Hartstreet Oil: Diamondback Is One Of The Better Positioned Names For 2017

FANG has some of the best acreage in the country. Midland core valuations are above $40,000/developed acre. This is due to excellent Spraberry and Wolfcamp results, and other intervals that are economic at higher oil prices.

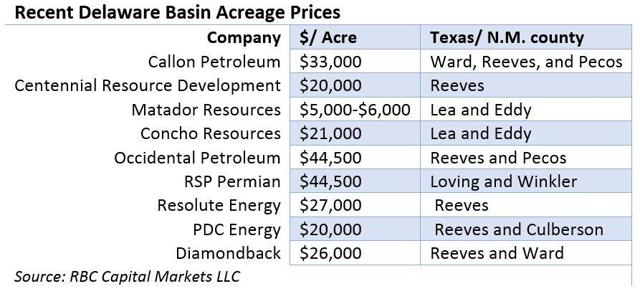

The recent addition of acreage in Pecos County has upside, and a couple of big wells could make this area another home run. Other operators have targeted this area, as seen in the picture below. In July of last year, Contango (NYSEMKT:MCF) made a purchase. The $26,000/acre paid by FANG seems cheap when compared to southern Reeves acquisitions. Pecos has seen less development, and will require investment. FANG will spend $75 million on infrastructure in 2017. Reeves leasehold could be better than Pecos, but there is a possibility of the opposite. Callon (NYSE:CPE) and Resolute (NYSE:REN) acquisitions caused major changes in valuation. Centennial (NASDAQ:CDEV) found value in southern Reeves, but also bought Pecos acreage that it has yet to develop. Matador's (NYSE:MTDR) purchase targeted the northwest shelf. Valuations reflect the differences in geology. I would watch this area, as EOG Resources (EOG) has added to its holdings. Concho (NYSE:CXO) added more acreage to an already impressive footprint. RSP Permian's (RSPP) and Occidental's (NYSE:OXY) purchases were in the Delaware core. PDC Energy (NASDAQ:PDCE) added an area with lower breakevens than the Wattenberg core.

In our opinion, all the deals were good. We think EOG's deals are the most intriguing. We also think the Delaware has more upside than Midland. Less traffic means more upside and/or downside. It is important to watch gringe deals, as one great well can bean significant increases to market cap.

FANG has completed 167 horizontal wells in the Midland Basin. It has over 1,100 total wells currently producing in the eastern Permian including verticals. We provided a type curve for its wells in the Midland Basin over 36 months.

