The Oldest Newest Natural Gas Play – Part 2

It wasn’t that long ago that tapping into an underground zone of natural gas 12 or 15 feet thick was considered a pretty good, and profitable, find. But the delightfully rapid evolution of horizontal drilling and pressure fracturing means Montney drillers like Encana (ECA) are are now finding profitable zones with a thickness of anywhere from 300 to 900 feet! The profitability of such zones soars, of course, but there are other longer term benefits, too, like fewer man-hours expended in exploration and less wear and tear on equipment.

I noted a number of potential stumbling blocks for all drillers in the Montney formation in Part 1 of this article published here. Among these which I didn’t delve into previously is the sheer volume of potential production. If there is a glut of gas being produced or too much to ship out using existing infrastructure, finds like this could actually depress the price of natural gas. I don’t see this as a long-term issue. As I mentioned in Part 1, the more electronics we use, the more electric cars we produce, and the more emerging markets emerge, the higher the demand rises for natural gas.

Indeed, already two of Alberta’s three operators of coal-fired power stations, Transalta Corp. (TAC) and Atco Group, both in Calgary, are working out how to switch plants to gas right now. The third, Edmonton’s Capital Power, is also accelerating a previously-announced decision to switch.

This is not only great news for the environment but the Canadian Association of Petroleum Producers says that replacing the 55% of Alberta’s power supply generated from coal (with a combination of natural gas and renewables) will increase gas demand by 1.5 billion cubic feet per day. Look beyond today’s stasis or some short-term supply overage. In the intermediate and long term, companies like Encana, profitable at even today’s depressed natural gas pricing, will be even more profitable.

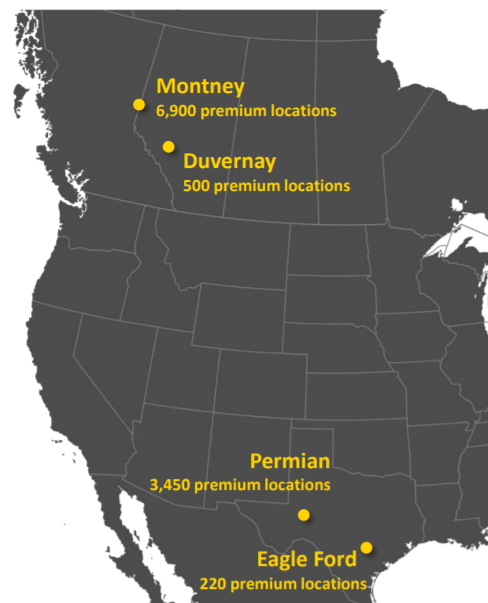

It isn’t just the Montney premium locations that have drawn me anew to Encana. Take a look at this map showing the location of the company’s primary acreage positions:

The Montney is the biggest. Encana entered the Montney 15 years ago and built a massive position totaling 600,000 net acres. The company is a true innovator in the Montney and among the very best operators there. Encana’s contiguous acreage position allows them to drill longer laterals, drive greater efficiency and develop serious economies of scale. In addition to dry gas and oil, Encana is on track to grow total Montney liquids production to 70,000 barrels per day by 2019, with the majority being the highest-value condensate.

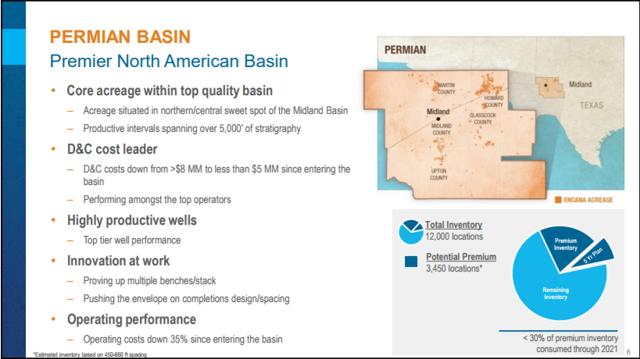

But you’ll notice their second-biggest position is in the booming Permian Basin, about which I have written before. The Permian may prove to be the most prolific in the USA before all is said and done.

A quick refresher is in order to make sense of some of the following graphs and charts. Natural gas is one of the cleanest, safest, and most useful forms of energy in our day-to-day lives. It is the cleanest of the fossil fuels and, like oil and coal, originates from the remains of plants and animals that lived many years ago. These organisms were buried and exposed to heat as a result of being highly compressed underneath thousands of feet of soil and rock. High temperatures and pressure transformed the once-living organisms in these rock layers into their basic hydrocarbon structure.

