnel. ESCO Technologies Inc. was founded in 1990 and is headquartered in St. Louis, Missouri.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 54.40+ Weighted Alpha

- 51.54% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 12.50% in the last month

- Relative Strength Index 79.59%

- Technical support level at 96.72

- Recently traded at 98.75 with a 50 day moving average of 89.63

Fundamental factors:

- Market Cap $2.53 billion

- P/E 31.15

- Dividend yield .33%

- Revenue expected to be down 2.40% this year but up again by 5.60% next year

- Earnings are estimated to increase 2.90% this year, an additional 10.90% next year and continue to compound at an annual rate of 15.00% for the next 5 years

- Wall Street analysts issued 2 buy and 1 hold recommendation on the stock

- The individual investors following the stock on Motley Fool voted 61 to 9 that the stock will beat the market

- 828 investors are monitoring the stock on Seeking Alpha

Disclosure: None.