|

Month |

Oil Bbl |

Gas Mcf |

MBOE |

Water |

Wells |

|

1 |

11,653.46 |

9.39 |

13.27 |

6,705.45 |

167 |

|

2 |

10,603.86 |

9.32 |

12.21 |

4,576.85 |

166 |

|

3 |

8,716.62 |

8.64 |

10.21 |

3,598.55 |

166 |

|

4 |

7,727.63 |

7.54 |

9.03 |

992.28 |

166 |

|

5 |

6,765.32 |

7.08 |

7.99 |

586.1 |

166 |

|

6 |

6,186.80 |

6.05 |

7.23 |

301.75 |

166 |

|

7 |

5,707.92 |

5.90 |

6.73 |

292.84 |

166 |

|

8 |

5,605.43 |

6.01 |

6.64 |

280.7 |

160 |

|

9 |

4,964.45 |

5.37 |

5.89 |

157.69 |

153 |

|

10 |

5,024.24 |

5.16 |

5.91 |

169.89 |

148 |

|

11 |

4,266.95 |

4.84 |

5.10 |

86.24 |

141 |

|

12 |

4,422.35 |

4.63 |

5.22 |

109.33 |

138 |

|

13 |

3,682.18 |

4.57 |

4.47 |

55.95 |

128 |

|

14 |

3,400.65 |

4.33 |

4.15 |

73.93 |

122 |

|

15 |

2,900.86 |

4.11 |

3.61 |

46.7 |

115 |

|

16 |

3,055.26 |

4.31 |

3.80 |

41.48 |

114 |

|

17 |

3,228.49 |

4.58 |

4.02 |

77.49 |

108 |

|

18 |

3,227.08 |

4.52 |

4.01 |

0 |

102 |

|

19 |

3,319.67 |

4.28 |

4.06 |

0 |

92 |

|

20 |

2,560.37 |

3.43 |

3.15 |

0 |

82 |

|

21 |

2,317.12 |

3.50 |

2.92 |

23.28 |

72 |

|

22 |

2,249.36 |

3.64 |

2.88 |

0 |

62 |

|

23 |

1,926.91 |

3.49 |

2.53 |

0 |

57 |

|

24 |

1,872.16 |

3.88 |

2.54 |

0 |

52 |

|

25 |

2,165.93 |

3.83 |

2.83 |

0 |

51 |

|

26 |

2,213.27 |

3.72 |

2.86 |

0 |

50 |

|

27 |

2,203.56 |

4.64 |

3.00 |

0 |

45 |

|

28 |

1,930.40 |

4.42 |

2.69 |

0 |

39 |

|

29 |

1,617.97 |

4.78 |

2.44 |

0 |

36 |

|

30 |

1,631.66 |

5.67 |

2.61 |

0 |

34 |

|

31 |

1,398.74 |

4.38 |

2.15 |

0 |

32 |

|

32 |

1,375.98 |

5.46 |

2.32 |

0 |

26 |

|

33 |

1,245.42 |

4.25 |

1.98 |

0 |

25 |

|

34 |

1,110.22 |

4.63 |

1.91 |

0 |

22 |

|

35 |

1,164.40 |

5.99 |

2.20 |

0 |

20 |

|

36 |

1,218.38 |

6.05 |

2.26 |

0 |

18 |

|

Total |

109,337 |

117.67 |

129.62 |

(Source: Welldatabase.com)

The cumulative oil production is 134,661 BO in three years. This may not sound outstanding, but it does improve significantly in more recent completions. It is important to mention the changes to design. The primary improvements have been around more complete fracturing of the interval. The more frac's created, the more resource is allowed to flow. This improves production results. The more frac's, the more sand and fluids used. There is still upside, and operators will continue to lower breakevens.

The graph below is the type curve for 63 wells that started producing after 11/1/14.

|

Month |

Oil Bbls |

Gas Mcf |

MBOE |

Water |

Wells |

|

1 |

16,453.72 |

11.50 |

18.44 |

890.03 |

63 |

|

2 |

14,768.54 |

10.96 |

16.66 |

0 |

63 |

|

3 |

11,673.31 |

9.43 |

13.30 |

0 |

63 |

|

4 |

10,779.53 |

8.67 |

12.28 |

0 |

63 |

|

5 |

9,168.94 |

7.82 |

10.52 |

0 |

63 |

|

6 |

9,068.20 |

7.53 |

10.37 |

0 |

63 |

|

7 |

8,492.66 |

7.76 |

9.83 |

0 |

63 |

|

8 |

7,574.60 |

6.82 |

8.75 |

0 |

57 |

|

9 |

7,594.42 |

5.93 |

8.62 |

0 |

50 |

|

10 |

7,336.20 |

6.22 |

8.41 |

0 |

45 |

|

11 |

5,514.39 |

5.44 |

6.45 |

0 |

38 |

|

12 |

6,701.97 |

5.26 |

7.61 |

0 |

35 |

|

13 |

6,792.33 |

5.10 |

7.67 |

0 |

25 |

|

14 |

5,359.73 |

5.28 |

6.27 |

0 |

19 |

|

15 |

2,439.72 |

4.46 |

3.21 |

0 |

13 |

|

16 |

3,116.81 |

4.53 |

3.90 |

0 |

13 |

|

17 |

3,763.40 |

6.32 |

4.85 |

0 |

10 |

|

18 |

3,427.23 |

6.23 |

4.50 |

0 |

8 |

|

19 |

3,255.99 |

4.33 |

4.00 |

0 |

7 |

|

20 |

1,576.47 |

3.21 |

2.13 |

0 |

5 |

|

21 |

1,186.85 |

5.83 |

2.19 |

0 |

2 |

|

Total |

146,045 |

138.63 |

169.96 |

(Source: Welldatabase.com)