Natural gas is found beneath the surface of the earth. Large layers of impermeable rock trap the natural gas as it, as a gas, attempts to migrate to the surface. Don’t be fooled by hearing that the gas is trapped in pools. The natural gas molecules are actually held in small holes and various-sized cracks in different rock formations.

Natural gas can be found by itself or in association with oil or liquid and condensate. As pure methane, it is both colorless and odorless. The fact that natural gas is combustible and burns more cleanly than other fossil fuel sources reinforces its position in the future energy supply chain.

There are many different ways to measure natural gas. Canada, as well as most of the rest of the world, reports in gigajoules (GJ), the US in thousands of cubic feet. Other common measures are in British Thermal Units; one Btu is the heat required to raise the temperature of one pound of water by one degree Fahrenheit.

Here is a handy chart to help you convert from one to another, courtesy of Perpetual Energy. You can use this chart as a reminder that one cubic foot of natural gas is equivalent to 1,000 BTUs. 1000 cubic feet of natural gas is equivalent to 1 million BTUs and also equivalent to 1.055 GJs. Etc.

Natural Gas Equivalents

|

1 cf |

1 MBtu |

|

1 Mcf |

1 MMBtu |

|

1 Mcf |

1.054615 GJs |

|

1 MMBtu |

1.054615 GJs |

|

6 Mcf |

1 Bbl |

Common Industry Abbreviations

|

Bbl |

Barrel |

|

Bcf |

Billion cubic feet |

|

BOE |

Barrel of oil equivalent |

|

BOE/d |

Barrels of oil equivalent per day |

|

Btu |

British thermal unit |

|

Mboe |

Thousand barrels of oil equivalent |

|

Mcf |

Thousand cubic feet |

|

MMcf |

Million cubic feet |

|

MMcfe |

Million cubic feet equivalent |

Also, whenever you see the term AECO it simply refers to a large natural gas hub called the Alberta Energy Company which is used as the benchmark for pricing Canadian gas.

Finally, also courtesy of Perpetual Energy, here is a reminder of the most common factors which affect the current and future prices for natural gas:

Upward and Downward Pricing Pressures

Current Upward Pressures

Production: Many factors can influence production worldwide. Ultimately, if production in any way declines, supply in essence declines causing the price of natural gas to rise.

Economy: Strong economic growth in North America causes demand to increase, resulting in an increase in natural gas prices.

Hurricanes: Strong hurricanes can result in large amounts of production being shut-in, usually temporarily, which in turn lowers supply and increases demand, causing prices to rise. Hurricanes can also negatively impact demand.

Oil Prices: Elevated crude oil prices decrease the demand for oil, causing users to switch to natural gas, increasing demand and therefore price.

Weather: Extremely cold weather in winter and hot weather in summer can significantly increase natural gas demand which causes prices to rise.

Future Upward Pressures

Demand: North American natural gas demand is expected to increase in the future. Gas for clean power generation and for industrial processes, particularly for Alberta oil sands developments, accounts for most of the expected increases in demand. Further demand increases are expected as North America moves towards more environmentally friendly fuels and clean energy alternatives.

Production: Despite increased drilling, conventional natural gas production and well productivity will continue to decline in the future as North American sedimentary basins reach increasingly mature levels of development. Unconventional sources of natural gas, like shale gas drilling, are in the early stages of technical development. New multi- stage fracture technology has improved the economics of unconventional shale and tight gas significantly.

Crude Oil Prices: Average crude oil price forecasts between $50.00 and $70.00 per barrel through to 2020 will provide steady support for natural gas prices.

Current Downward Price Pressures

Storage: Typically, natural gas prices and storage levels are inversely related.

Demand: Reduced demand normally results in lower natural gas prices.

Exchange Rate: Canadian natural gas prices and the Canadian exchange rate are inversely related.

Weather: Cold winters and hot summers typically result in higher prices, which in turn lowers demand for natural gas. This causes natural gas prices to fall as lack of demand causes storage levels to remain relatively high.

Future Downward Price Pressures

Liquefied Natural Gas (LNG): With the construction of liquefication plants globally, incremental increases in the future natural gas supply to North America is possible as imported liquefied natural gas will arrive in the North American marketplace if not purchased and consumed by other global markets.