Over the first year, oil production improved 26%, and 24% on a BOE basis. Lateral lengths were up 112 feet, which added to the increase increase. Below is a comparison of the two well samples:

|

Old |

New |

||||||

|

Month |

Oil Bbl |

Gas Mcf |

MBOE |

Month |

Oil Bbls |

Gas Mcf |

MBOE |

|

1 |

11,653.46 |

9.39 |

13.27 |

1 |

16,453.72 |

11.5 |

18.44 |

|

2 |

10,603.86 |

9.32 |

12.21 |

2 |

14,768.54 |

10.96 |

16.66 |

|

3 |

8,716.62 |

8.64 |

10.21 |

3 |

11,673.31 |

9.43 |

13.3 |

|

4 |

7,727.63 |

7.54 |

9.03 |

4 |

10,779.53 |

8.67 |

12.28 |

|

5 |

6,765.32 |

7.08 |

7.99 |

5 |

9,168.94 |

7.82 |

10.52 |

|

6 |

6,186.80 |

6.05 |

7.23 |

6 |

9,068.20 |

7.53 |

10.37 |

|

7 |

5,707.92 |

5.9 |

6.73 |

7 |

8,492.66 |

7.76 |

9.83 |

|

8 |

5,605.43 |

6.01 |

6.64 |

8 |

7,574.60 |

6.82 |

8.75 |

|

9 |

4,964.45 |

5.37 |

5.89 |

9 |

7,594.42 |

5.93 |

8.62 |

|

10 |

5,024.24 |

5.16 |

5.91 |

10 |

7,336.20 |

6.22 |

8.41 |

|

11 |

4,266.95 |

4.84 |

5.1 |

11 |

5,514.39 |

5.44 |

6.45 |

|

12 |

4,422.35 |

4.63 |

5.22 |

12 |

6,701.97 |

5.26 |

7.61 |

|

13 |

3,682.18 |

4.57 |

4.47 |

13 |

6,792.33 |

5.1 |

7.67 |

|

14 |

3,400.65 |

4.33 |

4.15 |

14 |

5,359.73 |

5.28 |

6.27 |

|

15 |

2,900.86 |

4.11 |

3.61 |

15 |

2,439.72 |

4.46 |

3.21 |

|

16 |

3,055.26 |

4.31 |

3.8 |

16 |

3,116.81 |

4.53 |

3.9 |

|

17 |

3,228.49 |

4.58 |

4.02 |

17 |

3,763.40 |

6.32 |

4.85 |

|

18 |

3,227.08 |

4.52 |

4.01 |

18 |

3,427.23 |

6.23 |

4.5 |

|

19 |

3,319.67 |

4.28 |

4.06 |

19 |

3,255.99 |

4.33 |

4 |

|

20 |

2,560.37 |

3.43 |

3.15 |

20 |

1,576.47 |

3.21 |

2.13 |

|

21 |

2,317.12 |

3.5 |

2.92 |

21 |

1,186.85 |

5.83 |

2.19 |

|

Total |

109,337 |

117.67 |

129.62 |

Total |

146,045 |

138.63 |

169.96 |

(Source: Welldatabase.com)

FANG has seen significant improvements in production per well based on this 21-month comparison. The newer wells outperform up to the 15 month. Oil production is equal in both groups, and the newer wells are producing less in months 20 and 21.

Enhanced completions have a flatter decline curve. Depending on the play, induced frac's can produce from 3 to 7 years then matrix production begins. This goes on for decades and has a decline curve much like conventional oil wells. The decline stays low throughout well life. Permian wells do not decline as fast as horizontals in other plays. This is the misunderstood variable in well economics. A decreased decline rate means more oil is produced the first year, and every year during induce frac production.

|

Oil Exponential Volumetrics |

Recovered: 146,086.31 |

|

|

EUR: 146,086.31 |

Months: 21 |

|

|

Working Interest |

80% |

|

|

Selling Price: |

$50/Bbl. |

|

|

Initial Capital Expense: |

$5,000,000 |

|

|

Lease Operating Cost (monthly): |

$1,555,128 |

|

|

Total |

Working Interest |

|

|

Total: |

$7,304,315 |

$5,843,452 |

|

Recovered: |

$7,304,315 |

$5,843,452 |

|

Total |

Working Interest |

|

|

Total: |

($6,555,128) |

($6,555,128) |

|

Recovered: |

($6,555,128) |

($6,555,128) |

|

Total |

Working Interest |

|

|

Total: |

$749,187 |

($711,676) |

|

Recovered: |

$749,187 |

($711,676) |

(Source: Welldatabase.com)

After 21 months of production, the average left to payback is $711K. After $543K from natural gas revenues we could estimate these wells will payback in under 2 years. Recent wells are showing better results. Given the very good well results in Midland and the upside to Pecos County in Delaware, FANG could be well positioned in 2017.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more