Unconventional Gas Supply: Reduced conventional natural gas supply is expected to be largely replaced by increased unconventional natural gas, particularly coal bed methane and shale gas.

Arctic Gas: Both the Mackenzie and the Alaska natural gas pipeline proposals offer the potential to deliver significant quantities of natural gas to the North American market once they are approved and constructed.

How does all this come together to make me feel strongly that ECA has a superb intermediate and long term future? That story is best told graphically:

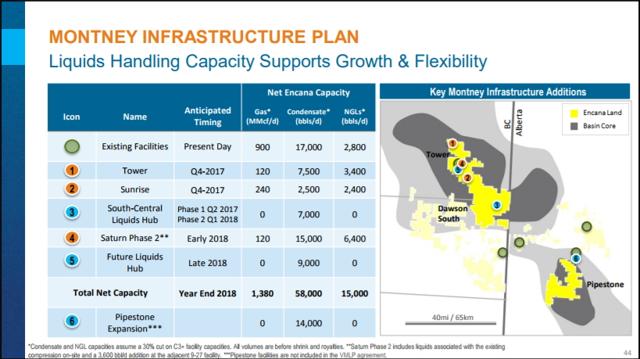

Here is Encana’s position in the Montney formation…

…and current and projected infrastructure.

Here is the overview of the Permian properties. Please note that the US properties are mostly in oil exploration and production while the Alberta and BC properties are natural gas and natural gas liquids (NGLs.) About 2/3 of their production is natural gas.

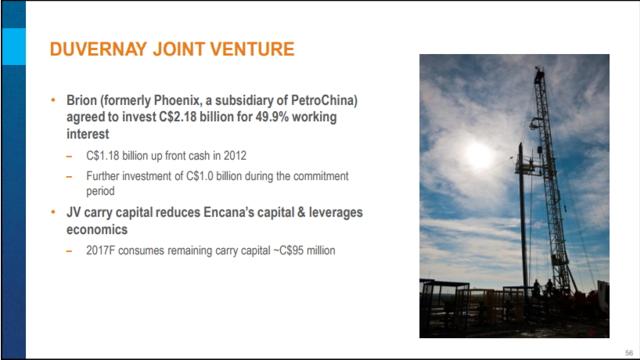

Contrary to comments I have received that foreign and US firms are deserting Canada because of possible disruption by environmental lobbies…

So much for the “business” side of the equation. On balance, I believe it has never looked better. How about the stock valuation side?

Well, Encana still has trouble getting financing at the same level the Exxons and Chevrons do. In fact their weighted average cost of capital (WACC) is 20.33%, while their current return on invested capital (ROIC) is -7.12%. That’s why they are joint venturing with others who provide capital while Encana provides expertise. I expect these numbers to change significantly in the coming months and years.

Net margins are about 19%, not bad for this sector, this industry and the cash this company is laying out to build for the future. ROE is a respectable but not earth-shattering 13.08% and ROA is an equally respectable 5.42%.

Encana’s PE is 12.4, price-to-book is 1.54, and the price/sales ratio is 2.42. The best news is that, unlike many other energy companies that see high insider selling on any stock price rally, insiders have been steady buyers of Encana all year.

On balance, I think this is a company destined for greatness. The stock price isn’t particularly cheap or dear but I think it is worth owning here just above its mid-range point for the past 52 weeks (but down YTD.)

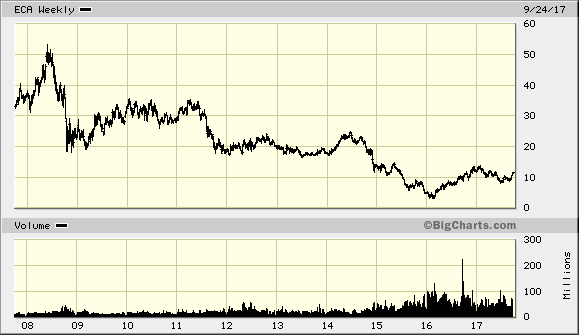

And here, like so many energy firms, is how the mighty has fallen over the past 10 years.

I may get a chance to add to my position at a lower price. But looking at the value of future earnings, I certainly won’t mind initiating a 750 share position for our Growth & Value Portfolio here.

Disclaimer: Do your due diligence! What's right for me may not be right for you; what's right for you may not be right for me. Past performance is no guarantee of future results. Rather an ...

more